04-05-2021 | Luca Crivellari | treasuryXL |

Corporate to bank communication is still a very pressing issue in cash management. There are several alternatives that allow corporates to interface and exchange data with banks, and most of the times it is complex for treasurers to identify the best choice. The consequence of not adopting the best setup might be to receive inadequate or old information, or the inability to have the right level of control over the issue of payments. The aim of the article is to assist treasurers in identifying all the relevant variables, and to take a decision that factors in all the possible impacts of each alternative.

Introduction – Why bank connectivity is still a hot topic?

In 1973, over 200 banks from 15 countries created a cooperative body with the aim of easing the communication among banks. This organization was born under the name of SWIFT, the Society for Worldwide Interbank Financial Telecommunication.

SWIFT enables its customers to automate and standardize the processing of financial transactions, thereby lowering costs, reducing operational risk and eliminating inefficiencies from their operations.

The rise in global trade was the main reason why financial institutions were pressed by defining a common standard for international payments and reporting, and the aim was to avoid lengthy conversions, useless charges and operational inefficiencies that might derive from the use of different standards.

Fast forward to today, SWIFT is the undisputed backbone of financial markets, with over 11,000 financial institutions and corporations in more than 200 countries, processing a record of 46,3 million messages in a single day on the FIN service. SWIFT messages are nowadays used for both bank-to-bank and corporate-to-bank communication, and the organization has developed dedicated categories for messages that are related to payments, cash management, foreign exchange, trade finance, treasury markets, and securities.

Overtime, several other organizations with a similar aim were created, at national or international level. It is worth to mention the CBI (Customer to Business Interaction, former Corporate Banking Interbancario) consortium in Italy, and the EBICS (Electronic Banking Internet Communication Standard) protocol in Germany.

We still live in a world of different standards and practices, where corporates often struggle in navigating among the different options they have when it comes to issue a payment or to receive a piece of account statement. This article is meant to be a guide for corporate treasurers on how to select the right connectivity setup, because there is no such a thing as a universal optimum, and every alternative has its own advantages and its own shortcomings.

From the experience I gathered during the last years of conversations with several corporates based throughout Europe, one of their most relevant priorities is to consolidate an accurate picture of the liquidity available in the company bank accounts, on a daily basis. Too many organizations, including some with a relevant experience in international business and with a very important turnover, are still relying on Excel files shared on a monthly basis, in order to get the information of the balance that is sitting in a certain bank. In a world where business is changing rapidly, this can be an issue.

Moreover, the ever-changing technology landscape is adding complexity to the issue. New trends as the API-based connectivity can definitely allow a more efficient exchange of information, shortening the gap to a real time treasury, while the migration from MT to MX messaging standard is going to heavily impact how payments are going to be settled in the near future.

In conclusion, bank connectivity is still a hot topic because it is yet perceived as being a complicated issue by many corporates, and there is a clear need for treasurers to figure out all the relevant variables before choosing the most valid option for their company.

The alternatives on the market

Years of innovation and progress in information technology and financial markets have developed a wide array of possible bank connectivity services. In order for a treasurer to take the most educated choice, it is essential to list and examine all the options available. The list goes from the simplest to the most complex.

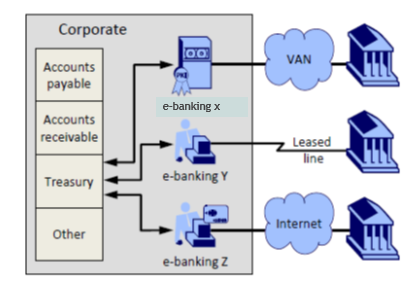

- E-banking or bank-proprietary platforms: the base scenario nowadays is for a company to exchange messages and documents over an e-banking platform. This kind of platforms are provided by most of the commercial banks, and they include a common range of functionalities such as the possibility to import payment files from the Enterprise Resource Provider, approve them and send them over to the bank for the execution of the transaction. On the informative side, banks can allow their clients to download account statement messages, and possibly to collect statements sent by other banks.

Additional features that an e-banking platform might have are, for example, the possibility to manage direct debit mandates, or to place FX dealing orders to the bank.

Most of the e-banking solution in the market are endowed with a scheduler function that allows to exchange files with external systems such as the Enterprise Resource Provider or the Treasury Management System.

Companies that are relying on an e-banking platform for bank communications should carefully examine the range of functionalities that are included in the solution, when looking for a bank to work with. Corporate e-banking platforms developed by international banks might be more adequate for companies with international business, while domestic banks might develop functionalities that are more fit to the domestic market.

Another variable to consider is the technology that runs behind the platform. Most banks are nowadays offering web-based solutions that are more flexible and easier to maintain than hosted solutions.

The main advantage of relying on e-banking connectivity is the fact that it requires virtually no effort for the channel to be available, especially if it is a web-based service.

Although it is a very practical solution, companies that have multiple banking relationship will need to activate multiple e-banking platform to issue transactions from these bank accounts. Another shortcoming is that the availability and the security of each e-banking platform relies on the systems of the bank who is providing the service, and this can be a potential risk if the financial institution is not disciplined enough to run a highly secure infrastructure.

- Multibank platforms: one of the most annoying disadvantages of leveraging on e-banking connectivity is to maintain the access to multiple platforms, and to constantly need to switch from one to the other during the day. This shortfall can be bypassed by the adoption of a multibank platform. These solutions work just like an e-banking platform, but they give the possibility to manage bank accounts belonging to more banks via a single solution.

This possibility is often developed by multinational banking groups, that might allow to reach bank accounts within the same banking group via a single e-banking solution.

Alternatively, some banking communities have developed country-wide standards that allow the possibility to manage all the bank accounts that a company has in the country with a single e-banking channel. This is the case of Italy with the CBI service.

Technical advantages and disadvantages of this solution are essentially the same of the e-banking connectivity that was described in the previous point.

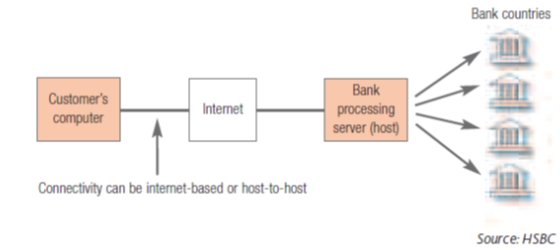

- Host to host connectivity: some financial institutions allow their corporate clients to exchange files via a secured file transfer mechanism. This option is preferred when the company has a privileged relationship with a specific bank, and this is the case because the setup of a host-to-host connection can be a time consuming task both on the bank and on the corporate side.

It is important to bear in mind that a dedicated host to host connection can be a resource intensive solution to maintain, therefore it is key to agree with the partner bank who is responsible in the maintenance of the service, and which is the minimum uptime contractually agreed.

Having a host to host connection with a specific bank means that the company is clearly trusting the security protocol of the financial institution. Connections of this kind are normally secured by an encryption protocol, and this makes a host-to-host connection generally more secure than an e-banking connection.

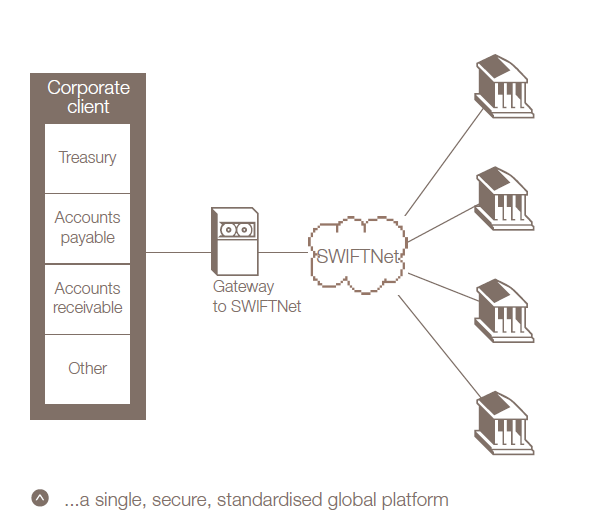

- SWIFT connection: most of the companies with a complex cash management infrastructure choose to connect directly to the SWIFT network.

Being part of the SWIFT network means for a company to be identified with a specific SWIFT code, the same identifier that is normally used by banks.

It also means that a company can securely exchange files with several banking partners from a single channel, and for this reason a SWIFT connection is the preferred option for companies that have implemented a central payment factory.

Two separate services are used within the SWIFT network: the FIN service is used to exchange single MT messages to banks connected to the network. This service is normally used to receive account statements such as MT940/2.

The second service used is called FileAct, and it is the service used to exchange any kind of file to banks. This service is mostly used for bulk payment files such as XML.

Joining the SWIFT network as a mean to consolidate payment operations in the company headquarter or in a shared service center can definitely bring efficiencies, but at the same time it makes sense to go through this road only if the company has the necessary resources to maintain a SWIFT connection overtime, or if it is willing to outsource the maintenance of the connection to a service bureau.

- API-based connection: with the sharp rise of open banking in Europe, driven by the PSD2 regulation, the adoption of APIs is becoming more and more common among banks, corporates, and software vendors. An API, or Application Programming Interface, is an interface that allows a secure exchange of information among several software applications. Through an API, the company and the bank can exchange information such as payment files or account statements, without the need to setup and maintain a resource-intensive host-to-host connection.

Although it is a very interesting concept, most of the players in the financial industry still have to develop an adequate IT infrastructure in order to get the benefits of this new protocol.

An important role can be played by software vendors that are offering Enterprise Resource Providers or Treasury Management Systems, since they have a strong incentive to differentiate their offer by develop APIs that would connect their solution to the largest possible number of banks.

Who should manage your SWIFT connection, and why should it be FIS?

Every company that wishes to connect to the SWIFT network should ask itself which configuration is the best for them. The main question to consider for a company is if it has the adequate resources to manage and run a SWIFT connection, or if they want to leverage on a service bureau.

Companies that wish to setup and maintain their SWIFT connection should plan the IT resources required to host the SWIFT software, and the personnel that will be dedicated to fulfill all the functional and technical duties required by SWIFT or by the banks.

Because of the effort that is required to setup and maintain a SWIFT connection, a company might decide to outsource those tasks. A SWIFT service bureau can help companies to establish and ensure the availability of the SWIFT network overtime.

Via the Managed Bank Connectivity service, FIS offers its capabilities as one of the largest SWIFT service bureaus in the world, being a key partner for more than 350 groups of banks and corporates, spread in over 35 countries. As part of the Service Level Agreement that FIS has with its clients, service availability is set for a minimum of 99,5%, although the average uptime for 2020 was 99,99%.

Companies that choose to leverage on a service bureau are either those with a very limited staff within the treasury department, or those that have a very complex cash management infrastructure.

The cost of connecting to the SWIFT network via a service bureau can be quite relevant, therefore companies that are evaluating this kind of solution should create a comprehensive and accurate business case that includes both direct and indirect expenses for both alternatives.

Which variables should be considered?

A company should consider several variables when evaluating which is the most adequate connectivity setup.

- The size of the business: it might sound overkill for a small corporate to adopt a SWIFT connection, in fact most of the small business normally rely on e-banking portals. More complicated connectivity choices are normally more expensive, and it might not be sustainable for a modest company to adopt more complex solutions

- The number of markets the company is operating: multinational companies normally need several banks in order to do business internationally, therefore a company that is active in several countries might want to adopt a SWIFT connection in order to collect the daily account statements and to orchestrate their payment flows.

- The number of banking relationships: a company that is operating with several banks might find difficult to maintain access to several e-banking portals. In this case, a company of this kind might want to evaluate a SWIFT connection, unless a country wide multibank standard is available.

- The company treasury policies: there are several reasons for a company to centralize their payments at headquarter level, or to keep them at country or at division level. The choice of connectivity should reflect the processes in place within a company: in corporate groups where every country is responsible to issue their own transactions, and banking relationships are limited in number, e-banking platforms can work just fine, while on the other hand an international payment factory will most probably require access to the SWIFT network.

Whatever process should the company have in place, it should anyway explore a way to consolidate the account statements of all the subsidiary at headquarter level, in order for the holding company to have complete information on the liquidity situation at group level, and to make sure that liquidity is used in the best possible way.

How to choose the best connectivity solution?

If there is one thing that I have learned by talking to corporate treasurers overtime, it is that no treasury is alike, and every treasury has its own peculiarities.

Given the vast array of bank connectivity options, I will define a few examples of treasury infrastructure, and I will pair them to my recommended choice of connectivity.

Case

|

Recommended solution

|

|

Company Alfa

|

| Alfa is a company based in the UK, producing semi-finished goods for the food industry. The production is completely sold to English companies, and all its suppliers are based in the UK.

Alfa has two bank accounts, with two English cooperative banks. |

Through the e-banking portal of the two banking partner, Alfa will be able to perform all the necessary operations for its daily business. |

|

Company Beta

|

| Beta is the headquarter company of a large conglomerate of ventures, operating in several industries. Since the subsidiaries operate in very different markets, the group policy is for every subsidiary to manage their treasury separately, and to orchestrate their payments independently.

The group has relationships with around 30 banks, counting more than 600 bank accounts. |

Every subsidiary of the Beta group will choose its most efficient setup, but the holding company will need to setup a channel to collect efficiently the account statement of all the 600 bank accounts of the group. This will allow Beta group to closely monitor the transactions and to efficiently use its liquidity.

Given the large number of bank relationship, my advice would be to setup a SWIFT connection. |

|

Company Gamma

|

| Gamma is a group of companies providing consulting services. The group has grown dramatically in the last years, acquiring smaller ventures around the world, and the CFO just hired a group treasurer that has the task to rationalize the banking relationships, and to setup the most efficient treasury infrastructure.

Payments are quite limited in number. |

It would make sense for Gamma to look for a global bank with which to open bank accounts around the world.

By having one main bank, Gamma will easily orchestrate a cash pooling from its headquarter, and it will be easy for the group treasurer to control the payments that are performed by the local staff.

The most efficient connectivity scenario is a host-to-host connection (or a connection via API if available), with the main banking partner, while payments from minor bank accounts will be done via the e-banking. |

|

Company Delta

|

| Delta is a telecommunication company operating at global level. Due to the nature of its business, the company sends and collects a vast amount of payments of any size from retail and business customers located in several countries.

The company needs to offer the widest range of payment options, therefore it needs to have relevant banking relationships in many countries. |

The best way to orchestrate payments and collections on such a complex company is to setup a connection to the SWIFT network.

Given the very complex cash management setup and the large number of banks involved, it will be essential to have the infrastructure served by a service bureau. |

|

Company Epsilon

|

| Epsilon is a company operating in the mining and trading industry, headquartered in Spain but with operations in other five countries.

The company needs to maintain a wide range of banking relationship due to the complex financing plans in place.

The treasury department employs a single person, and there is no plan for the company to hire more treasury staff. |

Due to the complex landscape of banking relationships, and the need for the company to control the incoming and outgoing information flows to the banks, my advice would be to implement a SWIFT connection.

As highlighted in the box, it would be extremely hard for a single person to handle the requirements coming from SWIFT and the banks, therefore my suggestion is to adopt a Service Bureau |

Conclusion – a complex matter requires a complex answer

As I do with most of the complex questions I receive, when asked which is the ideal connectivity setup for my company, my natural answer is: “it depends”.

The aim of this article was to communicate how sophisticated it can be to identify the best possible way to connect a corporate to a bank, or to several banks. My wish is for every treasurer out there to carefully balance all the options, and to include all the relevant items into a specific business case, in order to have a functioning and sustainable infrastructure.

More about the author, who is Luca Crivellari?

Luca is based in Italy and he is a Sales Executive at FIS, specialized in Corporate Liquidity solutions. He has a solid experience in cash management and treasury, having matured experiences in banking and fintech.

Luca is based in Italy and he is a Sales Executive at FIS, specialized in Corporate Liquidity solutions. He has a solid experience in cash management and treasury, having matured experiences in banking and fintech.

Thank you for reading!

On Tuesday 27th March 2018, treasuryXL attended a seminar in Amsterdam organised by

On Tuesday 27th March 2018, treasuryXL attended a seminar in Amsterdam organised by