| 7-1-2019 | by Marc Verkuil |

Supply Chain Finance (hereinafter referred to as ‘SCF’) involves financing solutions helping businesses, usually through the involvement of a third party lender, to free up working capital trapped in supply chains. These solutions target financing of specific working capital items, such as payables, inventories or receivables, as the underlying products move from origin to destination in the physical supply chain. Examples of SCF solutions include factoring, inventory repurchase, dynamic discounting, and reverse factoring programs. The latter solution (hereinafter, the ‘RF Program’), which has been offered by an increasing number of banks lately, involves a Seller being given the opportunity to sell its receivables (invoices) on a specific Buyer (typically) without recourse to a financial institution or investor (hereinafter, the ‘Factor’) at a discount in return for the immediate receipt of the (discounted) cash or liquidity from these receivables. In funding the Seller, the Factor is exposed to the Buyer as it assumes the credit risk on the latter, i.e., the (in)ability of the Buyer to pay its outstanding debt to the Seller (or Factor directly) at maturity.

RF Programs are in essence a form of credit arbitration and require participants in the supply chain with different credit standings…

SCF is often marketed as a ‘win-win’ for all parties involved. In recent years dozens of articles in Treasury and related magazines and possibly a similar number of sessions at conferences and seminars, some of which were even completely dedicated to this subject, have heralded SCF, and RF Programs in particular, as the ‘holy grail’ in working capital (finance) management. Although most of the observations in this article are valid for other SCF solutions, focus will be on RF Programs, which are based on the premise that a Seller will benefit from the better credit-standing (or rating) of a Buyer, as a Factor is willing to provide funding to the former on the basis of the credit (risk) of the latter, i.e., at a discount rate similar to the one the Buyer rather than the Seller would be able to obtain from lenders for funding its working capital. Interestingly enough, however, principally without exception all of these articles and sessions have been written and presented by representatives of two of the same participants in these solutions: the Buyers and the Factors, and although they all provide various, mostly valid arguments for the benefits of these solutions to the Sellers, they also tend to provide little or no input on the disadvantages, risks, and pitfalls of these solutions to the latter. Therefore, this article focuses on the perspective of the Seller, the financially and often commercially ‘weaker’ participant in the SCF transaction. Please note that the reference to the ‘weaker’ participant does not limit this to small SMEs, but in day-to-day reality applies to the vast majority, if not all Sellers (with an intent to) participating in SCF as the premise of the solution would otherwise not be valid anyhow. The author of this article used to work for an investment grade rated, powerful, global commodities trading company with revenues in excess of USD 45 billion, which was in fact frequently requested, or even practically forced to participate in RF Programs as the ‘weaker’ Seller.

The opportunity for Sellers to enter into RF Programs usually does not come in isolation…

One other aspect of basically any RF Program is important to take into account; even though an RF program cannot be directly or formally linked to the (payment) terms & conditions agreed between Seller and Buyer, as the program may in that case be deemed by auditors to correspond to and thus to be reclassified as debt in the financials of either participant which would defeat at least part of the purpose of these solutions, the most common benefit sought by the Buyer, often even expressed prior to the Seller being made aware of the opportunity to enter into an RF Program, is the request to the Seller for an extension of its payment terms to and in favor of the Buyer. The Buyer clearly does not wish to cannibalize the debt capacity with its lenders (read: the Factor) in return for nothing; in fact, the Buyer is usually the initiator of the sequence of events leading up to an RF Program in its efforts to improve working capital management first and foremost for its own and rightful benefit (and even if a Buyer would claim it (indirectly) offers an SCF opportunity in order to support a ‘struggling’ Seller, this would still be done primarily in the best (short term) interest of the Buyer, which in that case will no doubt already be looking for longer term buying alternatives). It should be evident that an extension of the payment term has an embedded cost for the Seller, which it should (at least try to) pass on to the Buyer through an increase of its product pricing. A term extension from, e.g., 45 to 90 days, will otherwise require the discount rate of the SCF solution to be half of the Seller’s existing cost of (incremental or marginal) debt funding in order for both funding options to break even.

The benefits of RF Programs are evident…

The most obvious benefits of RF Programs to Sellers are well documented: lower cost of funding, immediate availability of liquidity, lower working capital and (usually) debt levels, financial opportunities to grow and invest, and more limited credit exposure to the Buyer(s). The risks, disadvantages, and pitfalls to the Seller are on the other hand much less frequently mentioned.

However, disadvantages may include an increase in the Seller’s cost of capital…

One of the most important objectives of a Treasurer, certainly one of a public company, is minimizing its company’s weighted average cost of capital or ‘WACC’, i.e., achieving the optimal level and cost of debt and equity funding. By entering into an RF Program, and most other SCF solutions for that matter, the Buyer and Seller are effectively scaling down the value of their working capital and balance sheets respectively; the Buyer by virtue of obtaining extended terms from the Seller and thus of increasing its days of payables outstanding leading to lower net working capital and (debt) funding balances, and the Seller by virtue of converting part of its receivables balance into immediate liquidity and thus of reducing its days of sales outstanding typically followed by the repayment of outstanding on-balance sheet debt. As the proceeds of an RF Program will practically never be used to return funds instantly to the Seller’s shareholder(s), the Seller’s WACC will practically always increase as it has reduced the normally more cost efficient (i.e., less expensive after tax) debt balance on its balance sheet without proportionally reducing its more expensive equity position, e.g., through share repurchases. An increase in a company’s WACC is hardly ever a desired outcome for a Treasurer in considering a financing transaction, and even if this by itself does not necessarily preclude Sellers from entering into these types of (off-balance sheet) transactions for other good reasons, especially the size and relative proportion of this type of debt funding should merit careful consideration from a Treasurer in its analysis of the company’s total (future) debt to equity mix. A company with a not a-typical debt to equity ratio of 30/70, a cost of equity of 8,5% and a cost of debt of 3,5% has a WACC of 7,0%; if, as a result of an SCF solution and the subsequent repayment of some of its on-balance sheet debt (and all rates staying equal), such company would end up with a debt to equity ratio of 20/80, its WACC would increase to 7,5%, even if its total cost of debt funding, i.e., including the cost of an SCF program that is less expensive than the existing cost of debt, would end up being lower in this example!

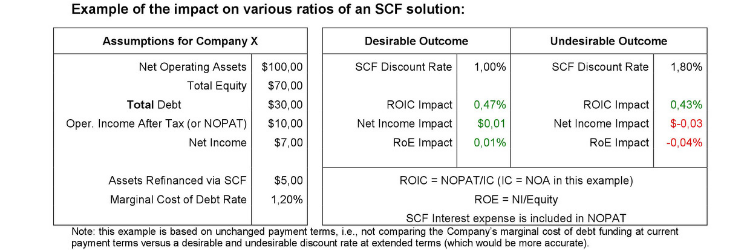

The argument of RF Programs resulting in ROIC improvement is generally true; at the same time, it is not the whole story…

One of the most important reasons for companies to use the proceeds of RF Programs to pay down debt is the fact that a vast majority of these programs is uncommitted, implying that each participant in the relevant supply chain, Seller, Buyer or Factor, may unilaterally and ‘without cause’ decide to discontinue or amend the RF Program at any given moment. E.g., a Factor may decide to increase the discount offered to the Seller if the former assesses that the Buyer’s credit-worthiness has deteriorated (or if the Buyer has been downgraded) or it may decide to discontinue or limit the RF Program if the Factor no longer has (sufficient) credit available on the Buyer, while the Buyer and/or Factor may decide to discontinue the Program if the Buyer needs its credit capacity for other transactions, such as a significant acquisition financing need. The Seller should consider two pitfalls as a result of the uncommitted nature of these SCF solutions: (1) the cost or discount rate of these programs should be compared to existing cost of debt funding of the Seller, and (2) prior to entering into an RF Program, the Seller should carefully assess its commercial proposition both at inception and at the moment these programs are discontinued.

With reference to the first pitfall, marketeers of SCF solutions regularly argue that their programs are “cheaper than the WACC of the Seller”, “will increase the return on invested capital (hereinafter, ‘ROIC’) of the Seller”, or will “decrease the total cost of debt funding”. With respect to the comparison to the Seller’s WACC, this argument has already been refuted earlier: it does not make sense to compare the cost of debt funding (in an SCF solution) to that of debt and equity funding (in a WACC) of a company, while SCF solutions will most likely increase the WACC in any case. The ROIC improvement argument is mostly true, but far from a complete one. Even if an SCF solution is significantly more expensive than a company’s cost of debt funding, an increase of its ROIC may be achieved due to the fact that despite the return, i.e., net income in the numerator decreasing, the invested capital, i.e., (receivable) assets in the denominator will decrease even more leading to an improved ROIC or return on net assets. However, in that case this company’s net income and thus its return on equity will decrease, while it will also lower the company’s earnings per share as a result of such transaction. Bottom line, such a transaction will reduce a company’s shareholder value (or EVA), another outcome a Treasurer would typically want to avoid. A numerical example of this is included at the bottom of the second part of this article which will be posted tomorrow. It suffices to say that unless a company only wishes to be managed and valued on its ROIC performance, which would be surprising to say the least, any SCF solution that is more expensive than a company’s existing cost of debt funding will harm most of its financial ratios and definitely its shareholders. This brings up the last argument mentioned above of a decrease of the total cost of debt funding; comparing working capital financing provided by SCF solutions to long term and often committed debt funding is an ‘apples to oranges’ comparison as the latter forms of funding are intended and used for different purposes or reasons, such as funding of permanent or other long term assets, or as a safeguard against volatile markets or sudden spikes in working capital needs. Furthermore, as argued before, the proceeds of SCF solutions are typically used to pay down short-term and usually uncommitted (working capital) debt making the comparison to the cost of (incremental or marginal) debt funding the only appropriate one in most cases.

In the next and final part of this article, focus will be on the possible commercial impact of SCF for a Seller and on the regulators’, investors’ and credit rating agencies’ points of view, while some conclusions and recommendations will be presented as well. To be continued…

Marc Verkuil

Marc Verkuil

Treasury Professional