| 24-2-2017 | Carlo de Meijer |

Last year August I wrote a LinkedIn blog on blockchain and trade finance. There I described the various pilots and plans for using this technology in the trade space. In that month, the bank-backed R3CEV blockchain consortium revealed that 15 of its member banks had participated in a trial involving trade finance. Since then activity in this area has accelerated. It signals that enterprise banks are increasingly interested in the application of the blockchain to trade finance. The idea is that a distributed database like a blockchain can form the basis for a wholly digitized supply chain.

“Blockchain lends itself easily to the trade finance industry, which heavily rely on the settlement of sensitive information. This technology could be used to digitise sales and other legal contracts (smart contracts), allow the location of goods to be monitored and facilitate payments in close to real time. Potentially, business transactions can be executed directly on the platform itself through the use of “smart contracts” embedded in the platform and the platform could be further connected to payment systems and distribution networks for smoother flow of payments, goods and services.” – I wrote in Blockchain and trade finance: projects and pilots

Moving from the proof-of-concept stage into production

It is also becoming all the more clear that blockchain technology is moving from the proof-of-concept stage into production, especially for cross-border payments and trade finance. Last week seven European banks announced their plans to develop a trade finance platform based on blockchain technology. Let’s have a look – there are more examples.

European banking consortium: cross-border trade platform

Seven of Europe’s biggest banks (Deutsche Bank, HSBC, KBC, Natixis, Rabobank, Société Générale and UniCredit) signed a Memorandum of Understanding in Brussels under which they intend to collaborate on the development and commercialisation of a new product called Digital Trade Chain (DTC). A shared cross-border trade finance platform for small and medium-sized using blockchain technology.

The product is based on a prototype trade finance and supply chain solution originated by KBC and tested to ‘Proof of Concept’ stage. The aim of the project is to simplify trade finance processes for SMEs by addressing the challenge of managing, tracking and securing domestic and international trade transactions by connecting all of the parties involved (i.e. buyer, buyer’s bank, seller, seller’s bank and transporter), online and via mobile devices. They thereby hope to accelerate the order-to-settlement process and decrease administrative paperwork significantly. The group plans to initially focus on building critical mass in seven European markets.

S7 Airlines and Alfa-Bank pilot the first Russian blockchain LoC transaction

Two Russian companies, S7 Airlines, and Alfa-Bank, have successfully closed a deal using a smart contract to settle and record a Letter of Credit (LoC) on a blockchain. Deloitte in Russia provided legal support to the project. Only the people with information about the original parameters of the deal can view the status of the letter of credit in the blockchain record. In this transaction, in addition to Alfa-Bank and S7 Airlines, the information is available to a service company that receives money under the letter of credit. Legally, this transaction meets all the requirements for a letter of credit as a form of bank settlement, and demonstrates the potential of smart contract application in the framework of Russian legislation.

“The transaction enabled us to test the capabilities of smart contracts and understand how the technology helps to improve business processes and document flow efficiency. We are planning to continue cooperating with Alfa-Bank in this area.” – Dmitry Kudelkin, Deputy General Director, S7 Group

Barclays enabled first global trade transaction trial

Barclays announced that it had successfully completed the first global trade finance transaction trial using blockchain technology. The test enabled two partners, Ornua, an Irish agriculture co-operative (formerly the Irish Dairy Board), and Seychelles Trading Company, a food product distributor, to successfully transfer trade documentation via a blockchain platform created by its accelerator program graduate, Wave. A blockchain-based letter of credit closed a transaction between Ornua and the Seychelles Trading Company, guaranteeing the export of almost US$100,000 worth of cheese and butter from Ireland to the Seychelles, facilitated by Barclays. Meanwhile, the funds for the transaction were transferred via Swift.

Wave has worked with Barclays in developing new solutions for trade finance. The start-up’s blockchain-based technology connects all members of a supply chain to a decentralised network, allowing them direct exchange of documents. Wave’s blockchain-based system allows all parties to see, transfer titles, and transmit shipping and other trade documentation through their decentralized network. The new platform helps optimise internal processes for banks and reduces the risk of documentary fraud, while speeding up the time it takes to complete a trade transaction – from as many as 20 days, to just a few hours.

“Blockchain is a very good solution to eliminate the pain in international trade, because you have an industry that combines all industries, because all industries are either importers or exporters at some level. You have the carrier, the bank and the customer and it’s hard to find one centralized entity everyone can work with.” – Wave founder Ruschin

IBM promotes Blockchain Trade Finance In India

In India, IBM is hoping to promote mainstream adoption of blockchain by collaborating with multinational company Mahindra, which operates Mahindra Finance. IBM and Mahindra are developing a blockchain-based trade finance solution to offer banks in the country. The cloud-based tool will look to facilitate trade finance transactions between buyers and suppliers, and could overhaul trade finance for SMEs in particular.

The companies have already completed a proof of concept that “represents a significant step forward in blockchain, a more compelling and efficient supply chain solution for Mahindra Finance’s small and mid-sized enterprise loan business”. IBM and Mahindra will explore other use cases for blockchain including applications for Mahindra’s car and tractor manufacturing operations.

Microsoft and BAML to Test Blockchain for Trade Finance

Microsoft and Bank of America Merrill Lynch (BOML) announced a collaboration on blockchain technology to fuel transformation of trade finance transacting. The companies have teamed up to implement blockchain technology in trade finance to facilitate faster, safer, cheaper and more transparent transactions. The main objective of the collaboration is to develop and test blockchain technology and establish best practices for blockchain-powered exchanges between businesses and their customers and banks, before commercializing it. Microsoft’s own cloud-based platform Azure will be utilized to test the project. Microsoft Treasury experts will serve as advisors and initial test clients. Development and testing of the initial application, built to optimize the standby letter of credit process, is currently in progress.

CBA, Wells Fargo and Brighann Cotton pioneered blockchain trade finance transaction

The Commonwealth Bank of Australia (CBA), Wells Fargo and trading firm Brighann Cotton have successfully completed the “first” global trade finance transaction experiment in October between two banks using blockchain, smart contracts and the Internet of Things (IoT).

“The interplay between blockchain, smart contracts and the Internet of Things is a significant development towards revolutionising trade transactions that could deliver considerable benefits throughout the global supply chain.” Michael Eidel, CBA. The trade involved the shipment of 88 bales of cotton worth approximately $35,000 from Texas US to Qingdao, China. The transaction mirrors a letter of credit, executed through a collaborative workflow on a private distributed ledger – Skuchain’s Brackets system – between the seller (Brighann Cotton in the US); the buyer (Brighann Cotton Marketing Australia); as well as their respective banks (Wells Fargo and CBA).

By connecting Brighann Cotton’s container to the internet of things (IoT), both CBA and Wells Fargo have been able to “track a shipment in real time”. It was the geographical location which triggered the smart contract to release the payment for the cotton (which happened via the traditional Swift system, allowing the banks to avoid having to win the approval of prudential regulators for the deal).

Major banks from India and Dubai complete blockchain trade finance transaction.

ICICI, India’s largest private bank, and Emirates NBD, recently announced successful international transactions for both trade finance and remittance purposes using blockchain technology.

This pilot transaction was executed to showcase confirmation of import of “shredded steel melting scrap” by a Mumbai-based export/import firm from a Dubai-based supplier, and to exchange and authenticate original international trade documents. The blockchain trade application co-created by ICICI Bank “replicates the paper-intensive international trade finance process as an electronic decentralised ledger”.

The information contained in the blockchain transaction included a purchase order, an invoice, shipping and insurance papers. Each participant was able to access and view a single dataset, to authenticate ownership of goods digitally, transmit their trade documents, check the status of their applications, and transfer their titles, while maintaining confidentiality. Further, it allowed each participant to check online the status of the application, transfer of title and transmission of original trade documents through a secure network, while preserving client and commercial confidentiality. The application is designed to work with existing banking systems and processes, allowing banks to “plug in their systems and process.”

“I envision that the emerging technology of blockchain will play a significant role in banking in the coming years by making complex bilateral and multi-lateral banking transactions seamless, quick and more secure.” – Chanda Kochhar, ICICI MD & CEO

CGI rolls out blockchain lab for trade finance

CGI, a leading IT and business service provider, has launched a lab, a digital sandbox dedicated to helping its trade finance and supply chain clients harness the efficiencies of blockchain for new and existing products. The formal launch took place at Sibos, Geneva, and is part of the company’s rapidly increasing use of Ripple’s distributed ledger solutions. But, the lab itself will soon explore the benefits to trade finance more broadly.The Trade Innovation Lab is a three-tiered “sandbox” that begins with platforms that could include Ethereum, BigchainDB, Ripple, Corda and Eris Industries, then works with CGI’s blockchain developers to build messaging workflows via the Intelligent Gateway that can be integrated via APIs to new blockchain applications. As part of the digital sandbox offering, the company will let its clients experiment with how various blockchains interact with its new Digital Intelligent Gateway, which allows for the sending of a wide range of supply chain messages.

UBS and IBM test blockchain for trade finance

Swiss UBS and IBM have collaboratively designed a project that replicates the entire lifecycle of an international trade transaction on Hyperledger`s Fabric blockchain. Aim is to simulate a complete international trade transaction incorporating stages such as trade finance, cargo inspections, bills of lading, customs inspections, release and payment. The trade finance project is in its earliest stages and focuses on just a single aspect of the process, combining payment transactions, foreign exchange payments and more, into one single, elaborate smart contract.

By programming that process into a smart contract on Hyperledger, both parties expect to be able to cut the processing time down from seven days to one hour. Besides the letter of credit process, the project also aims to incorporate the account opening process, to build a user-friendly interface, “capable to operate on the go, from a transportation vehicle for example”. It remains unclear how long it will take to complete the international trade project.

Consortium rolls out blockchain trade finance app in Singapore

Bank of America Merrill Lynch, HSBC and the Infocomm Development Authority of Singapore (IDA) have jointly developed a prototype solution built on blockchain technology that could change the way businesses around the world trade with each other. The consortium used the Linux Foundation open source Hyperledger Project blockchain fabric, which development was supported by IBM Research and IBM Global Business Services.

The application mirrors a paper-intensive letter of credit (LC) transaction by sharing information between exporters, importers and their respective banks on a private distributed ledger. This then enables them to execute a trade deal automatically through a series of digital smart contracts. Each action in the workflow is captured in a permissioned distributed ledger, giving transparency to authorised participants whilst encrypting confidential data. With this concept, each of the four parties involved in an LC transaction – the exporter, importer and both of their banks – can visualise data in real time on a tablet and see the next action to be performed.

“A letter of credit conducted on blockchain enables greater efficiencies and visibility in trade finance processes, benefitting multiple parties across its value chain,” – Khoong Hock Yun, assistant chief executive of the IDA’s Development Group. The consortium now plans to conduct further testing on the concept’s commercial application with selected partners such as corporates and shippers.

Remaining challenges

As evidenced by the recent announcements of successful international trade finance transactions via blockchain, promising to transform trade finance over the coming decade for business around the globe, streamlining the trade finance process, cutting time and expense from the process, the real-world use of the technology in trade finance will see a growing trend. It however could take a while before the technology will take off in a massive way and will fundamentally transform trade finance.

Going forward, the big challenge for banks wanting to employ blockchain at scale for trade finance will be the interoperability of different blockchain or distributed ledger systems. Another issue that needs to be addressed seriously is integration. How will buyers, sellers, and any required trusted third party/intermediary, interface to the network? Without having to implement an entirely new technology infrastructure, the parties involved in the trade finance process will need flexible tools to map and process documents and payments.

“The introduction of blockchain in your company will require the well needed time. You will have to address the enterprise issues around transaction audibility, visibility and integration into existing business functions. Without this, a profitable integration of the blockchain in the company will prove to be a difficult story” .

Carlo de Meijer

Economist and researcher

More articles about blockchain from Carlo de Meijer:

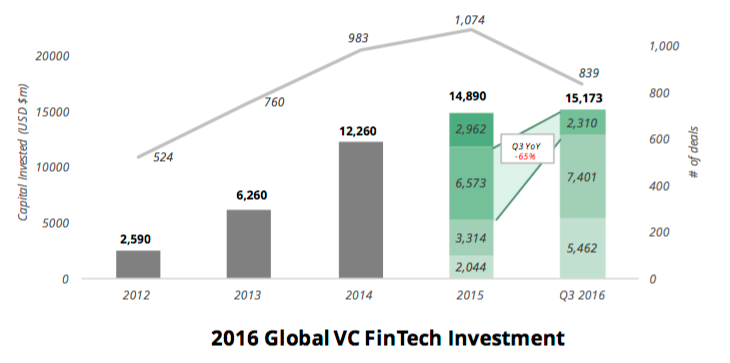

Last week one of my clients started an unscheduled brainstorm session about recruitment for Fintech companies. We ended up having quite an interesting discussion. Within Treasurer Search we see an increase in assignments in this market, both permanent as well as interim. I would like to share the result of the discussion and what our experience taught us so far.

Last week one of my clients started an unscheduled brainstorm session about recruitment for Fintech companies. We ended up having quite an interesting discussion. Within Treasurer Search we see an increase in assignments in this market, both permanent as well as interim. I would like to share the result of the discussion and what our experience taught us so far.

FinTech is a term that is becoming popular in the financial world. Only one third of the financial experts know what this means and understands what consequences it has for their business. How this innovation is currently changing the ecosystem of money, is still relatively unknown.

FinTech is a term that is becoming popular in the financial world. Only one third of the financial experts know what this means and understands what consequences it has for their business. How this innovation is currently changing the ecosystem of money, is still relatively unknown.