What do you want to know about Treasury?

| 30-10-2017 | treasuryXL |

It has always been our mission to promote Treasury as a profession and to increase the awareness of Treasury within business. Currently there are more education choices for students to study and appreciate Treasury, but we still felt there was a gap – knowledge for anyone who was genuinely interested in learning more about Treasury.

It has always been our mission to promote Treasury as a profession and to increase the awareness of Treasury within business. Currently there are more education choices for students to study and appreciate Treasury, but we still felt there was a gap – knowledge for anyone who was genuinely interested in learning more about Treasury.

With this in mind, we decided to proactively launch a new initiative – Treasury for non-treasurers. We consider this as our call to action.

Who are these people?

These can be students; career professionals in other disciplines who are curious; people in the finance industry who are considering either a career change or specializing in the field of Treasury; anyone who just wants to understand what a treasurer does on a day-to-day basis.

What is our aim?

Having always written for the professional, we were confronted with the challenge of getting our information across to people who do not have in depth knowledge. After a lot of research and analysis we decided that the best approach would be to attempt to simply explain the workings of Treasury, without going into too many technical details.

What will be in our articles?

With our knowledge, that relies also on the invaluable input of our expert community, we are considering a framework encompassing such topics as:

- Treasury department – roles and responsibilities

- Financial products for trading – Spot FX, Forwards, Options, Futures

- Financial products for liquidity – deposits, loans, commercial paper

- Financial products for financing – private placements, bond issues, equity

- Cash flow forecasting – models and procedures

- Working Capital Management – payables, receivables, inventory

- Risk management – interest rate, FX, commodity, credit, liquidity, operational

- Fintech – Treasury Management Systems, inhouse, exchanges

- Cash concentration – physical sweeps, notional pooling, overlay structures

- Education – study, on-line courses, sources of data

- Economic and political – inflation, unemployment, leading and lagging indicators

This is a comprehensive and challenging list – but not impossible – which will, hopefully, increase people’s understanding and perception of the treasury function.

What we need?

Feedback – and plenty of it please.

These articles will not be written chronologically but, if there are certain topics that you wish to have explained then please do not hesitate to contact us. It is only with your input that we can truly create a service to meet your demands. We think we know what you would like to know, but only you can tell us!

What next?

Hopefully, when the series is a success, we can consider publishing e-books. Credit would always be given to those they have taken their time and effort to impart their knowledge and wisdom to others.

Who are you?

Please feel free to contact us and let us know more about you:

- What is your profession/vocation?

- What industry do you work in?

- What interests you about Treasury?

- Are you interested in making career choices?

- Need help for your company, but are too small to have in-house expertise?

- What do you think about the finance industry?

- What do you think about the EURO?

- How about Brexit?

So, come back regularly and watch this space!!

Tell me and I’ll forget. Show me, and I may not remember. Involve me, and I’ll understand.

[button url=”https://www.treasuryxl.com/contact/” text=”Contact us” size=”small” type=”primary” icon=”” external=”1″]

[separator type=”” size=”” icon=””]

Currency volatility is a well-known uncertain component of international business. In the pre-euro era one could suffer severely by currency movements of its European neighbours. Corporations, dealing within euro countries, have diminished the currency exposure.

Currency volatility is a well-known uncertain component of international business. In the pre-euro era one could suffer severely by currency movements of its European neighbours. Corporations, dealing within euro countries, have diminished the currency exposure.

As if the finance industry is not already facing enough challenges swimming though the sea of regulatory acronyms – BASEL iii, EMIR, MIFID ii, SOX, KYC etc. – a new directive is due to come into force on the 25th May 2018, namely GDPR.

As if the finance industry is not already facing enough challenges swimming though the sea of regulatory acronyms – BASEL iii, EMIR, MIFID ii, SOX, KYC etc. – a new directive is due to come into force on the 25th May 2018, namely GDPR.

Op donderdag 9 november 2017 vindt de voorlichtingsavond voor de Postgraduate opleidingen, waaronder de opleiding Treasury Management & Corporate Finance, van de School of Business and Economics van de Vrije Universiteit Amsterdam plaats.

Op donderdag 9 november 2017 vindt de voorlichtingsavond voor de Postgraduate opleidingen, waaronder de opleiding Treasury Management & Corporate Finance, van de School of Business and Economics van de Vrije Universiteit Amsterdam plaats.

Traditionally, banks provided the infrastructure to enable payments to take place. Nowadays, there are many different third party online payment services that compete directly with the bank models. We came across an interesting article detailing the rise of a mobile payment platform with a large customer base in China, which is bigger than well-known services such as Paypal. It is part of the Alibaba Group who already have a large presence in Europe via AliExpress – after making a large impact on European online shopping, will they make an impact on the payments systems?

Traditionally, banks provided the infrastructure to enable payments to take place. Nowadays, there are many different third party online payment services that compete directly with the bank models. We came across an interesting article detailing the rise of a mobile payment platform with a large customer base in China, which is bigger than well-known services such as Paypal. It is part of the Alibaba Group who already have a large presence in Europe via AliExpress – after making a large impact on European online shopping, will they make an impact on the payments systems? We all have these topics we know are important but never get the highest priority. Until it is too late. Cybersecurity is one of them. Do you want to be the treasurer named in the newspapers? Finding examples and input on-line is not hard. Only this morning these articles popped up through LinkedIn:

We all have these topics we know are important but never get the highest priority. Until it is too late. Cybersecurity is one of them. Do you want to be the treasurer named in the newspapers? Finding examples and input on-line is not hard. Only this morning these articles popped up through LinkedIn:

According to a recent Juniper Research study “Blockchain Enterprise Survey”, IBM is seen as the number one provider of blockchain to business, well ahead of its competitors. These results are based on a survey of 400 business users from organisations actively considering, or in the process of deploying blockchain technology. Of the surveyed 43% ranked IBM first, followed by Microsoft (20%) and Accenture.

According to a recent Juniper Research study “Blockchain Enterprise Survey”, IBM is seen as the number one provider of blockchain to business, well ahead of its competitors. These results are based on a survey of 400 business users from organisations actively considering, or in the process of deploying blockchain technology. Of the surveyed 43% ranked IBM first, followed by Microsoft (20%) and Accenture.

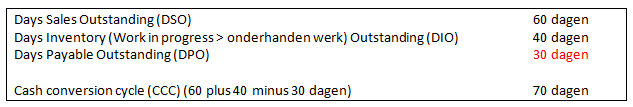

Waarom aandacht voor werkkapitaalbeheersing? Professionele services organisaties zoals advocaten, accountants maar ook andere tijd schrijvende organisaties kenmerken zich door een uiterst loyale cliënt opstelling. Loyaal in de zin dat de cliënt vraag centraal staat en dat deze vraag zo spoedig mogelijk beantwoord dient te worden. Als het probleem van de cliënt is opgelost is de professional tevreden. Op zich is daar niets mis mee. Maar dan……..

Waarom aandacht voor werkkapitaalbeheersing? Professionele services organisaties zoals advocaten, accountants maar ook andere tijd schrijvende organisaties kenmerken zich door een uiterst loyale cliënt opstelling. Loyaal in de zin dat de cliënt vraag centraal staat en dat deze vraag zo spoedig mogelijk beantwoord dient te worden. Als het probleem van de cliënt is opgelost is de professional tevreden. Op zich is daar niets mis mee. Maar dan……..