Forward Rate Agreement (FRA)

| 05-01-2018| Arnoud Doornbos |

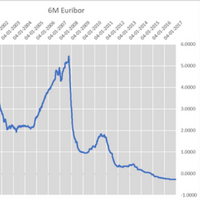

Money Market outlook

Money Market outlook

At the press conference on 14 December 2017, the ECB announced that expectations for economic growth and inflation have been adjusted upwards. But despite optimistic growth, the ECB is not yet fully convinced of a continued upward trend in domestic price pressures. And thus Draghi: “An ample degree of monetary stimulus … is necessary for underlying inflation pressures to continue to build up.”

For this reason, the ECB will maintain the buying program at least until September 2018. And only then will an increase in policy rates come into the picture. Since the beginning of 2017, investors have seen the chance that the ECB will implement an increase in policy interest rates. This has not yet had an effect on the three-month Euribor rate. This has been stable at around -0.3% for the whole of 2017, and we expect that this will be the case in the vast majority of 2018 as well.

But markets will go up again for sure during time and borrowers need to prepare themselves for that moment. A good interest rate risk management can help to extent the pleasure of using favorable low interest rates for your company. Hedging your short term interest rate exposure with FRA’s could be a good idea. Good timing is essential.

Definition

A Forward Rate Agreement’s (FRA’s) effective description is a cash for difference derivative contract, between two parties, benchmarked against an interest rate index. That index is commonly an interbank offered rate (-IBOR) of specific tenor in different currencies, for example LIBOR in USD, GBP, EURIBOR in EUR or STIBOR in SEK. A FRA between two counterparties requires a fixed rate, notional amount, chosen interest rate index tenor and date to be completely specified.

FRAs are not loans, and do not constitute agreements to loan any amount of money on an unsecured basis to another party at any pre-agreed rate. Their nature as a IRD product creates only the effect of leverage and the ability to speculate, or hedge, interest rate risk exposure.

How it works

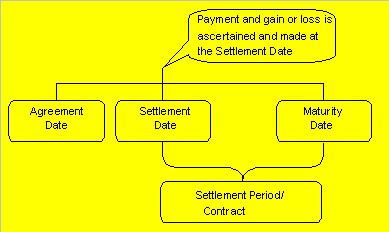

Many banks and large corporations will use FRAs to hedge future interest or exchange rate exposure. The buyer hedges against the risk of rising interest rates, while the seller hedges against the risk of falling interest rates. Other parties that use Forward Rate Agreements are speculators purely looking to make bets on future directional changes in interest rates.

In other words, a forward rate agreement (FRA) is a tailor-made, over-the-counter financial futures contract on short-term deposits. A FRA transaction is a contract between two parties to exchange payments on a deposit, called the Notional amount, to be determined on the basis of a short-term interest rate, referred to as the Reference rate, over a predetermined time period at a future date.

At maturity, no funds exchange hands; rather, the difference between the contracted interest rate and the market rate is exchanged. The buyer of the contract is paid if the published reference rate is above the fixed, contracted rate, and the buyer pays to the seller if the published reference rate is below the fixed, contracted rate. A company that seeks to hedge against a possible increase in interest rates would purchase FRAs, whereas a company that seeks an interest hedge against a possible decline of the rates would sell FRAs.

Valuation and Pricing

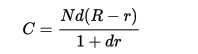

The cash for difference value on a FRA, exchanged between the two parties, calculated from the perspective of having sold a FRA (which imitates receiving the fixed rate) is calculated as:

where N is the notional of the contract, R is the fixed rate, r is the published -IBOR fixing rate and d is the decimalized day count fraction over which the value start and end dates of the -IBOR rate extend.

where N is the notional of the contract, R is the fixed rate, r is the published -IBOR fixing rate and d is the decimalized day count fraction over which the value start and end dates of the -IBOR rate extend.

For USD and EUR this follows an ACT/360 convention and GBP follows an ACT/365 convention. The cash amount is paid on the value start date applicable to the interest rate index (depending in which currency the FRA is traded, this is either immediately after or within two business days of the published -IBOR fixing rate).

For mark-to-market (MTM) purposes the net present value (PV) of an FRA can be determined by discounting the expected cash difference, for a forecast value r:

![]() where vn is the discount factor of the payment date upon which the cash for difference is physically settled, which, in modern pricing theory, will be dependent upon which discount curve to apply based on the credit support annex (CSA) of the derivative contract.

where vn is the discount factor of the payment date upon which the cash for difference is physically settled, which, in modern pricing theory, will be dependent upon which discount curve to apply based on the credit support annex (CSA) of the derivative contract.

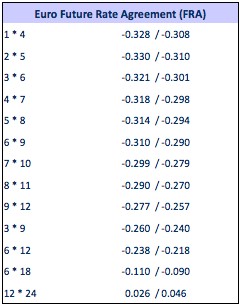

Quotation and Market-Making

FRA Descriptive Notation and Interpretation

How to interpret a quote for FRA?

[EUR 3×6 -0.321 / -0.301%p.a ] – means deposit interest starting 3 months from now for 3 month is -0.321% and borrowing interest rate starting 3 months from now for 3 month is -0.301%. Entering a “payer FRA” means paying the fixed rate (-0.321% p.a.) and receiving a floating 3-month rate, while entering a “receiver FRA” means paying the same floating rate and receiving a fixed rate (-0.321% p.a.).

Due to the current negative Money Market rates means receiving actually paying and the other way around.

Interim Treasury & Finance