SEPA Instant Payments – a catalyst for new developments in the payments market (part II)

26-02-2024 | SEPA Instant Payments – a catalyst for new developments in the payments market by François de Witte

26-02-2024 | SEPA Instant Payments – a catalyst for new developments in the payments market by François de Witte

| 28-11-2017 | François de Witte |

In 2018, when PSD2 comes into force, banks will lose their monopoly on payment services and customer’s account details. Bank customers will be able to use third-party providers (TPP) to administer their payments. When a customer agrees on using the services of a TPP, then their bank has to give access to TPPs to their accounts. TPPs are then able to build and offer services that compete with the existing bank services. During the summer 2017, I published a Summer Update on PSD2. Since then, a lot of things have moved, and hence I found it the right moment to provide an update to you on some developments on PSD2, in this area.

In 2018, when PSD2 comes into force, banks will lose their monopoly on payment services and customer’s account details. Bank customers will be able to use third-party providers (TPP) to administer their payments. When a customer agrees on using the services of a TPP, then their bank has to give access to TPPs to their accounts. TPPs are then able to build and offer services that compete with the existing bank services. During the summer 2017, I published a Summer Update on PSD2. Since then, a lot of things have moved, and hence I found it the right moment to provide an update to you on some developments on PSD2, in this area.

Some member states have already advised that they expect delays in the transposition of PSD2 in the national law, e.g. Belgium (by March 2018), the Netherland (by June 2018), Sweden, Poland, Spain and France.

Following countries already announced that they will be on track, e.g. Italy, Finland, Ireland, Czech Republic, Germany and Bulgaria.

By end November the EBA should publish the revised draft on the SCA (Strong Customer Authentication) and Secure Communication. We expect that a number of points, raised by the market participants, will be incorporated in the text.

With regard to the access to TPPs, article 113.4 of PSD2 explicitly states that the member states shall ensure the application of the security measures within18 months following the entry in force of the law. Hence, we might expect that this part of PSD2 needs only to be implemented by Q3 2019. However, in some countries, the authorities are pushing for an earlier implementation (e.g. in Belgium by end Q1 2018). Given the strategic importance and the IT act, I recommend starting this quite soon.

Banks will have to implement interfaces, so they can interact with the AISPs and PISPs. This compliance with PSD2 is mandatory and all banks will have to make changes to their infrastructure deployments.

The challenge is to create standards for the APIs specifying the nomenclature, access protocols, authentication, etc.”. Banks will have to think about how their new API layers interact with their core banking systems and the data models that are implemented alongside this.

A number of working groups were constituted to further elaborate on these standards, the most important ones being the UK’s Open Banking Working Group (OBWG), the Berlin Group, and STET. Experts seem to agree that the Berlin Group Standard is the most elaborate one., as it incorporates the most relevant use cases and has been built with the latest technology standards using REST, OAuth2, JSON and HTTP-signature. It relies on ISO 20022 elements for structuring the data to be exchanged between TPPs and ASPSPs

As Marc Lainez, CEO of Ibanity, part of Isabel Group (developing API and PSD2 solutions for the XS2A and beyond) pointed out: “We can already see a fragmentation on the market. Several groups publishing specifications that are on many points different. With the RTS still being a moving target at the moment, those specifications are also incomplete as some details still need to be clarified. Some banks also choose to implement their own specifications without following closely any of those already published. In engineering, a standard is usually something that emerges through the best practices of an industry, it is not something that can be thought off entirely before it is actually used. At Ibanity, we are convinced that fragmentation will be a reality and several formats and specifications will co-exist on the market for some time. Looking at them from a pure software engineering point of view, we can say that those that seem the closest to what TPPs are actually expecting in terms of API quality are the specifications from the Open Banking Working Group and the Berlin Group. They still need, of course, to be challenged by the market with real use cases.“

The large banks have already started working on being PSD2 compliant and on building for the opening of their banking architecture to the TPPs. However, several small or medium sized banks only started recently on this project.

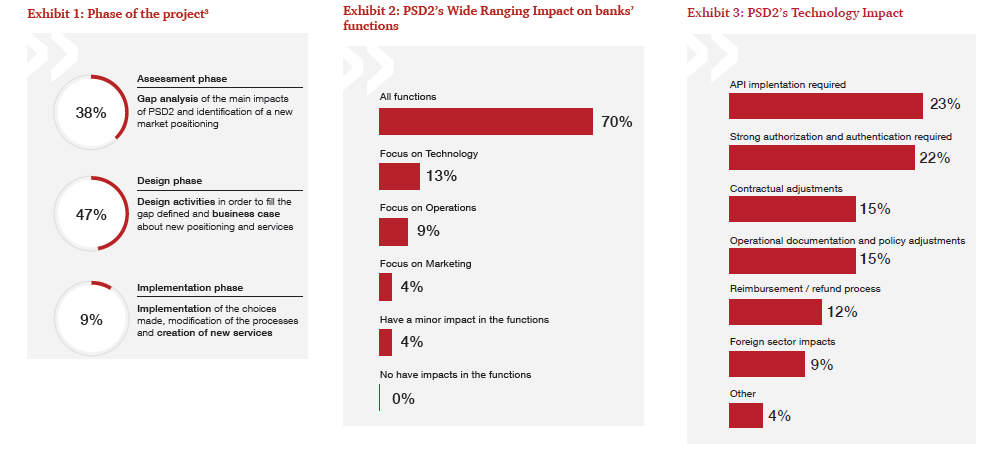

PSD2 has numerous interdependencies with other regulations (such as GDPR and eIDAS Regulation), promising a complex implementation with multiple stakeholders. For many banks, compliance by 2018 will be a challenge. Moreover there is a strong technology impact, adding to the complexity of the project. The following graphs of a market survey of PWC are a good illustration of the current state of the project with the European banks:

The PSD2 creates challenges. Several topics need to be clarified such as the RTS and the market players need also to agree on common standards for the interfaces. Moreover there are some unclarities in the text.

However, there are solutions in the market to withdraw the hassle for Banks and TPPs. The clock is ticking in the PSD race. Consequently, there is no justifiable reason for any bank to delay starting these projects.

François de Witte – Founder & Senior Consultant at FDW Consult and Senior Expert – Product, Business development and sales manager at Isabel Group

François de Witte – Founder & Senior Consultant at FDW Consult and Senior Expert – Product, Business development and sales manager at Isabel Group

[button url=”https://www.treasuryxl.com/community/experts/francois-de-witte/” text=”View expert profile” size=”small” type=”primary” icon=”” external=”1″]

[separator type=”” size=”” icon=””]

| 18-10-2017 | treasuryXL | The Paypers |

Traditionally, banks provided the infrastructure to enable payments to take place. Nowadays, there are many different third party online payment services that compete directly with the bank models. We came across an interesting article detailing the rise of a mobile payment platform with a large customer base in China, which is bigger than well-known services such as Paypal. It is part of the Alibaba Group who already have a large presence in Europe via AliExpress – after making a large impact on European online shopping, will they make an impact on the payments systems?

Traditionally, banks provided the infrastructure to enable payments to take place. Nowadays, there are many different third party online payment services that compete directly with the bank models. We came across an interesting article detailing the rise of a mobile payment platform with a large customer base in China, which is bigger than well-known services such as Paypal. It is part of the Alibaba Group who already have a large presence in Europe via AliExpress – after making a large impact on European online shopping, will they make an impact on the payments systems?

With a customer base 400 million strong, Alipay alone represents 50% of all online shopping in China. As the number of Chinese tourists in Europe increases by 100% annually, this tool is offering a wealth of business opportunities for retailers and e-merchants.

From taxi fare to the water bill, to purchases in small shops, or traffic tickets—online as well as in the physical world—Alipay can be used for almost any transaction. Such incredible flexibility puts this e-wallet at the centre of daily life in China. Witness the staggering figures: over 175 million transactions per day, peaking at one billion orders processed on 11th November 2016, dubbed “Singles Day,” a huge shopping fest organised by Ali Baba since 2009.

Please read more by referring to the original article on The Paypers.

| 17-8-2017 | François de Witte |

Early 2017, I published a post about PSD2, a lot of opportunities, but also big challenges. Now half a year later, I would like to update you on some developments in this area. PSD2 still needs to be transposed in the national legal system of all the member countries, and according to my knowledge several countries, including Belgium, have not yet released the draft laws. This creates quite some uncertainty in the market, as there will be several country-specific specifications. Hence one can expect that Fintech’s and other TPPs might already have started their certification application in countries that already enacted PSD2 in their local legislation.

Early 2017, I published a post about PSD2, a lot of opportunities, but also big challenges. Now half a year later, I would like to update you on some developments in this area. PSD2 still needs to be transposed in the national legal system of all the member countries, and according to my knowledge several countries, including Belgium, have not yet released the draft laws. This creates quite some uncertainty in the market, as there will be several country-specific specifications. Hence one can expect that Fintech’s and other TPPs might already have started their certification application in countries that already enacted PSD2 in their local legislation.

LIST OF ABBREVIATIONS USED IN THIS ARTICLE

2FA: Two-factor authentication

API: Application Programming Interface.

EBA: European Banking Authority

PSP: Payment Service Provider

PSU: Payment Service User

RTS: Regulatory Technical Standards (final draft issued by the EBA on 23/2/2017)

SCA: Strong Customer Authentication

TPP: Third Party Provider

On 23 February 2017, the EBA published the final draft on the SCA (Strong Customer Authentication) and Secure Communication.

In this final draft, the EBA clarifies the new rules to be followed for customer authentication, applicable both for operations performed in traditional channels and over the new API (Application Programming Interfaces) services. The key clarifications concern the following:

Following systems would comply:

1. The 2-device-authentication, where the user has two independent devices:

2. The 2 app authentication:

This approach does rely on two different apps running on the same mobile device.

In order to dynamically link the transaction, the draft RTS states the following requirements must be met:

The exemptions from the SCA including also:

The draft RTS (not finalized, not approved yet) also states that Screen scraping is no longer allowed. Screen scraping is a method to take over remotely the data on the screen of the user. This creates a lot of opposition in the financial community, in particular the Fintech’s, as this complicates the interaction between the bank, the TPP, and the PSU. On the other hand, the both the EBA and the EBF (European Banking Federation) are against it. There is a power game ongoing.

Banks will have to implement interfaces, so they can interact with the AISPs and PISPs. This compliance with PSD2 is mandatory and all banks will have to make changes to their infrastructure deployments.

Although PSD2 does not specifically mention the API (Application Programming Interfaces), most technology and finance professionals assume that APIs will be the technological standard used to allow banks to comply with the regulation.

An API is a set of commands, routines, protocols and tools which can be used to develop interfacing programs. APIs define how different applications communicate with each other, making available certain data from a particular program in a way that enables other applications to use that data. Through an API, a TPP application can make a request with standardized input towards another application and get that second application to perform an operation and deliver a standardized output back to the first application. For example, approved third parties can access your payment account information if mandated by the user and initiate payment transfer directly.

In this framework, the challenge is to create standards for the APIs specifying the nomenclature, access protocols, authentication, etc.”. Banks will have to think about how their new API layers interact with their core banking systems and the data models that are implemented alongside this.

At this stage, following working groups were constituted to further elaborate on these standards:

In the meantime, several providers are developing their services, including in the Benelux Equens Worldine, Capco, Sopra Banking and Isabel.

Along with the arrival of open API banking, there is also clear momentum for providing real-time services such as “instant payments”. This requires banks to shift their entire product and service mindset towards immediate delivery and to make fundamental changes to their legacy systems. While this is a challenge, it also presents opportunities (see also my article in TreasuryXL on this topic: SEPA Instant Payments – a catalyst for new developments in the payments market (https://www.treasuryxl.com/news-articles/francois-de-witte/sepa-instant-payments-catalyst-new-developments-payments-market and https://www.treasuryxl.com/news-articles/francois-de-witte/sepa-instant-payments-a-catalyst-for-new-developments-in-the-payments-market-part-ii/).

The large banks have already started working on being PSD2 compliant and on building for the opening of their banking architecture to the TPPs. However, several small or medium sized banks only started recently on this project. Hence a lot has to be done, and I do expect some shortages in resources in the next coming months.

With regard to the access to TPPs, article 113.4 of PSD2 explicitly states that the member states shall ensure the application of the security measures with the 18 months following the entry in force of the Hence, we might expect that this part of PSD2 needs only to be implemented by mid-2019. Given the strategic importance and the IT act, I recommend starting this exercise much earlier.

The PSD2 creates challenges. Several topics need to be clarified such as the RTS and the market players need also to agree on common standards for the interfaces.

However, there are initiatives, such as the Berlin Group, the UK’s Open Banking Framework and the STET group, which help give further clarity and direction in the absence of specific technical detail.

Consequently, there is no justifiable reason for any bank to delay starting these projects.

The clock is ticking in the PSD race.

If you want further update on this topic, you can join the 1 day training session on this topic, which I will give on 22/11/2017 at Febelfin Academy.

François de Witte – Founder & Senior Consultant at FDW Consult

François de Witte – Founder & Senior Consultant at FDW Consult

[button url=”https://www.treasuryxl.com/community/experts/francois-de-witte/” text=”View expert profile” size=”small” type=”primary” icon=”” external=”1″]

[separator type=”” size=”” icon=””]

Please read my earlier articles on PSD2:

PSD 2: A lot of opportunities but also big challenges (Part I)

PSD 2: A lot of opportunities but also big challenges (Part II)

Sepa instant payments – A catalyst for new developments in the payments market (Part I)

Sepa instant payments – A catalyst for new developments in the payments market (Part II)

[separator type=”” size=”” icon=””]

| 8-8-2017 | Carlo de Meijer |

Early July SWIFT announced that 22 global banks recently joined its Blockchain proof of concept (PoC) initiative introduced in January this year in collaboration with six leading correspondent banks (ANZ, BNP Paribas, BNY Mellon, RBC Royal Bank and Wells Fargo). The PoC is part of SWIFT’s ‘gpi’ (global payments innovation) service, the new standard for cross-border payments, aimed to “re-arm the correspondent banking system for a new age of technological disruption”.

Early July SWIFT announced that 22 global banks recently joined its Blockchain proof of concept (PoC) initiative introduced in January this year in collaboration with six leading correspondent banks (ANZ, BNP Paribas, BNY Mellon, RBC Royal Bank and Wells Fargo). The PoC is part of SWIFT’s ‘gpi’ (global payments innovation) service, the new standard for cross-border payments, aimed to “re-arm the correspondent banking system for a new age of technological disruption”.

This Blockchain PoC initiative is designed to explore whether blockchain technology can help banks to improve the reconciliation of their international nostro accounts in real-time, optimising their global liquidity. If so, that would be a break through event for both SWIFT and blockchain.

Currently, banks cannot monitor their account positions in real-time due to lack of intraday reporting coverage. The present pain points banks currently experience when making cross-border payments center around a lack of visibility into the end-to-end transactions lifecycle. Under the current correspondent banking model, banks need to monitor the funds in their overseas accounts via debit and credit updates and end-of-day statements. The maintenance and operational work involved represents a significant portion of the cost of making cross-border payments.

“Cross border payments are like a black box for us. We don’t know when the funds will be credited, we don’t know what fees will be charged and we also have problems with reconciliation”. states Martin Schlageter, head of Treasury Operations at Swiss healthcare conglomerate Roche.

As such, the POC recognises the need for banks to receive real-time liquidity data in order to manage funds throughout the business day.

The PoC is being undertaken as part of SWIFT gpi, a new service that “may revolutionise the cross-border payments industry by combining real-time payments tracking with the speed and certainty of same-day settlement for international payments”.

The SWIFT gpi should be seen as SWIFT’s response to the problems they faced after a series of attacks events that showed that “all was not as secure as everyone believed”. SWIFT gpi initiative was first announced at the annual Sibos conference in 2015. The project went into live production in January this year to address core problems related to speed, transparency and traceability of cross border payments.

SWIFT gpi not only delivers a much-needed improvement in the speed of transaction, but also improves overall customer experience by creating predictable settlement times and clear statuses, through additional (unaltered transfer of) information on remittances and transparency around the FX rates and fees applied throughout the payment cycle.

“The ability to deliver enhanced remittance information alongside the payment will help customers make better decisions along the payment chain, while also creating better efficiency opportunities. The decision to make gpi available in the “cloud” is also exciting, and we anticipate this will lead to the development of entirely new services, that combine SWIFT gpi with capabilities provided by banks, clients and vendors.“ says Tom Halpin, Global Head of Payments Product Management, HSBC Global Liquidity and Cash Management

Key features of the SWIFT gpi service include a secure tracking database in the cloud accessible via APIs, and enhanced business rules.

Cornerstone of SWIFT gpi is the highly innovative new cross-border TRACKER, a special tracking feature that enables international payments to be traced real-time. It allows banks to provide corporate treasurers with a real-time, end-to-end view (visibility) on the status of their payments, including confirmations of the amount credited to the beneficiaries’ account. The Tracker is available via an open API, making it compatible with proprietary banking systems worldwide – helping to ensure maximum impact of gpi benefits at a greater adoption speed.

A second key feature is the OBSERVER, a quality assurance tool that monitors participants’ adherence to the gpi business rules. Gpi’s transparency ensures that remittance information such as invoice references, is transferred unaltered to recipients.

Membership is open to any supervised financial institution that agrees to comply with SWIFT’s business rules. But also non-bank organisations can join SWIFT gpi initiative. The SWIFT gpi service has received considerable bank support across the globe. And the number of global transaction banks that are actively using SWIFT’s gpi service is continuously growing. Since its launch the number of banks that are live with SWIFT gpi has risen beyond 100, and hundreds of thousands GPI payments have already been sent across 85 country corridors. This represents more than 75% of all SWIFT cross border payments.

“The increasing number of banks going live on this service addresses the demands of corporate treasurers. Hence, banks cannot afford to not join the initiative and go live as soon as possible. Our expectation is that all of our cross-border payments will be end-to-end Swift gpi payments in the future.” Group of Swiss corporates

SWIFT expects that numerous additional banks will join the gpi initiative in the coming months. The ambition is for all countries to be live by the end of 2017.

Next to the design of the second phase of SWIFT gpi, that is already underway focusing on additional digital capabilities and further enhancements such as ‘a rich payment data service’, for its third gpi phase SWIFT started exploring the potential of new technologies such as Distributed Ledger Technology (DLT), including blockchain, through a Proof of Concept (PoC).

Launched in January 2017 with six founding banks the SWIFT Blockchain PoC initiative, designed to validate/explore whether blockchain can be used by banks to improve the reconciliation of their international nostro accounts (these are accounts that a bank holds in a foreign currency in another bank to handle international financial transactions for their customers) (these are accounts that a bank holds in a foreign currency in another bank to handle international financial transactions for their customers) in real –time, optimising their global liquidity. At its core, the PoC builds on SWIFT’s rulebook as part of the intraday liquidity standard gpi.

This SWIFT Blockchain PoC initiative aims to help banks overcome significant challenges in monitoring and managing their international nostro accounts, which are crucial to the facilitation of cross border payments.

“Whilst existing DLTs are not currently mature enough for cross-border payments, this technology, bolstered by some additional features from SWIFT, may be interesting for the associated account reconciliation,” “This PoC gives us the opportunity to test DLT and determine if it can be applied to this particular use case.” Wim Raymaekers, Head of Banking Market and SWIFT gpi at SWIFT

In developing the POC, SWIFT is leveraging the Hyperledger Fabric v1.0 technology, and combining it with key SWIFT assets, to bring it in line with the financial industry’s requirements.

“SWIFT will leverage its strong governance, PKI security scheme, BIC legal identifier framework and liquidity standards expertise to deliver a distinctive DLT PoC platform for the benefit of its community.” Damien Vanderveken, Head of R&D, SWIFTLabs and User Experience at SWIFT

The PoC application will use a private permissioned blockchain in a closed user group environment, with specific user profiles and strong data controls. User privileges and data access will be strictly governed. This to ensure that all the information related to nostro/vostro accounts is kept private. Only account owners and its correspondent banking partners will see the details.

SWIFT gpi member banks can apply to participate in this Blockchain PoC. Next to the 6 founding banks, another 22 banks have recently joined the SWIFT blockchain PoC. They include include:

ABN AMRO Bank; ABSA Bank; BBVA; Banco Santander; China Construction Bank; China Minsheng Banking; Commerzbank; Deutsche Bank; Erste Group Bank; FirstRand Bank; Intesa Sanpaolo; JPMorgan Chase; Lloyds Bank; Mashreq Bank; Nedbank; Rabobank; Société Générale; Standard Bank of South Africa; Standard Chartered Bank; Sumitomo Mitsui Banking Corporation; UniCredit; Westpac Banking Corporation.

“Collaboration is the cornerstone of innovation,” “This new group of banks allows us to greatly extend the scope of multi-lateral testing of the blockchain application and thus adds considerable weight to the findings. We warmly welcome the new banks and look forward to their insights” says Wim Raymaekers, head of banking markets and SWIFT gpi at SWIFT.

Moving forward, the SWIFT PoC Blockchain application will undergo testing, with the results scheduled to be published in September and presented at Sibos in Toronto in October. Working independently of the founding banks, the 22 institutions will act as a validation group to test in a deeper way the PoC’s Blockchain application, that is currently under development by SWIFT and the group of six founding banks. They will evaluate how the technology scales and performs.

For banks

The potential business benefits ensuing from a successful SWIFT blockchain POC may be significant. If it proves to enable banks reconcile those nostro accounts more efficiently and in real time, that may lower costs and operational risk.

“The potential business benefits ensuing from the PoC are clear,” “If banks could manage their nostro account liquidity in real-time, it would allow them to accurately gauge how much money is required in each account at any given point, ultimately enabling them to free up significant funds for other investments.” Damien Vanderveken, head of R&D, SWIFTLab and UX at SWIFT.

It brings together banks worldwide who want to offer an enhanced cross-border payments experience to their corporate clients. By being part of SWIFT gpi, banks may improve the quality of their correspondent relationships and networks, helping to reduce risks and management costs and improve compliance.

“Transparency is key to a good end-to-end client experience. SWIFT gpi is a significant step in the evolution of correspondent banking, which remains the primary means through which cross-border payments are delivered worldwide. Bank of America Merrill Lynch is pleased to be working with like-minded institutions around the world to better serve each other and our respective customers.” states Greg Murray, head of Global Product Management for High Value Payments and FI/NBFI Products in Global Transaction Services at Bank of America Merrill Lynch.

For corporate treasurers

SWIFT gpi may enable corporates engaged in international trade to get paid for services, or delivery of goods, in a more timely fashion, enabling a faster supply chain process. It also enables a more accurate reconciliation of payments and invoices, optimizes liquidity with improved cash forecasts and reduces exposure to FX risks with same-day processing of funds in the beneficiary’s time zone.

“Being part of SWIFT gpi, and working with our industry counterparts, is giving correspondent banks a platform to examine and refine current processes, and to collaborate and explore different, more efficient ways of doing things. Ultimately, our clients will benefit most from this initiative,” Kent Marais, head of TPS product management at Standard Bank SA.

SWIFT and the banks have designed the gpi services so that banks have flexibility in how they offer the new services. They can deliver the gpi service in very different ways. Services could potentially include enhanced invoice presentment and reconciliation to facilitate financial supply chains, exchange of supply chain documentation to improve global trade, exchange and interactive enquiry of account and processing conditions to improve end-to-end straight through processing, and providing additional party and transaction information to support compliance and sanctions screening of cross-border payments.

“SWIFT has addressed several of the pain points corporates have had with cross-border payments,” “Changes to existing corporate payments infrastructures should be very limited, if any. So hopefully, corporates won’t need to make any major investments to benefit from smoother cross-border payments.” says Magnus Carlsson, AFP’s manager of treasury and payments

Given the size of the number of banks and corporates participating in SWIFT gpi, the SWIFT Blockchain PoC may face the challenge of scalability. If that could be solved in a successful way it may be another prove of the viability of blockchain and DLT to enhance cross-border payments.

Economist and researcher

More on blockchain from this author:

Blockchain: accelerated activity in trade finance

Blockchain and derivatives: Re-imagining the industry

The digital trade chain: The blockchain train is rolling

Please feel free to visit the treasuryXL/articles page to see more articles.

| 2-8-2017 | Hans de Vries |

Banks have long been target of wild spread ideas that their role as facilitator in the (inter) national money transaction industry will soon be overtaken by new Fintech initiatives like PayPal, Bitcoin and recently Ethereum. The idea behind these new technologies is that the Trusted Third Party (TTP) role of the conventional banks which is crucial for the operational day to day operations of the economic systems can be overtaken by the new block chain technology. Main advantages are clear: transactions are no longer limited by timing (no dependency on the operational boundaries of clearing houses, cut-off times of banks per currency, immediate processing etc), account opening procedures at the banks, the costs involved in maintaining accounts and transactions themselves etc.

Banks have long been target of wild spread ideas that their role as facilitator in the (inter) national money transaction industry will soon be overtaken by new Fintech initiatives like PayPal, Bitcoin and recently Ethereum. The idea behind these new technologies is that the Trusted Third Party (TTP) role of the conventional banks which is crucial for the operational day to day operations of the economic systems can be overtaken by the new block chain technology. Main advantages are clear: transactions are no longer limited by timing (no dependency on the operational boundaries of clearing houses, cut-off times of banks per currency, immediate processing etc), account opening procedures at the banks, the costs involved in maintaining accounts and transactions themselves etc.

The recent Ransomware attacks, that had an enormous impact on numerous companies and governmental institutions at a global level, showed however a less favorable aspect of this new technology. Due to its lack of control on the specifics of account ownership, Bitcoin proved to be the ideal means to collect the ransom money the victims have to pay to free their systems. This piracy trend will in my view also seriously hamper the future development of these sort of bank independent transaction mechanisms. Even more threatening for the Bitcoin development are the recent crypto robbery cases in which millions of dollars’ worth balances were stolen from the accounts. These incidents show the vital role of the banks as TTP since most banks are obliged to deliver their services according to the rules and regulations of their national and super-national banks. As indicated before, this means that for opening accounts lots of formalities have to be endured (the KYC rules are in some countries stretched to the absolute max). At the same time., due to the international regulations the control on international transactions are very extensive and therefore at the same time very costly for the banks. Every violation of the international code book on transactions to banned countries can have severe financial consequences for the banks involved. An last but not least banks have to maintain an international network of correspondent banks to make sure that the international transactions reach their beneficiaries in a reasonable timeframe and at reasonable costs.

This whole system has of course been developed to gain maximum control on transaction flows locally and worldwide. However it also provides the trust needed to be able to deal with (inter) national trade flows crucial to our economic day to day operations. As long as there are no ways to secure your transactions and balances in a bitcoin like environment as most transaction banks are providing today, Bitcoins remain a very interesting technological experience but will in no way replace the role of banks as TTP shortly.

Treasury/Cash Management Consultant

More articles of this author:

Will the European banks strike back?

The Euro from a treasury perspective

New norms in banking: More than 30 new areas emerging. Pick your fights!

| 31-7-2017 | Jan Meulendijks | Finextra |

Instant payment services become more popular. UniCredit is testing the EBA Clearing’s RT1 real-time platform and preparing for the roll out of this service to 30 banks in Italy and Germany. Last week Finextra published an article about this development. Our expert Jan Meulendijks gives his opinion about the EBA Clearing’s RT1 real-time platform.

Instant payment services become more popular. UniCredit is testing the EBA Clearing’s RT1 real-time platform and preparing for the roll out of this service to 30 banks in Italy and Germany. Last week Finextra published an article about this development. Our expert Jan Meulendijks gives his opinion about the EBA Clearing’s RT1 real-time platform.

EBA’s RT1 is a probably a life-saving step for the banking/financial world as we know it today. SEPA was of course a major improvement in speeding up cross-border EURO-payments, but still the clearing process and therefore also the required processing time, was rather something from the 20th century and not up to today’s technical standards.

Without RT1 (and maybe similar developments yet to come) the banks are about to lose their payment processing activities and the related profits to other parties, mainly in the public domain (Blockchain) and ITC-sector. Microsoft, Google and Apple are names that will be appearing in this industry.

Remarkable: Italian banks seem to be fore-runners in joining RT1. Italy has always been infamous for the archaic infrastructure of their local and cross border payment systems. The slogan “what is backward will become forward” seems to apply here.

Jan Meulendijks – Cash management, transaction banking and trade professional

Jan Meulendijks – Cash management, transaction banking and trade professional[button url=”https://www.treasuryxl.com/community/experts/jan-meulendijks/” text=”View expert profile” size=”small” type=”primary” icon=”” external=”1″]

[separator type=”” size=”” icon=””]

More articles that might be interesting to read:

SEPA Instant Payments – a catalyst for new developments in the payments market (part I)

Instant payments for treasurers

Instant Payments: the SEPA Instant Payments rulebook is published, what’s next?

[separator type=”” size=”” icon=””]

| 19-7-2017 | François de Witte |

On 29 June 2017, I attended a workshop organized by Fintech Belgium on how Instant Payments will push the financial sector to innovate. In this article (the first part of 2) I will set the scene by presenting some use cases. In the second part (online next week) I share some views on how Instant Payments, in combination with PSD2, will be a game-changer in the market.

On 29 June 2017, I attended a workshop organized by Fintech Belgium on how Instant Payments will push the financial sector to innovate. In this article (the first part of 2) I will set the scene by presenting some use cases. In the second part (online next week) I share some views on how Instant Payments, in combination with PSD2, will be a game-changer in the market.

The new generation customer claims “I want it all, and I want it now”. It is his anthem for having packages delivered, ordering food or finding a taxi driver. Payments are next, and they expect the financial industry to follow by offering real time or near real time experience.

As opposed to real-time payments with smartphones, transferring money between banks or cross-border payments often takes several days to be processed. For this reason, the EPC (European Payment Council) decided to introduce SCT Inst scheme: a real-time payment system where interbank transactions will be cleared within maximum 10 seconds at any time of the day and 365 days of the year. Similar schemes were already successfully put in place in other states (e.g. Denmark, Sweden and the UK).

As already mentioned by Boudewijn Schenkels on TreasuryXL, the characteristics of the new SEPA Instant Credit Scheme are the following:

The scheme should be operational in November 2017, but in some countries it is already live (e.g. Finland and Spain). Besides the processing, an important aspect is to ensure that the beneficiary is advised.

As Alessandro Longoni outlined earlier on treasuryXL, both from a cash management, and from a treasury perspective, Instant Payments open many new possibilities both for merchants, and corporates.

Thanks to its irrevocability, the SCT Inst will also be a disruptor for existing PSPs such as Paypal and Amazon Pay. It is expected that the banks will charge much lower fees then them. We might also expect that this scheme would also challenge in the cards market, where new players could benefit from both PSD2 and SCT Inst to offer more competitive payment schemes. However the card operators might also react by adapting their prices and/or offering additional new services.

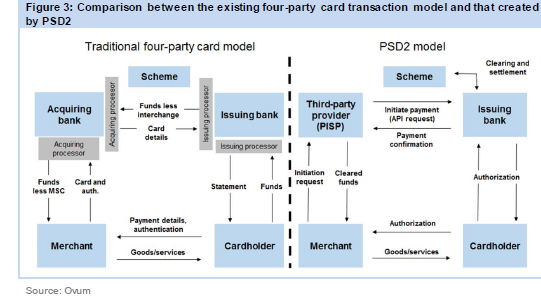

For the banks, merchants, and the payment industry more widely, the PISP (Payment Initiation Service Provider) model will have a significant impact on the way in which consumers and merchants transact in the future. Unlike the traditional four-party card model, customers would “push” cleared funds to merchants, with ACH transactions replacing the current card CSM (Clearing & Settlement Mechanism). This will significantly simplify the existing payment model, with fewer players and interactions involved.

The drawing down below illustrates this quite well:

Source: OVUM – Instant Payments and the Post-PSD2 Landscape

We also expect that thanks to the new schemes and competitors, the use of cash will decrease, although cash will remain important for a while. Cash is accessible to all, also those who do not have a bank account. It enables immediate settlement without intervention of a third party. Cash is the only payment instrument that currently guarantees the user’s privacy and anonymity, while all electronic transactions are traceable.

In the second part of this article, which will be online next week, I will tell you more about instant payments as a game changer.

François de Witte – Founder & Senior Consultant at FDW Consult

François de Witte – Founder & Senior Consultant at FDW Consult

[button url=”https://www.treasuryxl.com/community/experts/francois-de-witte/” text=”View expert profile” size=”small” type=”primary” icon=”” external=”1″]

[separator type=”” size=”” icon=””]

More articles from this author:

Treasury for non-treasurers – cash conversion cycle and working capital management

Flex Treasurer – Besparing na een Treasury Quickscan: nog meer praktijkvoorbeelden

[separator type=”” size=”” icon=””]

| 9-5-2017 | Patrick Kunz |

We cannot switch on the news without hearing about technological advancements which, supposedly, make our lives easier, better or smarter. We all embrace these, get used to them and cannot do without them anymore. Sometimes we think back to the time before these advancements and cannot image how we lived without them. The same applies to treasury.

I am 35 years old; my experience in treasury was always linked to IT. I sometimes hear stories from older treasurer who worked without computers, later tabulating/punch cards and still managed to do a good job in their field. Of course times have changed; information is faster than in these days and also the need to process it. We all had to embrace the new technology. In this blog I will try to analyse the link between IT and treasury and try to make predictions about the future or at least where I wish the future would go (in treasury terms).

In the old days payments were a manual process with people entering them in the banking system or sending them to the bank via fax. Nowadays, we link our ERP system with the banking system and have a batch file automatically added to the bank. With bulk payments a payment hub can be used which will make the whole process bank independent, fast and cheap. If wanted and needed the whole process can be made straight-through by automating it from creating a payment to approving it.

The future will make payments even faster (instant payments should be possible in the sepa region from November onwards), cheaper and more bank independent (PSD2 regulation allows non banks to link with your bank and provide (payment) services). Maybe we will be using our facebook account for payments sooner or later. Bitcoin could be an alternative payment currency and/or be used to hedge non deliverable currencies (to achieve this the volumes need to increase significantly).

An important part of the treasurers work is risk management. Hedging FX, interest rate, commodity prices are daily business for a treasurer. Doing the deal is easy, doing the right deal is more difficult. A treasurer can only hedge correctly if he knows what he is hedging: the exposure. To know the exposure information of the business is key. The reason for the exposure originates in sales (FX) or procurement (FX and Commodity). These departments need to be aware that the actions they take might have consequences for the treasurer and therefore the treasurer needs to have some information. I have been at companies where sales was daily generating a lot of USD exposure at a EUR company. They were supposed to let finance know about positions. Often this was done at day’s end or forgotten and done a day later. Result: an exposure on USD without the treasurer knowing it; a risky position. IT helped to fix this. Sales entered a deal in a program and the relevant FX exposure was automatically shared with the treasurer via an API to the Treasury Management System. The treasurer could decide directly whether he needed to hedge or not and even aggregated deals to get better rates at the bank. For small deals a link was set up with a FX trading platform to STP them at the best rate.

The future in risk management will be even more automation within the company (internal) but also with connections to banks and risk solution providers. Prices are becoming more transparent due to the fact that bank independent solutions are available which compare prices, in real time. Risk management sales is becoming less a bank business. Brokers are having less hurdles to enter the market, due to IT platforms in the cloud. Why pick up the phone and call your bank for a EUR/USD quote when you can compare prices via an online platform and directly trade it? Often you don’t even have to settle via your own bank accounts but you can have it directly sent to your customer or supplier.

For Trade Finance blockchain will become the new standard. The financing and shipping of commodities is a rather paper based process which is inefficient and slow. Blockchain could automate and improve the speed massively. The challenge to achieve this is big as there are many parties involved, but initiatives have started so the future is beginning now.

As above examples show information is key to a treasurer. Even more so, as treasury is often a small team and most of the information comes from other departments. To get this information the treasurer can use several nice IT solutions. The ERP systems helps, but the treasury needs to know where to find the information. A treasury management system is often used to sort all treasury related information. TMS can link with ERP systems or other systems to gather information. The TMS will sort this information so that the treasurer is well informed and can make decisions. When I started in treasury 10 years ago the market for TMS was small; systems were expensive and limited in use (payments only, fx only etc). Nowadays a TMS does not have to be expensive anymore. A SME (Small medium enterprise) could use it to upgrade their treasury information. Most TMS can be used for all aspects of treasury (cash Management, risk management, corporate finance, guarantees etc). This will give the tech savvy treasurer an edge. The treasurer with most information can make the best decision. In treasury taking decisions while being well-informed often means either costs saving (e.g. better cash position, lower working capital) or lower risk. The IT savvy treasurer contributes to an optimally functioning company; he/she should be considered a business partner; he knows your cash position, your risk position and your balance sheet, hopefully in real time at all times.

Treasury, Finance & Risk Consultant/ Owner Pecunia Treasury & Finance BV

Other articles of this author:

Flex Treasurer: The life of an interim treasurer

How much are you paying your bank?

| 31-03-2017 | Alessandro Longoni |

Building on the ideas shared in a previous article about Cash Conversion Cycle on treasuryXL, this piece focuses on the developments that new European laws will bring in the areas of Instant Payments and how this will affect Treasury.

Building on the ideas shared in a previous article about Cash Conversion Cycle on treasuryXL, this piece focuses on the developments that new European laws will bring in the areas of Instant Payments and how this will affect Treasury.

As part of further standardization within the union, European regulators mandated the industry to develop an “instant payments” product aimed to making the funds available on the receiving side “within a maximum execution time of ten seconds”. The SCT Inst scheme has been developed to allow for consumer payments (C2C, C2B) in Euro for the SEPA and will be an optional scheme – meaning that PSPs and Banks are not obliged to join.

From a cash management perspective, Instant Payments open an array of new possibilities for merchants, especially for those operating eCommerce operations. Currently if a customer places an order on a friday late afternoon, the funds are made available (earliest) on monday evening, while the order is most likely processed and delivered by Saturday afternoon. With SCT Inst, if the order is placed on friday at 21:00, the funds will be received (maximum) at 21:00:10 and already available to pay suppliers if needed.

From a treasury perspective, Instant Payments will also allow for more transparency on transactions and easier reconciliation, but time needs to be devoted to update the current tools to facilitate for this. As Instant Payments will gain customer adoption, the incoming payments cash account will be filled with hundreds or thousands of transactions per day, as opposed to one per day coming from your Payment Service Provider. Having direct access and insight in each single transaction will make it easier to reconcile it with the relative order, check the amount and book it in the general ledger, but the sheer number of lines in the system requires current tools to be updated to cope with the increased volume and speed.

There are several benefits this new payment method brings to the table, including a strong reduction of working capital trapped to fund operations, however, in order to extract all the benefits, ERP systems need to be updated to check the status of transactions in real-time instead of intervals. Without investing in developing the current tools further, companies risk missing out on the new opportunities to deliver better customer service and create additional efficiencies in cash management.

Alessandro Longoni

Managing Consultant at Proferus