The New Normal in measuring Banks’ Performance – Providing direct value to Corporates (for free)

05-10-2022 | BuyingTeams | treasuryXL | LinkedIn |

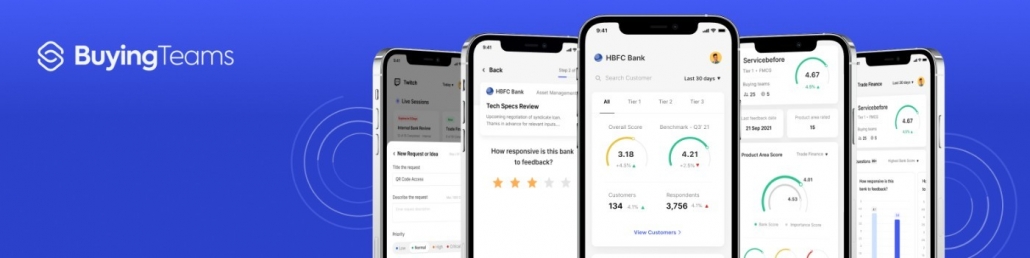

BuyingTeams – Improved Bank and Business Customer collaboration

Introduction of Buying Teams

BuyingTeams is founded by 3 former senior bankers, and on a mission to improve the collaboration between and banks and their corporate customers. The vision is to digitize the industry of corporate customer feedback and collaboration and provide value to both banks and corporates in their global organizations. The SaaS solution offered is built on the wishes and demands from both parties to ensure value for all.

Whether you sit in a corporate treasury front office role, or you are in a back-office role, without direct bank contact, you will benefit from the BuyingTeams bank collaboration solution.

Customer Data Problem

All founders of BuyingTeams have experienced firsthand the lack of detailed and actionable customer data for banks, that they now have set out to provide.

They have also experienced how banks’ largest corporate customers, very understandably, become still less inclined to reply to customer surveys, as they have little or no value in doing so – other than pleasing the banks they work with. Feedback fatigue is clearly present.

Flipping the process to a solution

Buying Teams turned the process upside down, and looked into customer feedback to banks from the bank customers’ – the companies’ – perspective:

How can we bring value to the companies while at the same time ensure timely and actionable customer data and insights for banks?

“We have actually solved this with the BuyingTeams Bank Feedback and Collaboration tool”.

They asked approximately 20 large and international companies from 4 different countries and across industries, which critical functions they currently would like to see in a bank collaboration tool. Based on these results Buying Teams started developing a solution that matches these interest points.

Examples are:

- Questions prepopulated with an option to add their own

- Access to benchmarking data

- Bank services divided into phases

- Automation features, and more

The solution is developed aiming at both large as well as medium sized companies, who wish to enhance their banking relationships. Companies having multiple banking partners as well as companies working only with one bank will benefit from the solution.

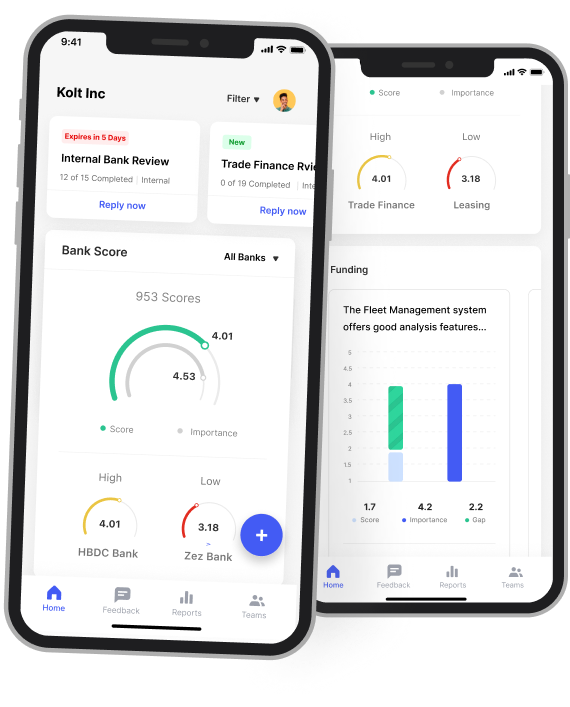

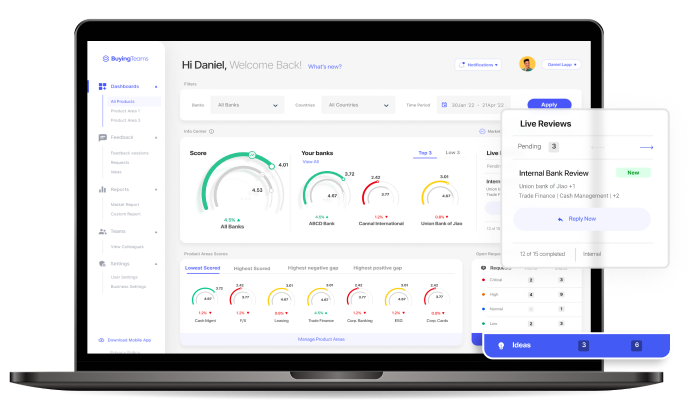

See all your banks at a glance

Companies can now work in one single digital tool and have all their feedback and other important data on the banks saved within their own solution. In just one overview companies can see all their banks in a real-time Dashboard and follow the development in banks’ capabilities and service levels over time.

All colleagues within the company can be included and provide input, indicating which banks are performing well and in which areas of their business relationship, and indeed also where there is room (and desire from corporate side) to improve the collaboration. Input can be related to different phases; sales/advisory, delivery/implementation or indeed the daily use of the bank and will give specific and valid data that were not previously available.

All colleagues within the company can be included and provide input, indicating which banks are performing well and in which areas of their business relationship, and indeed also where there is room (and desire from corporate side) to improve the collaboration. Input can be related to different phases; sales/advisory, delivery/implementation or indeed the daily use of the bank and will give specific and valid data that were not previously available.

This is extremely valuable for the front-office people in the organization that have meetings and negotiations with banks (and for the banks as well). They can be much more prepared than before, and with a minimum of effort and time spent. It is our strong belief, that this brings immense value in the bank-dialogue.

Measuring banks’ performance, free for corporates

From our initial user dialogues, we have companies planning to invite +100 people in their global organization into BuyingTeams, and we also have companies with only one or very few users. BuyingTeams brings value to both cases.

The BuyingTeams solution also offers the corporates the option to benchmark their banking partners on different parameters relevant for each individual corporate.

“We wish to have as many companies as possible to experience the value that our solution brings, so we have made it free of charge for companies”.

A summary of BuyingTeams features that bring corporates added value directly

- Full data Dashboard on all banking partners

- All colleagues working with banks have a voice

- Reliable and structured data for bank meetings

- Access to benchmark data on banks and banking services

- Data based on template questionnaires and/or tailored by the corporate itself

- Eliminate time spent on phone interviews and ad hoc spreadsheets for you and your team

- Overview and sharing of requests and ideas for banks

BuyingTeams’ solution is available as SaaS, and companies can start using the platform within a few minutes.

Final thoughts

For a long time, corporates have been servicing their banks with feedback, where the process have provided very little (if any) value for them, and a degree of “feedback-fatigue” has emerged over the past years.

With the right feedback and collaboration tool, corporates can now create valuable information and insights to the corporate itself, as well as to the relevant banking partners, who can use one and the same platform.

A platform creating value for both sides of the feedback process, in a real-time SaaS environment.

Interested? Go to buyingteams.com for information