Why Trade Finance Matters for Banking

07-10-2024 | In collaboration with Wim Kok, we provide valuable insights into the critical role of trade finance products in global trade.

07-10-2024 | In collaboration with Wim Kok, we provide valuable insights into the critical role of trade finance products in global trade.

06-09-2023 | Surecomp hosted an event to raise awareness of the benefits of ‘collaborative trade finance’ in Utrecht, Netherlands

29-05-2023 | Continuing our theme of connectivity, in this blog we’ll take a closer look at how trade finance technology can connect all transaction participants, empowering more efficient trade while supporting collaboration (instead of competition) across the trade finance ecosystem.

22-05-2023 | Companies need to secure trade finance as quickly and safely as possible to support their international trade agreements. However, a complex, paper-based process means many are waiting days for bank guarantee approvals, exposing them to FX volatility, rising transaction costs and liquidity constraints.

16-05-2023 | Trade finance offers exceptional growth opportunities for businesses looking to trade internationally, but has sadly lagged behind other services due to its complicated nature and high barrier to entry. Surecomp streamlines this process through digitalisation helping to unlock greater access to all businesses.

03-11-2022 | treasuryXL | Wim Kok | LinkedIn |

treasuryXL is the community platform for everyone with a treasury question or answer! A common question asked by treasurers is what Factoring means in Trade Finance. In today’s article Ask the treasuryXL Expert, Wim Kok defines factoring in trade finance for us.

Well, there is a pretty good definition included in the Standard Definitions for Techniques of Supply Chain Finance, prepared by the Global Supply Chain Finance Forum and published by the ICC in 2016. It is currently being updated, but the definition is still alright.

There they give the definition of factoring in trade finance as: Factoring is a form of Receivables Purchase, in which sellers of goods and services sell their receivables (represented by outstanding invoices) at a discount to a finance provider (commonly known as the ‘factor’). A key differentiator of Factoring is that typically the finance provider becomes responsible for managing the debtor portfolio and collecting the payment of the underlying receivables.

There are a number of things I would add to this to explain the terminology and make it more clear:

I trust this will be helpful and give more insight into this subject.

Wim Kok

Do you also have a question for one of the treasuryXL experts? Feel free to leave your question on our treasuryXL Panel. The panel members are willing to answer your question, free of charge, with no commitment.

25-05-2022 | Wim Kok | treasuryXL | LinkedIn |

Episode 4 of a series of educational videos on URDTT (Uniform Rules for Digital Trade Transactions) is now available. Please take a look and let me know what you think. Previous episodes 1 are, of course, still available on our YouTube channel.

Trade Advisory Network Limited and treasuryXL Trade Finance experts launched their fourth episode of a series of free, educational videos on URDTT. There will be 6 episodes in total covering all aspects of the development, interpretation, and application of URDTT in the context of a digital trade strategy. In the upcoming period, you can expect one educational video per month.

Duration: 16.42 min

Enjoy, explore and develop!

Interested to know more about this topic and the upcoming educational videos? Contact our Expert Wim Kok.

International Business Consultant

Trade Finance Specialist

17-03-2022 | Wim Kok | treasuryXL | LinkedIn |

Episode 3 of a series of educational videos on URDTT (Uniform Rules for Digital Trade Transactions) is now available. Please take a look and let me know what you think. Episodes 1 & 2 are, of course, still available on our YouTube channel.

Trade Advisory Network Limited and treasuryXL Trade Finance experts launched their third episode of a series of free, educational videos on URDTT. There will be 6 episodes in total covering all aspects of the development, interpretation, and application of URDTT in the context of a digital trade strategy. In the upcoming months, you can expect one educational video per month.

In this session, we look at the parties involved in a Digital Trade Transaction (DTT). We start with the principal parties – the seller and the buyer – and then move on to the financial services provider, and finally cover any other parties that might be involved.

Duration: 14.46 min

Enjoy, explore and develop!

Interested to know more about this topic and the upcoming educational videos? Contact our Expert Wim Kok.

International Business Consultant

Trade Finance Specialist

22-02-2022 | Wim Kok | treasuryXL | LinkedIn |

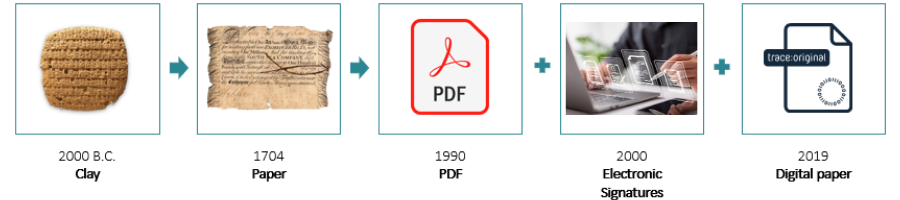

A fantastic end-to-end digital journey has begun to create a paperless supply chain ecosystem for the benefit of all parties concerned in the documentary (paper heavy) Supply Chain settlements of today.

For this Enigo AB (www.Enigio.com) started at the basis of the current standard, the paper document. A clean sheet of paper!

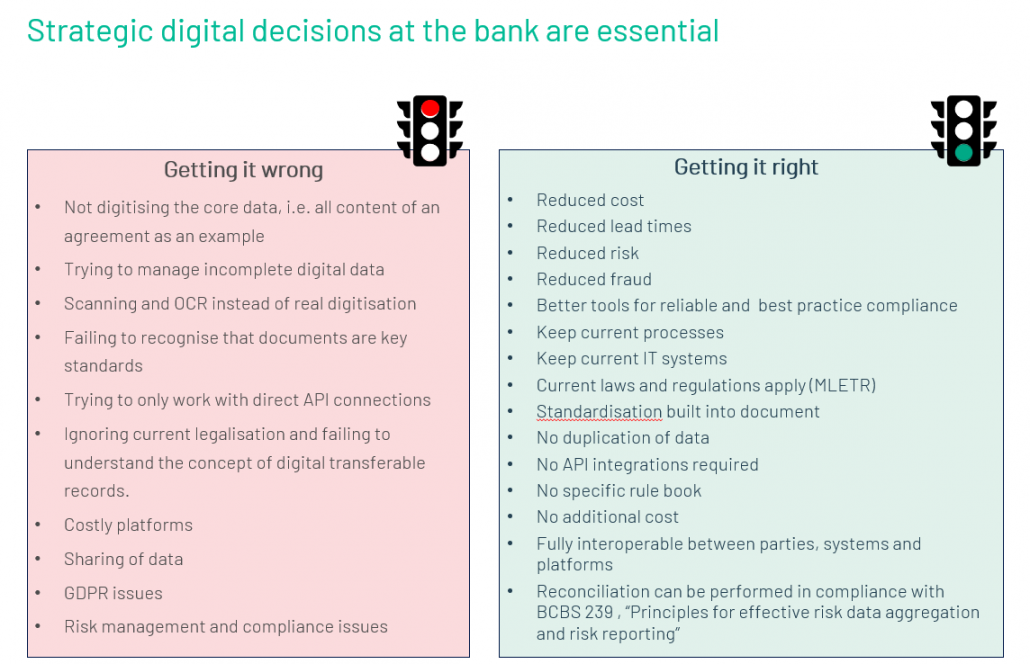

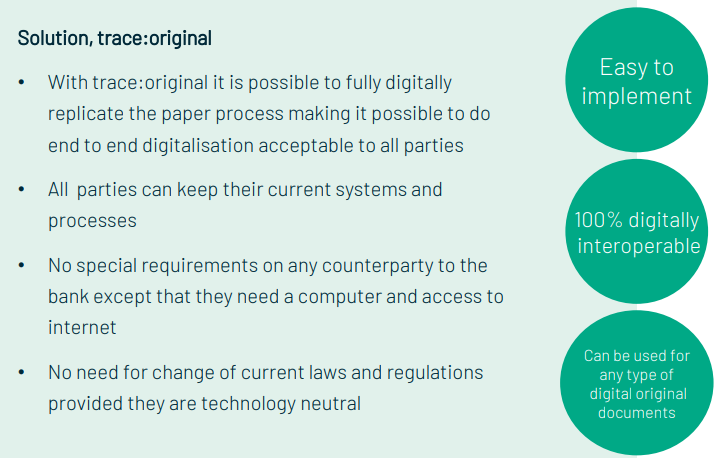

A large share of the communication in a trade finance transaction is already digitalised. Banks structure customer communication through portals, negotiate via safe e-mail and sign using e-signatures, not to forget SWIFT which has already enabled the digitalisation of many products and process steps between banks. A major obstacle for achieving a completely digital trade finance world has been the requirements to be able to manage and present documents in their original form. Enigio’s focus has therefore been to create a digital document with the same properties as its paper equivalent. The trace:original document is designed to be able to hold all necessary data to execute a transaction and at the same time not being tied to any specific transaction infrastructure. More importantly it can also be managed by anyone with access to a computer and the internet.

How does the solution work? Watch below video:

Following the accelerating momentum (after and pushed by the Covid pandemic), we see changing environment in the banking landscape, which is becoming rapidly more adoptive for transformation, especially digitalisation of the paper heavy trade documentation evidencing import- and export transactions. Both infrastructures, paper and digital documents must co-exist. There will be countries being early digital adopters and others lagging. An infrastructure agnostic digital trade finance document of any type can serve all the aspects of the global digital ambition extremely well. Interoperability can be achieved on different levels and by using different tools. One of the most forceful ways of achieving interoperability is by standardisation of data definitions and data formats. Json Schemas and the trace:original document is a perfect connector to achieve digital interoperability not only between blockchain based trade finance platforms but for all trade finance platforms.

The banks’ lack of investment decisions for end-to-end digitised trade processes impacting their customers have created a large cost effect on corporations.

Footnote: further detail to be found on the website: www.Enigio.com

Thank for reading and stay tuned!

International Business Consultant

Trade Finance Specialist

10-02-2022 | Wim Kok | treasuryXL | LinkedIn |

Episode 2 of our series of educational videos is now available. Please take a look and let me know what you think. Episode 1 is, of course, still available on our YouTube channel.

Trade Advisory Network Limited and treasuryXL Trade Finance experts launched their second episode of a series of free, educational videos on URDTT. There will be 6 episodes in total covering all aspects of the development, interpretation, and application of URDTT in the context of a digital trade strategy. In the upcoming months, you can expect one educational video per month.

Episode 2 of this series of videos focuses on URDTT (Uniform Rules for Digital Trade Transactions). Subsequent episodes will focus on the use of electronic records, payment obligations and, the role of banks/non-bank financial service providers.

Duration: 11.38 min

Enjoy, explore and develop!

Interested to know more about this topic and the upcoming educational videos? Contact our Expert Wim Kok.

International Business Consultant

Trade Finance Specialist