| 03-11-2016 | Carlo de Meijer |

During my economics study in the seventieth of last century (indeed a long time ago!) one of the courses I followed was agricultural economics. Recently I met a Canadian (with Dutch roots) from the agricultural business and we were talking about the opportunities for using blockchain technology in this area. Up till now there has been very little talk of blockchain applications within core agricultural areas. But he told me that this is changing and that the agriculture industry is now increasingly exploring the potentials of using blockchain for the “agri sector”.

During my economics study in the seventieth of last century (indeed a long time ago!) one of the courses I followed was agricultural economics. Recently I met a Canadian (with Dutch roots) from the agricultural business and we were talking about the opportunities for using blockchain technology in this area. Up till now there has been very little talk of blockchain applications within core agricultural areas. But he told me that this is changing and that the agriculture industry is now increasingly exploring the potentials of using blockchain for the “agri sector”.

This triggered me to write this blog asking myself the question: how and where is the agriculture industry using blockchain and what is the potential for massive blockchain growth in the agricultural economy.

Agricultural business is a complex industry

The agricultural business nowadays is a huge, important, industrialised but very complex industry. The agricultural supply chain is an inefficient one, characterised by a large-scale non-transparent and non-communicating network consisting of many actors, processes, products and data. A big problem here is the great disconnection between supplier and retailer. The lack of transparency and disconnection makes it very difficult to track issues, tracing the origin of products and give a fair price for producers. And that while regulatory pressure, food crises and scandals (such as the mad cow disease (BSE) and cross contamination)) have increased the need for greater supply chain transparency and thus the need for data integration. These days, the public is increasingly embracing the need for transparency in food products and farming techniques.

Retailers want the best quality agricultural products, while also seeking to the lowest prices. On the other hand a growing number of consumers are demanding sustainable food products. They have less trust in existing agricultural products food, increasingly seeking information on authenticity and production practices. Consumers, especially within these niche markets, are increasingly willing to pay for products that provide this information.

“Consumer demand for “clean” food, including organic, is skyrocketing, but producers and manufacturers are often struggling to verify the accuracy of data from farm to table”.

Blockchain can help …

The agriculture industry is now looking for ways to alleviate the complex issues related to farming and distribution. They have a strong need for supply chain intelligence, especially for technology that supports traceability of critical products data through the supply chain across all of affected businesses. Currently, there’s however no easy, accurate and efficient way to identify the exact origin of an agricultural product.

Blockchain could here play an important role. While many of the existing technologies are inadequate or too costly to help, blockchain technology has all ingredients to become a real problem-solver. This technology records information in a distributed ledger in a way that is both secure and immutable. By being distributed among many users these ledgers are resilient with no single point of failure, and they can be (depending on design), transparent to all users. The blockchain technology thereby removes the need for formally identifying both parties to the transaction thus major cost savings can be achieved.

…. to solve existing problems

According to a report from AgriDigital using blockchain could solve many of the existing shortcomings/problems. The use of this technology could lead to improved product tracking and tracing origin of products, efficient supply chain management, fair pricing and decreased transaction fees, etc.

Efficient Supply Chains in Developed Economies

Possibly the highest potential for blockchain in agriculture is in the developed world, where it can be very helpful in monitoring the supply chain of food products. This technology seems to have the best potential to bring overall provenance and transparency throughout the food supply chain. The blockchain technology offers significant opportunities including increased transparency and data integrity, “with immutable provenance data from farm to table”, allowing a visible assurance of authenticity.

Product tracking

By providing both parties with access to information on similar transactions, as well as on the current stock price of goods, even suppliers in rural areas are able to determine what their harvest is currently worth and sell it to distributors at a price that reflects global market conditions.

Tracing origin

By establishing a blockchain-driven ecosystem for the registration, payment, and transport of crops or other agricultural products, retailers can also verify easily that the product they are receiving is exactly what they paid for (product origins).

“With every step of the transaction process recorded on the blockchain, if a supplier claims that its coffee beans are ethically sourced from Colombia, for example, this can easily be confirmed by tracing the journey from farmer to coffee shop, alleviating concerns about misrepresentation” AgriDigital report.

From a consumer point of view, using transparent distributed ledger could give consumers confidence about where their food comes from and how it was produced. With monitoring the consumer food chain they can have a better idea of the origin of the food, the date on which it was created and the efficiency with which it occurred, instead of relying on the existing systems that can be manipulated easily.

Fair pricing and decreased transaction fees

Blockchain can provide an easy solution for both buyers and suppliers seeking to negotiate a fair price for their product. Using Blockchain, commodity buyers are able to deal with their supplier directly and transfer payment via mobile. This may ensure that farmers receive fair payment for their produce and the retailer pays a fair price as that would save the retailer money in agents. Ultimately, this technology enables farmers, manufacturers, and retailers to justify premiums for certain products.

Minimising Human Error

Blockchain can also be used to minimise physical and financial losses in the agricultural sector caused by human errors. By adopting blockchain technology tasks can be taken from the workforce in many ways and automate them, minimising the amount of resource that is wasted or misused. Also, Blockchain can present information to farmers regarding diseased products throughout their supply chain: what types of crop are they; where were they grown? By drilling down into this data set, the farmer can then minimise future losses.

Use cases

There are nowadays various blockchain use cases that could be adopted by the agriculture industry, ranging from real-time management of supply chain transactions and financing, smart (farm) contracts, data monitoring to reduced human errors.

Management transparent transactions

Blockchain enables both small farm firms and agricultural concerns to be able to keep track of their transactions and contractual obligations with buyers, suppliers and other stakeholders in order to maintain accountability. Thanks to this technology the connection between commodity buyers and farmers can now be monitored more closely, and distribution channels streamlined yet further. This minimises fraud, maximises transparency, and ensures that each link in the supply chain is satisfied.

Efficient financing

But also financial transactions between farmers and buyers, that are nowadays hugely inefficient, could be improved thanks to blockchain technology. As it will enable real-time payment on delivery, this may improve the settlement process for farmers, buyers, and banks. As a result, farmers get paid immediately, industry competition increases and buyers save time and money. Also, adding transparency, trust, and efficiency to settlements can decrease risk and unlock new financing mechanisms for banks.

Smart farm contracts

Another use case is that of smart contracts in the agriculture industry. This especially relates to the provision of agricultural services linked to conditions and rules that could be specified in the blockchain, fulfilment of which is verified via the technology platform, such as pre sales of harvests or trigger compensation for the farmer based on confirmed weather data in real time. Sensors that automatically feed data into the blockchain in real time will provide the basis for smart contracts of this kind. The blockchain will not only be able to verify payments or record ownership properly. Rather it will automatically ensure that contracts are complied with, protecting the rights and obligations of contracting parties.

Data Monitoring

A fourth use case – and one of the most obvious one – is in data monitoring. It allows farmers to capture data in real-time. For instance, wireless sensors can be integrated into fields to monitor crop growth, harvesting, and subsequent yield, with all of the data recorded onto the blockchain. That will help them plan their areal more effectively and maximise the “success rate” of their harvests. Over time, this information would become an invaluable resource to the farmer.

Land registry

Another application of blockchain technology, especially for developing countries is to record land ownership in the country. In many countries in South America, but also Africa and South East Asia, a great majority of land is still unregistered. These countries often struggle with land tittle fraud, leaving the poor, who have most of their wealth in land, vulnerable. There is nowadays a growing number of countries in these regions that are thinking about using a permanent and secure land title record system based on blockchain technology.

Better Finance for the developing countries

Blockchain also has huge potential to create and improve access to finance in the developing world. For many of the farmers in these countries, affordable access to capital remains a huge challenge. Mobile banking creates novel financing opportunities such as micro-financing, but because of a lack of transparency and therefore high risk, the current paradigm is tons of small and costly transactions. Blockchain can — and already is — solving this problem for financiers and farmers. Examples include agri-ledger out of the UK, BitPesa in East Africa, and Rebit in the Philippines.

The concept of Smart Farms

The integration of all these various applications of blockchain technology in agriculture could lead to the concept of so-called smart farms. These are a form of sustainable agriculture that aims to enhance environmental quality, integrate technology with natural biological cycle controls and create economic viability within farm operations. Smart farming thereby involves the collection and distribution of large amounts of data related to different farming methods, weather conditions and animal health. Smart farming employs a lot of digital equipments and remote sensors, to collect the necessary information such as the information in advance so that timely measures can be taken regarding fertilisers, soil mapping, crop yields and machinery used. Smart farming also makes use of sensors for the early detection of animal health and upcoming reproduction events. This kind of livestock data is collected by monitoring the body movements of animals, their body temperature, pulse rate and tissue resistivity. GPS is also used for locating their positions.

Start-ups

Globally, there is a growing number of start-ups exploring the potential for blockchain in agriculture. Some of them already provide practical blockchain based solutions to various food items, to improve the traceability of food throughout supply chains and provide concrete proof of origin such as SkuChain. Other start-ups such as Filament provide blockchain solutions to create concepts like smart farms. Additional start-ups like Provenance and FarmShare are also researching and developing blockchain-based agricultural platforms.

SkuChain (supply chain)

SkuChain Technology is a distributed ledger blockchain-based system in the food industry that relies on its immutable nature to solve the problem of supply chain integrity. They focuses on the creation of direct relations, which simultaneously increases confidence and visibility of flow of goods. SkuChain is nowadays developing a system of improved (next generation) barcodes and RFID tags, with the aim to digitally secure the transfer of goods across the entire global supply chain and protecting end to end supply chains against counterfeiting. They therefor will provide cryptographic proof of each SKU’s origin and supply chain that can be verified all the way from the start to the point of consumption.

Filament (smart farms)

Another start up is Filament, a wireless sensor firm, that is developing sensors to monitor crop health and recording results in a blockchain. With Filament’s platform, users connect physical objects and existing networks into “wider networks and applications” – making smart farm technology into reliable infrastructure. By monitoring the food supply chain, consumers can get a better idea of where the food is coming from, the date it was created, and how it was produced more efficiently.

Provenance (tracking)

Others such as UK start-up Provenance are using blockchain to improve the traceability of food and provide concrete proof of origin. Provenance uses blockchain to keep a track of food supply chains and makes the information public, secure and all-inclusive. The ledger is used to document the supply chain of materials, ingredients, and products to provide consumers with greater transparency about their authenticity and origin. They provide buyers – in the format of a real-time data platform – with a fully transparent record allowing the end user to see each step of the journey the product has taken: where it is, who has it, and for how long.

Farmshare (community-supported agriculture)

FarmShare, another start-up, is developing an agricultural system that runs on the blockchain to evolve community-supported agriculture in developing economies. The project is an evolution of the CSA model, which takes advantage of the blockchain’s potential for creating new forms of community property ownership, collaborative labour relationships, and locally-oriented alternative economies. Farmshare has been networking with its local community and within the technology industry. Farmshare thereby uses blockchain technology to buy, sell and trade a local crypto currency (cryptographic tokens) that can be used/exchanged to purchase weekly deliveries of locally produced food from nearby farms within a natural community. FarmShare enable shares in harvested crops to be electronically distributed to members, creating self-sufficient local economies. This in turn generates greater involvement within the community, and ensures there are incentives for local agriculture to be run more effectively.

Real world examples

Tuna industry

Provenance is now experimenting with proving the supply chain of the tuna industry in Indonesia being delivered to Japanese restaurants. Mobile, blockchain technology and smart tagging were thereby used to track fish caught by Indonesian fishermen with verified social sustainability claims. They used information on sensors or RFID tags and local certification, recorded in the blockchain, to track the fish along its journey from “hook to fork”. Its ambition was to demonstrate a solution to the serious need for data interoperability: “for tracking items and claims securely, end-to-end, in a highly robust, yet accessible format without the need for a centralised data management system”. The pilot was successful in tracking responsibly-caught fish and key social claims down the chain to export. It was found that blockchain technology meet these needs and offer an “exciting paradigm shift” necessary for traceability in such vast complex supply chains as the South East Asia fishing industry.

Local grain industry

Start-up Full Profile is starting with an in-market blockchain pilot for the 2016-2017 grains harvest in Australia. Since the grain industry deregulated in 2008, growers have been increasingly exposed to payment risk — not receiving money for their crop once a shipment legally changes owners. Because blockchain records detailed information for every transaction along the value chain, this technology can take out a number of risks faced by growers and traders selling grain. Thanks to this increased transparency buyers and sellers both have access to the information, as well as information about similar transactions, so both parties have a fuller understanding of fair prices. For grain growers and traders, key features of blockchain, such as real-time payments and settlements, allow growers to get paid for their grain the instant they deliver loads of grain at harvest.

Agribusiness trade

The use of blockchain technology could also dramatically transform agriculture across Africa. WakChain is Africa’s first permissioned blockchain for the farmer and the continent’s agribusiness. Wakchain nowadays uses this technology to scale up the transformation brought about in Nigerian agriculture. Existing structural inefficiencies, poor market and transport linkages mean that the farmer is disincentivized from fully reaping the rewards. Blockchain could create the foundation for more seamless intra-African trade especially in the agribusiness value chain. The idea of Wakchain is that farmers and players in the African agribusiness value chain should be able to trade from anywhere in the continent, using blockchain technology and in a manner that maps the distributed nature of agricultural activities. Blockchain can help African farmers by enabling them transact, verify and enforce the provisions of their contracts better.

Future

Though we haven’t yet seen the large-scale commercial adoption of blockchain, and there are still many bottlenecks to remove, this technology has the ability to fundamentally transform the agriculture industry. Blockchain technology has big potential to solve significant problems in the food and agricultural industry. Farmers in the Western world have always been eager adopters of technologies that make sense and deliver real value. It will be interesting to see how lucrative blockchain can prove to be for the present day farming techniques. The challenge now for blockchain, and agricultural technologies in general, is connecting the technology to viable business models and compelling use cases. All the start-ups mentioned above are working hard to do just this.

Carlo de Meijer

Economist and researcher

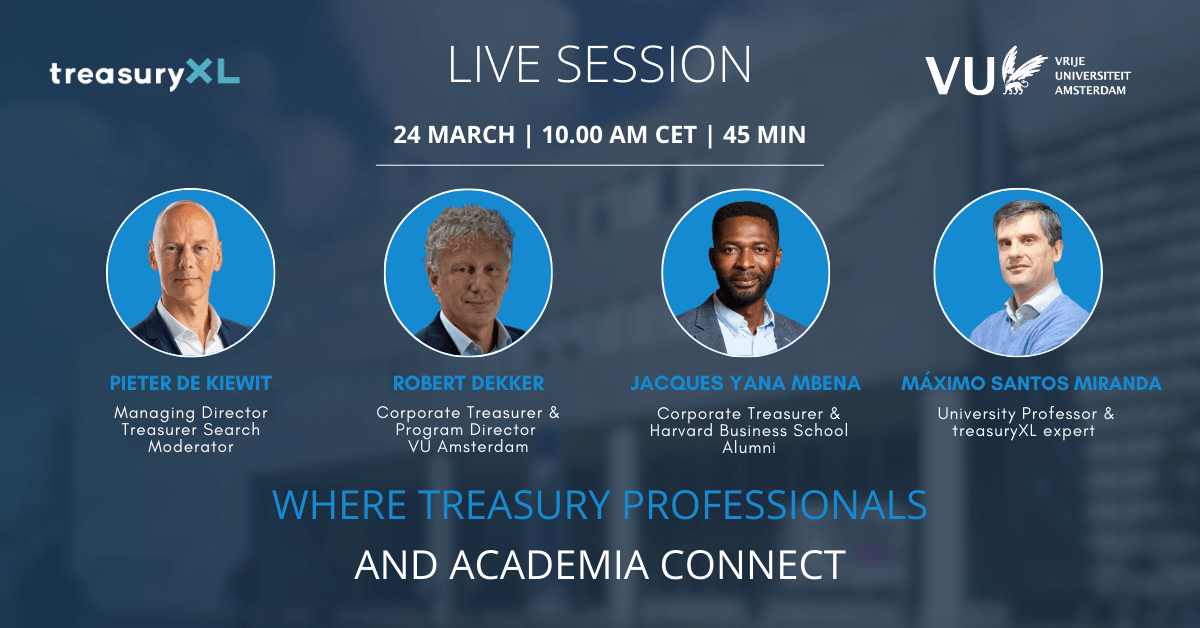

If you are working as a treasurer and think about following a training you might as well look on the internet: an increasing number of programs are given online. We thought that it might be useful to check what’s on there and present a few.

If you are working as a treasurer and think about following a training you might as well look on the internet: an increasing number of programs are given online. We thought that it might be useful to check what’s on there and present a few.  Annette Gillhart – Community Manager of treasuryXL

Annette Gillhart – Community Manager of treasuryXL

As RBS in april 2016, ABN AMRO announced recently that they will lay off another 1500 employees worldwide and reduce services due to ongoing digitalisation. We came across

As RBS in april 2016, ABN AMRO announced recently that they will lay off another 1500 employees worldwide and reduce services due to ongoing digitalisation. We came across

Since we’ve started at April 21th 2016, treasuryXL made some important steps and we’ve been growing ever since. Our community is continuously expanding with authors, editors, sponsors and readers. Everyday we provide you with fresh, treasury related content: articles, vacancies and events. In the start-up fase it was our main interest to make the site known to you and find out about the focus and issues that added value to the market and the treasury community. Now we’re taking it to the next level!

Since we’ve started at April 21th 2016, treasuryXL made some important steps and we’ve been growing ever since. Our community is continuously expanding with authors, editors, sponsors and readers. Everyday we provide you with fresh, treasury related content: articles, vacancies and events. In the start-up fase it was our main interest to make the site known to you and find out about the focus and issues that added value to the market and the treasury community. Now we’re taking it to the next level!

At its introduction time SEPA seemed to be just another (more complicated) payment method, more imposed by EU-regulations than a market requirement. For international for exporting companies however, there is a very interesting bonus in the form of SEPA’s possibilities in the field of direct debit. Foreign bank accounts can be debited (for receivables) in the same way as Dutch bank accounts.

At its introduction time SEPA seemed to be just another (more complicated) payment method, more imposed by EU-regulations than a market requirement. For international for exporting companies however, there is a very interesting bonus in the form of SEPA’s possibilities in the field of direct debit. Foreign bank accounts can be debited (for receivables) in the same way as Dutch bank accounts. Jan Meulendijks – Cash management, transaction banking and trade professional

Jan Meulendijks – Cash management, transaction banking and trade professional The European Commission recently launched an update report on the state of the Capital Markets Union (CMU) project. A comprehensive program of actions set out a year ago to put in place the building blocks for this CMU by 2019. Aim is to create deeper, and more integrated capital markets across the EU to lower costs and make the market more resilient. One year later this project is still “lacking an organic and coherent set of actions to bring down cross-border barriers and create a single market for capital, which could support the effectiveness of monetary policies”, according to the Commission.

The European Commission recently launched an update report on the state of the Capital Markets Union (CMU) project. A comprehensive program of actions set out a year ago to put in place the building blocks for this CMU by 2019. Aim is to create deeper, and more integrated capital markets across the EU to lower costs and make the market more resilient. One year later this project is still “lacking an organic and coherent set of actions to bring down cross-border barriers and create a single market for capital, which could support the effectiveness of monetary policies”, according to the Commission.

Allan & Overy publiceerde recent een onderzoek waaruit bleek dat de Europese alternatieve financieringsmarkt blijft groeien (bron:

Allan & Overy publiceerde recent een onderzoek waaruit bleek dat de Europese alternatieve financieringsmarkt blijft groeien (bron:

During my economics study in the seventieth of last century (indeed a long time ago!) one of the courses I followed was agricultural economics. Recently I met a Canadian (with Dutch roots) from the agricultural business and we were talking about the opportunities for using blockchain technology in this area. Up till now there has been very little talk of blockchain applications within core agricultural areas. But he told me that this is changing and that the agriculture industry is now increasingly exploring the potentials of using blockchain for the “agri sector”.

During my economics study in the seventieth of last century (indeed a long time ago!) one of the courses I followed was agricultural economics. Recently I met a Canadian (with Dutch roots) from the agricultural business and we were talking about the opportunities for using blockchain technology in this area. Up till now there has been very little talk of blockchain applications within core agricultural areas. But he told me that this is changing and that the agriculture industry is now increasingly exploring the potentials of using blockchain for the “agri sector”.