Should you choose Xe or wire transfers to send money abroad?

01-10-2020 | treasuryXL | XE |

We’ll take you through the process step by step to help you figure out the better option.

So, you’re looking to send money overseas. Obviously you’ve ruled out physically sending money via snail mail, so that leaves you with electronic methods. If you’ve done any online research, the most common terms you’ve probably come across are money transfer and wire transfer. You might’ve even seen them used interchangeably. Is there a difference?

Yes, there is a difference between wire transfer and online money transfer (also known as electronic funds transfer). While both methods transfer money from one bank account to another by electronic means, they’re not quite the same—and you won’t get quite the same experience with the two methods. We previously discussed the difference between transferring money with Xe and the banks. Now, it’s time to give the same attention to wire transfers. Where are you better off?

Which method is faster?

Both methods will take money around the world in a short amount of time. Wire transfers typically take around 3-5 business days, but this can vary. If the wire transfer involves an exotic global currency, if the transfer requires travel through intermediary banks, or you’re sending money to a country that doesn’t have a strong banking relationship with your country, the wire transfer could take even longer.

At Xe, your transfer will typically take 1-4 business days, though the majority of our transfers complete within 24 hours. Or, if you’re sending money to one of these countries, your money will reach its destination in just a few minutes. The timeframe will never be a mystery; we’ll communicate the expected arrival date before you confirm your money transfer, and we’ll communicate with you throughout the process so you’ll never feel that your money is lost in electronic limbo.

How much will they cost you?

Yes, both methods will cost you some money on top of the money that you’re already supplying to transfer. However, the costs will not be the same from provider to provider. You will be charged one fee to send a wire transfer. You may also be charged a fee from the receiving bank upon the money’s arrival. If the money travels through intermediary institutions, those institutions may also charge you a fee. And it’s not just fees: wire transfer providers can set their own exchange rates, and often add margins to those to boost their bottom line. Adding those together…you’re suddenly paying a lot more than you thought! When you transfer money through Xe, you will be charged one fee for your transfer. That’s it. One service fee, and it will be clearly displayed on our confirmation screen when you transfer money through the Xe app. You can even choose whether you’d like the fee to be taken from what you send or what your recipient gets, so there’ll be no mystery around how much money will make it to your destination.

What’s the process like? Is it convenient?

Some banks and providers have online wire transfer capabilities. But more often than not, you’ll need to go to the physical storefront, wait in line, and fill out the form each time. You’ll need to make sure that you have all of the information you need, otherwise you’ll be making another trip out to the wire transfer provider. Is it the most difficult thing in the world? Well, no. But could it be more convenient? Definitely.

The best part of online money transfers? You can do them anytime, anywhere. Just head to Xe.com or open the Xe app from your couch, your bed, or wherever you have internet access to initiate a transfer 24 hours a day, 7 days a week. You can enter your information in the secure online form and save it if you’re planning on making future transfers to the same recipient, and if you have any questions later on you can easily reach out to customer service for support.

Overall?

Both wire transfers and Xe money transfers are fast, secure, reliable ways to get money abroad. However, if you’re looking for quick arrivals, minimal fees, and an easy-to-navigate transfer process, we think you’ll be happy sending money with Xe.

Get in touch with XE.com

About XE.com

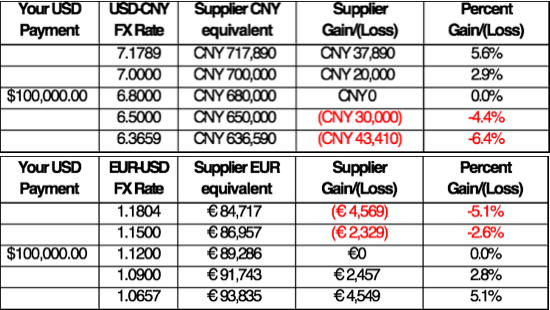

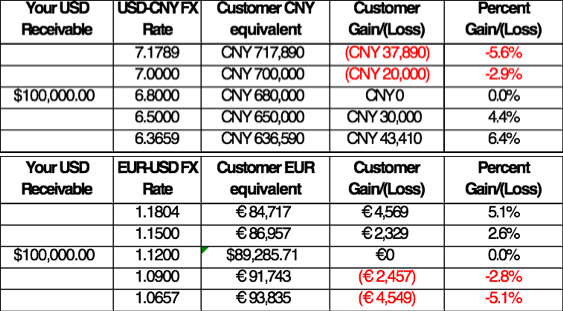

XE can help safeguard your profit margins and improve cashflow through quantifying the FX risk you face and implementing unique strategies to mitigate it. XE Business Solutions provides a comprehensive range of currency services and products to help businesses access competitive rates with greater control.

Deciding when to make an international payment and at what rate can be critical. XE Business Solutions work with businesses to protect bottom-line from exchange rate fluctuations, while the currency experts and risk management specialists act as eyes and ears in the market to protect your profits from the world’s volatile currency markets.

Your company money is safe with XE, their NASDAQ listed parent company, Euronet Worldwide Inc., has a multi billion-dollar market capitalization, and an investment grade credit rating. With offices in the UK, Canada, Europe, APAC and North America they have a truly global coverage.

Are you curious to know more about XE?

Maurits Houthoff, senior business development manager at XE.com, is always in for a cup of coffee, mail or call to provide you detailed information.

Visit XE.com

Visit XE partner page