|24-4-2017 | Carlo de Meijer | treasuryXL

Our expert Carlo de Meijer has published an interesting article about a blockchain initiative that we want to share with you. We have slightly shortened the original article about Ripple.

Our expert Carlo de Meijer has published an interesting article about a blockchain initiative that we want to share with you. We have slightly shortened the original article about Ripple.

Who is Ripple?

Have you ever thrown a stone in still water of a river or a lake. I did! The effect is rippling the water in a way that can be followed outwards incrementally. It might be this effect that the founders of Ripple, the payments blockchain network had in mind when choosing the name for their project. Did it ripple?

San Francisco based Ripple is seen as one of the most advanced distributed ledger technology (DLT) companies in the industry, which focuses on the using of blockchain-like technology for payments.

In just four years, Ripple has established itself as a key player in the fast-growing distributed ledger technology world. Since 2013, the Ripple Protocol has been adopted by an increasing number of financial institutions to “[offer] an alternative remittance option” to consumers. Especially the years 2015 and 2016 marked the expansion of Ripple, with the opening of an office in Sydney (April 2015) and the opening of European offices in London (March 2016 ) and in Luxembourg (June 2016).

In June last year, Ripple obtained a virtual currency license from the New York State Department of Financial Services, making it the fourth company with a BitLicense. As of 2017, Ripple is the third-largest cryptocurrency by market capitalisation, after Bitcoin and Ether.

What is Ripple?

Ripple is a financial real-time gross settlement solution, currrency exchange and remittance network using distributed ledger technology. Released in 2012, it purports to enable “secure, instant and nearly free global financial transactions of any size with no chargebacks”.

Ripple is built upon a distributed open source Internet protocol, consensus ledger and native currency called XRP (ripples) enabling (cross-border) payments for retail customers, corporations, and other banks.

The Ripple Protocol, described as “basic (settlement) infrastructure technology for interbank transactions”, enables the interoperation of different ledgers and payment networks and brings together three aspects of modern payment solutions: messaging, settlement and FX management. It allows banks and non-bank financial services companies to incorporate the Ripple Protocol into their own systems, and therefore allow their customers to use the service.

The protocol enables the instant and direct transfer of money between two parties. As such the protocol can circumvent the fees and wait times of the traditional correspondent banking system. Any type of currency can be exchanged including USD, euros, RMB, yen, gold, airline miles, and rupees.

“Ripple simplifies the [exchange] process by creating point-to-point and transparent transfers in which banks do not have to pay corresponding bank fees.” Chris Larssen, former CEO Ripple

The Ripple company also created its own form of digital currency dubbed XRP in a manner similar to bitcoin, using the currency to allow financial institutions to transfer money with “negligible fees and wait-time. One of the specific functions of XRP is as a bridge currency, which can be necessary if no direct exchange is available between two currencies at a specific time. For example when transacting between two rarely traded currency pairs. Within the network’s currency exchange, XRP are traded freely against other currencies, and its market price fluctuates against dollars, euros, yen, bitcoin etc.

Did it Ripple?

Growing adoption by banks

Ripple has experienced a growing adoption by banks. Many financial companies have subsequently announced experimenting and integrations with Ripple. The first bank to use Ripple was the online-only Fidor Bank in Munich, which announced the partnership early 2014. Fidor Bank would be using the Ripple protocol to implement a new real-time international money transfer network.

Since then a host of major banks have adopted Ripple to improve their cross-border payments, and many have completed trial blockchain projects. These banking institutions – including Santander, UniCredit, UBS, Royal Bank of Canada, Westpac Banking Corporation, CIBC, and National Bank of Abu Dhabi, among others – view Ripple’s payment protocol and exchange network as a valid mechanism for offering real-time affordable money transfers.

Some recent developments in the Ripple network

The real uptake of Ripple however started to take place in 2016 and continued during the first quarter of 2017.

National Bank of Abu Dhabi (February 2017), Axis Bank (January 2017), SEB (November 2016), Standard Chartered (September 2016), and National Australia Bank (September 2016) are the latest banks to join Ripple’s blockchain-powered network for cross-border payments. And more banks will get on the Ripple bandwagon during 2017. Ripple says its network now includes 12 of the top 50 global banks, ten banks in commercial deal phases, and over 30 bank pilots completed.

“Banks and their customers have been hearing about the promise of blockchain technology to enable real-time cross-border payments. Now, some of the most innovative and successful banks like NBAD are making this a reality by offering Ripple-enabled payments to their entire customer base, and in doing so, paving the way to make 2017 the year we see broad commercialization of blockchain take hold globally.” Brad Garlinghouse, CEO of Ripple

Further Rippling: enlarging the network

Global Payments Steering Group

Last year September Ripple created the “first: interbank group for global payments based on distributed financial technology. Bank of America Merrill Lynch, Santander, UniCredit, Standard Chartered, Westpac, and Royal Bank of Canada have joined as founding members of the network, known as the Global Payments Steering Group (GPSG). CIBC will also join the GPSG as a new member.

“The creation of GPSG is significant because this represents the first time that major banks have formulated policies to govern the transfer of money across borders using blockchain,” Donald Donahue, GPSG chairman.

GPSG aims to use Ripple’s technology to slash the time and cost of settlement while enabling new types of high-volume, low-value global transactions. The group will oversee the creation and maintenance of Ripple payment transaction rules, formalised standards for activity using Ripple, and other actions to support the implementation of Ripple payment capabilities.

R3CEV

Last year October R3 and twelve of its blockchain consortium member banks – including Barclays, NAB, Nordea, Royal Bank of Canada, Santander – have trialled Ripple’s Digital Asset XRP, to tackle the costs and inefficiencies of interbank cross-border payments. Ripple says XRP has the “fastest” settlement speed, settling in about five seconds or less.

“The prototype paves the way for a major overhaul of how banks process and settle cross border payments”. David Rutter, CEO of R3

Banks traditionally provision liquidity for cross-border payments by holding various currencies in local accounts with correspondent banks around the world. But these ‘nostro’ accounts are costly because banks have to fund them, trapping capital. Ripple argues that this can be fixed by instead using a digital asset – such as its XRP – which provides liquidity on demand.

Ripple’s network was trialled in R3’s lab and research centre, making markets for fiat currencies using XRP and then completing authenticated payments without multiple nostro accounts. The trial introduced XRP to test the feasibility of reducing or retiring the use of current nostro accounts for local currency payouts.

Ripple Innovations

In the meantime a number of important innovations were announced in the Ripple offering.

Ripple Validator Node

Global IT company CGI announced it is the first commercial enterprise to implement the Ripple Validator Node. Ripple validators are servers that confirm Ripple’s distributed financial technology transactions on the network. The CGI-hosted Ripple Validator Node provides banking clients with a trusted network partner for Ripple’s distributed financial technology that settles international and domestic transactions in real-time.

Smart Token Chain

Smart Token Chain (STC), a blockchain specialist in the FinTech sector, has completed its first full Smart Token transaction across the Ripple Network. Using Ripple gives STC universal access to a wide range of partners and customers without having to physically craft a digital relationship with each one. STC is leveraging Ripple’s open, neutral platform, called “Interledger Protocol” to move payments globally across different ledgers and networks.

Leveraging the Ripple platform with new Smart Token solutions is accelerating the move toward the launch of a truly useful blockchain and smart contract implementation, which has great potential for making global exchanges of value fast, affordable and highly secure. It also provides a well-documented audit trail that will make dispute resolutions more efficient and less frequent.

Ripple’s new cost model

Ripple created a cost model, designed specifically to help banks understand their cost structure and how Ripple can help them overcome current inefficiencies. With Ripple’s new cost model, banks can easily enter transaction volume and operational metrics to receive a custom cost analysis. The cost analysis breaks down cost to a per-payment level, for both a bank’s current system and if it were to use Ripple. By using this model banks can easily estimate the efficiency gains it could achieve using Ripple for international payments.

XRP Incentive Program

The XRP incentive program is designed to accelerate the use of XRP as a universal bridge currency by creating deep and liquid markets at the outset of being listed on digital exchanges. The program is funded by Ripple and will be operationally managed by exchanges for their liquidity providers.

Global financial institutions are increasingly looking for solutions to consolidate the liquidity tied up with the nostro accounts required to fund their overseas payments. Digital assets such as XRP allow for banks to fund their payments in real-time, and in the process, cut down their dependency on nostro accounts.

As a bridge currency, it can enable liquidity concentration around fewer currency pairs, making cross-border payments more efficient. As evidenced by R3’s trial with XRP for interbank cross-border payments, the use of Ripple and XRP can enable both cost-cutting and revenue opportunities for participating institutions.

BitGo makes XRP more accessible

Ripple’s efforts to build an active ecosystem around its XRP digital asset has been boosted by a deal with virtual currency processor BitGo. Under the programme, BitGo will provide multi-signature security, advanced treasury management and additional enterprise functionality for XRP, which will be integrated into the BitGo platform this year.

The Rippling goes on!

Ripple plans to enlarge the number of exchanges trading XRP. Working with a greater number of exchanges to list XRP is an important step to serve the growing demand for global payments in major and exotic currency corridors. Ripple has previously commented that by using its network and XRP as a bridge asset, banks can save up to 42% on interbank international payments.

“This cost-saving frees up capital to generate revenue opportunities, including new product offerings for high-volume, low-value payments and access to new corridors”, claims Ripple.

The Ripple effect goes on!

Carlo de Meijer

Economist and researcher

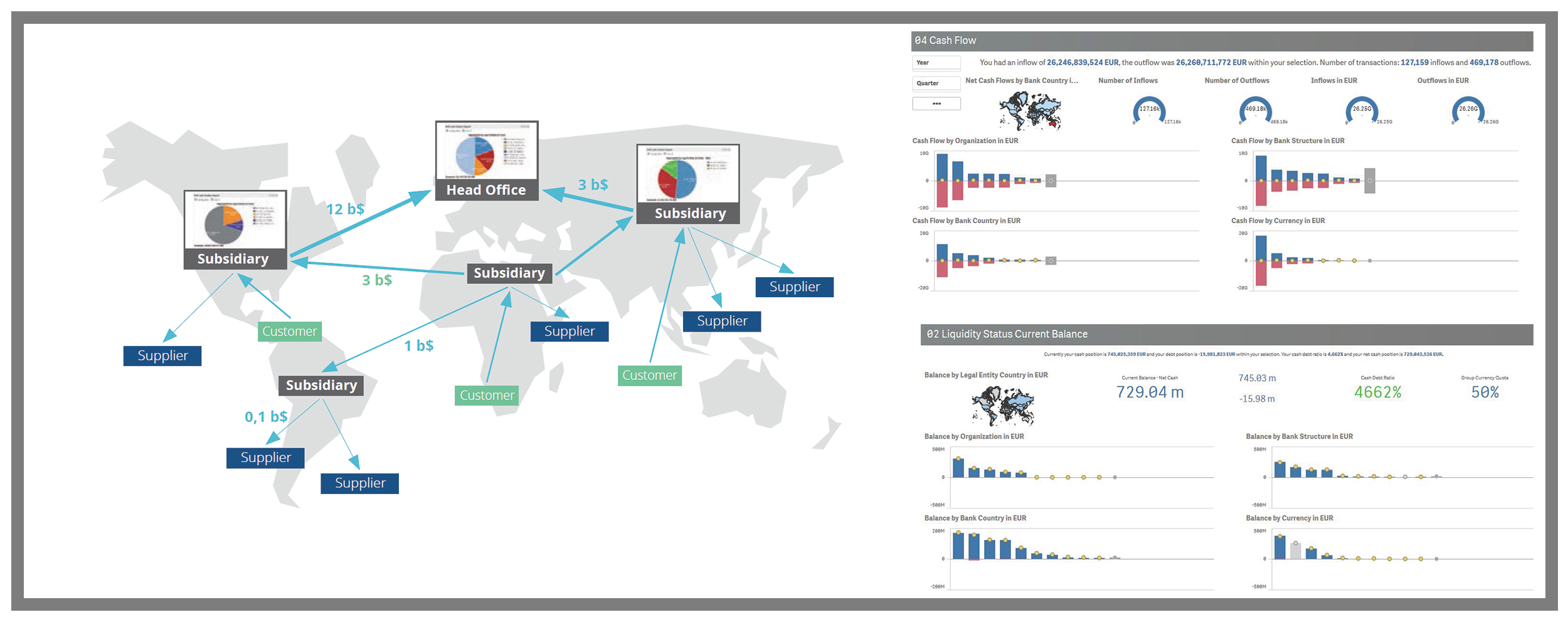

How do strategic professionals decide on the best path to success for their company? The key is in transparency and real-time reporting. If it comes to the responsibility of the treasurer or financial professional this means deciding about company-wide cash flow and liquidity levels, bank, customer and supplier relations and working capital.

How do strategic professionals decide on the best path to success for their company? The key is in transparency and real-time reporting. If it comes to the responsibility of the treasurer or financial professional this means deciding about company-wide cash flow and liquidity levels, bank, customer and supplier relations and working capital.

Last Friday I had the pleasure of visiting the Dutch Fintech Awards. Diversity, technology, marketing and entrepreneurship are the key words that in my opinion describe the event best. Both contenders as well as audience were mainly Dutch. Although the language used was English, the communication style, also due to the moderator, was very “Dutch direct”. This kept the program entertaining during the pitches of companies of less relevance for me.

Last Friday I had the pleasure of visiting the Dutch Fintech Awards. Diversity, technology, marketing and entrepreneurship are the key words that in my opinion describe the event best. Both contenders as well as audience were mainly Dutch. Although the language used was English, the communication style, also due to the moderator, was very “Dutch direct”. This kept the program entertaining during the pitches of companies of less relevance for me.

Our expert Carlo de Meijer has published an interesting article about a blockchain initiative that we want to share with you. We have slightly shortened the

Our expert Carlo de Meijer has published an interesting article about a blockchain initiative that we want to share with you. We have slightly shortened the

One of my friends who works in human capital development and is a psychologist, explained me once how we can increase our creative output. One of the elements he mentioned was mixing up the way information comes to you and how you digest it. For example, if you are used to create business plans sitting behind your desk and writing, a multi-person brainstorm session might tap into your undiscovered creative potential. And the other way around: if you are talker/listener, try writing for a change.

One of my friends who works in human capital development and is a psychologist, explained me once how we can increase our creative output. One of the elements he mentioned was mixing up the way information comes to you and how you digest it. For example, if you are used to create business plans sitting behind your desk and writing, a multi-person brainstorm session might tap into your undiscovered creative potential. And the other way around: if you are talker/listener, try writing for a change.

The last two Thursdays, the PowertoPay, SWIFT and TreasuryServices Treasury Seminar was held in Montfoort and Antwerp. We’re happy to say that it was a success! We got a lot of positive feedback during and after the seminars. Both had the same content but were hosted on two different days. The first one was held in Antwerp, Belgium on the 2nd of March in an old monastery (Elzenveld). The second one was held in Montfoort, The Netherlands on the 9th of March in the Heeren of Montfoort.

The last two Thursdays, the PowertoPay, SWIFT and TreasuryServices Treasury Seminar was held in Montfoort and Antwerp. We’re happy to say that it was a success! We got a lot of positive feedback during and after the seminars. Both had the same content but were hosted on two different days. The first one was held in Antwerp, Belgium on the 2nd of March in an old monastery (Elzenveld). The second one was held in Montfoort, The Netherlands on the 9th of March in the Heeren of Montfoort.