4 ways to optimise currency management in times of crisis

14-06-2022 | treasuryXL | Kantox | LinkedIn |

Did you know that CurrencyCast season 2 of Kantox is now available? In the first episode of the season, we look at four must-have tools to help you optimise your currency management and protect your business from risk in times of crisis. To see all episodes of CurrencyCast, click this link.

This week’s CurrencyCast looked at the four Currency Management Automation tools you need to navigate 2022’s predictable unpredictability. Here are our key takeaways:

(1) Put cash and currency management on the same page

The tool? The first Currency Management Automation tool is automated swap execution.

Why? Because, in times of pandemic and war, “Cash is King “. A recent risk treasury survey by HSBC finds that as many as 82% of CFOs say that cash management has been the most crucial issue during the last three years—and that is unlikely to change any time soon. The point is that cash management and FX risk management need to go hand in hand, especially in the current context.

How? By automatically executing the swap transactions that are necessary to adjust hedging positions to the settlement of the underlying commercial transactions, as cash flow moments do not always coincide. Failing to automate these cash adjustments properly hinders the whole risk management process. Yet, in FX risk management, cash management related tasks need as much attention —and as much automation— as other tasks of the FX workflow, like pricing with an FX rate, collecting and processing exposure information, or executing hedges.

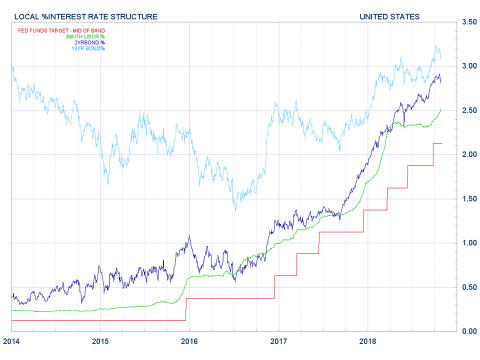

(2) Optimise the impact of shifting interest rates

The tool? The second Currency Management Automation tool is a robust FX rate feeder that enables commercial teams to price with the appropriate exchange rate, whether it’s the spot or the six-month forward rate, with all the required pricing markups per client segment and currency pair.

Why? Because interest rates are shifting in many places as we speak. As interest rates change, so does the difference between exchange rates with different value dates, also known as forward points. On the one hand, if your company is based in a strong currency area like Europe or North America and you are selling into Emerging Markets, your commercial teams may need to price with the forward rate to avoid unnecessary losses on the carry. On the other hand, you can take advantage of ‘favourable’ forward points to price more competitively without hurting your budgeted profit margins.

How? Most Treasury Management Systems (TMS) are not equipped with what we call at Kantox a ‘strong FX rate feeder’ that would enable commercial teams to quote with the appropriate exchange rate, in this case, the forward rate. For that, you need a software solution that, working alongside your existing systems, provides your commercial teams with all the FX rates they need for pricing purposes.

(3) Prepare for disrupted supply chains

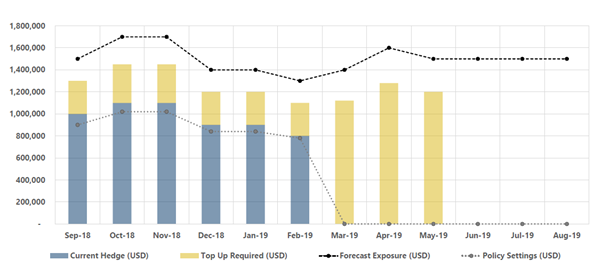

The tool? The third Currency Management Automation tool is an FX hedging program that allows you to delay —as much as possible, and according to your own tolerance of risk— the execution of hedges.

Why? Right now, as we speak, global supply chains are in turmoil. Commodity prices are seeing wild swings, and the economic outlook remains uncertain. This may lead to lower visibility regarding your cash flow forecasts and your forecasted exposure to currency risk.

How? One of the most fascinating tools that we have developed at Kantox —about which we will devote a future episode of CurrencyCast— allows treasurers to create a buffer from a ‘worst-case scenario’ FX rate that you wish to protect, if your aim is to keep steady prices during an entire campaign/budget period, and you can reprice at the onset of a new period.

This buffer, created by means of conditional FX orders, provides the flexibility to leverage information from incoming firm sales/purchase orders that are hedged. Forecast accuracy is usually correlated with time. As the campaign progresses, that flexibility allows you to gain more visibility into what is typically considered the less visible part of your exposure.

Delaying hedge execution also will enable you to:

(1) Create savings on the carry if forward points are not in your favour

(2) Set aside less cash than would otherwise be the case in terms of margin and collateral requirements

(4) Protect your profit margins and cash flows

The tool? Last but not least, the fourth Currency Management Automation tool needed to tackle 2022’s predictable unpredictability is —quite obviously— a strong FX hedging program.

Why? Because you need to protect your budgeted operating profit margins and company cash flows from currency risk. You may also desire to reduce the variability of your performance as measured in your financial statements. By allowing your firm to confidently buy and sell in the currency of your suppliers and customers, you take advantage of the margin-enhancing benefits of ‘embracing currencies’.

There is an additional benefit that may prove particularly relevant these days. In the event of a sharp devaluation of your customer’s currency, if you only sell in a handful of currencies such as EUR or USD, your customer may be tempted to unilaterally wait for a better exchange rate to settle their bills. You don’t want to be in that position — and you do it by selling in local currencies in the first place.

How? With the help of a family of automated hedging programs and combinations of hedging programs designed to systematically protect your firm from currency risk. These can be personalised whatever the pricing patterns of your business — whether you face dynamic prices or you desire to keep steady prices during an entire campaign period, or you wish to keep prices as stable as possible during a set of campaign periods linked together.