De 403-verklaring van Shell inzake de NAM. Een analyse.

| 14-02-2018 | Theo Paardekooper |

De juridische en fiscale structuur van een groep van ondernemingen is een belangrijk onderdeel van het framework waarin een treasurer zijn werkzaamheden verricht. Bij het aangaan van aansprakelijkheid voor het uitvoeren van een groot bouwkundig project, het geven van borgstelling voor financieringen en het sluiten van cashpools is deze juridische structuur een belangrijk item. Ook het publiceren van informatie aan de markt is hierin een onderwerp.

Uit informatie van de Kamer van Koophandel blijkt dat op 8 juni 2017 Shell de voor NAM verstrekte 403-verklaring heeft ingetrokken. De NAM heeft op 2 juni 2017 haar jaarrekening over het boekjaar 2016 gedeponeerd. De Groningse inwoners maken zich echter zorgen. In hoeverre kan hun toekomstige claim betaald worden door de NAM? Wat als deze claim niet financieel gedragen kan worden? Welke rechten hebben partijen met een claim en wat is de impact nu voor Shell? Op deze vragen volgt in dit blog een antwoord.

STERKMAKING AAN DOCHTERMIJEN EN DE 403-VERKLARING

Sterkmakingsverklaringen van moedermijen aan dochtermijen zijn een bron van juridisch conflict. Een bekend voorbeeld hierin is de Ceteco affaire. Moedermij handelshuis Hagemeijer had een sterkmakingsverklaring afgegeven voor de financiering van haar dochtermij Ceteco. Toen deze dochter failleerde bleek dat zowel de banken als de provincie Zuid-Holland een grote oninbare vordering hadden, die uiteindelijk niet verhaald kon worden op de moedermij. De toenmalige Commissaris van de Koningin Leemhuis-Stout moest om deze affaire aftreden.

De 403-verklaring is ook een sterkmaking van de moedermij aan haar dochter. Maar wat betekent deze sterkmaking? Banken sluiten per definitie hun eigen hoofdelijke aansprakelijkheids aktes naast deze 403-verklaring. Omdat de 403-verklaring door de moedermij eenzijdig kan worden opgezegd, willen de banken niet verrast worden door deze plotselinge intrekking van de aansprakelijkheid van de moeder.

De 403-verklaring is in essentie bedoeld om de administratieve lasten te verlagen en biedt de mogelijkheid om informatie van dochters voor concurrenten geheim te houden.

De aansprakelijkheid uit hoofde van de 403-verklaring reikt verder dan vorderingen die rechtstreeks voortvloeien uit rechtshandelingen. Ook vorderingen tot schadevergoeding wegens vernietiging of ontbinding van een overeenkomst vallen hieronder, maar vorderingen uit hoofde van een belastingaanslag of onrechtmatige daad zijn weer uitgesloten.

IMPACT VAN INTREKKING

Terug naar Shell. Wat houdt de door Shell afgegeven 403-verklaring in? De 403-verklaring betreft een verklaring naar aanleiding van art 2:403 van het burgerlijk wetboek. Hierin staat dat een dochtermij geen jaarcijfers hoeft te publiceren mits (lid f) een rechtspersoon (in dit geval Shell) zich hoofdelijk aansprakelijk stelt voor de uit de rechtshandelingen van de vennootschap (NAM) voortvloeiende schulden.

Het intrekken van de 403 verklaring is in artikel 404 beschreven. In lid 2 staat hierin echter vermeld dat de aansprakelijkheid blijft bestaan voor schulden die voortvloeien uit rechtshandelingen die zijn verricht voor de intrekking van de verklaring. Schuldeisers hebben 2 maanden de tijd om zich te verzetten tegen intrekking van een 403 verklaring. Voor bestaande verplichtingen blijft de hoofdelijkheid gehandhaafd.

Het verhalen van de aardbevingsschade op NAM valt echter niet binnen de 403 verklaring van Shell. Deze schade wordt namelijk betiteld als een onrechtmatige daad. Pas als de NAM een schikking zou treffen, dan komt de 403-verklaring weer om de hoek kijken.

Wat gebeurt er nu bij een claim? Kan NAM zelf de schadevergoedingen van de Groningers betalen?

Uit de jaarrekening over 2016 blijkt dat NAM 60% van de schadevergoeding voor haar rekening neemt. In 2016 is EUR 98 miljoen onttrokken aan een voorziening; groot EUR 495 miljoen.

In 2016 is het personeelsbestand met ca. 500 fte ingekrompen. Deze reorganisatie was ingezet als gevolg van lagere omzet en hogere operationele kosten, o.a. voor schadevergoeding van het Groninger gasveld. De netto winst over 2016 bedroeg EUR 526 miljoen. Hiervan is EUR 469 miljoen aan dividend uitbetaald aan de aandeelouders Shell en Exxon. Het eigen vermogen van NAM is met EUR 197 miljoen bescheiden. De bezittingen van NAM betreffen met name de waarde van de toekomstig winbare reserves van EUR 3 miljard. Ergo, NAM kan alleen betalen als het gas uit de grond blijft halen en daarom is een 403-verklaring van Shell voor de inwoners van Groningen een belangrijk zekerheidsinstrument, mits een schikking wordt getroffen.

Maar is de terugbetaalcapaciteit van NAM relevant bij een 403-verklaring? Feitelijk is het antwoord “nee”. De Hoge Raad heeft bepaald in het AKZO-ING arrest dat er geen sprake is van een borgtocht, maar dat sprake is van hoofdelijkheid van de moeder. Dit betekent dat niet eerst NAM de verplichting hoeft te voldoen, maar direct Shell kan worden aangesproken op een schadeclaim.

Praktisch zal eerst NAM een claim krijgen, maar Shell kan zich niet verschuilen achter NAM.

IFRS IMPACT

Shell consolideert NAM in haar jaarcijfers. NAM wordt als een joint operation in IFRS geclassificeerd. Na het intrekken van de 403-verklaring zal Shell de NAM blijven mee consolideren. Het wordt nog wel interessant of de accountant in staat blijft om een goedkeurende verklaring aan NAM te blijven geven. De huidige voorzieningen voor de aardbevingsschade zijn immers te laag. Als de gaskraan verder wordt gesloten, dan kan de NAM niet anders, dan hulp van haar moedermijen vragen, voor de waarborging van haar continuïteit.

What’s in it for Shell? Doelstelling was om het publiek duidelijk te maken hoeveel de staat aan de gaswinning verdient en hoeveel NAM. In de verdeling van de schade is informatievoorziening belangrijk. Echter, het intrekken van de 403-verklaring was hiervoor helemaal niet nodig.

Subsidiair is het verkrijgen van een betere onderhandelingspositie tegenover de overheid een uitgangspunt. Maar het is echt naïef van Shell/NAM om te veronderstellen dat hierin enig voordeel te behalen valt. De publieke opinie doet hierin haar werk.

CONCLUSIE:

Nu Shell heeft verklaard om op papier garanties te verstrekken voor de aardbevingsschade is mijn advies aan Shell om de 403-verklaring weer bij de KvK te deponeren. Alle beperkingen aan de garantie zullen via politieke en publicitaire druk worden aangevallen, leidend tot een veel grotere imagoschade.

De Brent Spar ontmanteling en de daaraan gekoppelde boycot van Shell producten in Nederland en Duitsland zal menig oud gediende bij Shell nog goed in het geheugen liggen.

Een geruststellende gedachte voor de Groningers.

Independent treasury specialist

Since the beginning of February there has seen large declines in all the major stock markets – Dow Jones down 9%, AEX down 7%, DAX down 7%, FTSE down 5%. The major reason given is that the market has been disturbed by the thought that interest rates in the US will rise more quickly than previously expected as prospects of inflation come to the fore. Going counter to this thought is the explanation that stock markets achieved good growth in 2017 – all major markets were up with some growing by 15% – and that this is a bout of profit taking, before participants will buy on the dip.

Since the beginning of February there has seen large declines in all the major stock markets – Dow Jones down 9%, AEX down 7%, DAX down 7%, FTSE down 5%. The major reason given is that the market has been disturbed by the thought that interest rates in the US will rise more quickly than previously expected as prospects of inflation come to the fore. Going counter to this thought is the explanation that stock markets achieved good growth in 2017 – all major markets were up with some growing by 15% – and that this is a bout of profit taking, before participants will buy on the dip. At the moment headline inflation is remaining stable, but it appears that the market is expecting inflation to move higher in 2018. The increase in the yield of US 10 year Treasury rates has been more rapid than expected – at the moment the yield is almost 2.90%. It would appear that the increase in US rates is pulling other currency yields higher. Furthermore rises in US interest rates will have an impact on FX hedging policies for companies.

At the moment headline inflation is remaining stable, but it appears that the market is expecting inflation to move higher in 2018. The increase in the yield of US 10 year Treasury rates has been more rapid than expected – at the moment the yield is almost 2.90%. It would appear that the increase in US rates is pulling other currency yields higher. Furthermore rises in US interest rates will have an impact on FX hedging policies for companies. In January 2018, Carillion – a British construction, engineering and facilities company – entered into liquidation. They had been in existence since 1999 after a demerger from Tarmac, which had been founded in 1903. They were the second largest construction company in the British isles, employing more than 40,000 people and were listed on the London Stock Exchange. They were known for their role in Private Finance Initiative (PFI) schemes – a form of Government outsourcing. Their insolvency has led to the loss of jobs, shutdowns of ongoing projects, and financial losses to more than 25,000 pensioners and 30,000 suppliers.

In January 2018, Carillion – a British construction, engineering and facilities company – entered into liquidation. They had been in existence since 1999 after a demerger from Tarmac, which had been founded in 1903. They were the second largest construction company in the British isles, employing more than 40,000 people and were listed on the London Stock Exchange. They were known for their role in Private Finance Initiative (PFI) schemes – a form of Government outsourcing. Their insolvency has led to the loss of jobs, shutdowns of ongoing projects, and financial losses to more than 25,000 pensioners and 30,000 suppliers. Lionel Pavey – Cash Management and Treasury Specialist

Lionel Pavey – Cash Management and Treasury Specialist There are various signals that a number of corporates are moving their blockchain projects towards production. We recently have seen the announcement of the IBM – Maersk project, to create a blockchain based corporate. If accepted in a sufficient way by the various players in the shipping industry supply chain that could mean a real breakthrough for blockchain and other distributed ledger technologies. “The big thing that is missing from this industry to digitize and unleash the potential of the technology is really to create a form of utility that brings standards across the entire ecosystem,” Maersk’s Chief Commercial Officer Vincent Clerc.

There are various signals that a number of corporates are moving their blockchain projects towards production. We recently have seen the announcement of the IBM – Maersk project, to create a blockchain based corporate. If accepted in a sufficient way by the various players in the shipping industry supply chain that could mean a real breakthrough for blockchain and other distributed ledger technologies. “The big thing that is missing from this industry to digitize and unleash the potential of the technology is really to create a form of utility that brings standards across the entire ecosystem,” Maersk’s Chief Commercial Officer Vincent Clerc.

There has been a significant rise in the value of the EUR in the last year compared to the USD. From a low of USD 1.05 around the end of February 2017, the EUR has climbed up to USD 1.25 – representing an increase of around 20 per cent. Analysts are talking about the price rising above USD 1.30 later this year. All very good from the EUR side, but what is causing the EUR to appear so strong and the USD so weak?

There has been a significant rise in the value of the EUR in the last year compared to the USD. From a low of USD 1.05 around the end of February 2017, the EUR has climbed up to USD 1.25 – representing an increase of around 20 per cent. Analysts are talking about the price rising above USD 1.30 later this year. All very good from the EUR side, but what is causing the EUR to appear so strong and the USD so weak? The electronic analysis of bank fees not only cuts costs but also helps to sustainably improve the quality of treasury processes.

The electronic analysis of bank fees not only cuts costs but also helps to sustainably improve the quality of treasury processes.  TIPCO Treasury & Technology GmbH

TIPCO Treasury & Technology GmbH These are volatile times in the world of Bitcoin and all other cryptocurrencies. Over the last 2 months there have been large swings in the price – price opened up around USD 10,000 at the start of December 2017 and then roared ahead to over USD 19,000; this was followed by continual declines with the price dropping below USD 9,000 at the end of last week. This morning the price has gone under USD 8,000. Bitcoin has been renowned for its volatility, but are there fundamental factors at work that are affecting the price?

These are volatile times in the world of Bitcoin and all other cryptocurrencies. Over the last 2 months there have been large swings in the price – price opened up around USD 10,000 at the start of December 2017 and then roared ahead to over USD 19,000; this was followed by continual declines with the price dropping below USD 9,000 at the end of last week. This morning the price has gone under USD 8,000. Bitcoin has been renowned for its volatility, but are there fundamental factors at work that are affecting the price? There are also other forms of cash concentration:

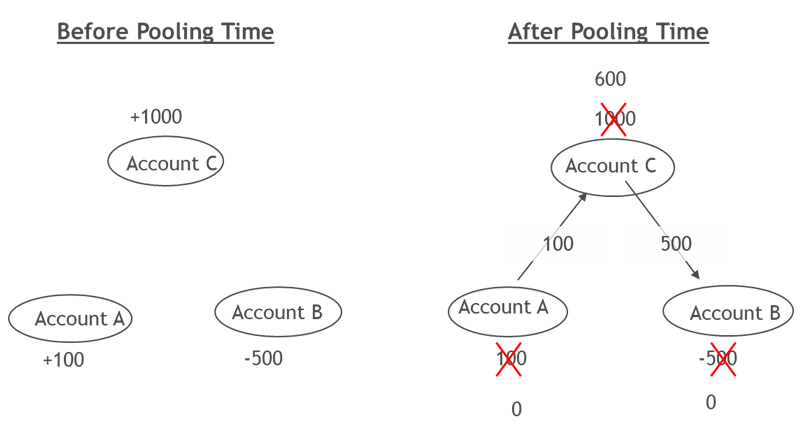

There are also other forms of cash concentration: