CFOs and treasurers are getting ready to face the many challenges of 2023. Finding the right approach to currency management will help them protect their company’s margins and adapt to the new reality.

In this episode of CurrencyCast, we sat down with our special guest, François Masquelier, for a complete session on the treasury fundamentals for 2023.

In this article, we will take you through:

- Trends in currency management to watch out for in 2023

- How to drive better currency management

- Technology and tools to optimize FX risk management

Setting the scene for 2023

Let’s analyse what upcoming currency management trends are going to be the main focus for treasurers this year.

Challenges and opportunities in currency management

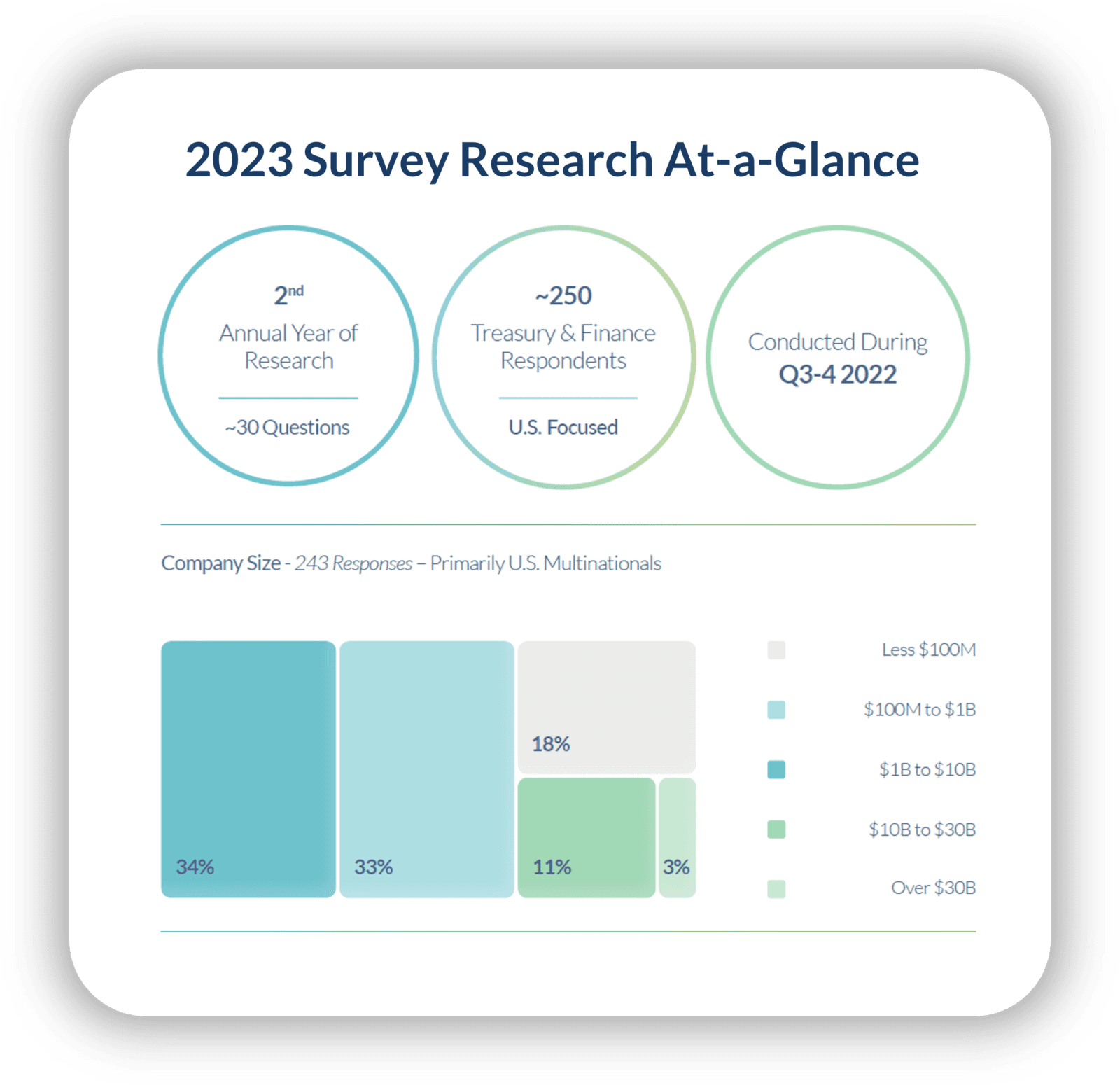

When we take a look at recent European Treasury surveys, the PwC global annual survey and the last OECD survey or surveys, there is a common theme regarding the main focus for treasurers this year.

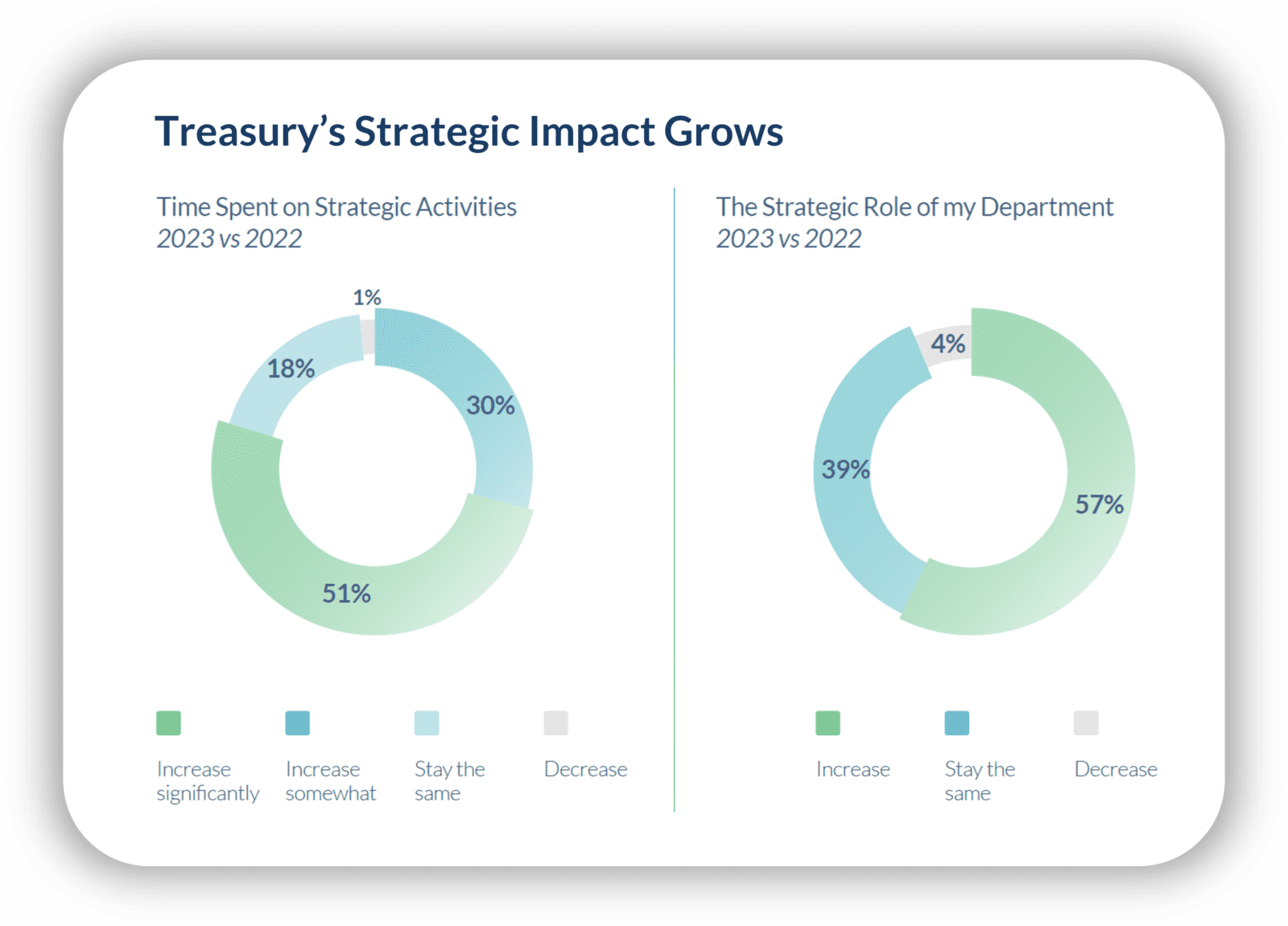

FX risk management is a top priority for corporate treasurers from 2023 onwards, right behind cash flow forecasting and digital transformation. This means that FX risk remains highly ranked by treasurers, and there are several reasons for this.

- First, the FX rate is highly volatile. And we saw this volatility in the last couple of months or years with COVID, the war in Ukraine, etc. It does not seem like this is going to shift towards decreasing market volatility for FX currencies. Interest rates are important due to swap points, differential interest and commodities.

CFOs need to protect operating margins as currency movements can affect them, thus, solid and efficient hedging strategies and tools are necessary. Despite this, corporate treasurers focus on manual processes, as automation is lacking.

- Another key factor for the importance of FX risk is digital transformation. CFO and treasurers are shifting their traditional mindset to consider the implementation of new financial tools and technology.

And this is mainly because they have started to realise that automation and digitization could be a way to reduce that risk or, at the very least, to improve the management of said FX risk.

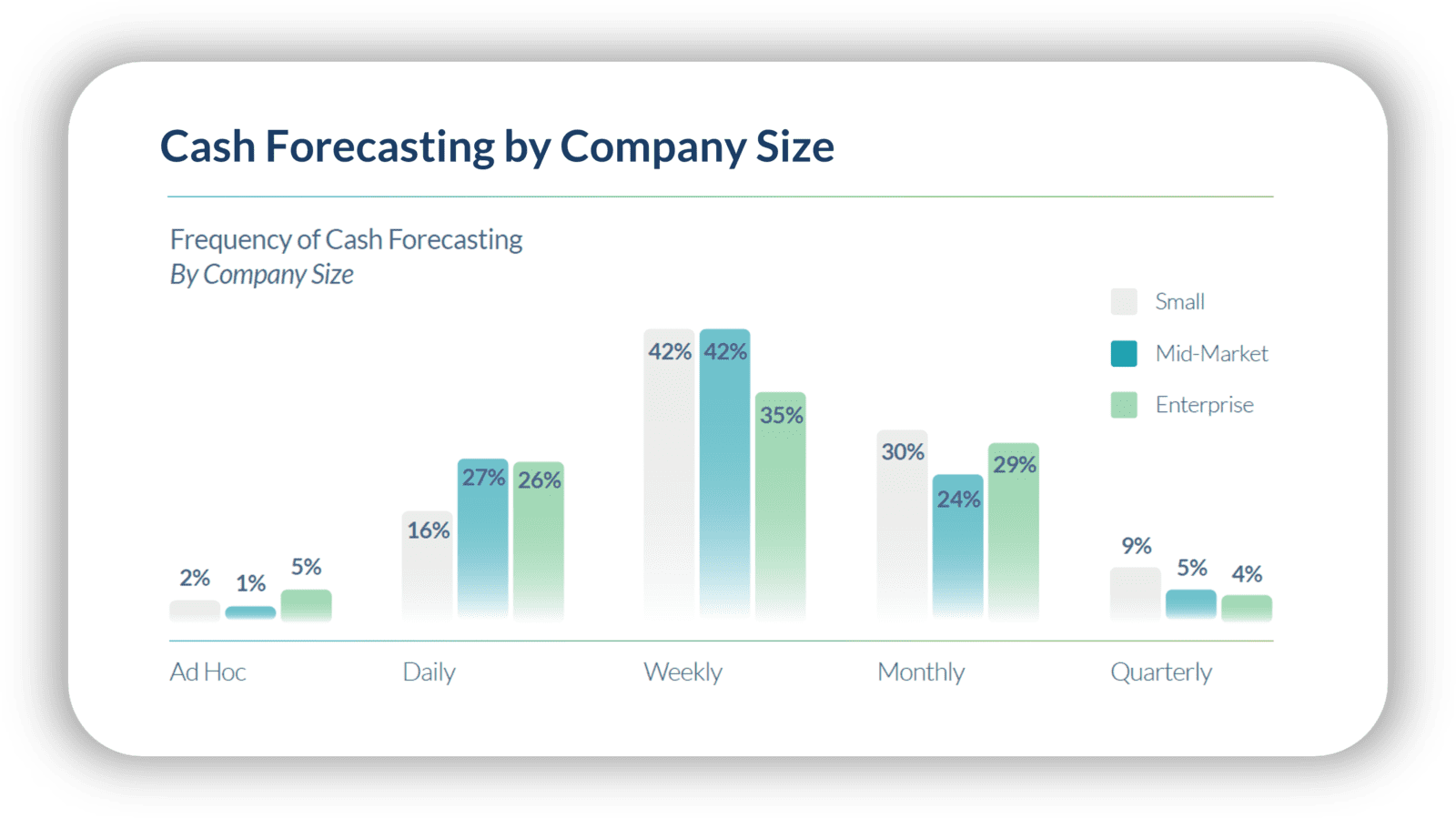

- Finally, last but not least is cash flow forecasting. It has been a top priority for a couple of years now; for 2023, it should remain a top priority. And again, for the same reason, because we live in a world of uncertainty.

So finance professionals need to make sure that they have accurate data and accurate forecasts. Otherwise, it would be difficult to manage your FX risk properly.

Large interest rate differentials

Sometimes CFOs do not always understand all the possibilities in terms of what we call optimizing forward points, that is to say, interest rate differentials.

The forward points may be a concern when there is a significant differential of interest, especially with exotic currencies. So it could be expensive to hedge certain currency pairs, depending on which side you are in. Sometimes those forward points could be in your favour, and sometimes could not be in your favour.

Treasurers with a favourable interest rate differential can decide not to hedge at all and just monitor the exposure. This is feasible, but as it is a highly manual task, the monitoring process of the open exposure can become quite tedious and inefficient.

However, the good news is that there exist certain solutions that allow them to dynamically manage your FX exposure. This way, finance professionals can reduce or mitigate the impact of the swap points and, ultimately, reduce the impact on costs.

The multicurrency world

The dollar and the euro remain important currencies, but there is a number of currencies from smaller but well-managed economies gaining ground.

As corporate treasurers are taking advantage of the benefits of buying and selling in more currencies, there is a microeconomic and bottom-up phenomenon leading to that multi-currency world.

Using the more exotic or smaller currencies, if managed properly, can protect your company against risks. The best approach to currency management this year is to use the most profitable currencies all the time.

Better currency management is possible

You can prepare for these trends if you have a strong currency management system that covers the entire FX workflow and allows you to have clear visibility over your exposure. Take a look at the two main areas that could be affecting your currency management strategy.

Accurate cashflow forecasting, or not?

Sometimes the importance of having accurate cashflow forecasts is somewhat overstated when it comes to currency management.

Let’s take the example of a micro-hedging program for firm sales or purchase orders. The exposure to hedge is already a contractually binding item, not a forecast at all. So we don’t have really much of an issue.

On the other hand, if you take the case of a layering program or layered hedging program, the FX rate would be built in advance, so the forecasted exposure to hedges is also known well in advance.

And finally, thanks to conditional orders that protect a budget rate, the Treasury team can have time to update and finetune their cashflows.

Fewer silos, better treasury

At Kantox, we believe that currency management is more than just currency risk management, and that currency risk management, in turn, is more than just the instant execution of a hedge.

But that requires a holistic approach to currency management, to cover the entire FX workflow. This means doing away with a siloed approach that allows the company to grow beyond imagination.

In treasury and finance, there are many silos that impact the optimal management of the department. Having clear communication and flow of information with other departments is vital. It provides better visibility of the exposure and gives the CFOs the ability to react to the volatility in the market faster.

Something key in the challenging context we are facing that impacts the very thin operating margins, and a great way to generate added value to the treasury function.

One clear example of this is the companies with subsidiaries that operate in foreign currencies. By offering the subsidiaries to invoice or be invoiced in the local currencies, you are centralising the FX risk, generating value for them and improving risk management.

Another example of tearing down the silos in treasury management is the relationship between the commercial and finance teams. They don’t always see eye to eye, but providing commercial teams with the FX rate they need in real-time is a good way of eliminating that silo mentality.

As consultants from McKinsey said, the early adopters who drive cross-functional teamwork are going to reap the benefits and see a great increase in annual revenue growth.

Technology to optimize your currency management

Now that you know where to focus on improving your currency management, consider what tools could streamline this. But don’t forget to analyse if the current process is hurting you more before implementing new technology. Consider what areas of your FX workflow need revamping.

TMS lack visibility

One of the main pain points for CFOs is not having access to real-time data and dashboards that reflect the current state of the company’s financials. This makes it more difficult for them to make the right decisions on time.

There are tools, like the TMS, that are used in the treasury function with the objective of getting summarized information and reports but they are not properly fit for decision making at the C-level.

They lack dashboards fed with real-time data that would make it easier or facilitate the communication between Treasury and the C-suite. TMS have a few other shortcomings when it comes to currency management.

“Often a CFO is a car driver who does not see his/her dashboard immediately but with delay” – François Masquelier

When pricing with an FX rate, using the forward rate instead of the spot rate can help companies in certain situations improve their competitive position without hurting their budgeted profit margins.

But most TMS lack a strong FX rate feeder, meaning the possibility of providing commercial teams with the appropriate rate -a spot, or the two-month or the six-month forward rate, the pricing markups for a client segment-

Another problem with TMS is that the functionalities in the report are standard and not really customer variables. They are more of like pret-a-porter solution.

When we talk about the reporting and development of specific functionality, treasurers must find a way to fulfil these gaps and find the missing pieces.

This means that in the pre-trade phase of the FX workflow, TMS is not covering the needs of treasurers and CFOs.

AI, the future of treasury?

ChatGPT is all the rage right now, AI or artificial intelligence is making a comeback. But is it going to be the future in terms of treasury management and cashflow forecasting?

AI could play a role in the future of treasury management. However, we are still in the early days and there are many other ways CFOs and treasurers can start the digitization of the treasury function before resorting to AI.

There are some things that need to change in the way treasury is done and the approach of many finance professionals to the treasury tech stack. Those in charge of managing currencies need to be comfortable with their IT skills to make good use of new technology.

Another hurdle to the implementation of AI in treasury is the lack of access to comprehensive and immediate data. And finally, the inefficiency of highly manual processes when relying on spreadsheets for currency management. All of this takes away from producing accurate cashflow forecasts on foreign currencies.

Moving forward

As we have seen, there are many challenges to currency management that CFOs and treasurers will need to be well prepared for this year.

As interest rate differentials rise and the volatility in FX markets continues, there needs to be a good currency management system to handle the FX risk.

With the help of automation tools, finance professionals will be able to eliminate the silos that hinder the company’s growth and increase visibility over open exposure.

Download now our Currency Management Priorities for 2023 report to learn more about upcoming focus for treasurers and get your currency management strategy ready.