Unlocking Value: How TMS Delivers Measurable ROI for Corporate Treasury

08-01-2025 | Olivier Zurel often saw treasurers’ excitement fade when discussions shifted from a TMS demo to the resources needed for implementation.

08-01-2025 | Olivier Zurel often saw treasurers’ excitement fade when discussions shifted from a TMS demo to the resources needed for implementation.

14-12-2023 | How does Fintech impact the payments and corporate treasury landscape? And what are the opportunities for fintech entrepreneurs in the EU?

22-08-2023 | Recently we ran a poll to find out what solution treasurers thought was most important to maintain safety and security for financial processes.

23-02-2023 | treasuryXL | LinkedIn |

Download the comprehensive eBook on Treasury function, compiled by treasuryXL. This valuable resource covers a wide range of relevant topics including Treasury, Corporate Finance, Cash Management, Risk Management, and Working Capital Management.

Drawing on the expertise of Treasury professionals and their best practices, we have carefully crafted clear and concise articles that provide you with the most crucial information about the key topics in the world of Treasury.

In this eBook, we take a deep dive into each Treasury function and explore:

Whether you are new to Treasury or an experienced practitioner looking to expand your knowledge, this eBook is an essential resource that will help you stay up-to-date with the latest best practices and insights in the field.

We simply giveaway two presents for you! By signing up for our newsletter you will automatically receive the following in your inbox:

Subscribe, Join, Download and Relax.

Welcome to our community and have fun reading!

Director, Community & Partners at treasuryXL

14-02-2023 treasuryXL | Treasurer Search | LinkedIn

Join us for a thought-provoking Live Session on Interim Treasury Management, where our experts will delve into the pros and cons of this exciting market.

Unlock the Benefits of Interim Treasury Management: Discover Why it’s a Must-Have for Your Business!

Our panel of seasoned interim treasurers, including Emiel van Maris, Francois De Witte, and treasury recruiter Pieter de Kiewit, will share their valuable insights and experiences.

This webinar is designed for aspiring interim managers, potential clients, and anyone interested in learning more about this market.

Don’t miss this opportunity to gain tips and tricks from the experts in the field and engage in an open discussion.

Register now to secure your spot!

Everyone is welcome to this webinar.

🌟Moderator: Pieter de Kiewit of Treasurer Search

🌟Duration: 45 minutes

𝘉𝘺 𝘳𝘦𝘨𝘪𝘴𝘵𝘦𝘳𝘪𝘯𝘨 𝘺𝘰𝘶 𝘤𝘰𝘯𝘴𝘦𝘯𝘵 𝘵𝘰 𝘳𝘦𝘤𝘦𝘪𝘷𝘪𝘯𝘨 𝘤𝘰𝘮𝘮𝘶𝘯𝘪𝘤𝘢𝘵𝘪𝘰𝘯𝘴 𝘧𝘳𝘰𝘮 𝘵𝘳𝘦𝘢𝘴𝘶𝘳𝘺𝘟𝘓 𝘳𝘦𝘨𝘢𝘳𝘥𝘪𝘯𝘨 𝘵𝘩𝘦 𝘭𝘢𝘵𝘦𝘴𝘵 𝘵𝘳𝘦𝘢𝘴𝘶𝘳𝘺 𝘪𝘯𝘴𝘪𝘨𝘩𝘵𝘴. 𝘠𝘰𝘶 𝘮𝘢𝘺 𝘸𝘪𝘵𝘩𝘥𝘳𝘢𝘸 𝘢𝘯𝘺𝘵𝘪𝘮𝘦. 𝘗𝘭𝘦𝘢𝘴𝘦 𝘳𝘦𝘧𝘦𝘳 𝘵𝘰 𝘰𝘶𝘳 𝘗𝘳𝘪𝘷𝘢𝘤𝘺 𝘗𝘰𝘭𝘪𝘤𝘺.

We can’t wait to welcome!

Best regards,

Kendra Keydeniers

Director, Community & Partners

07-02-2023 | Eurofinance | treasuryXL | LinkedIn |

Join senior treasury peers on March 7th in London at EuroFinance’s 10th annual Effective Finance & Treasury in Africa. Understand changing developments and the unique opportunities and challenges of doing business in this dynamic region.

This year’s speaker line-up includes experienced treasurers – all active in African markets – including:

● Edward Collis, Treasurer, Save the Children

● Neiciriany Mata, Head of finance, Angola Cables

● Marta de Teresa, Group treasurer, Maxamcorp

● Chigbo Enenmo, Finance and treasury manager, Nigeria LNG

● Folake Fawibe, Integrated business service lead, Danone, Southern Africa

● Jan Beukes, Group treasurer, MultiChoice Group

They will discuss important topics including cash and FX, payments, liquidity and financing, digital transformation, share success stories and provide practical guidance on how to optimise your treasury operation for growth.

For the full agenda and to register, please visitt this link.

Quote discount code MKTG/TXL10 for an exclusive 10% discount for TreasuryXL readers.

If you have any questions, you can contact the EuroFinance team directly at [email protected].

27-10-2022 | treasuryXL | LinkedIn |

This eBook compiled by treasury describers all aspects of the treasury function. This comprehensive book covers relevant topics such as Treasury, Corporate Finance, Cash Management, Risk Management, Working Capital Management.

This eBook was prepared by treasuryXL based on the most useful best practices offered by Treasury professionals throughout the previous years. We compiled the most crucial information for you and wrote clear, concise articles about the key topics in the World of Treasury.

We took a deeper dive into each of the above-mentioned treasury functions and highlight:

We simply giveaway two presents for you! By signing up for our newsletter you will automatically receive the following in your inbox:

Subscribe, Join, Download and Relax.

Welcome to our community and have fun reading!

Director, Community & Partners at treasuryXL

27-10-2022 | treasuryXL | TIS | LinkedIn |

Working capital is a critical consideration for any business – particularly in an uncertain economic environment. If a company’s working capital is not managed effectively, the company may struggle to meet its obligations, secure the right level of funding, or invest in growth. But for many companies, gaining full visibility over working capital is often a difficult task – especially given how it is an activity that spans many different parts of the business.

Going a step further, recent economic and geopolitical events from the past couple of years have presented even more challenges to working capital management. In fact, PwC’s Working Capital Study 21/22 found that net working capital days reached a five-year high in 2020, “driven by the shock and uncertainty of the COVID 19 pandemic.” More recently, the 2022 AFP Strategic Role of Treasury Survey identified working capital improvements as one of the two most challenging tasks faced by treasury professionals today.

In order to manage working capital effectively, companies first need to understand it – you can’t manage what you can’t measure, as the saying goes. With this in mind, let’s dive a bit deeper into the core dynamics of working capital and the subsequent implications for treasury and finance.

Simply put, working capital is the cash that businesses can use to meet their day-to-day financial obligations, such as for paying rent, employee salaries, and supplier invoices. Calculated as the difference between a firm’s current assets and its current liabilities, a strong working capital position is essential to the smooth running of any company. For this reason, working capital is often described as the lifeblood of a business.

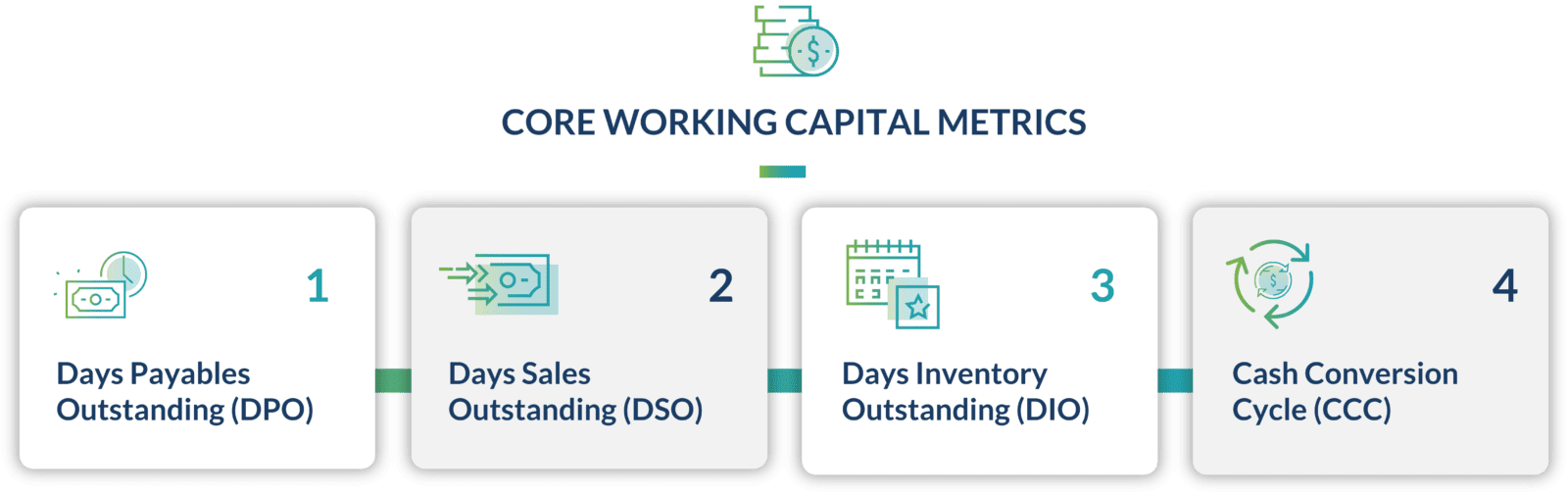

Working capital can be measured using a variety of metrics. The following concepts are key when it comes to understanding the component parts of the working capital cycle:

As a rule of thumb, the shorter a company’s cash conversion cycle, the more efficiently it is using its working capital – although typical cash conversion cycle times can vary considerably between different industries, world regions, and company sizes. Any company’s cash conversion cycle can also be adjusted by optimizing one or more of the above components: companies can speed up customer collections, delay/expedite payments to suppliers, and/or alter the timeframe that cash is tied up in inventory.

Treasury and finance teams have an important role to play in optimizing their company’s working capital. Working capital is critical to a company’s financial health: if the business doesn’t have enough cash readily available, it may struggle to pay its obligations on time. It may also seek more external financing than is really needed or may lack the funds needed to invest in innovation or business growth.

In order to effectively manage these cash inflows and outflows, treasury must not only have an accurate and timely view of their “current” working capital status, but they must also have a grip on future cash flows as well. This means that treasury must be proactive in developing cash forecasts that reflect anticipated changes in working capital, including deviations in supplier invoicing or payment behavior, as well as changes to the level of planned spend by procurement and other internal departments.

By working with other departments such as procurement, AP, and AR, the treasury team is well placed to drive improvements to the cash conversion cycle and unlock the company’s working capital. Because treasury typically seeks to maintain global visibility and control over cash positions, payments activity, and general financial workflows, they are in the perfect position to evaluate and influence high-level working capital decisions. For this reason, treasury is sometimes referred to as the “steward” of working capital internally.

However, there are a variety of hurdles that can negatively impact treasury’s view of, and control over, working capital.

While the importance of effective working capital management is clear, there are a number of reasons why this can be a challenge:

Disparate Data Sources: By its nature, managing working capital means optimizing activities that span different departments within the organization, including accounts payable (AP), accounts receivable (AR) and procurement, as well as treasury and finance. Working capital needs to be managed holistically, with access to data from these different parts of the business – but this can be constrained by siloes and disparate systems and data sources.

Lack of Alignment & Communication: Effective working capital management can be held back by a lack of awareness or competing priorities across different parts of the business. Because there are a range of departments that need to be on the same page in order to drive working capital optimization, it can be difficult to align the KPIs and drivers of each department to achieve a cohesive strategy. For this reason, a strong focus on working capital is needed from senior management in order to ensure a consistent approach across the organization.

Global Operational Complexity: Payment practices, vendor or customer behavior, and internal business models can vary considerably across different countries and regions, which can make it difficult to manage working capital consistently at a global level.

Supply Chain Relationships: The relationship a company maintains with its vendors and suppliers within the supply chain can have a massive impact on working capital. For example, companies frequently adjust their working capital position by either reducing or extending the time they take to pay invoices to suppliers. However, these strategies can have an adverse impact on vendor relationships, especially if companies choose to delay payment as long as possible. As such, working capital strategies that focus on altering vendor invoicing or payment terms should always be treated carefully.

In order to drive improvements to working capital, treasury teams first need full visibility over their company’s global cash, payments, and invoicing activity. As noted above, obtaining this data in an accurate and timely manner presents a major challenge for most companies, as does the task of effectively analyzing and leveraging it.

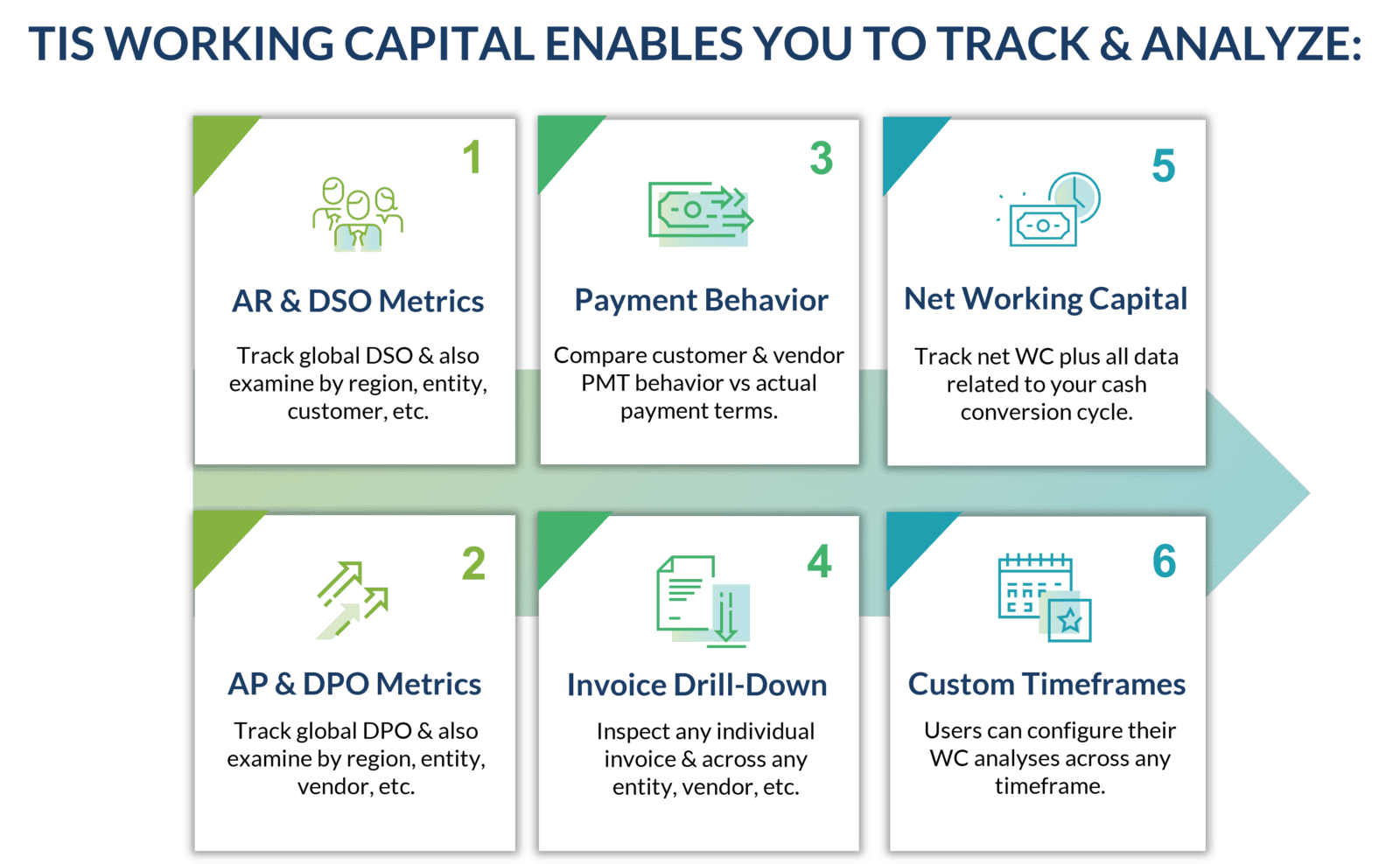

In order to simplify these tasks for treasury, TIS recently launched a new solution, TIS Working Capital Insights, which provides companies with 360-degree visibility over their core working capital metrics and KPIs.

With this suite of capabilities, organizations can seamlessly integrate their ERPs and corresponding AP and AR data with our solution in order to review payment terms and behavior for vendors and customers, analyze invoice and billing activity, and measure all elements related to their net working capital status and cash conversion cycle.

As TIS enables clients to aggregate and classify their data, users can evaluate their metrics globally or granularly according to specific entities, regions, or customers and suppliers. Users can also leverage TIS’ visual dashboards for intuitive reporting and refine their analyses by any timeframe to view activity and cash flows through customizable and flexible parameters.

By leveraging these tools in conjunction with TIS’ other liquidity and payment management solutions, organizations can access all data and information related to their global cash balances, payment statuses, and broader working capital operations for the entire company. The result is total visibility and control over working capital, and a much easier workflow for identifying the best strategies to optimize it.

For more information about TIS Working Capital solutions, download the full factsheet or request to speak with one of our experts!

12-10-2022 treasuryXL | Pieter de Kiewit | Treasurer Search LinkedIn

Throughout covid times the organizers of Eurofinance remained active and were able to create interesting web-based events. Still, general opinion in last weeks’ event in Vienna was that there is nothing like the live thing. The programme was packed with interesting content, the event floor with interesting companies and visitors.

By Pieter de Kiewit

Communication leading up to the event and the venue, the Wien Messe, radiated experience in events of this size. The numbers of representatives and visitors were impressive. Luckily, the venue is big enough to not nerve the visitors who have to get used to large crowds again.

The programme was spread out over the very large room for plenary meetings, five large rooms for parallel session with presentations & panel discussions and “open rooms” on the trade floor. Key note speakers like Guy Verhofstadt and Goran Carstedt were able to enthuse with stories beyond the scope of treasury, others covered topics about treasury technology, both practical & visionary and treasury organization, for example about my personal favourite, the treasury labour market.

For many, the trade floor was easily as interesting as the content. Visitors gained market information, for example preparing for a TMS selection and implementation. Also reuniting with old treasury friends and getting to know new ones, was relatively easy during well catered breaks. Some of the visitors created new legends during the Thursday night afterparty that is not covered by this looking-back-blog.

As treasuryXL ambassador I visited the various partners of the platform present and received positive feedback on the event. So Cobase, Kyriba, TIS, CashForce, Nomentia, Refinitiv and CashAnalytics, we hope to see you again in Barcelona again and welcome a number of new ones.

Hasta luego,

Thanks for reading!

06-10-2022 | treasuryXL | TIS | LinkedIn |

Don’t miss the latest episode of TIS’ Payments Hub Podcast! treasuryXL expert Patrick Kunz is featured in this edition. The topic of discussion is: Treasury in Finance; What are the newest trends and how can treasurers prepare?

In this episode, treasury and banking expert Kate Pohl speaks with industry consultant and thought-leader Patrick Kunz about the state of contemporary treasury best practices, technology utilization, and more.