Rousseff impeachment: short-term strength for BRL

22-04-2016 | by Simon Knappstein |

22-04-2016 | by Simon Knappstein |

Will the ousting of President Rousseff help the Brazilian Real to strengthen or not?

From a high of 4,15 at the end of January USD/BRL has fallen steadily to 3,55 level today. This strengthening came on the back of a broadly weaker USD, a rebounding oil price, renewed inflow into Emerging Markets in general and supported by a high carry for the BRL more specifically.

What has played an important role more recently is the diminishing popularity of president Dilma Rousseff. This comes in part by a massive corruption scandal at state-run oil company Petrobras with a lot of Worker’s Party politicians already convicted. Yesterday, the Brazilian Lower House voted for her impeachment over allegations for manipulating government accounts to hide a budget shortfall. All this has crippled the government’s ability to deal with an economic recession and rising unemployment.

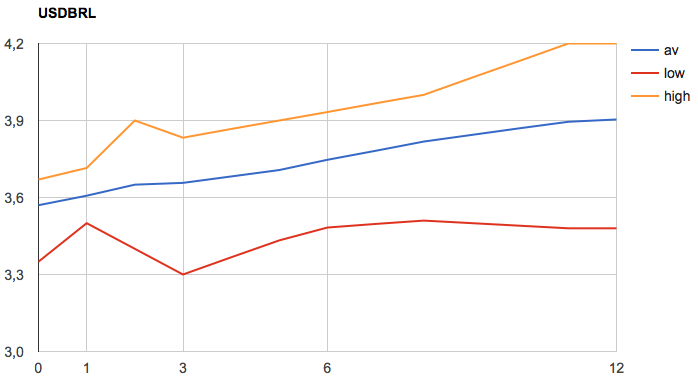

The consensus FX forecast for USD/BRL, with current spot at 3.62, is 3.90 in 12 months’ time.

According to Nordea the potential impeachment of president Rousseff is a “short-term positive for the BRL at best. Short-term positive because markets seem to cheer the potential for change and for more political stability under Vice President Temer, albeit with the recognition that the BRL has already strengthened a lot and that most of the impeachment may be priced. More importantly, however, Brazil’s huge and numerous challenges will not go away with President Rousseff and markets may soon realize that.”

ING that expects USD/BRL to trade at 4.05 in one year’s time states: “Yet, we continue to see a high risk of the current market euphoria to fade as an impeachment does not necessary mean a highly stable political environment thereafter”. That might be an understatement as vice-president Temer, who would assume power on an interim basis when Rousseff has to step aside, also runs the risk of an impeachment process.

And although, as Scotiabank poses it “hopes that changes in the country’s leadership could lead to more market friendly economic policies” market participants seem to underestimate that “Brazil is undergoing a deep economic crisis exacerbated by a profound crack in its political institutions” and more specifically underestimate “the nature of the structural change required to rebuild credible political institutions”. Scotia sees the BRL weakening to 4.20 in 11 months’ time.

So in the short-term the BRL might strengthen a bit further still but further out it is still in general expected to weaken to around 4.0 against the USD.

Owner of FX Prospect