USD/TRY, where to after the failed coup?

02-08-2016 | Simon Knappstein |

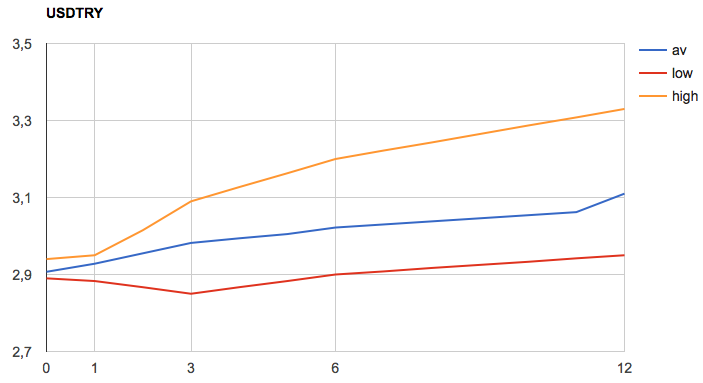

In my July consensus FX forecasts report USD/TRY was expected to rise to 3.11 in 12 months’ time. These forecasts were given prior to the attempted coup.

Now, two weeks further, the domestic situation in Turkey is clearly stabilising and it is a fine moment to take a look at the opinions of ING and Rabo on the outlook for USD/TRY. Rabo is currently expecting that USD/TRY will move to 2.90 in 1 year and ING is looking for USD/TRY to rise to 3.35 in 1 year’s time.

Rabo holds a relatively constructive view on the Lira based on a fairly strong economic growth and a high carry that tempts investors looking for yield. At the same time it sees the fact that Moody’s may downgrade Turkey’s credit rating to below investment grade as a clear risk. Such a downgrade, based on the post-coup political situation of increased concentrated political powers in the hands of President Erdogan that might lack the necessary rule of law and checks and balances, might trigger another wave of capital outflows from Turkish bonds and weaken the TRY significantly.

ING focuses on the easing cycle and also on the risk of a downgrade, both factors that would clearly keep the TRY under pressure. Furthermore it still sees idiosyncratic risks like the current account deficit, the large currency risk carried by the corporate sector and geopolitical risks all pointing to a weaker TRY.

My take away from this for the near term is that in the current benign market conditions the high carry may be the most important factor supporting the TRY and drive USD/TRY lower. A major risk is that Turkey’s credit rating may be downgraded to junk, maybe already within the next couple of days, which would seriously weaken the TYR.

Owner of FX Prospect