LIVE DISCUSSION | How FinTech is Revolutionizing Corporate Treasury

02-03-2023 | treasuryXL | LinkedIn | What new and exciting innovations are happening in the corporate treasury marketplace and how are FinTech’s playing a role in this space?

02-03-2023 | treasuryXL | LinkedIn | What new and exciting innovations are happening in the corporate treasury marketplace and how are FinTech’s playing a role in this space?

01-03-2023 | Sugandha Singhal | treasuryXL | LinkedIn | As treasurers, working capital management is a key part of our responsibilities. It is a metric of how efficiently a company is operating and how financially stable it is in the short term.

23-02-2023 | treasuryXL | LinkedIn |

Download the comprehensive eBook on Treasury function, compiled by treasuryXL. This valuable resource covers a wide range of relevant topics including Treasury, Corporate Finance, Cash Management, Risk Management, and Working Capital Management.

Drawing on the expertise of Treasury professionals and their best practices, we have carefully crafted clear and concise articles that provide you with the most crucial information about the key topics in the world of Treasury.

In this eBook, we take a deep dive into each Treasury function and explore:

Whether you are new to Treasury or an experienced practitioner looking to expand your knowledge, this eBook is an essential resource that will help you stay up-to-date with the latest best practices and insights in the field.

We simply giveaway two presents for you! By signing up for our newsletter you will automatically receive the following in your inbox:

Subscribe, Join, Download and Relax.

Welcome to our community and have fun reading!

Director, Community & Partners at treasuryXL

23-02-2023 | Aastha Tomar | treasuryXL | LinkedIn | After two years of hiatus, here I am again to write for the team I love the most and the team whom I owe the most in Netherlands. treasuryXL has a special place in my heart, I got linked with them as soon as I shifted to Netherlands in 2019 and since then they have been a constant source of support for me.

13-02-2023 | Dinesh Kumar | treasuryXL | LinkedIn | Imagine a setting where your treasury management system (TMS) and enterprise resource planning (ERP) system work together seamlessly, like a well-oiled machine. In this case, your treasury team has real-time visibility into financial transactions and can make informed decisions quickly and efficiently. The process of connecting a TMS to an ERP system may seem daunting, but it’s a crucial step in achieving a more streamlined, efficient and accurate corporate treasury operation.

09-02-2023 | The year’s second edition features a discussion on the newest treasuryXL poll results, including a review of treasurer voting patterns and expert perspectives on effective currency management.

31-01-2023 | François de Witte | treasuryXL | LinkedIn |

treasuryXL expert François de Witte will lead the upcoming advanced training on PSD2 & Open Banking, exploring its impact on finance and new challenges. Read below more

This training program prepares participants for 2 major challenges of the upcoming years in banking: PSD2 and Open Banking. This will have a major impact on the financial ecosystem and will create new challenges.

The goal of this training course is to:

26-01-2023 | François de Witte | treasuryXL | LinkedIn |

treasuryXL expert François de Witte will conduct advanced training on International Treasury Management and Corporate Finance at the House of Training in Luxembourg on March 2nd. Read below more

The treasurer is the custodian of the company’s daily liquidity and financial risks. He manages, anticipates, secures and help optimize cash flows by ensuring that financial needs are covered and appropriate instruments are used, as well as take necessary measures to mitigate financial risks.

At the end of this programme, the participant will able to:

The various modules will allow to acquire an in-depth knowledge of the different areas of the “Corporate Treasurer” profession.

Speaker: Hugues Pirotte / Professor of Finance at Solvay Brussels School

Speaker François De Witte / Treasury Consultant

Liquidity management – Basic concepts.

Speaker: Benjamin Defays / Senior Associate Vice President

Speaker: Lievin Tshikali

With the successive financial crises, serious concerns have naturally been raised in the population, forcing G24 governments and international organisations to build an incredible set of laws to “better” regulate/monitor the activities of banks and other financial institutions. This module provides an overview of international finance regulation. It considers some regulatory and practical issues affecting transnational financial transactions undertaken by global investment and corporate banks.

Speaker: François Masquelier / CEO

Speaker: François Masquelier / CEO

Financial professionals (finance, banking, accounting, tax, treasury…) willing to acquire an in-depth knowledge in corporate treasury and wishing to exercise this knowledge in practice.

19-01-2023 | Pieter de Kiewit | treasuryXL | LinkedIn | If you are interested in learning about FinTech and how to get into the industry, there are a few things you may want to consider. With my focus on corporate treasury, we are in close contact with various Fintech companies who ask us on a regular basis to support them in their recruitment. We learned these companies have specific requirements.

12-01-2023 | treasuryXL | LinkedIn |

A new year, a new edition in which we discuss the latest treasuryXL poll results. It is encouraging that once again many treasurers participated in the vote. We examined the voting patterns of treasurers and gathered the perspectives of experts Jack Gielen and Konstantin Khorev on the topic of APIs in treasury.

It is commonly understood that APIs are prevalent in today’s digital landscape. However, corporate treasurers can also reap benefits from API technology and its advantages. If you are unsure about the importance of APIs in Treasury or need more information, you should definitely watch the recording of the joint webinar together with Cobase on the future of APIs. It is encouraging that once again many treasurers participated in the vote. The current treasuryXL poll remains open and we encourage you to continue to have your voice heard! You can cast your vote on this link.

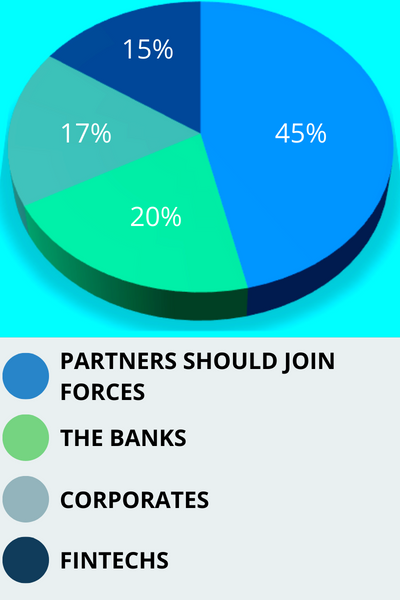

Question: Who should “give a push” and work on APIs?

That looks quite straightforward: partners should join forces. Do the treasuryXL experts agree, or what is their view on this?

Jack voted for the option that partners should join forces.

“APIs and the benefits are clearly on the map but there is also an understanding that there is still work to be done before those benefits will really be realised”

It is good to see that regarding the results of this poll, the market agrees that the success of corporate APIs and OpenBanking requires cooperation and cannot be dictated by 1 party. This means Treasurers clearly understand the complexity of the playing field. At the moment, although there are many initiatives by individual parties, there is a need to create a good partnership where the whole eco-system works together

The main benefits that APIs could realise if banks and companies were to work together are:

These benefits translate into being able to use the systems the treasurer has chosen more efficiently and better, more up-to-date insight into status, exposures and required actions.

Recently, Cobase set up the webinar “The Future of APIs” in collaboration with treasuryXL to discuss this topic. I was particularly impressed by the level of knowledge Treasurers have gained over the past year which was also reflected in the questions. APIs and the benefits are clearly on the map but there is also an understanding that there is still work to be done before those benefits will really be realised. Ultimately, the priority with the end customer, the treasurer, will determine how quickly other market players act.

Konstantin voted for the option that partners should join forces.

“By working together, we can achieve a more efficient and effective treasury management system.”

I agree with the majority view that the implementation of APIs in the treasury field should be a collaborative effort. Banks will play a key role in implementing these changes, but it is also crucial for corporates and TMS providers to set and specify the requirements. This ensures that the solutions being implemented align with the unique needs and goals of each individual corporate, and TMS providers can develop the tools and services necessary to support these needs. By working together, we can achieve a more efficient and effective treasury management system.

Recently, my latest article on this topic was published on treasuryXL. In it, I try to make it plain that APIs are a nice and easy solution, although they come with some limitations and challenges. At the same time, I believe that the future of bank connectivity lies in API technology. What do you think?