Commodity price risks deserve a spot within Treasury Management

| 26-09-2016 | Sjoerd Schneider |

Market price risks traditionally managed by a central Treasury department cover company-wide interest rates and currency risks. Commodity price risks have many of the same characteristics, however only few companies manage these risks within Treasury. Shouldn’t commodity price risks also be addressed by a central Treasury department?

Commodities are typically handled and processed throughout multiple departments, resulting in their price risks also being run in many different sections and locations. These risks are consequently almost always initially managed locally. When production companies centralize their Procurement departments, central management of price risks often follows within a few years.

The question for production companies without a dedicated Trading department is whether commodity price risk management belongs to Procurement or to central Treasury? Treasury classically lacks insight knowledge of commodities, but does have a company-wide view on price risks. In contrast, Procurement is far better informed on commodities but less on market prices. In any case, either part of the company will need to invest in building expertise.

Many mid-sized and large production companies I have spoken to in recent years have chosen to add risk management to their Procurement department. The main reason is keeping know-how of commodities close to the associated (purchase) contracts. The main drawback of this construction on the other hand is that these price risks are managed in a different place and possibly with a different strategy than interest rate and currency risks.

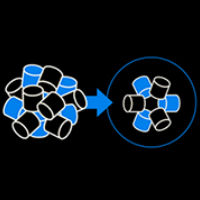

Managing highly correlated comparable risks in separate departments will lead to sub-optimal behavior: inefficiency, incorrect risk (VaR) numbers, inferior hedges and possibly even contrary hedges. For example, a separate approach to a USD position and a Copper position for a EUR based company would result in different hedges than a combined centrally managed approach. That is why, from a portfolio perspective, I strongly recommend funneling all market price risks to one central Treasury department. Diversification effects will be fully appreciated when all positions are managed as one portfolio. To be successful it is essential to create continuous interaction between the treasurers and purchasers: Treasury shall need to be much more embedded in the business than they are accustomed to.

When all price risks are managed centrally and internal collaboration is optimized, the company shall reap its rewards by having one single source of full insight into its exposures and by being able to swiftly manage all of them. This will lead to enhanced risk management and lower overall transaction costs.

Founder of Insposure