FX volatility creates opportunities

| 18-10-2016 | Victor Macrae |

| 18-10-2016 | Victor Macrae |

The British pound has strongly decreased in value against other major currencies such as the US dollar and the euro. Such FX movements can negatively impact firms’ financial statements and destroy firm value. On the other hand, they can also create opportunities. I would like to demonstrate this on the basis of a real case of a European based industrial firm which has the euro as functional currency. We’ll discuss two scenarios.

First, some time ago the firm was negotiating a takeover of a British firm. In anticipation of the M&A transaction it purchased British pounds against euros. However, the deal was unexpectedly cancelled. As a result the firm had to sell the pounds again. Luckily, the pound had strengthened against the euro in the meantime and the firm ‘gained’ millions due to the failed acquisition. This could however easily have been a ‘loss’ in case of a weakening of the pound. The ‘no FX strategy’ was in the firm’s favour this time, but I wouldn’t bet on it.

If you are thinking about a takeover in the UK (or any other country where the local currency is under pressure) it is wise to consider multiple FX hedging strategies. For instance, using options for these type of transactions not only provides you with a way out if the acquisition is not closed as an option gives you the right but not the obligation to purchase the FX. Furthermore, when the payment is due it also gives you the opportunity to buy the currency at the option’s strike price or at the lower prevailing market rate if the case.

Second, a characteristic of this industrial firm is that it is very dominant in its core markets. Due to this position, the firm predominantly sells its products in euro, also to customers with a different home currency. While it may seem that there is no FX risk, this strategy has led to currency issues, for instance in the Russian market. Due to the weakening of the Russian rouble against the euro, the firm’s products have become more expensive up to a point where sales in Russia have nearly ceased to exist. Russian customers cannot afford to pay the euro prices and demand pricing in roubles or a discount on the euro price.

This is an example where a firm’s exchange rate policy influences its core business activities. A solution could be to move production to Russia, and possibly to produce for other regions as well, although this has consequences far beyond the FX issue which have to be taken into account.

Both examples show that FX volatility can create opportunities. FX risk management should support the core activities of a firm and not the other way around. But if creative FX management helps create firm value, why not benefit?

Owner of Macrae Finance

Afgelopen weken hebben er verschillende artikelen in de internationale kranten gestaan over de lening die het IMF aan Egypte wil verstrekken. Daarbij zagen we ook de Egyptische minister van landbouw Nederland bezoeken om te leren van de Nederlandse expertise op het gebied van land- en tuinbouw. De ontwikkelingen op de financiële markt in Egypte krijgen ook meer aandacht, dus we kunnen concluderen dat het interessant is om even stil te staan hoe de lokale valuta daar is georganiseerd. Na een eerdere devaluatie in maart van dit jaar, wordt er nu alweer een volgende verwacht.

Afgelopen weken hebben er verschillende artikelen in de internationale kranten gestaan over de lening die het IMF aan Egypte wil verstrekken. Daarbij zagen we ook de Egyptische minister van landbouw Nederland bezoeken om te leren van de Nederlandse expertise op het gebied van land- en tuinbouw. De ontwikkelingen op de financiële markt in Egypte krijgen ook meer aandacht, dus we kunnen concluderen dat het interessant is om even stil te staan hoe de lokale valuta daar is georganiseerd. Na een eerdere devaluatie in maart van dit jaar, wordt er nu alweer een volgende verwacht. René Schilder – Co Owner 2FX Treasury BV

René Schilder – Co Owner 2FX Treasury BV “Federal Reserve Rates and INR Reverse Carry”. As we understand that Federal Reserve Chairman Janet Yellen turning Hawkish and asking for 25 Bps increase in September 2016. If we look carefully then Fed vice Chair Fisher also suggested the same and at the same time most prominent Bond Trader – Bill Gross also suggested increase of 25 Bps in September and 25 Bps in December. If this would happen then Overnight Rates of USD would move to 1% and this would be closer to Australia which is 1.5% in $ terms.

“Federal Reserve Rates and INR Reverse Carry”. As we understand that Federal Reserve Chairman Janet Yellen turning Hawkish and asking for 25 Bps increase in September 2016. If we look carefully then Fed vice Chair Fisher also suggested the same and at the same time most prominent Bond Trader – Bill Gross also suggested increase of 25 Bps in September and 25 Bps in December. If this would happen then Overnight Rates of USD would move to 1% and this would be closer to Australia which is 1.5% in $ terms. Rahul Magan – Chief Executive Officer Treasury Consulting LLP

Rahul Magan – Chief Executive Officer Treasury Consulting LLP

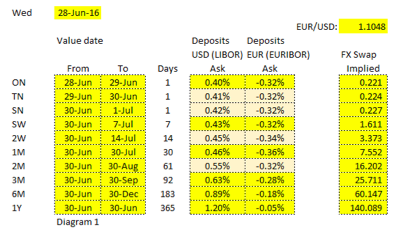

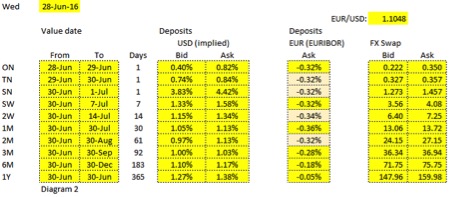

Now if we would consider exchanging a USD deposit versus a EUR deposit for 1 year the cash flows would be as follows:

Now if we would consider exchanging a USD deposit versus a EUR deposit for 1 year the cash flows would be as follows: e are looking at a single day FX swap, the annualized rate could swing a lot.

e are looking at a single day FX swap, the annualized rate could swing a lot.

Today in Rob Söentken’s Option Tales: When buying options it is tempting to see if the premium expenses can be minimized. A number of solutions are possible, which will be discussed in four articles. In the

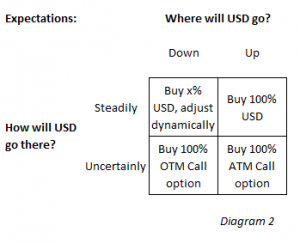

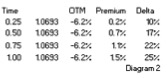

Today in Rob Söentken’s Option Tales: When buying options it is tempting to see if the premium expenses can be minimized. A number of solutions are possible, which will be discussed in four articles. In the  bought the option for 1.5%, we could sell it after 3 months at 1.1% and buy the USD through an outright forward transaction. This approach shows that the net cost of option protection would be only 0.4% (1.5% – 1.1%). Which would be cheaper than the premium of a 3-month option with the same Delta. Also, because the option has a higher Delta than a 3-month option with the same strike (25% vs 10%, see diagram 2), it will follow the spot market much better. The bottom line of paragraph 3 is that a longer dated option can be bought with the intention to sell it again at some point, the net cost being less than buying a shorter dated option. While it serves as a hedge against price changes.

bought the option for 1.5%, we could sell it after 3 months at 1.1% and buy the USD through an outright forward transaction. This approach shows that the net cost of option protection would be only 0.4% (1.5% – 1.1%). Which would be cheaper than the premium of a 3-month option with the same Delta. Also, because the option has a higher Delta than a 3-month option with the same strike (25% vs 10%, see diagram 2), it will follow the spot market much better. The bottom line of paragraph 3 is that a longer dated option can be bought with the intention to sell it again at some point, the net cost being less than buying a shorter dated option. While it serves as a hedge against price changes. buy the 1-year option in diagram 2 for 1.5%. Alternatively we could consider buying a right to buy this option for 0.4% in 3 months time. At that time the 1-year option will only have 9 months remaining, but the strike and 1.5% premium are fixed in the contract. On the expiry date of the compound option we can decide if we want to pay 1.5% for the underlying option. Alternatively, assuming nothing has changed, we could buy a 9 month option in the market for 1.1% (see diagram 2). In such a case we wouldn’t exercise the compound option.

buy the 1-year option in diagram 2 for 1.5%. Alternatively we could consider buying a right to buy this option for 0.4% in 3 months time. At that time the 1-year option will only have 9 months remaining, but the strike and 1.5% premium are fixed in the contract. On the expiry date of the compound option we can decide if we want to pay 1.5% for the underlying option. Alternatively, assuming nothing has changed, we could buy a 9 month option in the market for 1.1% (see diagram 2). In such a case we wouldn’t exercise the compound option.

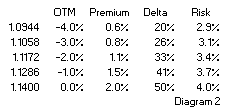

Risk appears fairly stabile across strikes, which makes sense because the premiums are calculated with one volatility on one underlying. The Risk on OTM is lower than that for ATM options. It appears that OTM premiums are relatively more expensive, they give protection against less potential loss.

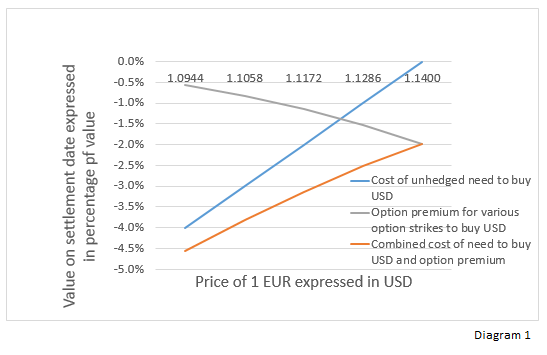

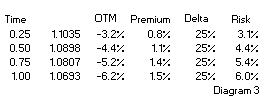

Risk appears fairly stabile across strikes, which makes sense because the premiums are calculated with one volatility on one underlying. The Risk on OTM is lower than that for ATM options. It appears that OTM premiums are relatively more expensive, they give protection against less potential loss. Diagram 3 shows Premiums, Delta and Risk for different tenors. ‘Time’ is the time to expiry of the options in fractions of years. Its shows that for longer tenors, the Risk is higher. But disproportionally. For the same chance on exercise a hedger could double the premium to buy a hedge for a 4x longer tenor.

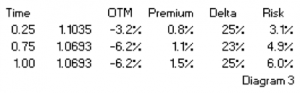

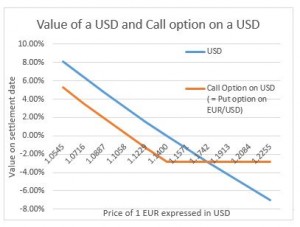

Diagram 3 shows Premiums, Delta and Risk for different tenors. ‘Time’ is the time to expiry of the options in fractions of years. Its shows that for longer tenors, the Risk is higher. But disproportionally. For the same chance on exercise a hedger could double the premium to buy a hedge for a 4x longer tenor. Diagram 1 explains his feelings. I assume he was considering only the left half of the payoff diagram. After an appreciation of the USD, a USD is always worth more than a call option on a USD, the difference being the option premium.

Diagram 1 explains his feelings. I assume he was considering only the left half of the payoff diagram. After an appreciation of the USD, a USD is always worth more than a call option on a USD, the difference being the option premium.