Does your treasury have a digital mindset?

| 25-9-2017 | Patrick Kunz |

In an previous article I have talked about the IT changes that make life easier for a treasurer in the future (or now already). In this article I want to talk about the digital mindset of the person using the IT – the treasurer. Treasury is a numbers game. We treasurers use these numbers to optimise the cash or risk of the company. We make money with money. These numbers have to come from somewhere in the organisation and it is usually never treasury itself.

BIG data

Big data is a hot topic in treasury but for treasury it was around longer. The treasurer needs to get their input information for all over the company. Cash inflow from sales, cash outflow from procurement and investment teams, HR etc. All this data needs to be gathered. The digital minded treasurer thinks about optimal ways of gathering this data: automatically. The treasurer starts its day with the actual cash balances and then looks forward. He/She basically needs to predict the future. How great would it be if all this data would be available with the push on a button. An ideal world ? Maybe, but it is possible. Bank statements can be automated to be loaded collectively or in a Treasury Management System. The treasurer starts the day with up to date cash balances, and he has not started working yet as this was automated. He then updates the cash forecast. How? By pushing update in his cash forecasting system. Sounds too easy? True, it took weeks to find out where to find the needed input information and to automate getting this data grouped together and in a structured way. But a digital minded treasurer knows that the data is somewhere in the organisation; it only needs to found and linked to the treasurers information recourses so it is always available. The treasurer only has to check the validity and the quality of the data and see if it needs improvement. In this way the digital minded treasurer can automatically create a cash forecast and continually improve it. A cash forecast should be ready before the second morning coffee. In an ideal world it would be ready with a push on a button. Artificial intelligence makes it possible. The digital minded treasurer is steering it.

Process improvements

The digital treasurer looks at ways to improve its document flows and payments. Not only looking at costs but also looking at how many (manual) interventions are needed. FX deals can be setup to straight through processed (STP) while blockchain would make it possible to improve the speed of payments or document flows globally. Everything is connected, as payments go from a process to straight through and instant it has an immedicate effect on the cash availability and forecasting. While now the bank is the place to go for bank accounts and payments this might not be the case in 10 years. The digital treasury might be able to setup his own bank in the future. By using technology.

The future

The treasurer makes sure that he is on the steering wheel while technology makes it possible for him/her to check his surroundings so he does not crash. A bigger front window makes for a better view forward (forecasting), a higher max speed makes for quicker travel (updating changes in forecasting), adaptive cruise control saves effort on speeds control (automatic updating and AI, STP). The treasurer knows he needs to keep the engine running to keep moving. He also realises that he does not need to be a mechanic to do this; however he needs to be able to tell the mechanics quickly why the car is not moving as the treasurer wants it to be so the mechanic can fix this. Or maybe the digital treasurer might change the car for a plane in the future, or even a rocket?

It is clear that technology and treasury are interconnected. Already now and even more in the future. A treasurer therefore needs a digital mindset to survive and keep up with the information needs of his department and the company as a whole. And it’s not rocket science (yet).

Treasury, Finance & Risk Consultant/ Owner Pecunia Treasury & Finance BV

Saving on FX deals? Often neglected but potentially a “pot of gold”

How much are you paying your bank?

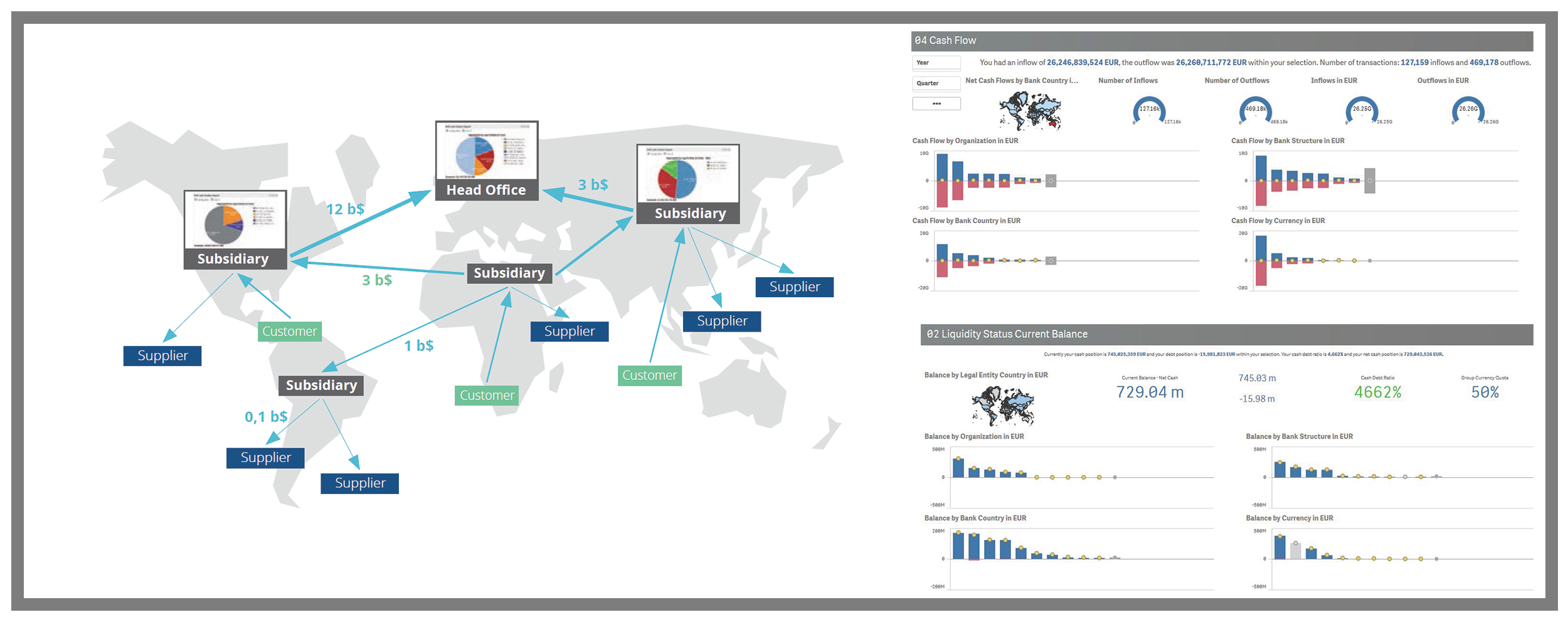

How do strategic professionals decide on the best path to success for their company? The key for strategic finance professionals and the best path to success lies in transparency and real-time reporting across company-wide cash flow and liquidity levels, bank transactions, customer and supplier relations and working capital.

How do strategic professionals decide on the best path to success for their company? The key for strategic finance professionals and the best path to success lies in transparency and real-time reporting across company-wide cash flow and liquidity levels, bank transactions, customer and supplier relations and working capital.

In their first session

In their first session

Proferus

Proferus Cashforce Cash forecasting 2.0

Cashforce Cash forecasting 2.0 How do strategic professionals decide on the best path to success for their company? The key is in transparency and real-time reporting. If it comes to the responsibility of the treasurer or financial professional this means deciding about company-wide cash flow and liquidity levels, bank, customer and supplier relations and working capital.

How do strategic professionals decide on the best path to success for their company? The key is in transparency and real-time reporting. If it comes to the responsibility of the treasurer or financial professional this means deciding about company-wide cash flow and liquidity levels, bank, customer and supplier relations and working capital.