How to Adjust Your Working Capital Management in a Changing Economy

27-07-2023 | The results are in, so find out what is considered the key strategy!

27-07-2023 | The results are in, so find out what is considered the key strategy!

13-07-2023 | In the last 12 months, the FX market has experienced significant turbulence due to high inflation, rising interest rates, and geopolitical issues.

15-06-2023 | The importance of symbology is growing as a result of its applications in regulatory compliance and its ability to support business efficiency. Firms are increasingly finding ways of using symbology in artificial intelligence and machine learning innovation. But what is symbology and how does it work?

07-06-2023 | Investors and traders are unanimous about one thing – there is considerable uncertainty for the fixed income markets. Firms must strategically prepare their fixed income trading desks, middle office and back office to protect – and create – customer and shareholder value.

26-04-2023 | Having spent a significant amount of time working on financing transactions for corporates, I appreciate the importance of debt financing for companies looking to fund existing operations and finance their growth plans.

23-02-2023 | treasuryXL | LinkedIn |

Download the comprehensive eBook on Treasury function, compiled by treasuryXL. This valuable resource covers a wide range of relevant topics including Treasury, Corporate Finance, Cash Management, Risk Management, and Working Capital Management.

Drawing on the expertise of Treasury professionals and their best practices, we have carefully crafted clear and concise articles that provide you with the most crucial information about the key topics in the world of Treasury.

In this eBook, we take a deep dive into each Treasury function and explore:

Whether you are new to Treasury or an experienced practitioner looking to expand your knowledge, this eBook is an essential resource that will help you stay up-to-date with the latest best practices and insights in the field.

We simply giveaway two presents for you! By signing up for our newsletter you will automatically receive the following in your inbox:

Subscribe, Join, Download and Relax.

Welcome to our community and have fun reading!

Director, Community & Partners at treasuryXL

14-02-2023 treasuryXL | Treasurer Search | LinkedIn

Join us for a thought-provoking Live Session on Interim Treasury Management, where our experts will delve into the pros and cons of this exciting market.

Unlock the Benefits of Interim Treasury Management: Discover Why it’s a Must-Have for Your Business!

Our panel of seasoned interim treasurers, including Emiel van Maris, Francois De Witte, and treasury recruiter Pieter de Kiewit, will share their valuable insights and experiences.

This webinar is designed for aspiring interim managers, potential clients, and anyone interested in learning more about this market.

Don’t miss this opportunity to gain tips and tricks from the experts in the field and engage in an open discussion.

Register now to secure your spot!

Everyone is welcome to this webinar.

🌟Moderator: Pieter de Kiewit of Treasurer Search

🌟Duration: 45 minutes

𝘉𝘺 𝘳𝘦𝘨𝘪𝘴𝘵𝘦𝘳𝘪𝘯𝘨 𝘺𝘰𝘶 𝘤𝘰𝘯𝘴𝘦𝘯𝘵 𝘵𝘰 𝘳𝘦𝘤𝘦𝘪𝘷𝘪𝘯𝘨 𝘤𝘰𝘮𝘮𝘶𝘯𝘪𝘤𝘢𝘵𝘪𝘰𝘯𝘴 𝘧𝘳𝘰𝘮 𝘵𝘳𝘦𝘢𝘴𝘶𝘳𝘺𝘟𝘓 𝘳𝘦𝘨𝘢𝘳𝘥𝘪𝘯𝘨 𝘵𝘩𝘦 𝘭𝘢𝘵𝘦𝘴𝘵 𝘵𝘳𝘦𝘢𝘴𝘶𝘳𝘺 𝘪𝘯𝘴𝘪𝘨𝘩𝘵𝘴. 𝘠𝘰𝘶 𝘮𝘢𝘺 𝘸𝘪𝘵𝘩𝘥𝘳𝘢𝘸 𝘢𝘯𝘺𝘵𝘪𝘮𝘦. 𝘗𝘭𝘦𝘢𝘴𝘦 𝘳𝘦𝘧𝘦𝘳 𝘵𝘰 𝘰𝘶𝘳 𝘗𝘳𝘪𝘷𝘢𝘤𝘺 𝘗𝘰𝘭𝘪𝘤𝘺.

We can’t wait to welcome!

Best regards,

Kendra Keydeniers

Director, Community & Partners

07-02-2023 | Eurofinance | treasuryXL | LinkedIn |

Join senior treasury peers on March 7th in London at EuroFinance’s 10th annual Effective Finance & Treasury in Africa. Understand changing developments and the unique opportunities and challenges of doing business in this dynamic region.

This year’s speaker line-up includes experienced treasurers – all active in African markets – including:

● Edward Collis, Treasurer, Save the Children

● Neiciriany Mata, Head of finance, Angola Cables

● Marta de Teresa, Group treasurer, Maxamcorp

● Chigbo Enenmo, Finance and treasury manager, Nigeria LNG

● Folake Fawibe, Integrated business service lead, Danone, Southern Africa

● Jan Beukes, Group treasurer, MultiChoice Group

They will discuss important topics including cash and FX, payments, liquidity and financing, digital transformation, share success stories and provide practical guidance on how to optimise your treasury operation for growth.

For the full agenda and to register, please visitt this link.

Quote discount code MKTG/TXL10 for an exclusive 10% discount for TreasuryXL readers.

If you have any questions, you can contact the EuroFinance team directly at [email protected].

30-11-2022 | treasuryXL | LinkedIn |

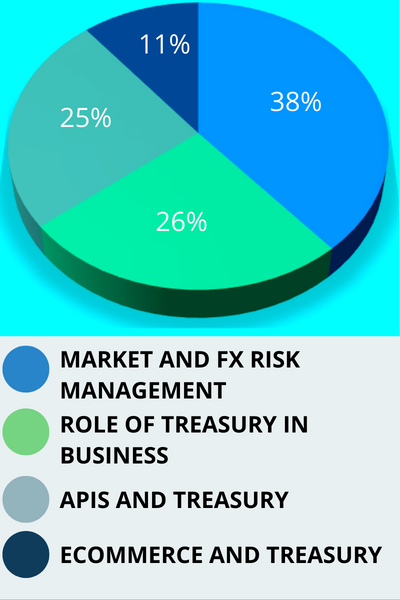

As 2023 is approaching, we explored what Treasurers are particularly looking forward to in treasury for next year. What will be the Treasury Trend of 2023? Are treasurers curious to know what is going to happen in the area of Market and FX Risk Management, or just what the developments are going to be in e-commerce related to Treasury? Or will the understanding of APIs in Treasury be the story of 2023, or the role of Treasury within companies? We sought it out!

As 2023 is approaching, we explored what treasurers are particularly looking forward to in treasury for next year. What will become the trends in treasury management next year?Are treasurers curious to know what is going to happen in the area of Market and FX Risk Management, or just what the developments are going to be in Ecommerce related to Treasury? Or will the understanding of APIs in Treasury be the story of 2023, or the role of Treasury within companies? We sought it out! This topic was also the subject of discussion during the last webinar together with Nomentia, you can find the recording here.

Question: What are you particularly interested in that will develop in 2023 in treasury?

We see that Market and FX Risk Management stands out a little, and that there is less focus on trends in e-commerce and Treasury. What do those within treasuryXL say about this, and what are they looking forward to for next year?

Huub is especially interested in the developments in APIs for Treasury for in 2023.

“My personal interest is in the focus on APIs, which is good, as APIs offer new functionalities and convenience for treasurers”

With the current political and economic turmoil, it makes sense that market risk is back on the agenda. Interest rates are rising and emerging markets are becoming riskier. My personal interest is in the focus on APIs, which is good, as APIs offer new functionalities and convenience for treasurers. However, it is a jungle because everyone promises APIs, but few deliver on them, and the few that do make them have no standards.

We also see APIs that are ‘disguised’ file connections. This makes sense, because an API means linking two applications and this can be done through authentication, security and then exchange of a file. We see this a lot with Payment Service Providers. Getting reporting files for matching purposes, for example.

The webinar the other day was interesting because Niki and I represent two different areas of treasury that are important to Patrick, a very experienced treasurer, namely market risk and technology. Together with Pieter as moderator, it was fun to hear the different perspectives and experiences!

Kim Vercoulen (Treasurer Search)

Kim is especially interested in the developments of Market and FX Risk Management for in 2023.

” Important question for the treasurer will remain what to do about this.”

I chose for Market and FX Risk Management. I think especially with inflation and higher interest rates, this is going to have an impact on the treasurer’s work within the treasury department.

This is obviously all going to play through on companies’ costs, and pressure on selling prices will also increase. Important question for the treasurer will remain what to do about this.

How this will affect the treasury market compared to the current year remains to be seen. That is what we are going to witness at Treasurer Search.

27-10-2022 | treasuryXL | LinkedIn |

This eBook compiled by treasury describers all aspects of the treasury function. This comprehensive book covers relevant topics such as Treasury, Corporate Finance, Cash Management, Risk Management, Working Capital Management.

This eBook was prepared by treasuryXL based on the most useful best practices offered by Treasury professionals throughout the previous years. We compiled the most crucial information for you and wrote clear, concise articles about the key topics in the World of Treasury.

We took a deeper dive into each of the above-mentioned treasury functions and highlight:

We simply giveaway two presents for you! By signing up for our newsletter you will automatically receive the following in your inbox:

Subscribe, Join, Download and Relax.

Welcome to our community and have fun reading!

Director, Community & Partners at treasuryXL