07-06-2022 | treasuryXL | Nomentia | LinkedIn |

As with most things, cash flow forecasting is easier said than done. Developing accurate forecasts can be a challenging job. Especially when your business is increasing in size, you need to consider many aspects. Fortunately, there are several great cash flow forecasting tools to help you overcome the challenges you have, to make forecasting easier and more accurate.

What is cash flow forecasting?

Simply put, cash flow forecasting is the practice of understanding your movement of money that goes in and out of the business, now, in the short-term, or in the long-term. A higher cash inflow than outflow results in a positive cash flow position. And when your cash outflow is bigger than your cash inflow, it results in a negative cash flow position.

Many professionals understand that analyzing cashflows is important yet fail to build reliable processes to do so accurately. Robust cash forecasting will help you understand what your cash position is now, and in the future, simply by analyzing cash in- and outflows.

The challenges of cash forecasting

We will not go too much into detail to discuss the challenges of cash forecasting, which we already did in this article. But commonly, treasury and finance teams struggle with two main reoccurring challenges:

1. Manual processes (lack of automation)

One of the key challenges in cash forecasting remains the amount of manual labor that goes into it. Especially when your organization is larger, and you need to combine financial data from different banks, subsidiaries, and ERP systems. Depending on how frequently your team runs the forecasting process, it can become very time-consuming.

According to different sources, it is recommended that treasury and finance teams run forecasts on a weekly basis to increase financial control. Imagine all the hours that go into this process by doing so manually: collecting data from multiple data sources and recording everything into your spreadsheets. And that doesn’t even include running the analyses to base your strategic decisions on. To top it off, the spreadsheets also contain many errors, which makes them less reliable.

To add to that, by collecting your forecasting data periodically you never have real-time insight into your cash position because your cash predictions may have changed already the day after you made your analysis.

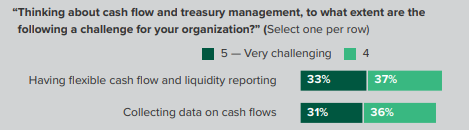

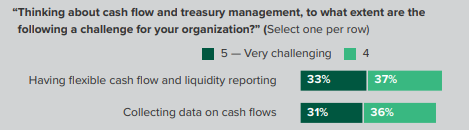

Having flexible cash flow and liquidity reporting, and collecting data on cash flows was found most challenging or very challenging for around 70% of decision-makers according to our study with Forrester.

2. Lack of centralization

As mentioned earlier, it is a very inconvenient aspect to create liquidity and forecast reports when the data you need is scattered across multiple systems. In global companies, you would need to access several bank accounts to check balances. Or you are working with different subsidiaries, where you need to rely on the timeliness and accuracy of your colleague’s input. Whatever systems you’re using, having a centralized place that automatically pulls all the data from them into one place in real-time can benefit you tremendously.

What is a cash flow forecasting tool?

Effective cash flow forecasting tools are there to help you overcome typical forecasting challenges. They help you manage and track all your business cash flows now and in the future. Allowing you to make better strategic and investment decisions for your business.

The advantages of using a cash forecasting tool

There are various solutions available on the market, and they all work differently. Ideally, a tool should be able to help you with your cash forecasting in various ways.

Access real-time information

A great tool gives you an instant overview of your cash position, inflows, and outflows at any time you need it. The more up-to-date your data is, the better you can justify your decisions.

Connect and centralize all source-systems

Especially for larger enterprises with multiple banks, ERPs, and other source systems, a tool needs to be able to flawlessly connect to all of them. That’s the only way for you to combine all the financial data required to make accurate cash forecasts.

Automate the process of collecting data for you

Both the gathering of real-time information and connection to all source systems should be automated by the tool or software. That way you can automatically gain real-time insight into your cash position without manual labour.

Automatically able to create reports and infographics based on your data

Following up on the previous point, once your tool has automatically-collected data, it should be able to visualize it in a customized way that suits your needs. Whether it is certain types of reports, graphs, or other dashboards.

Save resources while enabling better decision-making

Better and faster analyses of your cash position and forecast without creating reports manually will help you save the time that you can use for making strategic decisions.

The different types of cash forecasting tools

Basic tools for small and medium-sized companies

Market research has shown that in the U.S. in 2018 alone, around 63% of companies used spreadsheets for budgeting and reporting purposes. Even though this number was declining, spreadsheets are still considered the most basic go-to tool for cash flow forecasting.

The two main (free) providers for cash forecasting tools on a basic level (they don’t need explanation):

-

GOOGLE SHEETS

-

MICROSOFT EXCEL

Of course, you can make your spreadsheets as advanced as you want. But the fact is that most smaller organizations traditionally use spreadsheets to do their cash flow forecasting. Their set-ups are less sophisticated and with fewer data sources. As a result, it’s easier to pull the data you need.

The advantage of spreadsheets is that they are very cheap and effective. Yet, once your organization grows bigger and you start using several banks, and other source systems like ERPs, they become unmanageable and start taking a lot of your team’s resources.

Intermediate tools for small and medium-sized companies

There are several intermediate cash forecasting tools that are increasingly helpful for smaller and medium-sized companies compared to the basic tools. Sometimes they can replace spreadsheets completely, but most often they complement them.

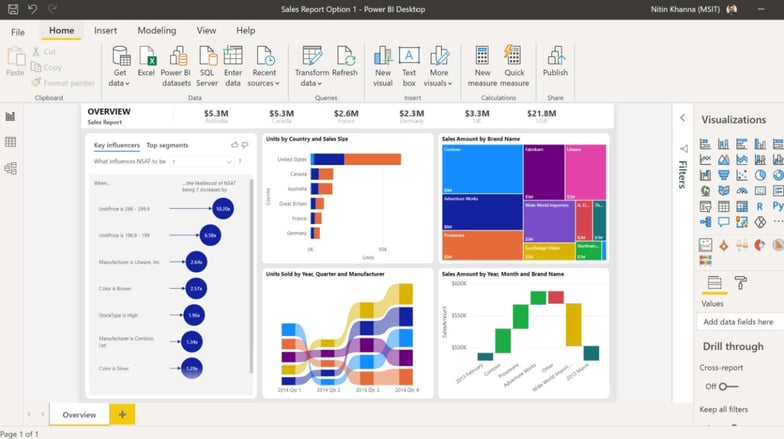

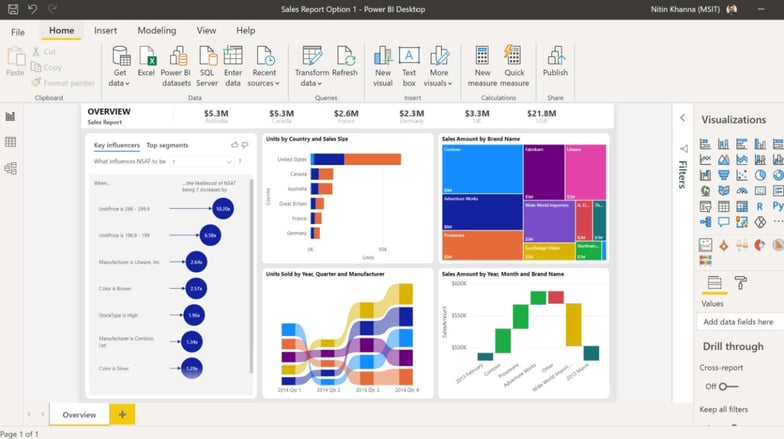

1. POWER BI

Microsoft’s Power BI is a tool that can collect data from different sources and allows you to visualize them through dashboards. Though it’s a handy tool, it requires quite a bit of training and getting used to. Connecting Power BI to your systems, importing data, and building the right reports can still require a lot of manual labor.

Power BI’s list of systems you can connect to is limited. Especially bank and ERP connections are lacking which are usually required for bigger companies.

Power BI dashboard example

2. CAUSAL

If you have an accounting system, a CRM, and some data warehousing system, chances are that Causal can help you out collecting that data in one place. Their data visualization tool will help you better understand the combined data from your connected places.

Just like Power BI, Causal is unable to connect to financial institutions, like banks, that are often required to get a better understanding of your cash position.

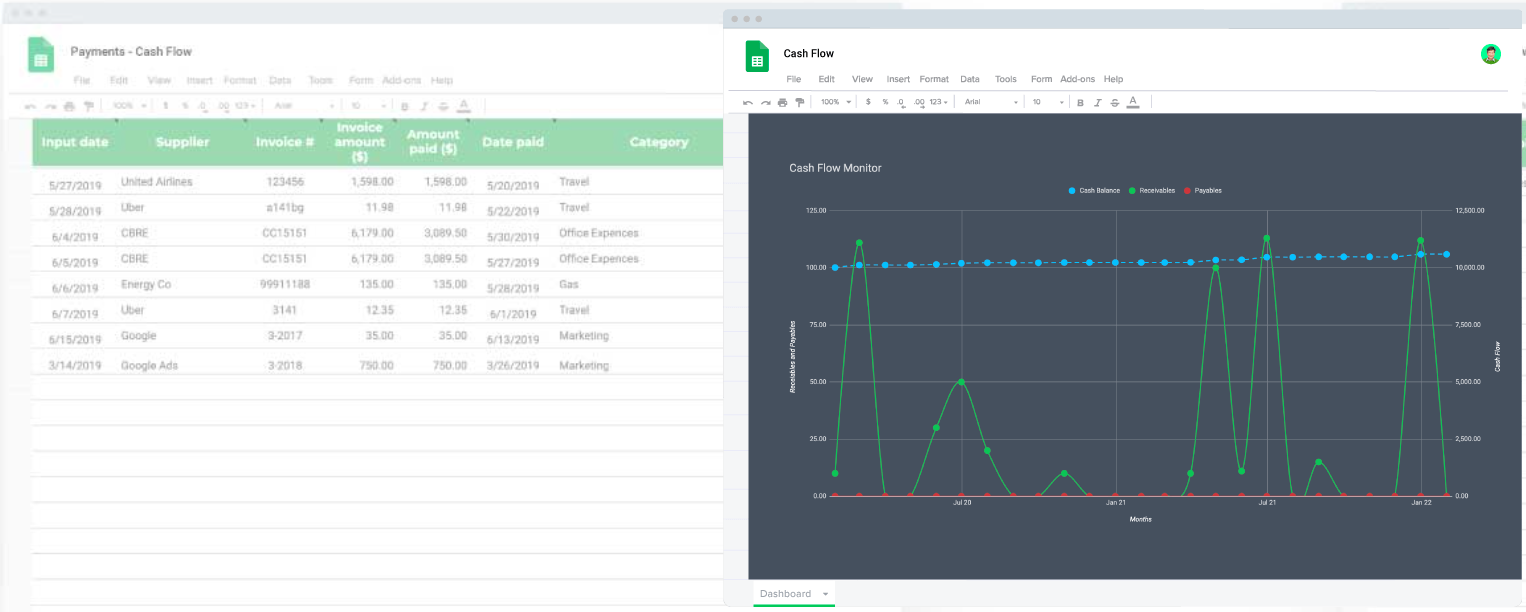

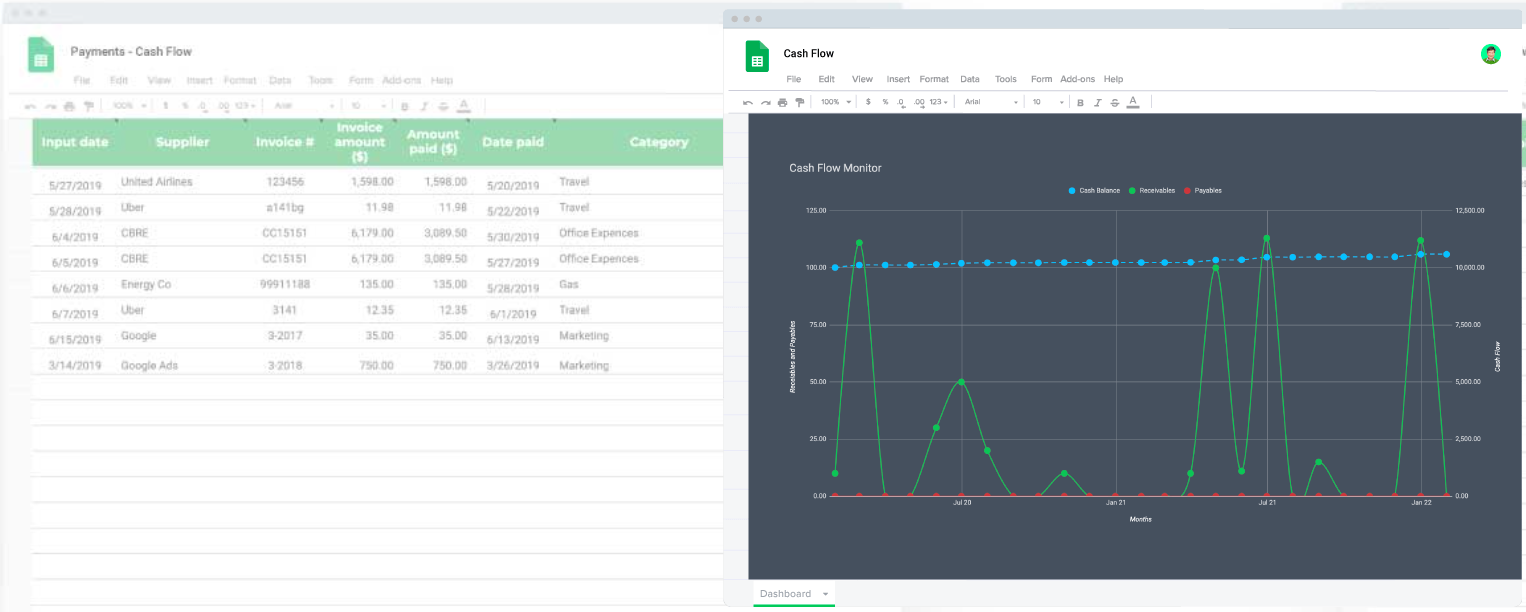

3. SHEETGO

Sheetgo is a handy tool when you want to combine the data from different spreadsheets. The more spreadsheets with financial data you have the more challenging it is to combine them and build accurate cash flow forecasts.

Sheetgo does not take away the manual work that includes pulling data from source systems. It is more a tool made to integrate with Google Sheets or Microsoft Excel.

Sheetgo’s cash flow template

4. NOMENTIA LIQUIDITY

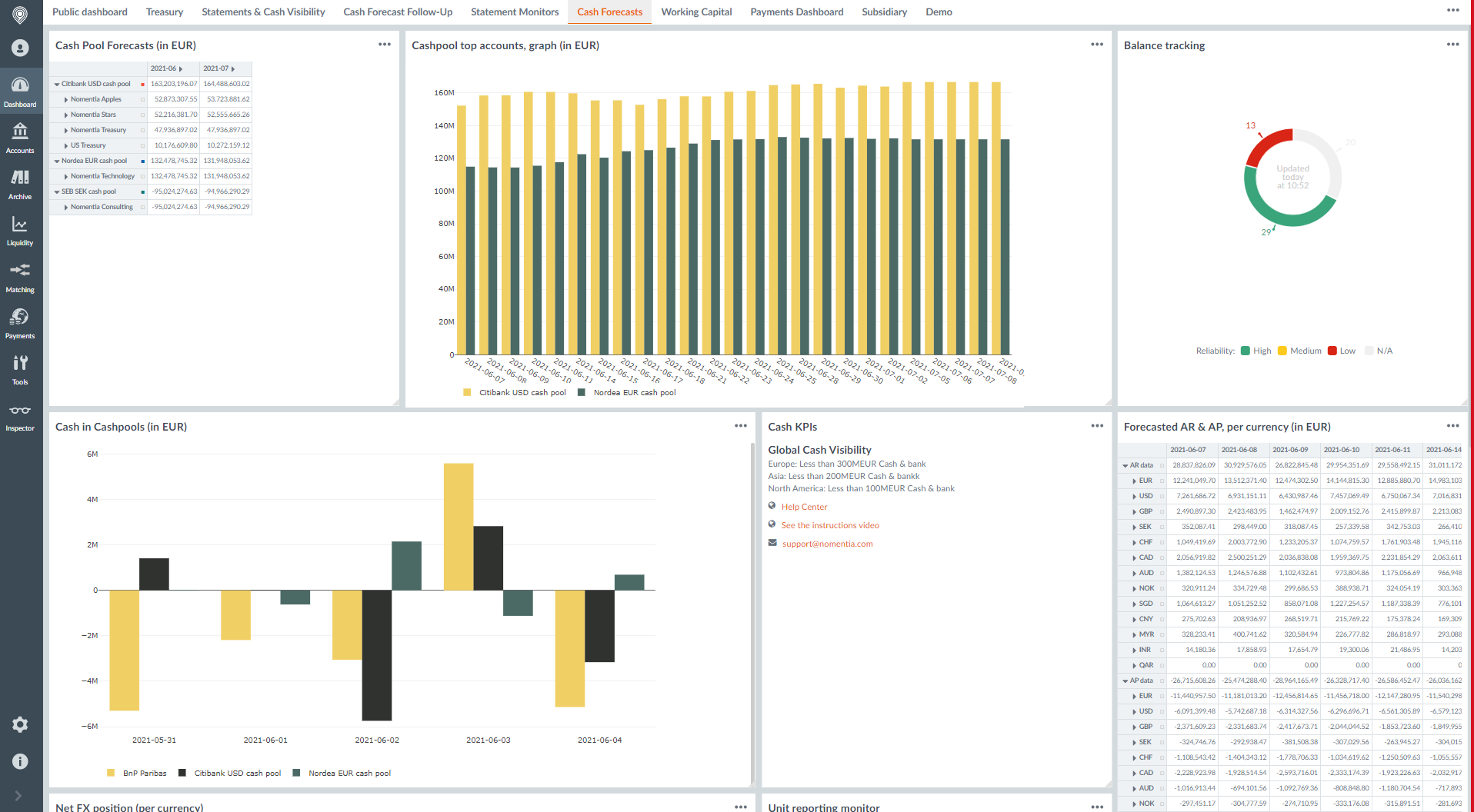

If you’re looking for a cash flow forecasting tool that can connect multiple source systems, banks, and ERPs – then Nomentia Liquidity is a great option. Nomentia Liquidity gives you visibility over your past, present, and future cash positions.

Nomentia automatically pulls all data from different source systems and visualizes them in a customized format for each client. The implementation is also done together with a dedicated customer specialist, so you don’t have to worry about any manual labor or integration problems.

Nomentia’s liquidity dashboard

Advanced solutions for medium and big-sized companies

If you’re looking for more complete cash forecasting services, then you need to consider the top treasury and cash management vendors that are well known. Most of these vendors offer Software as a Service (SaaS) solutions which take away the work of managing the solution.

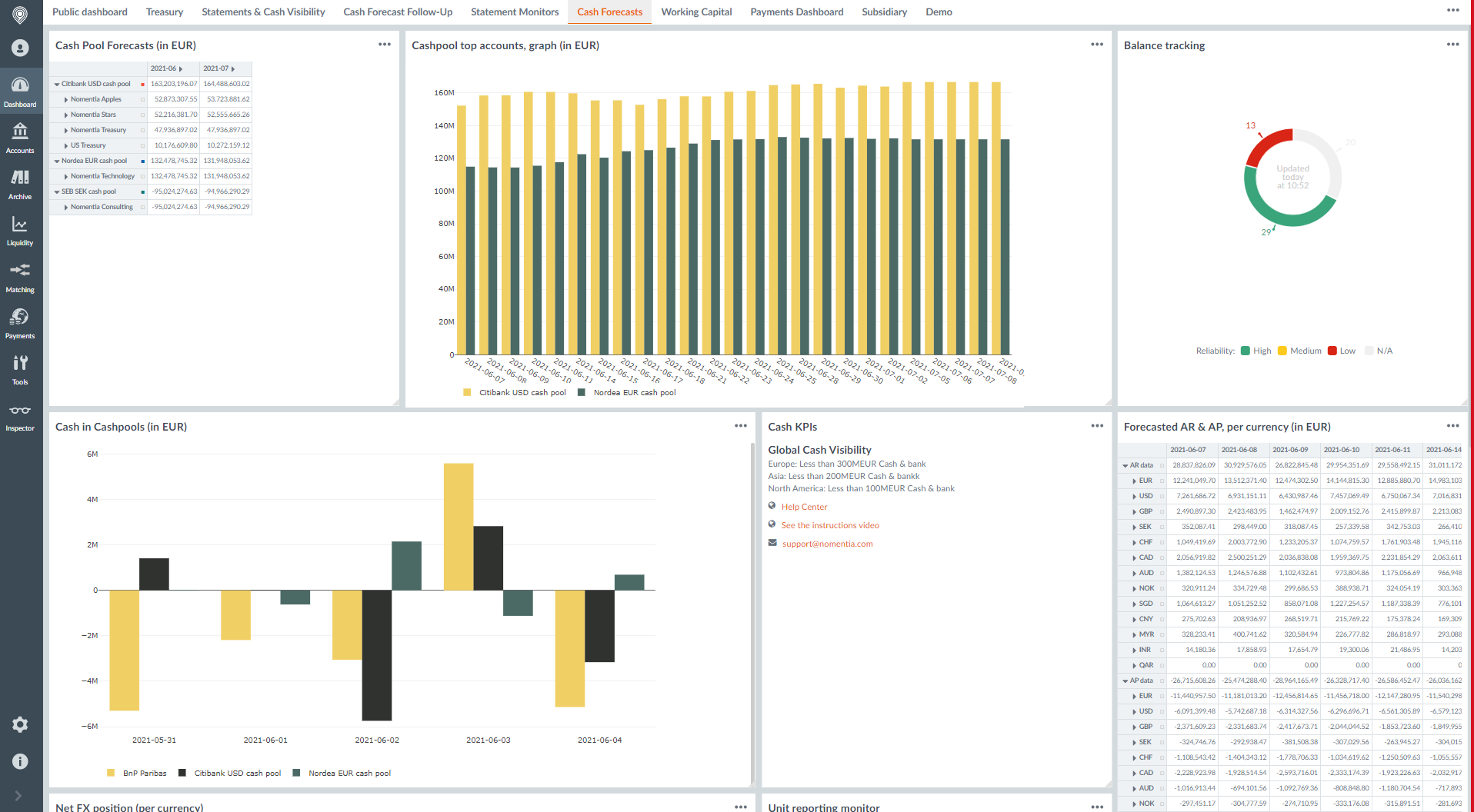

1. NOMENTIA CASH FORECASTING

Nomentia’s cash forecasting SaaS solution allows you to do forecasts as detailed as you require. You can run real-time forecasts continuously based on a collection of all scattered systems that hold your financial data.

The platform works very intuitively, and you can even run simulations for possible scenarios. The data visualization can be customized by yourself or by specialists from Nomentia. In contrast with other vendors, you can only opt for the cash forecasting module without committing to any other modules offered by Nomentia.

2. KYRIBA CASH AND LIQUIDITY

Kyriba has a tool for cash forecasts that combines multiple data sources. They can provide you with daily, weekly, monthly, or yearly cash forecasts.

In their SaaS, Kyriba has a worksheet that can help you automate manual work and connect different systems to each other for better-centralized cash forecasting analyses.

3. GTREASURY CASH FORECASTING

The cash forecasting tool by Gtreasury allows you to combine data into a single worksheet and run different analyses within it. You can run forecasts daily, weekly, monthly, quarterly, or annually.

A recent feature GTreasury introduced is the trademarked SmartPredictions, which can predict future liquidity and changing conditions with the help of data imports and artificial intelligence.

4. COUPA CASH AND LIQUIDITY

Coupa’s treasury solution includes a cash forecasting module that can build scenarios, and do analyses to measure your short, mid, and long-term business liquidity.

The financial data is captured in a reporting functionality that treasury teams can easily analyze and share within the organization. Coupa offers both standard and customized reports.

5. SERRALA CASH MANAGEMENT AND FORECASTING

Serrala offers cash forecasting as part of its bigger cash management solution. The module can be set up for cash flow-based planning categories, scenarios, and simulations.

The solution helps you automate your processes by configuring the settings yourself, and it gives you insight into your cash position through the consolidation of various data sources.

The right tool for your company depends on your needs

A cash flow forecasting tool can be beneficial for you to tackle the manual labor and time consumed due to a lack of centralization. If your set-up is not that advanced yet, you can rely on solutions like spreadsheets or intermediate tools like Power BI, Causal, Sheetgo, or Nomentia Liquidity.

For bigger companies with several source systems, we recommend looking into advanced cash forecasting tools that will significantly decrease your costs. Even if the initial investment of buying such a solution may appear slightly higher.