Basis Swap – how to convert your exposure

| 10-04-2018 | treasuryXL |

At the moment, there is a growing movement within interbank markets to replace all the existing interbank offer rates that are used to price a myriad of financial instruments. The motivation for this movement has been the revelation that these indices have been fraudulently priced by banks delivering inaccurate prices for the daily fixing. At the moment the markets are first looking at secured overnight lending indices – but these are not complimentary to all the existing instruments that regularly reference a longer tenor on an unsecured basis. These can lead to problems with the asset and liability management of a portfolio – not just for banks, but also for corporate clients.

So, what is a basis swap and how does it work?

A basis swap is an interest rate swap where both legs reference a floating rate – either in the same currency or on a cross currency. Examples would be a 3 month Euribor exposure against a 6 month Euribor exposure, or 3 month USD Libor versus 3 month GBP Libor. In a normal positive yield curve the interest rate for a longer tenor is higher than for the shorter period – 3 month USD Libor is 2.33746% and 6 month USD Libor is 2.47219%. There are 2 main reasons for the difference in price – the tenor is longer, therefore the risk of repayment is lengthened and the individual credit rating of the counterparty is also affected.

Before the financial crisis of 2008, basis swaps were traded, but not given much attention. Their primary function was for transforming the asset and liability management in the same currency. It was actively used in the cross currency market where a bank might raise long term funds in Japanese Yen, but needed to convert the proceeds into USD. Furthermore, the consensus at the time was that 1 master curve could be built to price all products – this used short dated deposits, 3 month interest rate futures and long date interest rate swaps to build the single curve.

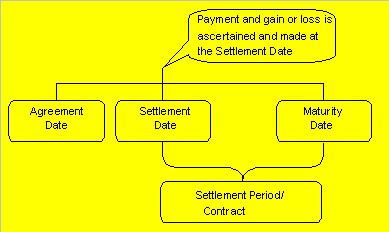

This meant that a 6 month deposit was built on the basis of a 3 month deposit and a 3m v 6m FRA (Forward Rate Agreement) . In such an instance there would be no arbitrage possible and the market did not really look at the basis risk. But the basis risk was inherent and certain market players exploited this misconception – particularly banks that received fiduciary funding via Switzerland.

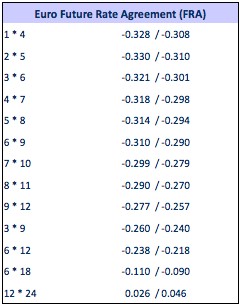

Today, there is far more awareness of the basis risk. 3 month Euribor is -0.329% and a 3v6m EUR FRA is -0.33/-0.31%. However the 6 month Euribor is 0.270% (we will leave you to do the calculation)

As a longer tenor has a higher interest rate (in normal market conditions) a basis swap referencing a 3 month versus 6 month payment would see the 3 month period being quoted as flat rate plus a premium, and the 6 month period being shown as a flat rate. A typical quotation for a 1 year EUR basis swap referencing a 3 month against 6 month Euribor would be priced around at about 5 -6 basis points premium. This means if you were to pay the shorter period of 3 months you would pay the base of 3 month Euribor plus 5-6 basis points every 3 months for 1 year, against receiving the 6 month Euribor flat every 6 months.

This product allows you to transform your position, but also gives insight into how the market sees the continuous 3 month and 6 month curves, together with their inherent basis risk.

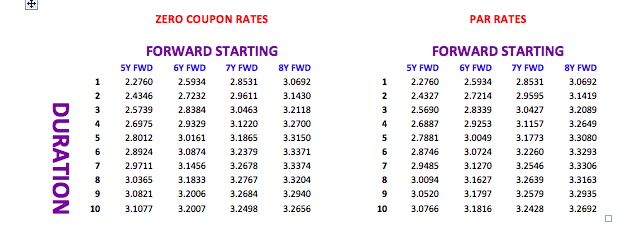

An interest rate swap curve that references a 6 month floating leg, will normally be built from an interest rate swap curve built off a 3 month floating leg, with an adjustment for the 3m v 6m basis swap to reflect the higher price on a 6 month curve.

There has been a significant rise in the value of the EUR in the last year compared to the USD. From a low of USD 1.05 around the end of February 2017, the EUR has climbed up to USD 1.25 – representing an increase of around 20 per cent. Analysts are talking about the price rising above USD 1.30 later this year. All very good from the EUR side, but what is causing the EUR to appear so strong and the USD so weak?

There has been a significant rise in the value of the EUR in the last year compared to the USD. From a low of USD 1.05 around the end of February 2017, the EUR has climbed up to USD 1.25 – representing an increase of around 20 per cent. Analysts are talking about the price rising above USD 1.30 later this year. All very good from the EUR side, but what is causing the EUR to appear so strong and the USD so weak? Despite interest rate being very low for the last few years, general consensus is that rates will eventually rise – rates will become more normal. Rates are being held down by the actions of central banks with their quantitative easing. As QE is scaled backed and stopped this should allow rates to rise from their current low levels. The big question is – how high will rates rise? The Euro is not yet 20 years old and that means that whilst there is a lot of data, it does not require looking through 50 or 60 years of data to try and find the norm.

Despite interest rate being very low for the last few years, general consensus is that rates will eventually rise – rates will become more normal. Rates are being held down by the actions of central banks with their quantitative easing. As QE is scaled backed and stopped this should allow rates to rise from their current low levels. The big question is – how high will rates rise? The Euro is not yet 20 years old and that means that whilst there is a lot of data, it does not require looking through 50 or 60 years of data to try and find the norm.

Money Market outlook

Money Market outlook

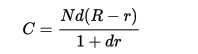

where N is the notional of the contract, R is the fixed rate, r is the published -IBOR fixing rate and d is the decimalized day count fraction over which the value start and end dates of the -IBOR rate extend.

where N is the notional of the contract, R is the fixed rate, r is the published -IBOR fixing rate and d is the decimalized day count fraction over which the value start and end dates of the -IBOR rate extend.

You might visit this site, being a treasury professional with years of experience in the field. However you could also be a student or a businessman wanting to know more details on the subject, or a reader in general, eager to learn something new. The ‘Treasury for non-treasurers’ series is for readers who want to understand what treasury is all about. From our expert Victor Macrae we received another article on risk management, of which we thought that it adds some extra aspects to the earlier article on riskmanagement.

You might visit this site, being a treasury professional with years of experience in the field. However you could also be a student or a businessman wanting to know more details on the subject, or a reader in general, eager to learn something new. The ‘Treasury for non-treasurers’ series is for readers who want to understand what treasury is all about. From our expert Victor Macrae we received another article on risk management, of which we thought that it adds some extra aspects to the earlier article on riskmanagement.