treasuryXL : Education & Training

| 18-07-2016 | treasuryXL |

The holiday season is finally here! While relaxing on the beach in Ibiza or making new memories in Bali, take some time to think about your career. Wait, what? Yes, do some thinking about your career between cocktails and sunbathing. Maybe it’s time to take your career to the next level by freshen up your knowledge or learning something new. treasuryXL has collected some of the education programs that take place in September.

The holiday season is finally here! While relaxing on the beach in Ibiza or making new memories in Bali, take some time to think about your career. Wait, what? Yes, do some thinking about your career between cocktails and sunbathing. Maybe it’s time to take your career to the next level by freshen up your knowledge or learning something new. treasuryXL has collected some of the education programs that take place in September.

1 September 2016 : Opleiding Treasury Management @ Nive Opleidingen

Praktijkgerichte beroepsopleiding tot Qualified Treasurer (QT)

Date: 1 september 2016

Costs: € 7.650; ex BTW

Location: Buitenplaats De Heiligenberg, Leusden

14 September 2016 : Introduction Hedge Accounting @ Wieltec Treasury Services

Training: Introduction Hedge Accounting – 14 september 2016.

Date: 14 September 2016, From 13:00-17:00

Costs: EUR 399,- (excl. VAT) per participant

Location: Van der Valk Hotel, Haagse Schouw 141, Leiden

15 September 2016 : Cash forecasting fundamentals @ ACT

Is it for you? Yes, if you’re:

- New to treasury or financial planning

- Experienced in treasury or financial planning, but want to review and update your forecasting skills and knowledge

- A member of treasury or financial planning tasked with reviewing or redesigning your cash forecast framework and processes

Date: 15 September 2016

Costs: ACT members, students and CPD accredited employers £750 + VAT, Other treasury/accountancy body members £800 + VAT, Non members £850 + VAT

Location: London

22-23 September 2016 : Treasury Accounting, Performance and Control @ Zanders

This course focuses on creating a secure and effective treasury controlling framework. It addresses the elements of a sound treasury governance structure, including the significance of an effective treasury strategy and policy, and the role of the treasury controller. We use the controlling framework to show how to measure the performance and effectiveness of the treasury function.

Date: 22-23 September 2016

Costs: € 1.500,00 ex VAT

Location: Amsterdam, the Netherlands

[separator type=”” size=”” icon=””]

See our event calendar for more education and treasury related events. Would you like to bring your event / course under the attention of our treasury community? Please contact our community manager Stephanie to discuss the possibilities.

treasuryXL wishes you a great summer!

[separator type=”” size=”” icon=””]

Stephanie Derkse – Community Manager treasuryXL

Stephanie Derkse – Community Manager treasuryXL

[social_links size=”normal” align=”” email=”[email protected]” facebook=”” twitter=”” google=”” linkedin=”https://nl.linkedin.com/in/stephanie-derkse-95b76925″ youtube=”” vimeo=”” flickr=”” instagram=”” behance=”” pinterest=”” skype=”” tumblr=”” dribbble=”” vk=”” xing=”” soundcloud=”” yelp=”” twitch=”” deviantart=”” foursquare=”” github=”” rss=””]

An increasing number of bankers come to my recruitment desk wanting to make a transfer to corporate treasury. This transfer can be made successfully but there are a number of things to take into account. Below the 8 career hurdles, I hear most about, in a transfer from banking to corporate treasury.

An increasing number of bankers come to my recruitment desk wanting to make a transfer to corporate treasury. This transfer can be made successfully but there are a number of things to take into account. Below the 8 career hurdles, I hear most about, in a transfer from banking to corporate treasury.

De afgelopen week zijn er grote verschillen gezien in de koers van de Britse pond na de uitslag van het referendum. In januari 2015 werd de markt ook al eens verrast door een onverwachte gebeurtenis: De Zwitserse Centrale Bank (SNB) veroorzaakte toen een schokgolf met het onverwacht loslaten van de ‘peg’ tussen de EUR en de CHF.

De afgelopen week zijn er grote verschillen gezien in de koers van de Britse pond na de uitslag van het referendum. In januari 2015 werd de markt ook al eens verrast door een onverwachte gebeurtenis: De Zwitserse Centrale Bank (SNB) veroorzaakte toen een schokgolf met het onverwacht loslaten van de ‘peg’ tussen de EUR en de CHF.  René Schilder – Co Owner at 2FX Treasury BV

René Schilder – Co Owner at 2FX Treasury BV Already over a decade the treasury community agrees that the modern treasurer does not act out of an ivory tower. Still, a lot of the treasury stories about funding, I hear in treasury recruitment, are about technical details. I learn in detail about USPP’s, interest hedging strategies and convertible bonds. Between these technical stories I notice other ones. I think they are inspiring and would like to share two of them.

Already over a decade the treasury community agrees that the modern treasurer does not act out of an ivory tower. Still, a lot of the treasury stories about funding, I hear in treasury recruitment, are about technical details. I learn in detail about USPP’s, interest hedging strategies and convertible bonds. Between these technical stories I notice other ones. I think they are inspiring and would like to share two of them. Op 26 mei jongstleden was ik uitgenodigd om de door

Op 26 mei jongstleden was ik uitgenodigd om de door

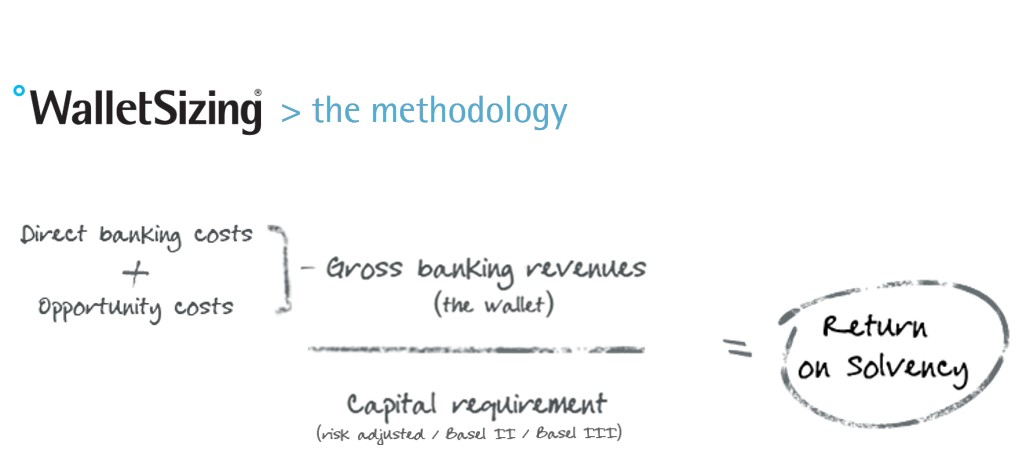

On april 13th of this year the Fintech innovation awards took place. Vallstein won the innovation award in treasury management with their Walletsizing® system. We asked Huub Wevers from Vallstein to give us an update on this new system. What’s new about it and who will benefit from using Walletsizing®?

On april 13th of this year the Fintech innovation awards took place. Vallstein won the innovation award in treasury management with their Walletsizing® system. We asked Huub Wevers from Vallstein to give us an update on this new system. What’s new about it and who will benefit from using Walletsizing®?

Huub Wevers is responsible for Corporate Solutions at Vallstein, the leading Bank Relationship Management specialist. Before joining Vallstein he has had eighteen years of experience in Banking at ABN AMRO and RBS, notably Transaction Banking. His responsibilities included Product Management, Account Management, Implementation and Operations, whereby his last role was the leadership of all Service & Operations in EMEA for RBS. At Vallstein Huub is responsible for building out the software solutions that Vallstein offers for corporates. Solutions that automate bank relationship management in order to assess the profitability that a corporate has for their banks, using all banking products and Basel III.

Huub Wevers is responsible for Corporate Solutions at Vallstein, the leading Bank Relationship Management specialist. Before joining Vallstein he has had eighteen years of experience in Banking at ABN AMRO and RBS, notably Transaction Banking. His responsibilities included Product Management, Account Management, Implementation and Operations, whereby his last role was the leadership of all Service & Operations in EMEA for RBS. At Vallstein Huub is responsible for building out the software solutions that Vallstein offers for corporates. Solutions that automate bank relationship management in order to assess the profitability that a corporate has for their banks, using all banking products and Basel III. Willem van Overveld beschrijft hoe een simpele SWAP constructie zonder margin calls toch lastig kan worden: de menselijk organisatorische kant van derivaten constructies krijgt vaak te weinig aandacht. Een voorbeeld uit de praktijk:

Willem van Overveld beschrijft hoe een simpele SWAP constructie zonder margin calls toch lastig kan worden: de menselijk organisatorische kant van derivaten constructies krijgt vaak te weinig aandacht. Een voorbeeld uit de praktijk: Willem van Overveld – Allround finance / treasury professional

Willem van Overveld – Allround finance / treasury professional Last week I visited an information session about financial postgraduate education. It was organized by the VU (Vrije Universiteit, Amsterdam). I noticed an increased interest in comparison to last years session, which is great. Information was provided about courses I see back in the CV’s of treasurers: CFA, RBA (Register Belegging Analyst) and of course RT (Register Treasurer) that has an overlap with the ACT courses. Education, specifically postgraduate, is a topic that returns in many of my meetings. This is what I notice on the topic:

Last week I visited an information session about financial postgraduate education. It was organized by the VU (Vrije Universiteit, Amsterdam). I noticed an increased interest in comparison to last years session, which is great. Information was provided about courses I see back in the CV’s of treasurers: CFA, RBA (Register Belegging Analyst) and of course RT (Register Treasurer) that has an overlap with the ACT courses. Education, specifically postgraduate, is a topic that returns in many of my meetings. This is what I notice on the topic: