2023 Treasury Priorities & Opportunities Survey Results

17-01-2023 | treasuryXL | TIS | LinkedIn |

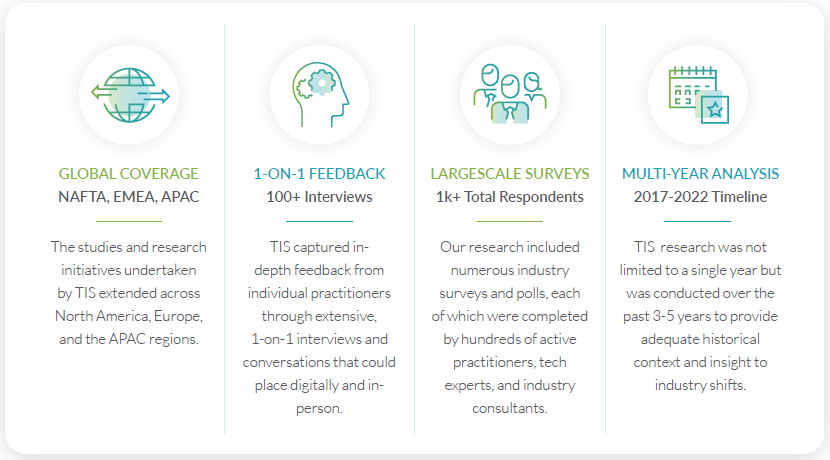

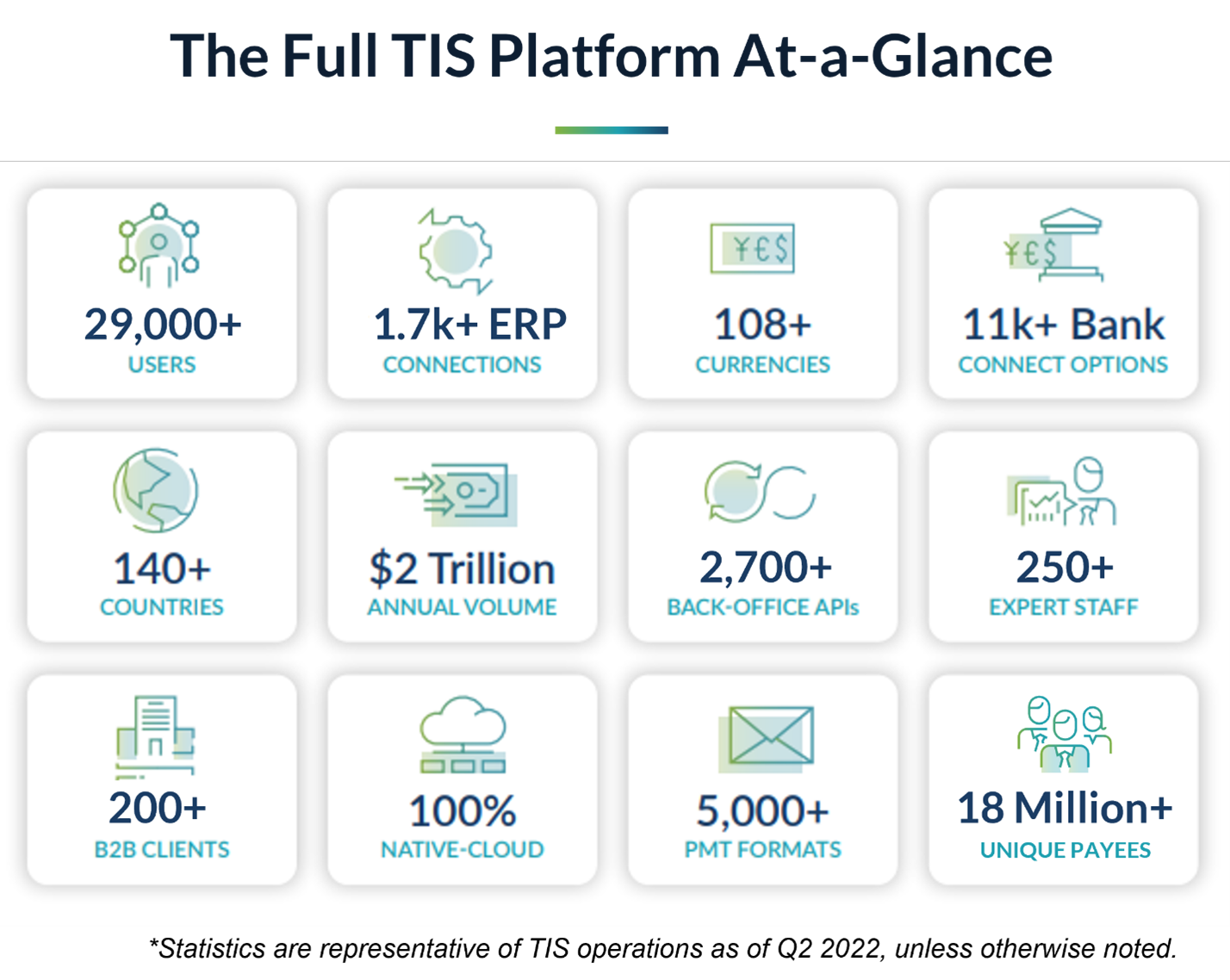

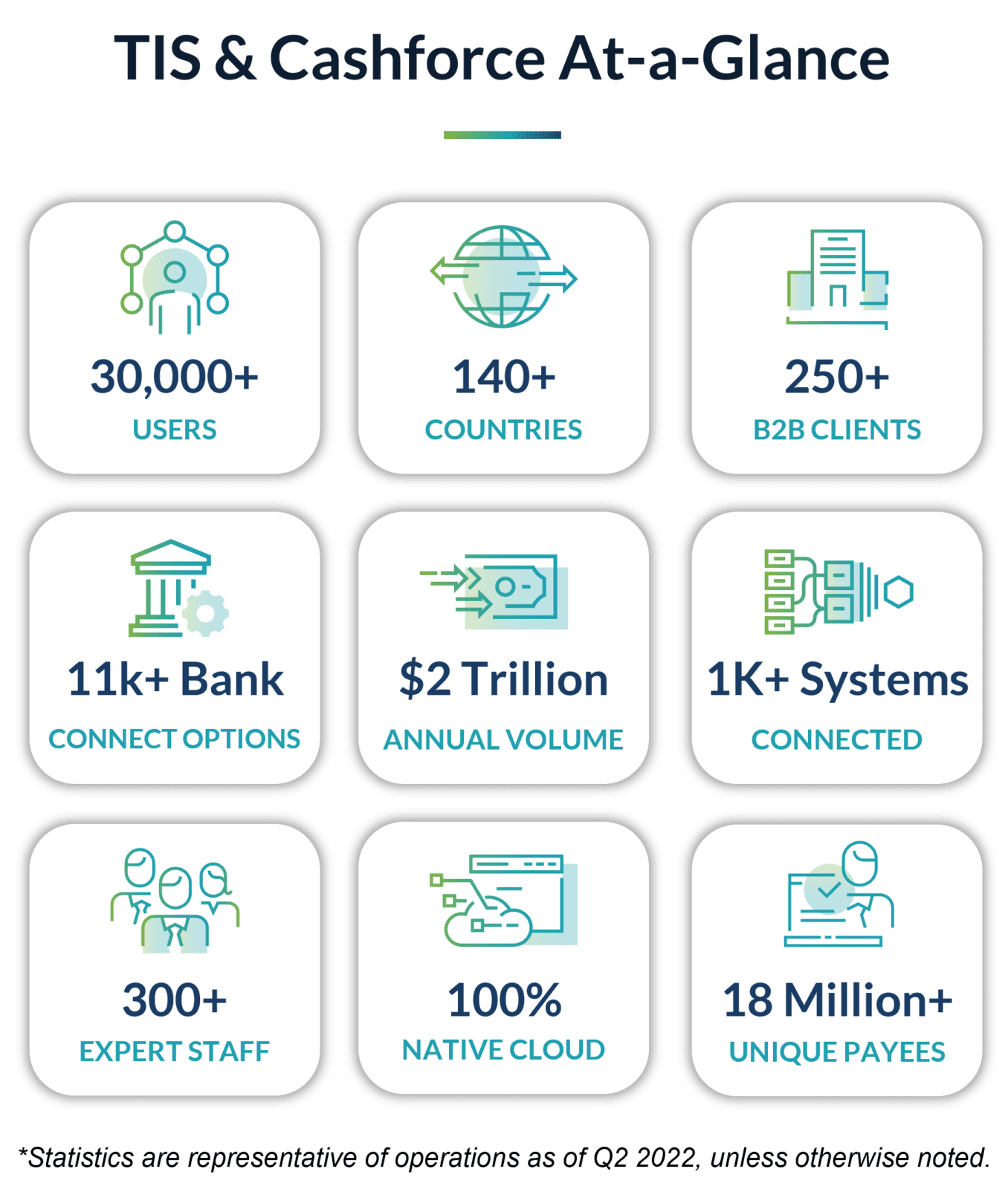

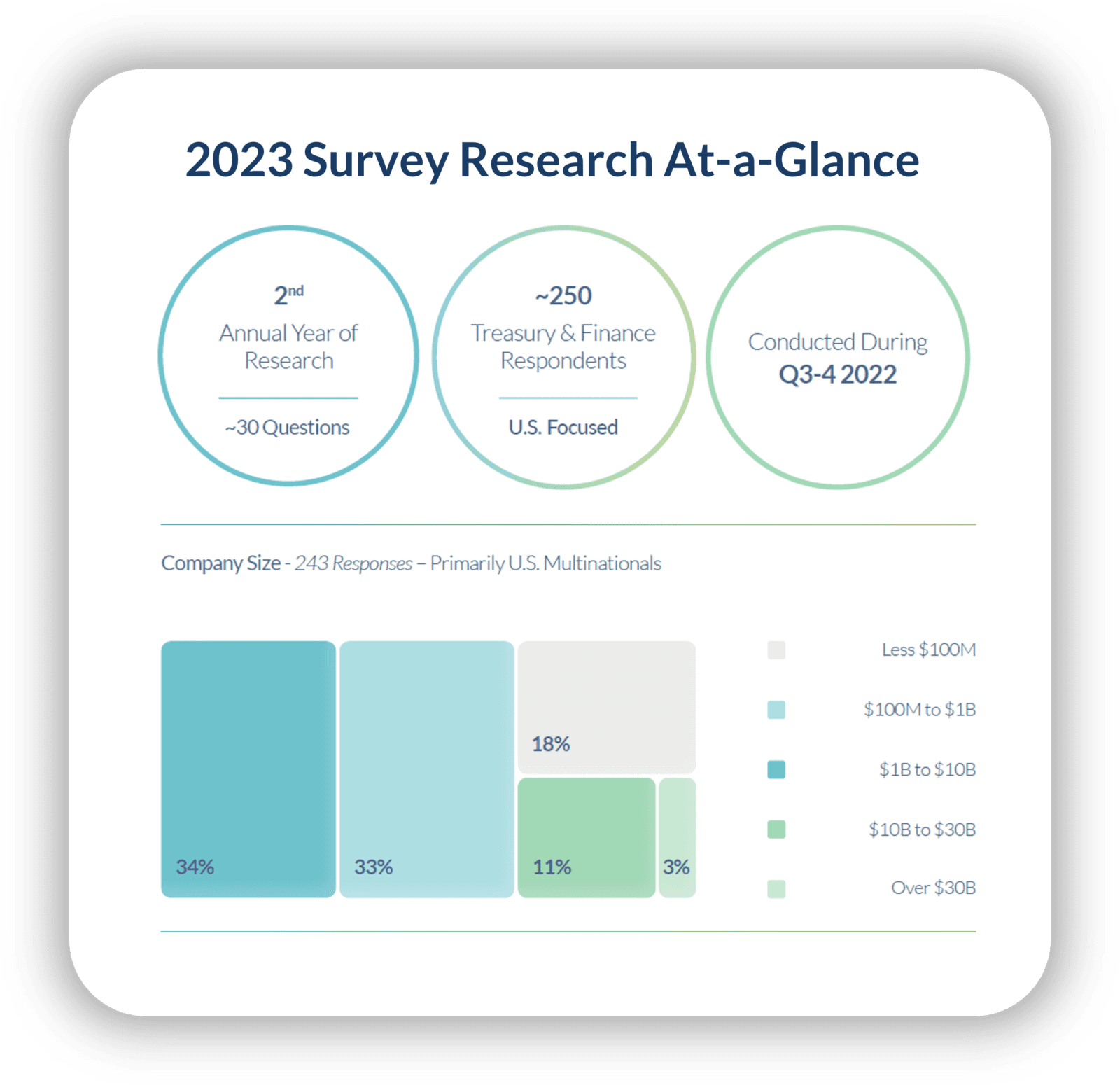

Now in its 2nd consecutive year, TIS is excited to release the findings from our 2023 Treasury Priorities & Opportunities Survey. Having run throughout the course of Q3-Q4 2022, our research again captured responses from hundreds of U.S. finance and treasury practitioners operating at companies of all sizes and industries. The goal was to capture their perspectives on a range of items including the ongoing adoption and use of finance and treasury technology, as well as upcoming staffing plans, strategic and operational expectations, and overall trends occurring in the space.

This blog serves as a summary overview of the key results and findings from TIS’ 2023 Treasury Priorities & Opportunities Survey. To access the full results and analysis, you can download the extended whitepaper here.

- Overall Composition of Treasury Operations

- Treasury Staffing & Professional Development Plans

- Treasury Technology Investment & Focus

- Cash Forecasting Preferences & Workflows

In total, over 250 practitioners responded to this year’s survey, which consisted of roughly 30 questions. All respondents held roles in either treasury or finance. In addition, all respondents were operating at companies with headquarters in the U.S., but most maintained an active international presence.

In terms of company size, 34% of represented companies had annual revenues of $100M – $1B, and another 34% had $1B – $10B annual revenue. 14% had revenues of over $10 billion, while 18% were under $100mm.

Regarding industry representation, construction and manufacturing firms accounted for over 27% of all respondents. Companies from the software, education, insurance, retail, and automotive sectors collectively accounted for another 40%.

In aggregate, our 2023 research initiatives are representative of an appropriately diverse spread of treasury and finance practitioners from a variety of company sizes and industries.

Treasury Responsibilities Increase as Staffing & Technology Investments Remain High

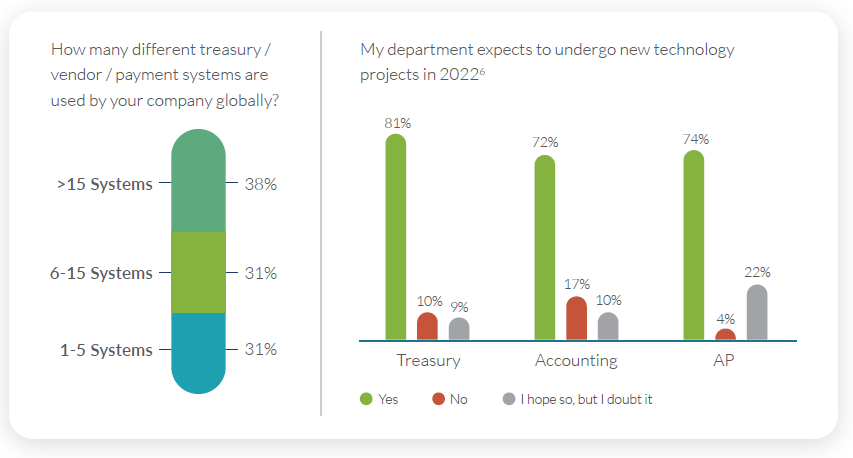

The findings from our 2023 research highlighted that despite strong economic headwinds and market uncertainty, a significant number of treasury teams are still expecting to add more staff and adopt new technologies in the year ahead. In fact, while 48% of teams expected to add more staff, only 3% planned to reduce their headcount. Similarly, over 50% of respondents plan to invest in new cash management and payments-related technologies.

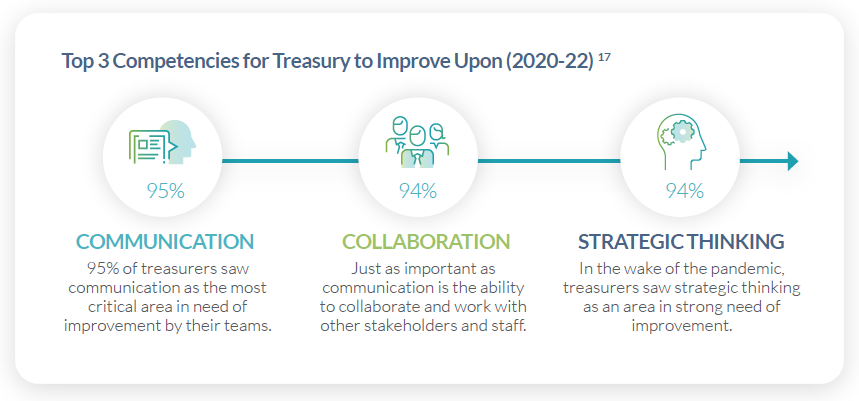

This should be taken as generally reassuring news for practitioners, especially given the wide-ranging budget and staffing cuts that have occurred within many U.S. companies and institutions in the past few months. However, these new technology and staffing additions are also being coupled with a new set of responsibilities and expectations from business leaders that may place greater strain on practitioners. These heightened expectations were clearly evident in our research, with 77% of practitioners indicating their list of responsibilities would increase in 2023, while just 2% believed their workload would be reduced.

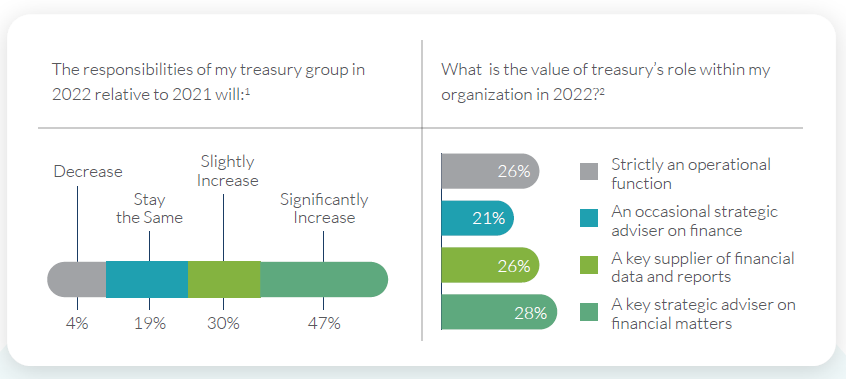

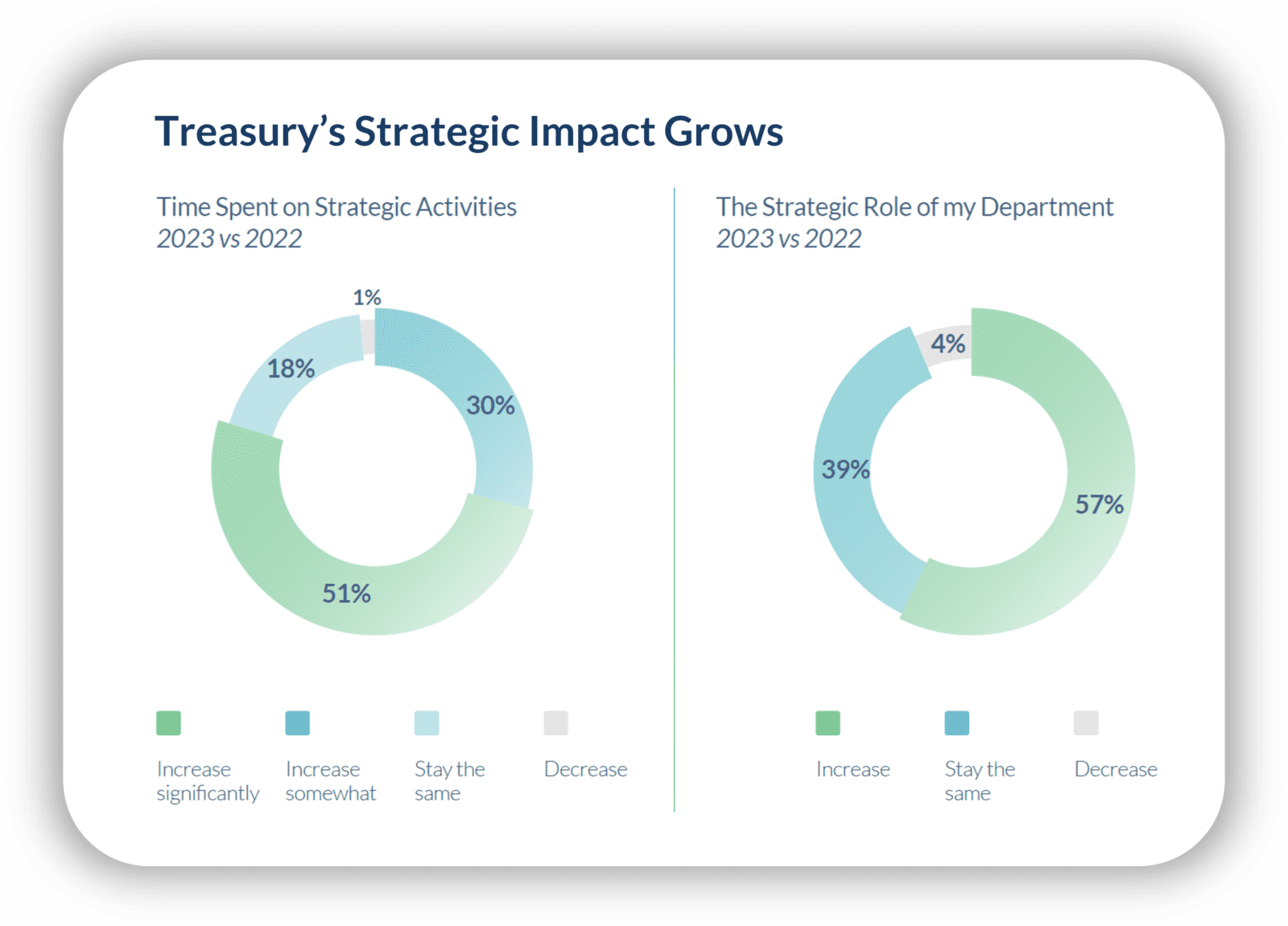

Regarding the nature of these new responsibilities, it appears that many treasury teams are being relied upon to execute and contribute towards more “strategic” internal functions. Based on the data, 57% of practitioners indicated that the strategic role of their treasury group would expand in 2023, while just 4% indicated a decrease. Going a step further, when asked whether treasury was viewed as more “operational” or “strategic” by management, practitioners were evenly split in their perspectives at 48% strategic and 52% operational, respectively.

Looking deeper into the growing influence and responsibility of treasury, another interesting finding was that most treasury teams seemed to exert heavy control over their company’s AP and AR operations, either directly or indirectly. On average, 69% and 67% of treasury groups maintained some level of control over these operations, with little deviation between companies of different sizes and industries.

Cash Forecasting is a Top Priority for Treasury in 2023

Although cash management and forecasting operations have long-been standard treasury responsibilities, data shows that practitioners have been placing an even greater focus on these operations over the past year.

Since early 2022, several major U.S. corporate treasury studies including AFP’s 2022 Strategic Role of Treasury Survey and Strategic Treasurer’s 2021 Treasury Perspectives Survey saw cash management, forecasting, and working capital projects ranked as top priorities for treasury teams. Our 2023 research corroborated these results with data showing cash management technology being the top priority for new software investments over the next year. In addition, cash management skillsets were listed as the most emphasized area of professional development focus for treasury teams in 2023.

Turning to cash forecasting, one primary focus of our research was learning more about the various forecasting workflows and strategies leveraged by treasury groups and companies of different sizes and industries. At a high level, we found that nearly half of survey respondents used a TMS to produce cash forecasts, with 20% leveraging an ERP and nearly 30% relying on Excel Spreadsheets. While Excel is still used predominantly by smaller teams, the use of TMS and ERP products was much more popular for companies with $500mm+ in annual revenue.

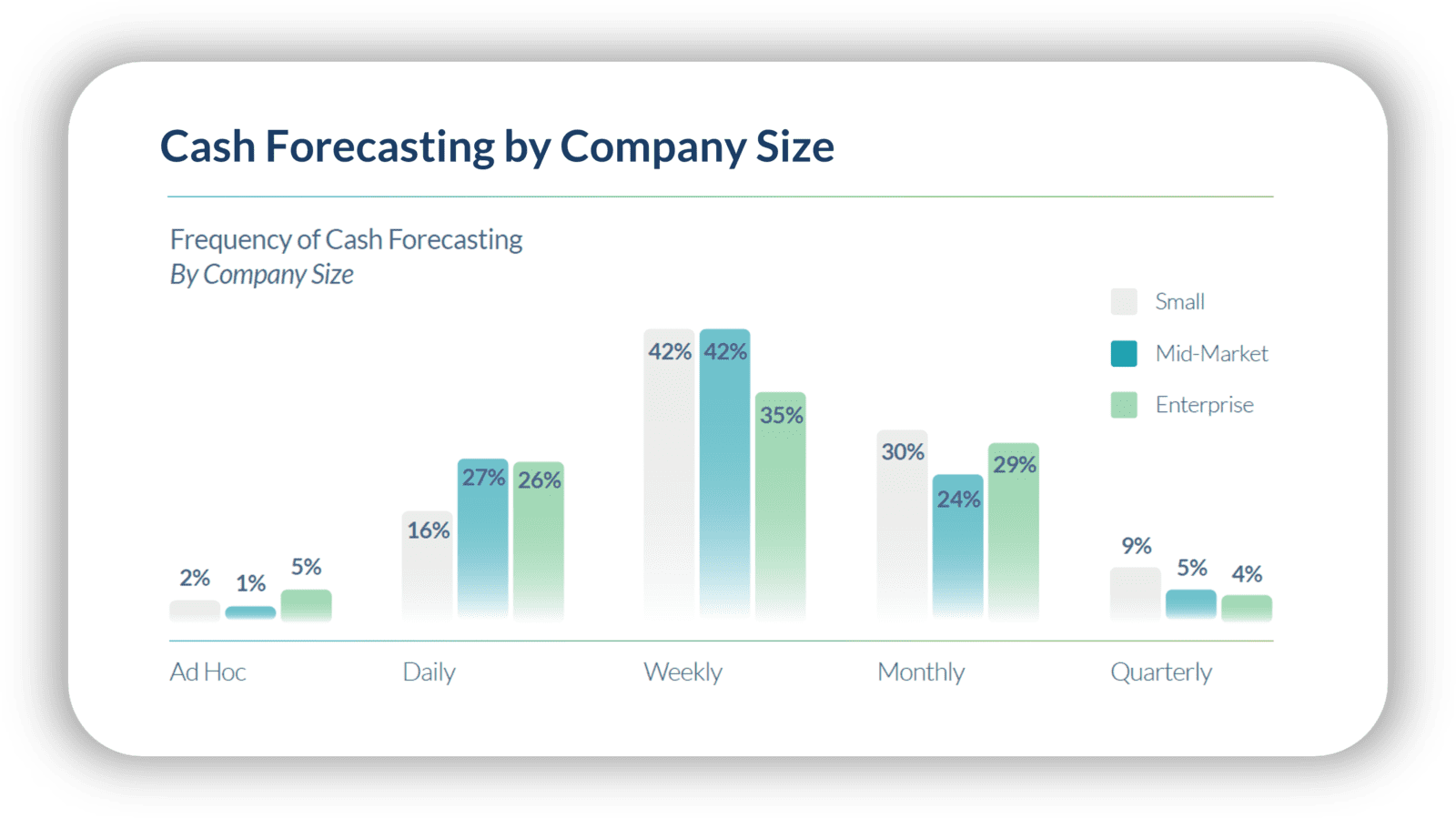

Regarding the preferred forecast horizon, 27% of teams focused on monthly forecasts, while 38% were prioritizing weekly analysis and 25% daily. Generally, smaller companies were only half as likely to conduct daily forecasts compared to larger firms, but 2x more likely to conduct quarterly forecasts. On the other hand, larger firms were more likely to conduct forecasts across numerous time periods including daily, weekly, and monthly. In aggregate, weekly forecasts were the most popular analysis period across all sizes and industries.

As a final point on forecasting and in-line with the broader digitalization shift that has been occurring in treasury for years, the top priority for practitioners when improving their forecast process revolved around either migrating away from legacy Excel-based processes or upgrading their existing software to achieve greater accuracy and automation.

To learn more about this research and for extended results and analysis, download the full whitepaper here. You can also watch our recent results webinar that features commentary on the key survey themes by a panel of industry experts.