| 20-05-2019 | Carlo de Meijer | treasuryXL

In my recent blog about IBM’s Blockchain World Wire I mentioned the use of Stable Coins as settlement instrument for global payment transactions. Not many are familiar with the term Stable Coins, because it is a relatively new type of cryptocurrency.

The Stable Coin market is however hotter than ever. In recent months, Stable Coins have seen remarkable growth in both size and variety. Today, with over 120 projects on the market, there is growing thinking that Stable Coins may trigger the mass adoption of cryptocurrency payments, thereby opening the crypto currency market. Facebook recently came with its WhatsApp Stable Coin. Even a traditional bank like JP Morgan has entered this market, with their own Stable Coin-like product named JPM Coin.

Why is there such a hype in talking about this phenomenon? And what are Stable Coins? How do they work and what should you know about it in terms of use cases, benefits and risks.

Why Stable Coins?

But first of all: why Stable Coins? The cryptocurrency market such as for Bitcoin, Ether and others suffers from high volatility and unpredictable price fluctuations. They are struggling to maintain a decent valuation against the fiat. Last two years we have seen the market capitalization of the crypto reaching a high of almost 1 trillion USD before bouncing back to less than 200 billion USD. Most of the coins are down 80% from their all-time highs.

This volatile nature is one of greatest criticisms directed towards the crypto market. Because of this high volatility, Bitcoin and most cryptocurrencies are inconvenient for daily transactions. The demand for cryptocurrency is mainly fuelled by speculation and trading. Retail merchants on the other hand are sceptical of accepting the crypto as a medium for financial transactions.

There is however a growing desire to bring stability to the cryptocurrency market. The current market sentiment is turning more towards less price-volatile options. It is thus not surprising that interest in Stable Coins is on the rise.

“Unlike cryptocurrencies such as Bitcoin, which are highly volatile, stable coins provide people with the pragmatic, helpful benefits of a cryptocurrency, without having to worry about distressing price changes since they are grounded in the real world.” Brigitte Luginbühl, CEO of SwissRealCoin

What are Stable Coins?

A Stable Coin is a cryptocurrency with all its intrinsic functionality, but does not suffer from the vulnerabilities of market fluctuations and price volatilities. They fall into the category of payment tokens, whose main purposes are store of value, medium of exchange, or unit of account. Like other cryptocurrencies, Stable Coins aim to become global, fiat-free money that is programmatically issued and tracked with the use of blockchain technology.

A Stable Coin refers to a class of cryptocurrencies that is pegged to a tangible, or stable, asset such as fiat money (which is specifically USD) or precious metal (which is generally gold). The idea of backing a cryptocurrency with a tangible asset is to reduce the price volatility associated with standard cryptocurrency. Since the Stable Coin is correlated to the gold or fiat, its valuation is fixed in relation to that underlying asset.

In theory, this makes Stable Coins ideal and usable as a store of value and a basic medium of exchange. They provide cryptocurrency traders and investors with an easy and simple way to keep value without losing to price swings. In doing so, digital coins may become far more practical for everyday use, and it may encourage global adoption.

Models of Stable Coins

To “get rid” of the volatility of the cryptocurrency market, different variations of Stable Coins have been introduced. Thereby a number of alternative types have emerged, backed by a multiplicity of assets, ranging from baskets of cryptocurrencies to physical assets. Most Stable Coins fall into one of the following models: fiat-collateralized, asset-based, crypto-collateralized, or algorithmic.

A. Fiat-collaterised

Fiat-collaterised Stable Coins are the most popular form of Stable Coins. They are fully backed i.e. on a 1:1 ratio by existing fiat currencies in real bank accounts such as the USD that is held in reserve by the Stable Coins’ issuers. The coins represent a claim on the underlying fiat currency.

How do they work?

Stable Coin working is quite simple. They are backed by a company or a central entity. This company or central entity manage the acceptance of new fiat and issues a corresponding amount of the fiat backed tokens. The issuing company holds assets in a bank account or vault (or works with a third party provider that does so on their behalf. The company or the central entity is the custodian of the fiat reserves, and it backs all the tokens.

A degree of trust in the central entity is created by third-party audits – validating that fiat reserves are kept equal to the token supply. If the holder wishes to redeem cash with his tokens, the company or central entity will wire transfer the fiat money to the holder’s bank account and the equivalent coins will be destroyed or taken out of circulation.

Pros and cons

Stable Coins have a fiat backed structure and their operations and working are simple to understand. Since these are backed by a stable fiat currency, there is not much fluctuation in the prices.

But, these fiat-based Stable Coins are issued by centralized entities with their own governance protocols and, in the case of full custody integration, can be vulnerable to fraud activities. This is very much against the concept of decentralized crypto. Additionally, not all fiat currencies are stable, as the fiat that underlies them, may not be stable itself.

Examples

Most known examples of fiat money-backed Stable Coins are dollar-based including Tether (USDT), TrueUSD (TUSD), USDCoin (USDC) and Gemini Dollar (GUSD).

B. Asset-based

Asset-based Stable Coins are backed by some type of commodities. The most common commodity which is collateralized is gold. Gold backed Stable Coin represents a specific value of gold. The physical gold in itself is stored in a trusted third party’s vault.

How do they work?

Asset-based Stable Coins work similarly in cases where the coin is backed by fiat money (see above).

Pros and cons

As these Stable Coins are backed by real assets they provide stability. In a way, the commodity has been tokenized. This brings greater liquidity and price discovery. The coin holder has the advantage of recoursing to the underlying asset. They can redeem these assets at the conversion rate to take possession of the real assets.

Just as in fiat money backed Stable Coins, they are governed by centralised entities. So some of the very concepts of crypto and digital currencies are defeated in this type of stable coin. The holder is dependent on the vendors and custodians. This can result in a single point of failure at some time. This system is also dependent on the audit and assessment by the third party, underscoring the purpose of cryptocurrency.

Examples

Examples of commodity-backed Stable Coins are Digix gold (DGX) and Petro Coin. DGX is dependent on the market value of gold and is fully redeemable at any point in time. The ownership/custodianship status is tracked on the Ethereum Blockchain. Petro Coin is a Stable Coin backed by the oil reserves of Venezuela.

C. Crypto-collateralised

Crypto-collateralized Stable Coins are backed by a mix or basket of other digital currencies like Bitcoin or Ether.

How it works

Crypto backed Stable Coins require holders to stake a certain amount of cryptocurrencies into a smart contract which will then result in the creation of a fixed ration of Stable Coins.

In this type of coins, the volatility risk of a single cryptocurrency is reduced and distributed in a group of cryptocurrencies. The Stable Coins are over-collateralized to withstand the extreme price fluctuations.

Pros and cons

The benefit of this method is that it is decentralized and as a result adhere to the trustless, transparency and secure structure of the crypto world. Therefore they are not vulnerable to a central point of failure.

Crypto backed coins are considered transparent because transactions are recorded on the public blockchain with full transparency and accountability. They are efficient in the sense that conversion from one crypto to another is quick as it occurs on the blockchain.

On the other hand they are volatile and complex. Since the underlying asset is a cryptocurrency itself, it is inherently much more volatile as compared to other types of Stable Coins. Also, there are multiple complex elements which can trouble the minting process of these stable coins.

Examples

The most prominent example of crypto backed Stable Coins is Dai. DAI does not rely on any central entity and lives on the blockchain. Its face value is pegged to the USD. It achieves stability by using an autonomous system of smart contracts.

D. Algorithmic (or Seignorage) Stable Coins

The most complex and less popular model are algorithmic Stable Coins. These Coins are not backed by collateral at all. Instead, they use various mechanisms to expand or contract their circulating supply as necessary to maintain a stable value.

Algorithmic Stable Coins are based on smart contracts (and other mathematical -based algorithms) where people put up collateral in a cryptocurrency (like Ethereum). This to back the value of a Stable Coin pegged to a fiat currency. With this method, there is no need for know your customer (KYC) measures to be put in place because there is no need for a counterparty to maintain reserves or redeem money from.

How it works

These types of Stable Coins maintain stability using an algorithm. This means that the Stable Coins are not actually backed by real-world assets. Instead, trust in the system is reliant on the expectation that the coins will gain a certain amount of future value (similar to Bitcoin).

These models are generally created with two tokens: the first is a Stable Coin, and the second is related to a bond, thus promising income if the Stable Coin rises in price. By purchasing the bond with the Stable Coin, supply is decreased. As the total demand for the coin increases, a new supply of stable coins are created to reduce price back to stable levels. The main objective is to keep the coin’s price as close as possible to USD 1.

Pros and cons

The advantages of these type of Stable Coin are that they are decentralized, they have an absence of collaterals and lastly, they are kept at stable prices.

On the other hand, these are the most innovative of Stable Coins but also the most complex and thus difficult to create these successfully.

Examples

Basis (formerly known as Basecoin) is an example of this type of Stable Coins. Basis is pegged to the value of USD through algorithmic adjustments of the coin supply. Prices are monitored using the Oracle system.

Use cases for Stable Coins

Stable Coins promise many of the same benefits as other cryptocurrencies – like cheap transactions and rapid settlement – without the price volatility typically found in the crypto markets. Through that combination, Stable Coins could satisfy the demand for high-quality fiat currencies in parts of the world with limited access to the global financial system.

Various use cases have been proposed for Stable Coins, including mobile app payments, alternative currencies in emerging markets and global payment systems. Currently, the most common use of Stable Coins is for crypto traders to move between investment positions seamlessly and create leveraged positions, without added volatility.

Stable Coins also could be useful for crypto exchanges that want to offer fiat-based trading pairs while reducing their engagement with legacy financial institutions. Another interesting use case, is one of coupon and dividend payments in the up and coming digital securities space. This may enable to receive coupon payments in real time via a Stable Coin directly into a smartphone’s digital wallet.

Benefits of Stable Coins

Just like any other cryptocurrency, Stable Coins may offer both benefits and risks connected to each alternative governance and price-stability models. The main goal that Stable Coins strive to create is an optimal currency in terms of price stability, scalability, privacy, decentralization and redeem ability.

Unlike Bitcoin or other cryptocurrencies, Stable Coins are more immune to price fluctuations because they are pegged to tangible and more stable assets, like the US dollar (USD).

“An optimal cryptocurrency should have the following four traits: price stability, scalability, privacy, and decentralization.” “Short-term stability is important for transactions and long-term stability is important for holding.” Forbes

“Stable coins are one of the keys to bringing the benefits of cryptocurrencies to everyday people, both in terms of price stability and decentralization of capital.” Rafael Cosman, founder and CEO of TrustToken,

These benefits give it a better chance of mass adoption, compared to existing crypto currencies. This will be especially relevant for people living in countries with unstable monetary systems, where residents are often exposed to hyper inflation and uncertainty.

Stable Coins development could also be of help for the general population in economic and/or political uncertain countries. If the fiat money is converted into Stable Coins it will ensure that the value of money is preserved.

The adoption of Stable Coins may also support capital market formation and can be used in new applications for decentralised finance on the blockchain. These include lending and derivatives markets because without borders and volatility, it becomes easier to lend money.

Traders and investors can change between cryptocurrencies, without being exposed to asset volatility. Stable Coins enable traders to keep value stable against a fiat currency, usually the dollar, while they’re in-between trades.

Finally Stable Coins may help in reducing the risk of high price movements. They can be used in the cryptocurrency market as a hedge against bitcoin and other top cryptocurrencies.

Main risks of using Stable Coins

There are however a number of bottlenecks that could limit the adoption of Stable Coins. First of all, there is the counter-party risk. By trusting a third-party keeping a cryptocurrency stable, the dollars or other fiat currencies could be fractionally reserved instead of fully backed. In this case, a bank run could cause the price of the coin to drop dramatically.

There is also the centralisation risk. Centralisation risks mean the same monetary issues that fiat-currencies face when a central authority has the power to print money without oversight. Accounts can be subject of misappropriation, being blocked, or accessed by unauthorised third parties.

In the case of algorithmic based Stable Coins there is the risk of algorithm manipulations. As most decentralised Stable Coins are embedded within smart contracts, there is a risk the algorithm which keeps the currency stable fails. Algorithms could even be manipulated by a third-party.

Stable Coins and Regulation

Thus far, Stable Coins have largely been got attention from regulatory agencies. There hasn’t been much discussion in the crypto industry about how U.S. securities and commodities laws might apply to Stable Coins. But also in Europe Stable Coins has got less scrutiny from a regulatory point-of-view up till no. But that may change.

As Stable Coins are seeing greater industry adoption, the US SEC and CFTC will likely take a harder look at their compliance status. But the main question is: how will those Stable Coins be characterised?

Given how dollar-backed Stable Coins are redeemed, the SEC might characterize them as “demand notes,” which are traditionally defined as two-party negotiable instruments obligating a debtor to pay the noteholder at any time upon request. Demand notes are presumed to be securities.

For its part, the CFTC might take the position that Stable Coins are “swaps” under Commodity Exchange Act Section. Under that definition, the CFTC might characterize Stable Coins as options for the purchase of, or based on the value of, fiat currencies.

If Stable Coins are classified as regulated securities or swaps, there could be serious consequences for a large segment of the crypto industry. For example, Stable Coin issuers might have to register their offerings and comply with all the ensuing regulatory requirements. Similarly, a company or fund that conducts or facilitates Stable Coin transactions might have to register as a broker-dealer.

The SEC and CFTC aren’t the only regulators that may take an interest in Stable Coins. Only time will tell how other regulators worldwide will approach the regulation of Stable Coins, particularly if they’re used to avoid trade sanctions or other transaction reporting obligations.

Asia ripe for Stable Coins

Stable Coins are looking to become a more attractive crypto solution, particularly in the Asia Region. And that for various reasons.

According to a recent report by Remitscope, more than 50 percent of remittance flows worldwide could be attributed to countries from the Asia Region. Current traditional money transfers however are far from instantaneous or frictionless and often result in the end customer paying unnecessary transaction costs.

With interest growing, a Stable Coin with a well-developed user experience built into the remittance solution would greatly appeal to these markets. In Asia’s emerging markets, the technology’s application in the remittance sector is especially promising. Stable Coins via blockchain technology can improve the speed and stability of these transfers—particularly in countries where financial infrastructure is still in development.

Asian countries are well placed to adopt Stable Coins. It is encouraging that cryptocurrency ATM usage has grown and more cryptocurrency ATMs means improved access to Stable Coins, which will only help the ecosystem mature and evolve for the better.

It is also very likely that we will see more non-USD Stable Coins being tailor-made for Asia. The emergence of more non-USD Stable Coins will signal that the market is maturing further and ready for the benefits of Stable Coins globally.

The regulatory environment, without overt regulatory guidance in jurisdictions, in the Asia Region is particularly favourable to encourage such innovation.

What is needed to drive adoption?

To drive Stable Coin adoption, further development is needed in both cryptocurrency exchanges and various cryptocurrency services.

First, making it easy to digitally deposit and withdraw fiat currencies into and out of exchanges remains a huge hurdle to widespread adoption of cryptocurrency as the process is slow and transactions can take a long time or, if they are fast, involve expensive fees.

There is also still a need to solve issues surrounding settlement and velocity in fiat deposits and withdrawals into exchanges. Top exchanges generally take weeks to process transactions and this often leads to increased customer service tickets.

Another issue is the margins on cash to cryptocurrency exchanges. These are very high, sitting at 7-10 percent globally. Not only is it expensive to transact and exchange cryptocurrencies on exchanges, but it is also less convenient when needing to withdraw cash. That is why there is a premium on cryptocurrency ATMs.

Cross-border payments and converting cryptocurrency to cash should be made more convenient for users across the world. Stable Coins could reduce friction when sending money between counterparties as its often quicker, cheaper, and far more convenient.

To improve the user experience, money transfer companies should be encouraged to start integrating cash to crypto features in their respective locations. Overall, consumers will benefit the most from this increase in competition with more options in providers and more locations to conduct their exchanges locally.

In the long term, with more Stable Coins from various other currencies being made available, exchanges could become more liquid, enabling greater efficiency in the crypto ecosystem. Risks for companies dealing with cryptocurrency to fiat gateways will also be reduced as they no longer need to worry about banking relationships and can instead just focus on maintaining a cryptocurrency wallet.

Forward Looking

Stable Coins may have a great potential. The total addressable market for Stable Coins is essentially all of the money in the world, or approximately $90 trillion. Stable Coins are a crucial element in the world of cryptocurrencies, as they can bring stability. They may pave the way for wider acceptance and real potential for global adoption..

The technology is however still relatively young and will continually evolve, but it is clear that demand is there. Before full adoption is reached, Stable Coin developers will need to address the various concerns still in the market. The key is to create the optimal cryptocurrency including features such as price stability, decentralization, scalability, and privacy.

“Stable coins will ultimately give people enough confidence to start using cryptocurrencies for daily transactions.” “Stable coins are trying to strike the balance of not being dependent on a central bank, while also securing price stability”. Brigitte Luginbühl, CEO of SwissRealCoin

Ultimately, decentralised Stable Coins may pave the way for a new and modern financial infrastructure that will remove inefficiencies, reduce risk stemming from centralised parties and change the way we transact.

For Stable Coins to be accepted as a viable alternative to fiat currencies, however, they must first intersect and integrate into our current financial infrastructure.

Carlo de Meijer

Economist and researcher

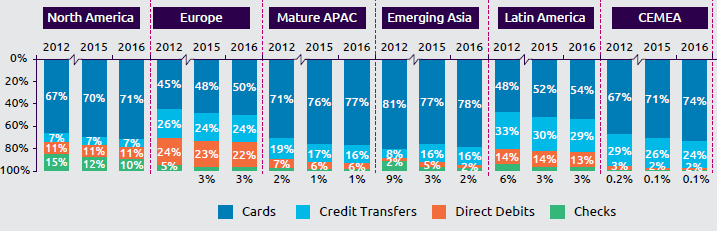

This title makes it sounds like it’s a fight. To be honest: it is! The market for international payments is huge and its lucrative. In a McKinsey report the 2018 market size for payment revenues was close to 2 Billion. Not strange everybody wants a slice of that.

This title makes it sounds like it’s a fight. To be honest: it is! The market for international payments is huge and its lucrative. In a McKinsey report the 2018 market size for payment revenues was close to 2 Billion. Not strange everybody wants a slice of that.