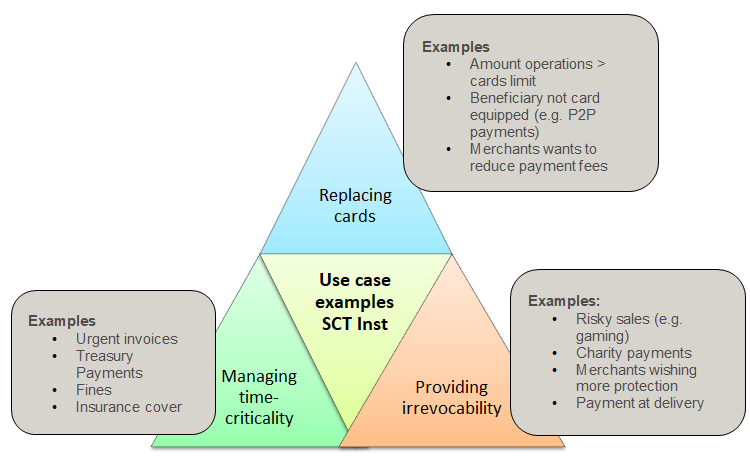

In the first article I have set the scene by presenting some use cases.

Will instant payments be a game changer?

The following table illustrates some use cases for the SCT Inst scheme:

Read other articles on Instant Payments by François de Witte

However, to extract all the benefits, ERP systems need to be updated to check the status of transactions in real time instead of at intervals. Without investing in developing the current tools further, the market actors risk missing new opportunities to deliver better customer service and create additional efficiencies in cash management.

There are several benefits this new payment method brings to the table, including a strong reduction of working capital trapped to fund operations.

Much will also depend on some factors such as:

- can it seamlessly be integrated into the sale process?

- which additional services will be linked to this type of payment? Retailers might want to combine these payments with their loyalty programs.

- what will be the rate of adoption by both banks?

- how quickly the various CMS systems in Europe will be able to interoperate?

- which prices the banks will charge for this new payment instrument?

- will it be possible to combine instant payments with new technologies such as the NFC (Near Field Communication)?

For the banks, this will imply major changes, as they need to be able to:

- make the necessary compliance and KYC checks

- do real-time processing and routing

- upgrade their current architecture to support SCT Inst

- comply with the SLA (Service Level Agreement) of the SCT Inst Scheme

- allow 24/7/365 operational processes, availability, reporting and servicing

- make extra notifications and reach filtering (as the SCT Inst scheme is not mandatory);

- adapt their fraud/sanctions management systems

- adapts their liquidity management processes and monitoring;

Hence I expect that not all the banks will follow, which is a pity because to enable a mass adoption of SCT Inst by the end-users, we need to have a large number of banks participating in the scheme. PSD2 and SCT Inst could be an incentive to modernize their payment architecture and processes.

There is also the current maximum payment limit of EUR 15,000.-, although this is expected to be raised, when the scheme is first rolled out. As a result of this ceiling, many transactions will not be eligible. This, along with the need to change “sticky” payment habits in certain countries, means adoption among retail and corporates will, at first, be gradual.

I think that it is a matter of time before instant payments become widely used in Europe. Although banks have a lot of challenges ahead, embracing innovations such as instant payments will be a crucial factor in meeting customers’ growing expectations for faster, more secure and more efficient payments. PSD2 could be a catalyst to the development of SCT Inst. Many Fintechs are already positioning themselves to offer their services.

The experts agree that whilst from the start, there will be use cases enabling the SCT Inst to take off, it will take a couple of years before we will see use cases in e-commerce and with the retailers, leading to a progressive mass adoption.

Conclusion

The SCT Inst will, in combination with PSD2 be a major game changer in the payments industry. It will be a disruptor in the current market, where cash, cards and online payment schemes still dominate.

It will also force the incumbent players to come up with new solutions, and in the end, we all, corporate, institutional or retail actors will benefit from this.

Scale is of paramount importance. Only if customers can be persuaded or pushed to use it, it will become economically viable on its own. However, it will take some years before the mass adoption will occur.