Basisprincipes van interne beheersing op het gebied van Treasury – deel II

11-05-2016 | by Jan Doosje |

Hoe vaak komt het nog voor dat een externe adviseur of een nieuw aangetreden functionaris moet constateren dat de financiële functie op het deelgebied Treasury qua opzet bij een bepaalde organisatie niet goed ingericht is ? Naar mijn idee te vaak, vooral waar het bedrijven en organisaties uit het midden- en kleinbedrijf betreft. En dit terwijl control op het gebied van de Treasuryfunctie vrij snel en vrij simpel te verkrijgen is!

Voor de ‘niet financiële’ lezer zal wellicht niet goed duidelijk zijn wat de Treasury functie inhoudt. Zie hiervoor mijn vorige artikel. Als tweede vraag komt op: “Wat is goed ingericht ?”.

Waar het bij organisaties vaak strak is geregeld wie er verantwoordelijk is voor bijvoorbeeld commerciële afspraken of waar de grenzen liggen voor autorisatie van een bepaalde offerte, dan wel wie er verantwoordelijk is voor ICT wil dit soort structuren nog wel eens aan de Treasury functie voorbij gaan. Bevoegdheden en checks en balances liggen hier nog wel eens in één hand. Uiteraard met alle risico’s van dien.

Enige voorbeelden van organisaties die risico’s lopen

- Wie kent ze niet, de bedrijven waar een administrateur of controller zowel de facturen accordeert als deze facturen betaalbaar stelt? En of het nog niet genoeg is, deze betalingen ook daadwerkelijk bij de bank autoriseert. Het behoeft geen betoog dat hier grote risico’s aan kleven.

- Of denk aan de onderneming waarbij een goedwillende controller een flink bedrag in dollars opneemt in de verwachting dat deze koers zal stijgen? Vooral bij bedrijven met veel internationale handel zal dit niet vreemd overkomen. Maar wat nu als blijkt dat de dollar verder daalt en er voor de onderneming verliezen opdoemen?

- Of het bedrijf dat zijn vermogen bij de Icesave bank had belegd en daar slechts een fractie van heeft teruggezien?

Er zijn nog vele voorbeelden op te noemen maar kern van alle voorbeelden is dat er niets geregeld is, er wordt uitgegaan van vertrouwen en dat kan tot financiële rampen leiden.

Bijvoorbeeld dat posities in rente (nog niet afgedekte leningen) of valutasaldi te lang op de (buitenlandse) bankrekening blijven staan en daarmee het resultaat van de onderneming substantieel kunnen beïnvloeden. Maar ook dat niet duidelijk is wie er nu eigenlijk een betaling mag autoriseren bij de bank. Wie heeft de contacten met de bank en met welke banken (tegenpartijen) mag de onderneming zaken doen?

Doelstelling Treasury bepalen

Als begin van een oplossing voor deze problematiek dient de organisatie te bepalen wat haar doelstellingen zijn op het gebied van Treasury. Is beheersing van risico’s de grootste drijfveer? Dan kan dit misschien gepaard gaan met wat hogere kosten. Of dient het beschikbare kapitaal tegen een zo hoog mogelijke rente te worden belegd tegen een aanvaardbaar risico?

Zodra deze vraag min of meer beantwoord is kan de organisatie hierop ingericht worden. Met ingericht wordt bedoeld dat er procedures en richtlijnen komen op het gebied van Treasury.

- Ten eerste zal bepaald moeten worden welke functionarissen er betalingsvoorstellen mogen inlezen bij de bank en wie deze mag autoriseren. Bij een wat grotere organisatie dienen deze autorisaties niet in één hand te liggen.

- Ook moet bepaald worden met welke banken men zaken wil doen en welke “grading” deze banken mogen hebben. Voor de crisis “wemelde” het van de triple A banken (AAA) maar tegenwoordig zijn deze met een lichtje te zoeken.

- Verder dient bepaald te worden of er van “instrumenten” gebruik gemaakt mag worden (denk hierbij aan opties, aandelen, vaste of variabele rente e.d.). Ook de verdeling over de instrumenten (maximaal X procent in aandelen, Y procent in obligaties met een bepaalde rating e.d.) en banken (bijv. maximaal 10% bij de X Bank en 50% bij de Y bank en 40% verdeeld over de Z en A bank) Dit dient in het Treasury statuut vastgelegd te worden.

Deze drie elementen zijn m.i. de basis voor een goed ingerichte treasury functie. Als dit goed is beschreven, vastgesteld en geïmplanteerd kan de ondernemer de werkzaamheden op dit terrein met een gerust(er) gevoel aan de betreffende medewerkers overlaten.

Ook is het van belang dat de “tegenpartijen” (de banken) waar de onderneming zaken mee doet, op de hoogte zijn van het Treasury statuut. Zij stellen het op prijs om het Treasury statuut te verkrijgen en adviseren graag hoe er verbeteringen behaald kunnen worden.

Kort samengevat kunnen de risico’s op het gebied van Treasury sterk gemitigeerd worden door een simpel in te richten structuur:

- Wie mogen zich bezighouden met aangelegenheden op het gebied van Treasury?

- Wat mag ieder van de functionarissen qua bevoegdheid?

- Met wie (welke banken e.d.) mag er zaken gedaan worden?

- Welke posities mag de onderneming innemen?

Om dit te bedenken en uit te schrijven gaat enige tijd voorbij maar het zal zijn vruchten afwerpen. Ook voor de ondernemer, de medewerkers, accountant evenals eventuele toezichthouders is het goed te weten dat er afspraken zijn op dit gebied en dat hier ook op gemonitord wordt.

Uiteraard wordt in dit artikel slechts op basisprincipes ingegaan. In een eventueel vervolg zal op ieder van de deelgebieden verder ingezoomd kunnen worden dan wel op de treasury functie zelf.

Conclusie is dat een op de wensen en eisen van de organisatie afgestemd Treasury beleid, tezamen met een goed gestructureerd en actueel Treasury statuut een grote mate van control op dit gebied geeft en dus als essentieel onderdeel van het in control zijn van de organisatie gezien moet worden.

Owner of Fimterim Advies & Consultancy

10-05-2016 | By

10-05-2016 | By

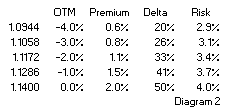

Risk appears fairly stabile across strikes, which makes sense because the premiums are calculated with one volatility on one underlying. The Risk on OTM is lower than that for ATM options. It appears that OTM premiums are relatively more expensive, they give protection against less potential loss.

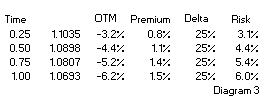

Risk appears fairly stabile across strikes, which makes sense because the premiums are calculated with one volatility on one underlying. The Risk on OTM is lower than that for ATM options. It appears that OTM premiums are relatively more expensive, they give protection against less potential loss. Diagram 3 shows Premiums, Delta and Risk for different tenors. ‘Time’ is the time to expiry of the options in fractions of years. Its shows that for longer tenors, the Risk is higher. But disproportionally. For the same chance on exercise a hedger could double the premium to buy a hedge for a 4x longer tenor.

Diagram 3 shows Premiums, Delta and Risk for different tenors. ‘Time’ is the time to expiry of the options in fractions of years. Its shows that for longer tenors, the Risk is higher. But disproportionally. For the same chance on exercise a hedger could double the premium to buy a hedge for a 4x longer tenor.

In

In

It all started in the 90 ‘s of the last century when the Securities and Exchange Commission (SEC) requested the Financial Accounting Standards Board (FASB) to provide guidelines for the presented net profit in financial statements. The idea was to help private investors make better comparisons between the various investment opportunities. The set out guidelines were made mandatory for all listed companies in the USA. The principles of the FASB guidelines – generally accepted accounting principles (GAAP) – were also adopted in the financial statements of unlisted companies and applied worldwide (IAS) and in The Netherlands (RJ).

It all started in the 90 ‘s of the last century when the Securities and Exchange Commission (SEC) requested the Financial Accounting Standards Board (FASB) to provide guidelines for the presented net profit in financial statements. The idea was to help private investors make better comparisons between the various investment opportunities. The set out guidelines were made mandatory for all listed companies in the USA. The principles of the FASB guidelines – generally accepted accounting principles (GAAP) – were also adopted in the financial statements of unlisted companies and applied worldwide (IAS) and in The Netherlands (RJ). Ad van der Plas – independent Treasury Consultant & Interim Manager

Ad van der Plas – independent Treasury Consultant & Interim Manager

26-04-2016 | by

26-04-2016 | by  Jan Meulendijks – Cash management, transaction banking and trade professional

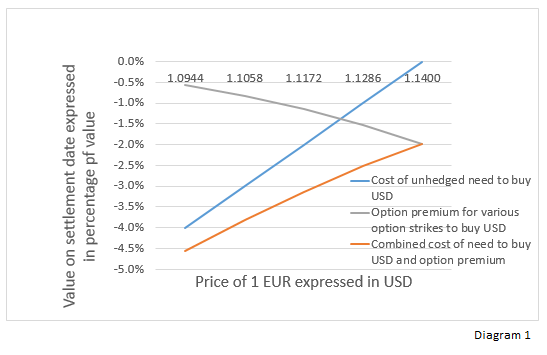

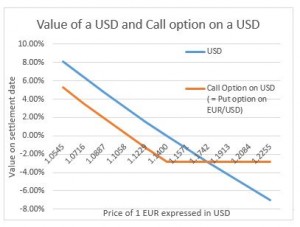

Jan Meulendijks – Cash management, transaction banking and trade professional Diagram 1 explains his feelings. I assume he was considering only the left half of the payoff diagram. After an appreciation of the USD, a USD is always worth more than a call option on a USD, the difference being the option premium.

Diagram 1 explains his feelings. I assume he was considering only the left half of the payoff diagram. After an appreciation of the USD, a USD is always worth more than a call option on a USD, the difference being the option premium.

22-04-2016 | by

22-04-2016 | by