Recently we were asked about RTGS & Open Finance. François de witte explores how instant payments & open banking are the answer! Fewer fees, faster transfers & more control. Read more in his article.

Introduction

On 19 March 2024, Regulation (EU) 2024/886 of the European Parliament and of the Council of 13 March 2024 was published in the Official Journal of the EU (OJ), read more here. This regulation amends the Single Euro Payments Area Regulation, the Cross-Border Payments Regulation, the Settlement Finality Directive, and PSD2 which regards instant credit transfers in euro. The Regulation enters into force on the twentieth day following its publication in the Official Journal of the EU (8 April 2024).

We take the opportunity to clarify the clearing mechanisms and the way instant payment in euro is cleared, and to see the impact on open finance.

Clearing Systems in Europe

When banks process payments of their clients to accounts outside their bank, they need to use clearing systems.

We distinguish 2 types of clearing:

- The gross settlement or RTGS (Real Time Gross Settlement):

RTGS is a system that transfers funds between banks on a one-to-one basis, in real-time, and with finality. This means that each payment is processed individually, as soon as it is initiated, and cannot be reversed or canceled. RTGS reduces the settlement risk and liquidity risk for the participants, as their payments are cleared in real-time. However, RTGS also requires more capital and resources from the banks, as they have to maintain sufficient balances in their accounts at all times and pay higher fees for each transaction. Examples are TARGET in Europe and CHAPS in the UK.

- The net settlement also called the ACH (Automated Clearing House):

Net settlement is a system that aggregates and offsets multiple payments between banks and settles them at a predetermined time or frequency. Each payment is not processed individually, but rather as part of a net position with other payments. Net settlement reduces the operational and transactional costs for the participants. However, net settlement also increases the settlement risk and liquidity risk for the participants, as they have to wait for the settlement for the finality of their payments. Examples are EBA Step 2 and STET for SEPA payments.

TIPS clearing as an enabler of Instant Payments

Instant payments require performant, but also cost-efficient RTGS systems, as the banks will have to execute all the Euro payments as instant payments, at the same charges as the non-instant payments.

To this end, TIPS (TARGET Instant Payment Settlement) was created in November 2018 as an extension of TARGET2, now replaced by T2. It enables payment service providers to offer fund transfers to their customers in real time and around the clock, every day of the year. Thanks to TIPS, individuals and firms can transfer money to each other within seconds, irrespective of the opening hours of their local bank.

TIPS operates on a full-cost recovery basis. Currently, the price per instant payment transaction is fixed at 0.2 cents (€0.002), which is shared equally between the sending participant and the receiving participant in TIPS (i.e. €0.001 for the Originator and €0.001 for the Beneficiary).

Impact on Open Banking

The Instant Payment Regulation will in combination with PSD2 provide a real boost to Open Banking, and might become a challenger for card and APP payments.

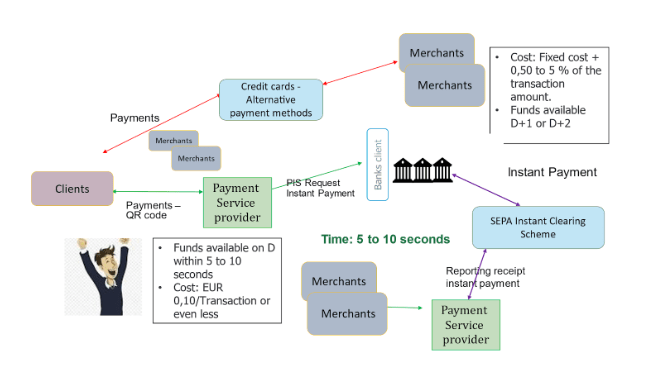

TPP (Third Party Payment Providers) are with their solution in combination with instant payments challenging the cards market and the wallets market, as the costs for the merchants are much lower, and the new SEPA Instant Credit Transfer scheme allows to have confirmation of the cleared funds within seconds, as outlined in the figure down below:

Figure: Example Use Case Instant Payments through TPP versus Alternative Payment Methods (Cards, Wallets, etc.):

PSD2 goes much further, as it enables new offerings such as dashboards with consolidated account overviews under a single portal. Banks and/or Fintechs are likely to develop solutions to better leverage their data, applying artificial intelligence (AI) and analytics to develop added value services, e.g., peer group profiling, customized financial health checks and personalized recommendations.

Open Banking is the first step in the direction of Open Finance, which goes far beyond payments.

The proposed FiDA (Financial Data Access proposal) EU Regulation aims to establish a clear regulatory framework enabling data sharing, provided that the clients agree on this. FIDA will grant to customers the right to authorize third parties – or data users – to access their data (read access) held by financial institutions – or data holders.

FiDA has a much larger scope than PSD2/3 and the PSR (Payment Service Regulation). Nearly all financial services data will be within its scope.

This will foster the development of embedded finance, also known as embedded banking. In simple words, it, is the use of financial tools or services — such as lending or payment processing — by a non-financial provider (e.g. Neobanks and Fintech), through its technology platform. The purpose of this is to integrate financial services within other environments and ecosystems, by the use of BaaS (Banking as a Service) platforms.

Non-Banks aim to extend their product through financial services, by partnering with banks and specialty finance companies to enable the technological functionalities and get regulatory or licensing requirements needed to offer the product.

Conclusion

Open finance will be a game-changer in the market and will be facilized by both the projected FiDA Regulation and by embedded finance. This will also impact the banks, who will have to adapt, and consider opening their data and platforms to third parties.