Cash management strategies have come under intense scrutiny of late as a result of various geopolitical and economic factors. Industry surveys point to corporates becoming more risk-averse and seeking to increase their cash balances as the specter of recession looms large.

In the first in a series of blogs, we look at how increased efficiency can enable treasury teams to achieve full visibility on cash at accounts across business locations and banks and the need to manage complexity around different payment formats.

Treasury dashboards

There are various solutions that help corporates gain visibility into their overall cash positions and run an efficient payments operation. For example, treasury dashboards are a useful tool for demonstrating actual fluctuations in cash positions, which supports real-time account visibility.

A treasury dashboard is a management tool that allows assessment of the financial organisation and position of a company. It is made up of various indicators, charts and instruments that combine to create a holistic view of historic financial performance and future projections.

Treasurers can use these dashboards to produce user-definable reports on financial transaction data such as receivables and payables, cash on hand, and days outstanding, as well as increasing the efficiency of their hedging strategies and maximising their impact on corporate strategy.

Despite corporate awareness of the benefits of such technology, there are still companies with operations across multiple jurisdictions that rely on Excel spreadsheets, locally filled and send around, and therefore lack timely and centralised visibility of the cash sitting in their various subsidiary businesses.

Harmonised practices also increase visibility. Uniform processes help treasurers track cash outflows and balances across the entire organisation, although it is important for companies to determine exactly what information should be visible and to whom.

Managing complexity around different payment formats

While treasurers may choose to accommodate for the many different payment formats as required by the banks internally, that is certainly not a core activity of any treasury team.

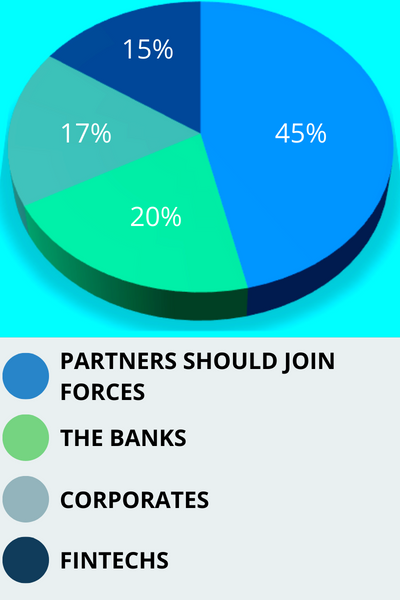

The choices they have are:

- Hire more specialised consultants;

- Rely on internal IT teams (which is not ideal because local IT teams are not specialists in payment technology and formats accordingly); or

- Find a partner/platform that takes care of – and specialises in – this activity.

By 2025 the high value payment systems of all major reserve currencies is expected to have moved to ISO 20022. ISO 20022 is a rich, structured and extensible messaging standard that is increasingly becoming the de facto standard for exchange of payments and reporting in high value, instant and other domestic payment schemes.

As a result, banks and the SWIFT community have decided that all financial institution to financial institution payments need to move to the standard. Adoption of ISO 20022 will begin on 20 March 2023.

However, although the richer data facilitated by ISO 20022 improves cross-checking, increases transparency, and reduces false positives, many corporates are holding onto older data formats rather than adopting newer, enriched versions that use XML. However, specialised support to enable the transformation to these new formats is readily available in the market.

In the second blog in this series we will look at the benefits of automatically processing bank statements and removing manual downloads of balance information from individual bank portals and manual uploads of payment files to every bank.

The ultimate guide for achieving efficient and safe multibank cash visibility and payments

Treasury teams looking to optimise their cash management processes realise that making smart decisions requires tactical and strategic planning. However, there are a number of principles that can be applied by any business to increase the level of insight into how funds move into and out of their organisation.

That’s why we created ‘The ultimate guide for achieving efficient and safe multibank cash visibility and payments’. In this guide you’ll find questions that you can ask yourself to determine your current level of efficiency and spot the areas you might need to improve.