| 07-05-2019 | Carlo de Meijer | treasuryXL

My last blog was about the IBM World Wire, a blockchain based platform for global payments. Another competitor in the blockchain payments world I have written about regularly is Ripple. Both are thereby targeting centralised payments messages network SWIFT.

IBM and Ripple however are not the only players in the blockchain payments world. Late last year R3 launched its new Corda Settler platform using Ripple’s XRP. But here it comes. In January SWIFT announced a partnership with R3 were they are collaborating to test Corda Settler, specifically to “integrate gpi with Corda Settler.” However, as Corda Settler depends on the XRP token, the partnership puts SWIFT and Ripple, the two rivals in an indirect connection. Will that result in a love triangle or even a “marriage a trois”? And could that work?

But first: What is Corda Settler?

In December last year, R3 announced the launch of Corda Settler. Corda Settler is designed in such a way to give companies a new fast, secure and reliable way to move crypto and traditional assets on a distributed ledger. The Corda Settler app is an open-source decentralized application (DApp), that runs on the Corda blockchain. It is aimed to facilitate global (crypto) payments across enterprise blockchain networks with Ripple’s XRP as its base currency. Corda Settler thereby focuses on the settlement of payments transactions between crypto and traditional assets within enterprise blockchains.

Corda Settler uses XRP

Both Corda and Ripple are open-source blockchain platforms with a focus on serving enterprise businesses. Therefore, it makes sense that Corda selected XRP, the globally recognized cryptocurrency, as the first and only supported cryptocurrency for settlement on the platform.

“The deployment of the Corda Settler and its support for XRP as the first settlement mechanism is an important step in showing how the powerful ecosystems cultivated by two of the world’s most influential crypto and blockchain communities can work together.” “While the Settler will be open to all forms of crypto and traditional assets, this demonstration with XRP is the next logical step in showing how widespread acceptance and use of digital assets to transfer value and make payments can be achieved.” Richard Gendal Brown, CTO at R3

While Ripple’s XRP is the first cryptocurrency supported by the Corda Settler, in the future it is very likely that R3 will make settlement in other cryptocurrencies possible.

“The Corda Settler is agnostic to which payment method is used. Whether it’s JP Morgan coin, or Wells Fargo coin, or BAML coin, or HSBC coin, it doesn’t matter to us. We have no horse in that race.” “We don’t have any financial incentives one way or another. We’re just trying to get as many people onto our platform as possible.”David Rutter, CEO of R3

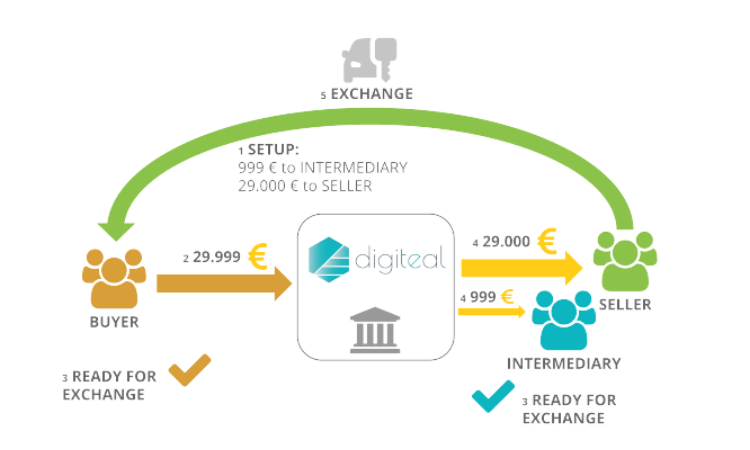

How does Corda Settler work?

The platform is still in its first stages of development. Corda Settler supports payments of all sorts to be settled through “any parallel rail supporting cryptocurrencies or other crypto assets”. Also any traditional rail capable of providing cryptographic proof of settlement can settle payments obligations. In the next phase of development, the Settler will also support domestic deferred net settlement and real-time gross settlement payments.

In its current phase, when a payment obligation arises on the Corda blockchain during the course of business, any of the parties involved now have the option to request settlement using XRP. The other party can be notified that settlement in XRP has been requested and that they must instruct a payment to the required address before the specified deadline presented to them.

After they make the payment, an oracle service will ensure the validity of the payment and settle the obligation. Uniquely, the Corda Settler will verify that the beneficiary’s account was credited with the expected payment, automatically updating the Corda ledger.

What does Corda Settler mean for the parties involved?

It is clear that in the transaction initiated by Corda Settler, the receiving party doesn’t need to use Corda to receive the payment. At the same time, it is not mandatory for the sending party to use XRP or any other cryptocurrency.

This means that using the Corda Settler; one can send XRP or dollar and the receiver can accept the payment in an entirely different currency. “Settlement Oracle” will broadcast the actual settlement notification. It can be operated through different entities like exchanges, banks, and others.

It will thus allow banks and other financial institutions to build their blockchain networks with minimum overheads. They don’t need to integrate the R3 technology fully. All they need is to let their clients receive deposits via Corda-enabled services.

SWIFT partnership with Corda

End January SWIFT has announced its partnership with R3’s Corda Settler to launch a proof-of-concept (PoC). The trial would see the interaction of SWIFT’s payments standard framework GPI (Global Payments Innovation) with R3’s trade finance platform.

“Following the recent launch of our Corda Settler, allowing for the payment of obligations raised on the Corda platform, it was a logical extension to plug into SWIFT gpi. SWIFT gpi has rapidly become the new standard to settle payments right across the world. All the blockchain applications running on Corda will thus benefit from the fast, secure and transparent settlement provided through the SWIFT gpi banks.” David E. Rutter, CEO of R3

Global Payments Innovation (GPI)

This trial will integrate SWIFT’s GPI Link cross border payments gateway with R3’s Corda Settler platform to enable the continuous monitoring and control of payment flows, settle GPI payments through their bank, and receive credit information.

SWIFT’s GPI is a messaging system based on existing messaging standards and bank payment processing systems. It has rapidly become the new standard to settle payments right across the world. The integration will also support application programming interfaces (APIs), as well as SWIFT and ISO standards to ensure global integration and interoperability.

It aims to provide quick and cost-effective transfers between SWIFT members. Through GPI “SWIFT hopes to assist banks enhance their relevance within the fast-evolving international payments ecosystem – by delivering immediate value to SWIFT’s members’ customers”.

Goal of the SWIFT-Corda Settler PoC

The objective of the PoC-trial is to try out interlinking of trade and e-commerce platforms with GPI – SWIFT’s new standard for cross-border payments and is an extension of other SWIFT trials with blockchaintechnology. These platforms need global, fast, secure and transparent settlement, preferably using fiat currencies.

“With the gpi Link, banks will be able to provide rapid, transparent settlement services to e-commerce and trading platforms, opening up whole new ecosystems to the speed, security, ubiquity and transparency of gpi and enabling them to grow and prosper in the new digital economy. Given the adoption of the Corda platform by trade ecosystems, it was a natural choice to run this proof of concept with R3.” Luc Meurant, SWIFT’s Chief Marketing Officer

“SWIFT GPI will integrate directly to Corda Settler, the application that allows participants on the Corda blockchain to initiate and settle payment obligations via both traditional and blockchain-based rails. This will enable obligations created or represented on Corda to be settled via the large and growing SWIFT GPI network”.R3 co-founder Todd McDonald

While SWIFT is keen to experiment with the possibilities opened up by blockchain-based trades, they are much less enthusiastic about using cryptocurrencies such as XRP.

Objective

The SWIFT and R3 Corda Settler trial will enable corporates to authorise payments from their banks via a GPI link to their bank through the Corda Settler platform. GPI payments will be settled by the corporates’ banks, and the resulting credit confirmations will be reported back to the respective trade platforms via GPI Link on completion.

By enabling trade platform ecosystems using Corda to integrate ‘GPI Link’ into their trade environments, SWIFT hopes to extend its reach beyond member banks to include to a wider range of corporates and markets.

The first stage of the PoC will work with R3’s Corda blockchain platform, Corda. SWIFT says it will not limit ‘GPI Link’ to R3’s DLT-based trade environment. SWIFT has plans, if the Corda PoC is successful, to extend the trial to other DLT, non-DLT and e-commerce trade platforms. The results of the PoC will be demonstrated – as a prototype – at Sibos in London in September 2019.

Corda Settler: Fiat currencies versus XRP

Swift said it is not (yet) using XRP on Corda Settler!. And that for a number of reasons.

“All trade platforms require tight linkages with trusted, fast and secure cross-border payments mechanisms such as GPI. While DLT-enabled trade is taking off, there is still little appetite for settlement in cryptocurrencies and a pressing need for fast and safe settlement in fiat currencies”. Luc Meurant, SWIFT’s chief marketing officer

According to SWIFT CEO Leibbrandt banks simply are not prepared to use a cryptocurrency as a clearing unit due to its price volatility. It appears that most banks prefer to use Corda’s technology for rapid and transparent settlement services in fiat currency rather than cryptocurrencies. Most enterprises prefer to settle via traditional payment mechanisms, albeit wishing for greater visibility into what is happening to payments and receipts. This leads to the need for trade platforms to have fast and safe settlement in fiat currencies.

“I think that the big part of Ripple’s value proposition is the cryptocurrency XRP. There we do find the banks are hesitant to convert things into a cryptocurrency right now because of the volatility in the currencies.” Leibbrandt, SWIFT CEO

Another reason why SWIFT is hesitant (not willing) to use crypto currencies is because the legal status of XRP and other cryptocurrencies remains unclear due to the current uncertain regulatory environment. Risk averse financial institutions are unlikely to adopt cryptocurrencies until regulations become clearer.

Ripple’s CEO Garlinghouse however argues back that “with SWIFT payments taking days and XRP payments clearing within seconds, SWIFT transfers are actually subject to much greater volatility due to fluctuating foreign currency rates”. At present, the banks take on that volatility risk by guaranteeing the amount sent will match the amount received. Because of XRP’s speed, which executes transactions in a matter of seconds, Ripple says it ‘eclipses’ volatility risk. With near-instant XRP-backed transfers, that volatility risk is actually completed eliminated.

“I hear people talk about volatility and I feel like they’re propagating this misinformation. Mathematically, there’s less volatility risk in an XRP transaction than there is in a fiat transaction.” Garlinghouse, Ripple CEO

Garlinghouse countered SWIFT’s legal arguments saying that every XRP transaction is vetted for Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance. Finally, Garlinghouse added that XRP payments greatly reduce systemic risks to banks in smaller economies, which have to use large amounts of money to prefund international transfers.

Mariage à trois?

With the launch of a universal settler app for payments on the Corda blockchain platform, using XRP as its first crypto payment trail, this may bring the Corda and XRP ecosystems into closer alignment.

Now SWIFT has partnered with blockchain consortium R3, we are in the strange position wherein SWIFT will be possibly be trailing Ripple XRP-powered payments. Through its experimental integration with R3, SWIFT may be indirectly integrating with XRP, though Leibbrandt has no desire to work with XRP directly.

It is still to be seen whether SWIFT will move beyond the proof of concept stage. But that might change. The future of SWIFT and Ripple’s relationship will not lay in the hands of present CEO Leibbrandt, as he will be stepping down as SWIFT CEO in June. His successor may be more receptive for the new world.

It is still speculative that the proof of concept — or a future trial — could see SWIFT being more interested in cryptocurrency settlement. On the other hand Ripple will do its utmost by leveraging its relationship with R3 to convince (SWIFT-related) banks to take the dive into cryptocurrency via the Corda Settler platform.

For now, the complex links between SWIFT, Ripple, and R3 are sure to trigger continued debate about the future of global finance.

Read the full article here

Carlo de Meijer

Economist and researcher

Presenter

Presenter