| 20-9-2017 | Lionel Pavey |

Brexit is a fact, no news here. Discussions about how this Brexit is going to look like are an ongoing topic in the newspapers. Hard Brexit or soft Brexit – what does it actually mean for the UK and the European Union? What are the consequences of a hard Brexit compared to those of a soft Brexit to all of us? It implies there are 2 paths that can be followed – actually there are 3.

Brexit is a fact, no news here. Discussions about how this Brexit is going to look like are an ongoing topic in the newspapers. Hard Brexit or soft Brexit – what does it actually mean for the UK and the European Union? What are the consequences of a hard Brexit compared to those of a soft Brexit to all of us? It implies there are 2 paths that can be followed – actually there are 3.

3 paths

- No deal

- Hard – should really be called a clean Brexit

- Soft – should really be called unclear Brexit

No deal

This is exactly as it says – if no deal is reached between both parties. UK would no longer be obliged to follow EU law and treaties. This would lead to a period of uncertainty and confusion and new treaties would need to be implemented, whilst both sides would not be receptive to each other. The EU could still try to pursue UK through international courts for monies that it felt were still owed. Highly turbulent, but could happen.

Hard

Leaving the EU by mutual consent but not actually agreeing on the future, UK would no longer have to observe the pillars of the EU that currently prevail. This includes such issues as immigration, free movement, asylum, fisheries and agriculture to name but a few. Trade would fall under WTO rules until a mutual trade policy could be drafted.

Soft

This implies links being retained between both parties, specifically towards trade. It would mean UK would gain entry to a tariff free EU market, whilst accepting free movement of people. UK would have to pay for entry, whilst being denied a vote in EU matters.

Scenarios and consequences

So, what are the chances of these scenarios and many others happening?

To answer that question we have to go back to the actual question asked at the referendum – “Should the United Kingdom remain a member of the European Union or leave the European Union?”

The wording is very important – it was not worded should we leave the EU; yes or no. This was to remove any bias in people’s comprehension as to what they were voting for. As the majority of the electorate voted to leave the EU, this makes any attempt at a soft Brexit difficult to justify against the vote of the people. Any agreement where UK pays the EU and accepts EU rule negates the referendum question.

If the referendum is negated by the actions of politicians against the will of the people, then this could lead to a crisis in the country. Flagrantly ignoring the will of the people could lead to social and political unrest.

Politicians in the UK work in Parliament, work for their party and also, very importantly, work for their constituents. A MP has to make him/herself available to answer questions from their constituents.

In the UK, voting, whilst primarily for a political party, is specifically for your local MP who represents you in Parliament. It would take a very brave (or foolhardy) politician who would ignore the will of the majority of the people. That is not to say that it could happen, just that the consequences are far reaching and difficult to predict.

The divorce settlement

The EU is demanding a sum of money from UK (currently thought to be around EUR 100 million) to settle outstanding commitments. As the 2 were never legally married, it appears an affront to demand money. UK was entitled to grant a referendum, allowing the people to decide, and no laws have been broken. The argument used by the EU that there is an agreed rolling budget for the period of 2014-2020 makes it appear that it is set in stone and can not be changed. Based on current UK contributions and the fact that they will leave in 2019, then EUR 100 million sounds excessive for the 1 remaining year of the budget.

Furthermore, if the EU wishes to pursue a divorce settlement, then UK can look at obtaining their rightful share of the assets of the EU – that also happens in a divorce. UK has been a net contributor to the EU budget for the last 40 years.

What are the consequences for all involved?

Markets will remain volatile – uncertainty will prevail at least for the next 18 months. Certain markets and countries will be badly affected – the EU fishing industry will certainly suffer if the UK exercise control over their maritime waters. Banking will be in a state of flux – will large banks leave UK and resettle in EU to have access to EU markets? Where will settlement of EUR transactions take place? German car manufacturers could be denied access to one of their top markets or face stiff tariffs to import their vehicles into UK. Will we be able to freely move and live where we want to, whilst seeking employment or claiming benefit?

The chances of forming any agreement within the next 18 months are small. There is so much that needs to be agreed upon in a relatively short time frame. If the will of the people is to be honoured, then one must draw the conclusion that the end result will be a hard Brexit.

If UK politicians choose for a Soft Brexit, then they could face the wrath of the people and a second Glorious revolution could happen, though I do not see Rutte playing the role of the Prince of Orange.

He, after all, ignored the will of the people over the Ukraine referendum…

I always try to write from an objective point of view. Being English by birth, I realize that a lot of what I have written can be perceived as subjective.I was unable to vote in this referendum but, if truth be told, I would have gladly voted to leave.

The EU has lost its way and further integration will eventually lead to fiscal union. This would result in a permanent transfer of wealth from the wealthy countries to the poorer. There would be no incentive for poorer countries to improve their economies – the rich will pay.

Lionel Pavey

Cash Management and Treasury Specialist

More articles from this author:

The end of the Euro as we know it – When the party ends?

The treasurer and data

Managing treasury risk : Risk management (Part I) (Parts II – VII to be found on treasuryXL)

Blockchain Innovation Conference 2017- An inspiring event

Treasury for non-treasurers: Data analysis and forecasting – seeing the future by looking at the past (Part I)

(Parts II – III to be found on treasuryXL)

Building a cash flow forecast model

[separator type=”” size=”” icon=””]

Do you run a business in Europe and the world is your market? Then you must face jitters due to the currency developments in the US and UK. The huge impact of Brexit on the sterling has seen a devaluation of around 30% against the Euro. The US dollar has weakened some 15% compared to early 2017.

Do you run a business in Europe and the world is your market? Then you must face jitters due to the currency developments in the US and UK. The huge impact of Brexit on the sterling has seen a devaluation of around 30% against the Euro. The US dollar has weakened some 15% compared to early 2017.

Since our start in April 2016, treasuryXL made major steps to become a well-established website. We are happy with what we have achieved and growth is promising. Currently, 12.000 site pages are visited on a monthly basis. We have a strong basis of readers who come back every month, often a number of times.

Since our start in April 2016, treasuryXL made major steps to become a well-established website. We are happy with what we have achieved and growth is promising. Currently, 12.000 site pages are visited on a monthly basis. We have a strong basis of readers who come back every month, often a number of times. Annette Gillhart – Community manager treasuryXL

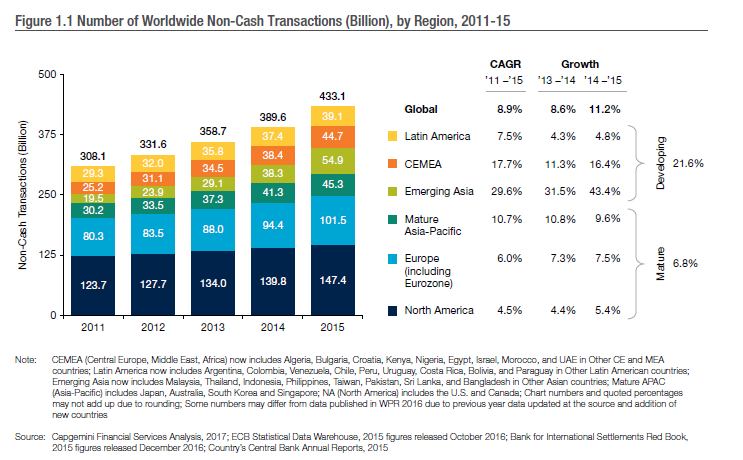

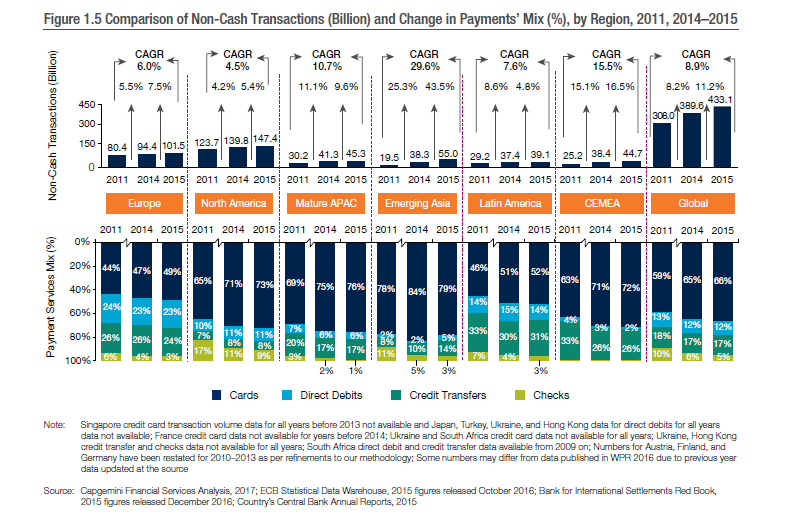

Annette Gillhart – Community manager treasuryXL Each year, during the summer, Cap Gemini publishes with BNP Paribas the World Payments Report, aiming at providing a preview of the global payments landscape. In the following I present you a short summary with what I consider the main findings. If you want to access the full report please click on this

Each year, during the summer, Cap Gemini publishes with BNP Paribas the World Payments Report, aiming at providing a preview of the global payments landscape. In the following I present you a short summary with what I consider the main findings. If you want to access the full report please click on this

François de Witte – Founder & Senior Consultant at

François de Witte – Founder & Senior Consultant at  Brexit is a fact, no news here. Discussions about how this Brexit is going to look like are an ongoing topic in the newspapers. Hard Brexit or soft Brexit – what does it actually mean for the UK and the European Union? What are the consequences of a hard Brexit compared to those of a soft Brexit to all of us? It implies there are 2 paths that can be followed – actually there are 3.

Brexit is a fact, no news here. Discussions about how this Brexit is going to look like are an ongoing topic in the newspapers. Hard Brexit or soft Brexit – what does it actually mean for the UK and the European Union? What are the consequences of a hard Brexit compared to those of a soft Brexit to all of us? It implies there are 2 paths that can be followed – actually there are 3.

Microsoft recently announced the introduction of the

Microsoft recently announced the introduction of the

In earlier blogs we informed you about

In earlier blogs we informed you about

Op 27 september is het zover. Buitenlandse investeerders en FinTech-specialisten van naam reizen dan af naar Brussel. Tijdens de

Op 27 september is het zover. Buitenlandse investeerders en FinTech-specialisten van naam reizen dan af naar Brussel. Tijdens de