Regulating cryptocurrencies: walking the tightrope

| 01-03-2018 | Carlo de Meijer |

Long-time regulators world-wide took a wait-and-see attitude towards the non-regulated markets for Bitcoin and cryptocurrencies. But that is changing rapidly. With the growing popularity of the crypto market, the large number of unregulated cryptocurrencies (more than 1300, greater attention is now being paid by Governments and other stakeholders around the world.

Long-time regulators world-wide took a wait-and-see attitude towards the non-regulated markets for Bitcoin and cryptocurrencies. But that is changing rapidly. With the growing popularity of the crypto market, the large number of unregulated cryptocurrencies (more than 1300, greater attention is now being paid by Governments and other stakeholders around the world.

Regulators across the world are looking at whether — and how — to regulate cryptocurrencies. As a reaction last week cryptocurrencies tumbled with the Bitcoin falling even below $6,000 after having reached a high of $20,000 on 17 December for fear of more regulation. The cryptomarket value also fell deeply from $674 billion in December to $315 billion. Also the hack of the Japanese crypto exchange Coincheck, where some hundreds of millions of dollars disappeared caused enough unrest. Up till now there is however no univocal direction in how cryptocurrencies are looked at and how to treat them.

Why intervene in the cryptocurrency market?

It is no surprise that governments and regulators are becoming more vocal and putting together tasks forces on how to deal with it. There are compelling reasons why cryptocurrencies should be under more scrutiny by regulators and supervisors. The threat of price volatility, speculative trading and hack attacks all call for stricter regulation. Main goal of regulators is to create long-term stability afforded by common policies and elimination of fraudulent actions and practices.

To protect the consumer

Firstly, there is the need of tighter oversight of crypto exchanges and trading platforms from the viewpoint of investor protection. These markets are however not transparent for private investors. There are clear risks for private investors associated to price volatility, operational and security failures at crypto exchanges, market manipulation and liability gaps. Many experts worry that the trade in Bitcoin futures, crypto funds and other highly speculative financial products will inflate a speculative bubble, while running the risk of losing all their money. In that case there is – unlike at normal currencies such as euro, dollar and yen – no public institution like governments or central banks behind it.

Fear of criminal activities

According to many, aside from the instability of cryptocurrency prices, these cryptocurrencies must have greater regulatory oversight in order to prevent illegal activity and illegitimate use. Aside from the instability of cryptocurrency prices, regulators are worrying about criminals who are increasingly using cryptocurrencies for activities (trading away from official channels) like fraud and manipulation, tax evasion, hacking, money laundering and funding for terrorist activities.

Systemic risk

There is also the systemic risk that is inherent to the crypto-economy. If it continues to grow uncontrolled there is the danger of destabilising the financial system worldwide. The overheating of the cryptocurrency market with speculative money and the wild price fluctuations have raised alarms and calls for tightening of regulations in many countries from the viewpoint of financial system stability. If the price bubble bursts, it can quickly endanger individual institutions and parts of the financial markets. If big losses would occur this could hurt the reputation of the whole market.

Regulators are stepping in

The advent and subsequent boom of cryptocurrencies on a global scale as well as the heavy fluctuations have left many governments scrambling to find ways to deal with this new phenomenon. Regulators and other official authorities worldwide are stepping in to define how they would oversee this cryptocurrency environment (what had been to date a legally “murky” environment). Governments around the world are now looking at how to regulate Bitcoin and other cryptocurrencies.

What could they actually do: the options

There are various options to deal with cryptocurrencies, ranging from a complete ban to the other extreme of creating an own state digital currency. The options are just warn and further do nothing, complete ban, categorise as financial asset, regulate the exchanges or create a state owned crypto currency.

Read the full article of our expert Carlo de Meijer on LinkedIn

Economist and researcher

There are many reasons for the creation of the Euro – mainly linked to memories of senior politicians who had experienced the Second World War, together with the fall of the Iron Curtain. Countries that trade together, share institutions, and a common currency, are less likely to declare war on each other seems to be the thinking. Furthermore, statesmen explained that economic and monetary union would lead to greater prosperity, increased employment opportunities for citizens and a higher standard of living. Cohesion, convergence, increased wealth and peace were certainly attractive points. So why, after 19 years, have the countries not achieved more convergence?

There are many reasons for the creation of the Euro – mainly linked to memories of senior politicians who had experienced the Second World War, together with the fall of the Iron Curtain. Countries that trade together, share institutions, and a common currency, are less likely to declare war on each other seems to be the thinking. Furthermore, statesmen explained that economic and monetary union would lead to greater prosperity, increased employment opportunities for citizens and a higher standard of living. Cohesion, convergence, increased wealth and peace were certainly attractive points. So why, after 19 years, have the countries not achieved more convergence? Cashforce

Cashforce

Most companies, regrettably, experience internal fraud. The financial value of the loss can be small or large – however the impact is the same. Internal investigations, procedural reviews, the time spent on detection, possible prosecution, together with the potential loss of reputation are significant factors above and beyond the monetary loss. Fraud can never be eliminated, but the threat can be minimised through proper procedures.

Most companies, regrettably, experience internal fraud. The financial value of the loss can be small or large – however the impact is the same. Internal investigations, procedural reviews, the time spent on detection, possible prosecution, together with the potential loss of reputation are significant factors above and beyond the monetary loss. Fraud can never be eliminated, but the threat can be minimised through proper procedures. I want to include you in my search for what is right. Newspapers don’t publish what is right but what sells (for the Dutch, why did the Volkskrant publish the story of Jillert Anema this week?). Politicians don’t work from their convictions but what gets them votes. Large companies pay low level taxes in countries where they don’t manufacture & sell, and no taxes where they do. Actions that benefit the environment are not implemented because it weakens our position in global markets.

I want to include you in my search for what is right. Newspapers don’t publish what is right but what sells (for the Dutch, why did the Volkskrant publish the story of Jillert Anema this week?). Politicians don’t work from their convictions but what gets them votes. Large companies pay low level taxes in countries where they don’t manufacture & sell, and no taxes where they do. Actions that benefit the environment are not implemented because it weakens our position in global markets.

Every year the EU raises money by applying a levy on member states that represents a percentage of their Gross National Income (GNI). The EU Budget operates on a 7 year plan and then an annual budget is proposed and agreed. The EU strives to use 94% of expenditure on policies and 6% on administrative costs. As with all budgets, there are 2 sides – income and expenditure. There are 4 main sources of income – traditional own resources, VAT (BTW) based resources, GNI based resources, and other resources. There are 6 main sources of expenditure – growth, natural resources, security and citizenship, foreign policy, administration, and compensations.

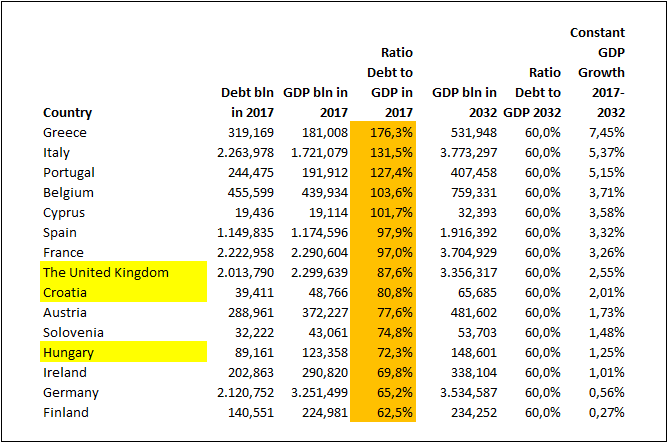

Every year the EU raises money by applying a levy on member states that represents a percentage of their Gross National Income (GNI). The EU Budget operates on a 7 year plan and then an annual budget is proposed and agreed. The EU strives to use 94% of expenditure on policies and 6% on administrative costs. As with all budgets, there are 2 sides – income and expenditure. There are 4 main sources of income – traditional own resources, VAT (BTW) based resources, GNI based resources, and other resources. There are 6 main sources of expenditure – growth, natural resources, security and citizenship, foreign policy, administration, and compensations. A few weeks ago the EU Commission released a report on debt sustainability within the EU. It provides an overview of the challenges faced by member countries over the short, medium and long term to meet the original convergence criteria – specifically, that existing Government debt is less than 60% of GDP. As with most Government related documents it is long – over 250 pages. A lot of attention is drawn to the Debt Sustainability Monitor (DSM) and the challenges faced to achieve the abovementioned criteria by 2032.

A few weeks ago the EU Commission released a report on debt sustainability within the EU. It provides an overview of the challenges faced by member countries over the short, medium and long term to meet the original convergence criteria – specifically, that existing Government debt is less than 60% of GDP. As with most Government related documents it is long – over 250 pages. A lot of attention is drawn to the Debt Sustainability Monitor (DSM) and the challenges faced to achieve the abovementioned criteria by 2032.

Leasing is a common method used in business to benefit from using an asset. The part owning the asset is called the lessor who agrees to allow the user – the lessee – to use the asset, in return for a rental fee. The lessee also has to agree to certain terms and conditions as to how the asset can be used and by whom. This arrangement allows a business to enjoy the benefits of an asset – normally property or equipment – without having to purchase the asset outright at inception. The contract can also offer flexibility to the lessee with regard to replacing an asset when it is determined to be outdated. On the 1st January 2019, new accounting standards will be implemented meaning that for a lessee all lease contracts will have to be displayed on the balance sheet – with exception of short dated leases (less than 12 months) and with a monetary value of less than USD 5000.

Leasing is a common method used in business to benefit from using an asset. The part owning the asset is called the lessor who agrees to allow the user – the lessee – to use the asset, in return for a rental fee. The lessee also has to agree to certain terms and conditions as to how the asset can be used and by whom. This arrangement allows a business to enjoy the benefits of an asset – normally property or equipment – without having to purchase the asset outright at inception. The contract can also offer flexibility to the lessee with regard to replacing an asset when it is determined to be outdated. On the 1st January 2019, new accounting standards will be implemented meaning that for a lessee all lease contracts will have to be displayed on the balance sheet – with exception of short dated leases (less than 12 months) and with a monetary value of less than USD 5000.

On the 25th May 2018, GDPR – regulation by the European union – will come into effect. It requires any company that does business within the EU to protect the privacy relating to the data held on consumers, as well as restricting the types of data that can be collected. Obviously, this will mean extra expense for companies as they have to invest in systems and procedures to meet their obligations. However, a recent report by Deutsche Bank has shown that the implications of implementing GDPR could also have an impact on revenue.

On the 25th May 2018, GDPR – regulation by the European union – will come into effect. It requires any company that does business within the EU to protect the privacy relating to the data held on consumers, as well as restricting the types of data that can be collected. Obviously, this will mean extra expense for companies as they have to invest in systems and procedures to meet their obligations. However, a recent report by Deutsche Bank has shown that the implications of implementing GDPR could also have an impact on revenue.