SEPA Instant Payments – a catalyst for new developments in the payments market (part II)

26-02-2024 | SEPA Instant Payments – a catalyst for new developments in the payments market by François de Witte

26-02-2024 | SEPA Instant Payments – a catalyst for new developments in the payments market by François de Witte

| 20-2-2017 | Boudewijn Schenkels | Sponsored content |

At the end of last year the SEPA Instant Payments requirements from the European Payments Council have been published. Consequently the Dutch requirements 3.0 from the Dutch Payments Association were published last month.

At the end of last year the SEPA Instant Payments requirements from the European Payments Council have been published. Consequently the Dutch requirements 3.0 from the Dutch Payments Association were published last month.

SEPA Instants Payments (also called SCT Inst – SEPA Credit Transfer Instant) will allow sending and receiving money 24/7 in seconds. European banking communities can go live from November 2017, the Dutch community has planned to go live from May 2019 with the first Instant Payments services. The development of the SEPA Instant Payments infrastructures of the banks and processors are in train. In april 2018 the start of the inter-CSM testing is planned, the end-to-end bank tests and the pilot phase from January until April 2019.

From our Instant Payments training classes for business professionals and IT staff, we find that participants are not fully aware of the large impact Instant Payments will have on the complete value chain and the opportunities it will bring. In order for you to understand the impact and opportunities, I will explain how Instant Payments are processed.

To give an impression of all the change aspects for users, the banks and the interbank processing side:

As the launch dates come nearer it certainly triggers managers to now thoroughly evaluate scope and time scales for (required) internal projects and ensure to be ready and steady before launch in 2019 as well as business professionals to anticipate and grasp the potential opportunities.

The key differences between the current SEPA Credit Transfer and the new SCT Inst scheme are:

In our training, we also explain the differences between the normal payment flow (SCT) and the Instant Payments flow (SCT Inst). The process flow is described below in summary and will take place in several seconds.

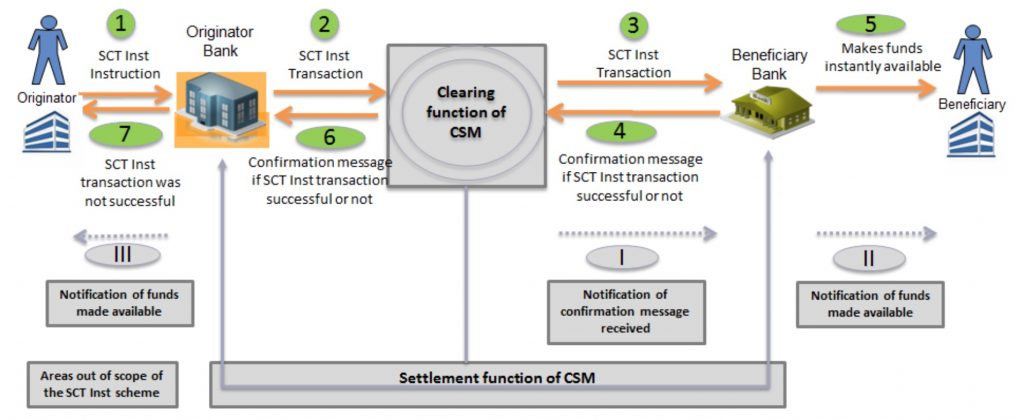

Figure 1. (Source: EPC Rulebook)

Several key actors are involved in the payments process:

The Originator Bank receives an SCT Inst Instruction from the Originator (Step 1). It verifies the instruction and sends the transaction to the CSM (Step 2), which verifies the message, ensures that the Originator bank has enough funds and instantly sends the SCT Inst Transaction message to the Beneficiary Bank. The Beneficiary Bank instantly verifies the payments and if it can be booked on the account of the Beneficiary (Step 3). The Beneficiary Bank confirms to the CSM if it was successful (positive confirmation) or not (negative confirmation with an immediate Reject) (Step 4). The Beneficiary can withdraw the funds (Step 5) instantly if in the previous step the confirmation was positive (and after the Beneficiary Bank has ensured that the CSM received the positive confirmation message). The CSM instantly reports to the Originator Bank if the SCT Inst Transaction had been successful (or not) (Step 6). In case the Originator Bank receives a negative confirmation about the SCT Inst transaction which indicates that the funds had not been made available to the beneficiary, the originator bank is obliged to immediately inform the originator (Step 7) and lift the reservation of the amount made in step 1.

This all means, that beside the flow of money, there is also a flow of messages between the customer and the bank. Both Beneficiary and Originator will be informed (in a few seconds) that the transaction is done (or not).

Are you interested in what the new SEPA Instant Payment will mean for your organization?

Come to our next open training (March 15 in Utrecht) or inquire about the possibilities of an in-house training.

More information at: www.paymentsadvisorygroup.com.

If you have any questions please contact us via: [email protected] .

Senior Consultant Payments @ Payments Advisory Group

| 11-11-2019 | treasuryXL | BELLIN

Often times, terms and definitions change over time; and sometimes terms remain the same but their meaning shifts. Take for example the word “bookkeeping:” accountants nowadays no longer put pen to paper and make manual entries in a book. Transferring this concept to treasury, we only need to look at the name of the department itself. Treasurers no longer watch over dungeons filled with treasure troves and other valuables (maybe with the exception of Fort Knox). But that’s not the only shift in meaning: we can also come across obsolete terms and definitions when it comes to the digitalization of treasury tasks and specifically with the term: treasury workstation.

Looking at search requests in Google, one of the most commonly searched terms in treasury is “treasury workstation” – a term that has been in use for treasury systems for many years. However, we need to ask ourselves if the term and the understanding of technology and processes associated with it are still appropriate today. Should they have long been replaced by other terms?

“Treasury workstation” contains the element of “station” that appears to have no place in today’s treasury world: mobile communication and the flexible use of systems are such obvious characteristics of our daily work that a “station” clearly no longer delivers. A workstation is literally stationary and therefore limited: it sits in one single place and is only available right there. Conversely, this is precisely where modern systems differ: they’re web-based and can be used from any mobile device without any limitations regarding security, user-friendliness, and functionality. Indeed, the very fact that modern systems are not stationary makes them so powerful. They’re mobile and any number of people can make use of them from anywhere.

Today, large departments and units need to be able to readily collaborate and exchange knowledge and data; a workstation seems inappropriate to meet these demands and stands for a status quo that IT has long left behind. No one wants to install software on a workstation anymore; no one wants to be tied to a desktop computer. The internet with all its enormous potential drives the optimization of business processes and data communication to the point where companies can no longer afford to back workstations, in particular in treasury.

At BELLIN, their system, tm5, is not a physical workstation limited to a specific location. The system is a web-based and dynamically-integrated platform that excels in ensuring global visibility, maximized security and uncapped work-hours saved. The key ingredient in regard to this article is that the system is web-based, yet accessibly by anyone company wide. We call this our Load Balanced Treasury approach which means no per-user licenses, ensuring subsidiaries can share data seamlessly, profit from real-time transparency, and maximize global security.

While many treasurers still refer to modern platforms as workstations, the distinction is important. Modern, web-based systems are platforms for collaboration, for cooperation and for uniting internal and external parties and partners who all contribute to treasurers always having the information they need to do their job: make decisions that reduce business risk, optimize asset management, manage funding and hedging and give the company the overall stability to meet the company objectives.

This is by no means limited to treasury. Unlike a workstation that is only ever available to the people in one particular office, treasury management systems serve the entire company and people from any department can be involved where needed. This allows treasurers to share the workload, get information first hand and have a fully integrated and connected workflow that ultimately benefits everyone.

Treasury workstations are a thing of the past and platforms like the BELLIN tm5 have long become established as industry standards. Consequently, it is time we reflect that fact in our terminology in order to find what businesses really need and stop searching for things that were modern years ago. “Station” ultimately suggests inflexibility, stagnation. As time goes by, both terminology and processes are subject to change and move forward – just as treasury does. Perhaps this is just a semantic error or term that has stuck over the years? Either way, as treasury enthusiasts and experts, we are keen to help the industry acclimate to the existing technological ecosystem.

| 05-11-2019 | treasuryXL | BELLIN

Open banking is about much more than advanced technology. It has an impact on business models, processes and ways of thinking – and it will definitely have a huge impact on treasury.

The EU’s revised payment services directive (PSD2) has forced European banks to set up standardised interfaces, so-called APIs, to enable third parties’ technological access to bank accounts. This is an attempt to break up the banks’ monopoly and boost competition amongst payment service providers.

When it comes to payments, PSD2 APIs are currently limited to single Euro payments area (SEPA) single payments. Simply put, they are generally ill-suited for corporate payment processing. Nevertheless, open access to customer and transaction data for third parties represents a radical change that threatens traditional banking business models.

While in the past, banks reigned freely over their customers’ financial data – often keeping them in the dark about margins, fees and transaction routes – open banking makes banking fundamentally more democratic and gives companies much more freedom and flexibility.

How does a company want to handle its payment processing? With open banking, it will be of little relevance to corporates exactly how their payments are processed. As long as the payment goes from A to B, the back-end technology being used is up to the service provider. What will be more significant for corporate treasury departments when it comes to payments is how quickly this information becomes available to them.

Today, treasurers are blind when it comes to intraday cash flow movements. Depending on the bank, they only receive balance information a few times a day at specific times. This has always been as real-time as it gets. Treasurers who would like to know their account balance at any time and in ‘real, real-time’ need to request this information. But how can you know when to best inquire about your account balance when you have no idea when money will be credited?

Some companies make use of automated requests, managed in their treasury management system (TMS). The system sends scheduled requests to the bank, for example every minute, to check if any new information is available. An analogy would be sending round a company postman to empty the letterbox every few minutes without knowing if anyone has actually posted a letter. This leads to enormous amounts of data and clogs up communication channels and systems, without really solving the issue.

A much more intelligent solution would be to not request the information until it is actually available. For that to work, there would need to be some kind of signal that data has come in – just like the signal flag on American letterboxes. New technologies, such as APIs and WebSockets, enable this kind of reversed order. The bank signals that a new balance is available as soon as money is credited to or debited from an account, and treasurers and other finance professionals can then take action. The same is true for payments, where status notifications for a transaction would be available straight away.

What will the future look like for banking communication? Will APIs relegate existing technologies, such as electronic banking internet communication standard (EBICS) or SWIFT, to the sidelines? APIs’ greatest downfall is their lack of standardisation. Conversely, complete and powerful standardisation across the SEPA area is the biggest asset of these established communication channels.

In the context of PSD2, there have been various European initiatives to achieve standardisation, for example those of the Berlin Group. However, there is no comparable global initiative, and when BELLIN recently analysed the open banking offering of the ten most relevant banking groups, the discrepancies were staggering. What is needed are suitable enhancements of established technologies that could then be combined with new technologies, for example combining the EBICS protocol with API technology.

And this future is not far off. Massive changes that will impact treasurers’ day-to-day work significantly are just around the corner. Large retailers have already implemented instant payment solutions using APIs that not only enable them to transfer money, but also to receive notifications when a payment has come in as soon as it does. This has enabled them to fully connect payment processing, real-time balance information and customer service.

Direct communication of data between companies and banks is likely to have other, far-reaching consequences for treasury, for example when it comes to FX and risk management. Real-time corporate-bank communication definitely brings challenges for cash management. Banks will have to solve how cash pooling is handled in the future whilst also determining the time on which interest calculations are based. However, with new standards for speed, efficiency and data quality, open banking will continue to revolutionise treasury far beyond 2020.

Product Manager Solution Management

| 26-02-2018 | Paul Stheeman |

Last month we saw the anniversary of several historical moments. 1000 years ago, in January 1018 the Peace of Bautzen ended the German-Polish War. More recently, in January 1998, American President Bill Clinton surprised the world by denying in a press conference that he had sexual relations with Monica Lewinsky. More importantly for Treasurers and the citizens of Europe January 2018 marks the tenth anniversary of the establishment of SEPA, the Single European Payments Area.

In Europe we have become used to SEPA. Initially we all groaned at the idea of having 22-digit long bank accounts numbers called the IBAN, nicknamed as “IBAN the Terrible”. But the introduction of SEPA in January 2008 has brought a number of benefits to over 520 million citizens in Europe. Not only are the 19 Eurozone countries members of SEPA. All other EU countries participate as well as countries such as Norway or Switzerland.

The main benefit is that we now have one payment zone. Previously, making a transfer from Italy to the Netherlands was a cross-border payment. This meant that a whole week could pass between the time when the payer initiated the transfer in Italy and the recipient actually received the funds on his Dutch bank account. In addition, banks in both countries would charge considerable fees for making the transfer. Payment is now done within 24 hours and banks should not charge more than for a domestic payment.

SEPA not only covers transfers. Direct debits and debit cards also are handled in a similar manner through SEPA. And a new instant payment scheme is currently being rolled out, allowing payments to be completed within seconds on a 24/7/365 basis.

SEPA is also strongly regulated. The European Commission established the legal foundation through the Payment Services Directive or PSD. Payment products are overseen as are technical standards.

In the last ten years SEPA has established itself as being the platform for payments in Europe. Due to its wide acceptance and success in its first decade it is likely to accompany us for many years ahead as new payment methods are developed in the digitalised world.

Owner of STS – Stheeman Treasury Solutions GmbH

12-9-2017 | FM.NL | treasuryXL |

Op 27 september is het zover. Buitenlandse investeerders en FinTech-specialisten van naam reizen dan af naar Brussel. Tijdens de European FinTech Awards & Conference 2017 zullen zij oordelen hoe de veelbelovende techbedrijven van Europa ervoor staan. De omgetoverde FinTech-awardzaal van ‘The Egg’ bombardeert de Europese hoofdstad deze dag tot hét techcentrum van Europa. De top 100 aanstormende FinTech-bedrijven van Europa zijn bekend. Wie wordt gekozen tot winnaar?

Op 27 september is het zover. Buitenlandse investeerders en FinTech-specialisten van naam reizen dan af naar Brussel. Tijdens de European FinTech Awards & Conference 2017 zullen zij oordelen hoe de veelbelovende techbedrijven van Europa ervoor staan. De omgetoverde FinTech-awardzaal van ‘The Egg’ bombardeert de Europese hoofdstad deze dag tot hét techcentrum van Europa. De top 100 aanstormende FinTech-bedrijven van Europa zijn bekend. Wie wordt gekozen tot winnaar?

Bron: FM.NL

Bron: FM.NL

Veelbelovende FinTech-bedrijven & verrassende visies op de European FinTech Awards in Brussel:

Deel expertise en visies. Laat u verrassen tijdens de vele kennissessies, keynotes en pitches. Krijg de beste antwoorden op uw vragen: Hoe schaalt u efficiënt een FinTech-bedrijf op? Wat kunnen we leren van succesvolle FinTechs? Hoe reageren banken en wat denken investeerders?

Laat u inspireren door de meest veelbelovende FinTech-bedrijven ten overstaan van aanwezige investeerders, stakeholders en andere belangstellenden op 27 september 2017. Dit is de dag waarop u de beste FinTechs van Europa pas écht leert kennen.

Bezoek de European FinTech Awards & Conference met korting

Ontmoet 27 september 2017 in ‘The Egg’ in Brussel 400 nationaal en internationaal befaamde FinTech-entrepreneurs, bankiers, investeerders en adviseurs. De European FinTech Awards & Conference 2017 biedt een unieke kans om uw netwerk te vergroten. Laat deze kans niet glippen om gearriveerde FinTech-sprekers op het podium te zien en 30 pitches te zien van Europa’s beste innovatieve ondernemingen van dit moment.

Speciaal als TreasuryXL community lid krijgt u 10% korting met de code: Friend2017, boek vandaag uw ticket(s)

De European FinTech Awards wordt georganiseerd door Alex van Groningen en B Hive.

Annette Gillhart – Community Manager treasuryXL

Annette Gillhart – Community Manager treasuryXL

[button url=”https://www.treasuryxl.com/about/” text=”Meer informatie over treasuryXL” size=”small” type=”primary” icon=”” external=”1″]

[separator type=”” size=”” icon=””]

| 19-7-2017 | François de Witte |

On 29 June 2017, I attended a workshop organized by Fintech Belgium on how Instant Payments will push the financial sector to innovate. In this article (the first part of 2) I will set the scene by presenting some use cases. In the second part (online next week) I share some views on how Instant Payments, in combination with PSD2, will be a game-changer in the market.

On 29 June 2017, I attended a workshop organized by Fintech Belgium on how Instant Payments will push the financial sector to innovate. In this article (the first part of 2) I will set the scene by presenting some use cases. In the second part (online next week) I share some views on how Instant Payments, in combination with PSD2, will be a game-changer in the market.

The new generation customer claims “I want it all, and I want it now”. It is his anthem for having packages delivered, ordering food or finding a taxi driver. Payments are next, and they expect the financial industry to follow by offering real time or near real time experience.

As opposed to real-time payments with smartphones, transferring money between banks or cross-border payments often takes several days to be processed. For this reason, the EPC (European Payment Council) decided to introduce SCT Inst scheme: a real-time payment system where interbank transactions will be cleared within maximum 10 seconds at any time of the day and 365 days of the year. Similar schemes were already successfully put in place in other states (e.g. Denmark, Sweden and the UK).

As already mentioned by Boudewijn Schenkels on TreasuryXL, the characteristics of the new SEPA Instant Credit Scheme are the following:

The scheme should be operational in November 2017, but in some countries it is already live (e.g. Finland and Spain). Besides the processing, an important aspect is to ensure that the beneficiary is advised.

As Alessandro Longoni outlined earlier on treasuryXL, both from a cash management, and from a treasury perspective, Instant Payments open many new possibilities both for merchants, and corporates.

Thanks to its irrevocability, the SCT Inst will also be a disruptor for existing PSPs such as Paypal and Amazon Pay. It is expected that the banks will charge much lower fees then them. We might also expect that this scheme would also challenge in the cards market, where new players could benefit from both PSD2 and SCT Inst to offer more competitive payment schemes. However the card operators might also react by adapting their prices and/or offering additional new services.

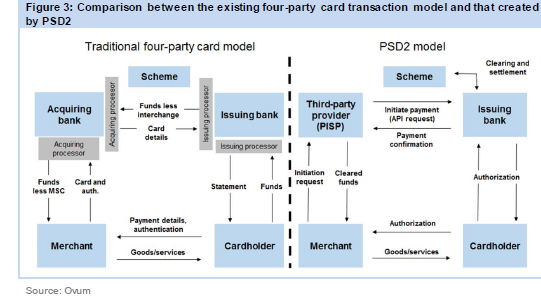

For the banks, merchants, and the payment industry more widely, the PISP (Payment Initiation Service Provider) model will have a significant impact on the way in which consumers and merchants transact in the future. Unlike the traditional four-party card model, customers would “push” cleared funds to merchants, with ACH transactions replacing the current card CSM (Clearing & Settlement Mechanism). This will significantly simplify the existing payment model, with fewer players and interactions involved.

The drawing down below illustrates this quite well:

Source: OVUM – Instant Payments and the Post-PSD2 Landscape

We also expect that thanks to the new schemes and competitors, the use of cash will decrease, although cash will remain important for a while. Cash is accessible to all, also those who do not have a bank account. It enables immediate settlement without intervention of a third party. Cash is the only payment instrument that currently guarantees the user’s privacy and anonymity, while all electronic transactions are traceable.

In the second part of this article, which will be online next week, I will tell you more about instant payments as a game changer.

François de Witte – Founder & Senior Consultant at FDW Consult

François de Witte – Founder & Senior Consultant at FDW Consult

[button url=”https://www.treasuryxl.com/community/experts/francois-de-witte/” text=”View expert profile” size=”small” type=”primary” icon=”” external=”1″]

[separator type=”” size=”” icon=””]

More articles from this author:

Treasury for non-treasurers – cash conversion cycle and working capital management

Flex Treasurer – Besparing na een Treasury Quickscan: nog meer praktijkvoorbeelden

[separator type=”” size=”” icon=””]

| 11-4-2017 | Mark van de Griendt | treasuryXL

In 2014 publiceerde expert Mark van de Griendt een artikel over de voordelen (en nadelen) van SEPA en IBAN, die toen werden ingevoerd en Electronic Bank Account Management. Intussen zijn SEPA en IBAN al bekende fenomenen, maar Electronic Bank Account Management is alleen maar complexer geworden, zeker in het tijdperk van Fintech. Reden genoeg om nog een keer terug te kijken op wat Mark toen zei. Intussen zijn processen veranderd en zijn er nieuwe uitdagingen bijgekomen. Maar wij denken dat wat hij schrijft nog steeds actueel is…

In 2014 publiceerde expert Mark van de Griendt een artikel over de voordelen (en nadelen) van SEPA en IBAN, die toen werden ingevoerd en Electronic Bank Account Management. Intussen zijn SEPA en IBAN al bekende fenomenen, maar Electronic Bank Account Management is alleen maar complexer geworden, zeker in het tijdperk van Fintech. Reden genoeg om nog een keer terug te kijken op wat Mark toen zei. Intussen zijn processen veranderd en zijn er nieuwe uitdagingen bijgekomen. Maar wij denken dat wat hij schrijft nog steeds actueel is…

In het verlengde van de SEPA- en IBAN- invoering kijken veel ondernemingen bewuster naar de processen die samenhangen met het beheer van bankrekeningen en het contact met hun banken. Daarnaast wordt veel gesproken over Electronic Bank Account Management (EBAM).

Of het nu gaat om het digitaal openen of beëindigen van conto’s of om de uitwisseling van informatie, zoals het beheer van tekenbevoegdheden, van EBAM wordt verwacht dat het in het gegevensverkeer tussen banken en klanten niet alleen voor transparantie, efficiëntie en kostenbesparingen zorgt, maar ook voor het voldoen aan governance-eisen.

Om echter van de voordelen van EBAM te profiteren, moeten de meeste ondernemingen eerst hun interne processen optimaliseren, stelt Mark A. van de Griendt, Sales Director bij TIS. “Deze optimalisatie wordt bereikt met een strak ingericht Bank Account Management (BAM), in combinatie met daarop afgestemde software.”

Bij veel bedrijven is het beheer van de bankrekeningen niet optimaal georganiseerd. Het proces verloopt niet transparant en niet efficiënt. Op lokaal niveau worden autonoom rekeningen geopend of beëindigd. “Dit gebeurt vaak zonder dat het hoofdkwartier of de treasury-afdeling het weet. Onduidelijk is dan of de banken aan de eisen voldoen die de onderneming aan de financiële partners stelt,” weet Van de Griendt. “Daarnaast heeft een groot aantal banken dan toegang tot essentiële bedrijfsinformatie, zonder dat centraal geregistreerd is welke partijen dat zijn. In het gunstigste geval worden Excel-tabellen door de treasury-afdeling verzameld om tot een overzicht te komen.”

Ondernemingen moeten hun interne processen, die te maken hebben met het openen en beëindigen van bankrekeningen en met de veranderingen bij tekenbevoegden, analyseren en indien nodig opnieuw inrichten. Met een centraal BAM-platform creëert een onderneming de basis voor eenheid in het datamanagement en een duidelijke taakverdeling bij het verwerken van belangrijke informatie met betrekking tot bankrekeningen.

Op deze manier is op het gebied van transparantie, centralisering, kostenreductie en governance al veel te bereiken, nog zonder dat EBAM uitgerold wordt. Concreet betekent dit: een onderneming structureert zijn bankrekeningprocessen. In het ideale geval door het gebruik van workflowsystemen.

Hoe komt een onderneming tot een geoptimaliseerd proces? Van de Griendt: “Door software, die alle data samenbrengt die voorheen in afzonderlijke Excel sheets werd bijgehouden. De software verzamelt informatie die verder gaat dan de individuele bankrekening; van belang is immers ook de rating van de bank, of aanwijzingen hoe het ERP-systeem met de betreffende instelling moet communiceren.”

Vervolgens moeten alle processen die te maken hebben met het openen of beëindigen van rekeningen en met het doen van transacties in de workflow-software opgenomen worden. Hierbij worden ook de processen vastgelegd waarvoor het vier-ogen principe geldt.

In tegenstelling tot enige jaren geleden, zijn er nu krachtige en efficiënte Bank Management Oplossingen die de workflow ondersteunen. “Deze oplossingen structureren en automatiseren werkprocessen. Vooral cloud-oplossingen, die op SaaS-basis worden afgenomen, zijn snel inzetbaar zonder langdurige IT-implementaties,” stelt Van de Griendt.

Voor een optimaal proces is een geautomatiseerde inventarisatie van bankrekeningen, de daaraan gekoppelde juridische documenten en de tekenbevoegdheden nodig. Op die manier heeft de treasury-afdeling van het hoofdkantoor altijd een compleet overzicht en voldoet aan alle governance-eisen

Als bovengenoemde maatregelen zijn doorgevoerd heeft een onderneming al een grote stap gezet op de weg naar een efficiënter Bank Account Management. Vervolgens kan de stap naar EBAM gezet worden. In dat geval communiceert de onderneming op basis van XML-bestanden met de bank. In deze digitale communicatie worden ook tekenbevoegdheden en rechten van verschillende verantwoordelijken automatisch meegenomen.

Mark van de Griendt – Cash Management Expert at PowertoPay

Mark van de Griendt – Cash Management Expert at PowertoPay

[button url=”https://www.treasuryxl.com/community/experts/mark-van-de-griendt/” text=”View expert profile” size=”small” type=”primary” icon=”” external=”1″]

[separator type=”” size=”” icon=””]

| 6-4-2017 | Olivier Werlingshoff |

Working Capital is the term for the operating liquidity of a company that can be used and is needed to continue the day to day business. To calculate the working capital you have to deduct the current liabilities from the current assets. By managing your account receivables, accounts payables and inventory you can fluctuate your cash position and optimize your working capital so that the cash “trapped” in the company can be lowered to a minimum while you are still able to meet your payment agreements.

Working Capital is the term for the operating liquidity of a company that can be used and is needed to continue the day to day business. To calculate the working capital you have to deduct the current liabilities from the current assets. By managing your account receivables, accounts payables and inventory you can fluctuate your cash position and optimize your working capital so that the cash “trapped” in the company can be lowered to a minimum while you are still able to meet your payment agreements.

The way you are making or receiving payments can have influence on the trapped cash and therefore can influence your working capital.In a few articles we will dive into the world of payments and explain the influence on working capital. In this first article we will discuss the wire transfers within the EU and cross border.

SEPA

With SEPA all payments in the EU are considered as a local payment. To minimize your banking process time with bank transfers you don’t need to open local bank accounts in the different countries in the EU anymore. If you have a customer in, let’s assume Spain and you agreed on a payment term of 30 days, you send your invoice by mail as soon as the client signed the contract. At that moment your working capital will increase with the amount until the moment the amount is paid into your bank account.

You can mention on your invoice that payments can be done by transfer to your IBAN number in The Netherlands. The maximum processing time will be one banking business day if you send the payment instruction before the cut off time of your bank. This means that if the client is doing the payment on Friday before the cut off time, mostly 3.30 PM, the amount will be on your account on Monday. Otherwise you will receive it on Tuesday.

Risk of non-payment

With wire transfers you still have the risk of nonpayment by you customer. Within the SEPA area you can also use Direct Debits. With this type of payment you can be the one who initiates the payment and if your client accepts, your money could be on your account after the agreed payment term of 30 days. Furthermore Direct debits can’t be reversed by your client when you use the Business variant.

Cross border

If you have a client in the US, you will also send him the invoice by mail to skip the postage process. You can ask him to transfer the amount to your IBAN number. The client will probably convert the amount in his own currency and make an international transfer. With a cross border transfer you will have different costs: the outgoing transfer cost, the incoming transfer cost and also even sometimes correspondent bank costs. Besides the high costs, payments can even take a week before reaching your bank account.

What is the effect on your working capital? Because it takes a long time before you get paid, your accounts payables will increase and the “days sales outstanding” will be longer than the 30 days you agreed on.

When you have a lot of international clients in one specific country you can make a calculation whether opening a local account in the country of your clients could be profitable for you. To avoid correspondent cost you can choose a bank that has connections with your main bank.

After receiving the money on your local account there are some instruments you can use to sweep the balance to your main account in The Netherlands, those products are called pooling techniques.

In the next articles we will focus on payments by internet, credit – and debit cards but also payment on delay and trade products.

Owner of WERFIAD

More articles from this author:

How to improve cash awareness without targets

|8-2-2017 | Jan Meulendijks | iTreasurer |

In October 2014 iTreasurer published an article ‘The Five Cash Management Initiatives Treasurers Should Consider‘ about how treasurers keep focus on ways to keep cash management in their organisation efficient and cost effective. As this is always an important issue and also relevant in 2017, we asked our expert Jan Meulendijks to comment on the article.

iTreasurer stated in their article that treasurers should spend their time on five initiatives and that they should be part of a treasurers’ overall budget and resource planning process.

iTreasurer stated: ‘Initially rolled out as an approach for risk mitigation for commercial payment transactions in Euro, SEPA adopters have found that SEPA, or the Single Euro Payments Area, provides a more efficient way to transfer and collect funds across borders without managing all the different legal payment frameworks of each country. But despite the many bright spots of SEPA, “reconciliation in 2014/2015 was still a challenge,”

According to Jan Meulendijks the development of reconciliation tools has now become an issue for ERP/General ledger software developers and that the banks do not need to focus on it any more. Processing digital account information/account statements are a well established feature of financial software programs and also include the processing of open accounts receivables.

‘The SEPA initiative has acted as the catalyst for other global projects, with high priority placed on account rationalization. By reducing accounts across Europe, many large US multinational corporations are realizing significant savings in both hard- and soft-dollar costs. “In the SEPA environment, all corporates needed was one account for payments and one account for receivables across the SEPA landscape,’ said Mr. Brieske, Regional Head of Trade Finance and Cash Management Corporates Global Solutions Americas, Global Transaction Banking, Deutsche Bank in the article. At that time keeping every bank happy was a tough job, if not impossible. Being able to spread the wallet across fewer banks was one of the positive by-products of a bank consolidation.

Treasurers had continued to find ways to alleviate the growing cash balances that had become strategically more important to their organizations. Structures like in-house banks (IHBs) were becoming more commonplace as organizations took the next step to further enhance their global liquidity models. The practical considerations for the evolution of the IHB could be directly attributed to global expansion and increased revenue mix overseas in addition to complexities related to time zones, language, growth of regional shared services and decision execution.

As a result of the ongoing RMB regulatory changes, there had been a significant improvement in the ease of making cross-border RMB payments via China. The RMB was a fairly new currency on the international scene then. The RMB internationalization project had begun to pick up steam over the second half of 2014, with many global MNCs looking to launch new cash management strategies in Asia. New structures were thought to be able to unlock China’s previously “trapped cash” challenge, and optimize their cash held in this part of the world where many opportunities lie for them.

Jan sees a tendency today that the more the deregulation of the RMB progresses the more one can treat it as any other currency. However, this is not achieved yet and Asia will continue to be an region where ‘trapped cash’ occurs on a regular basis.