| 14-8-2017 | Rob Beemster |

Many negative issues surround the President of the United States. Approval rating hits new low, surprise on his erratic conduct seems to grow daily. Trump is a unique politician. He is incomparable to any other western political leader. I want to pinpoint his monetary policy in 2017, by looking at the pattern of the dollar so far this year.

The dollar in 2017

Currency pair January 2017 August 2017 Relative decrease USD

EUR/USD 1.05 1.18 12.4%

AUD/USD 0.72 0.80 11.1%

GBP/USD 1.22 1.32 8.2%

USD/JPY 1.18 1.10 6.8%

USD/CNY 6.96 6.70 3.7%

Maybe Mr Trump does have a foreign economic policy.

He sees the results of Chinese manipulation and soft American response as an unfair trade relationship. The President of the US must do something about these unbalances. At least, this is how Trump judges.

Let’s take into account this Potus is a streetfighter. Long bilateral meetings with the Chinese are not options for Trump. Fast and furious, that it is: Bring the dollar down!!

And this is going on for half a year now. It is going the Trump way. Tough (but efficient)!

How to see the future value of the dollar?

The current outlook for the dollar against its main trading relations is related to some issues:

– Process of QE by ECB, and Euro interest rates

– North Korea

– China’s position in this geopolitical stress

– Economic conditions of the US

– Economic conditions of the main trading partners of the US

These are very important to determine the future value of the dollar. But this is the holistic view, we are all used to. Let’s be flexible and take a different stance. Just conclude as Trump will do. Be his alter ego.Then the most important issues are:

– Pattern of the Euro against the dollar and the bilateral trade balance between US and Germany

– China’s reaction to a lower dollar

– US trade balance

– US corporates repatriation of overseas cash

– US investments to produce within America

– FDI (Foreign Direct Investment) in America

This is a totally different scope. If we want to understand Trump, then we have to use his view on the international arena. The above mentioned bullet points are crucial. All can easily be measured, Trump loves that. I would like to go through these points to be able to clarify the possible outcome of the dollar for the coming time.

Pattern of the Euro against the dollar and the bilateral trade balance between US and Germany

The more than 12% revaluation will have a serious impact on the trade balance between US and Germany. When the correction emerges, Trump might temper his view on Germany. When we notice correction in the trade data, the dollar has gone far enough…

China’s reaction to a lower dollar

So far the yuan has gained some territory but not as much as other major currencies rose against the dollar. How will PBOC and the Chinese Government react on Trump’s wishes to correct the trade balance by a devaluation of the dollar against the yuan? If they take action on Trump’s stated requirements, whatever this may be, then pressure may diminish.

US trade balance

For many years the US faces a deficit on its trade balance. The more than $500 billion yearly shortage is a notable pain point. If a remarkable achievement can be noticed on short term, a more relaxed dollar attitude may be expected.

US corporates repatriation of overseas cash

In history, attempts have been organised by US governments to return overseas cash of US corporations. During President Bush jr Presidency, corporations did repatriate cash. When Trump does decrease the corporate tax tariff to 15% and he rewards the US corps to transfer their money back to the US without any other penalty payments, a large repatriation may get going. Many of these funds will until now be held in local currencies, so a switch to the dollar may occur.

US corps return back to America

Trump has ordered US companies to produce in the US instead of overseas. If he becomes successful by bringing factories back to the US, the trade balance will shift, employment will improve. Also when large repatriation is done, these funds can be invested in local factories.

FDI in America

Many non-US corporations are scared by the threat of the US government that regulations like import tariffs and other taxes may be charged on imports. It will damage the advantage corporations have experienced last couple of years due to the high dollar. If special import tariffs are installed, investments may be done in the US to avoid these special expenditures. Onshore producing on American soil will become an alternative.

How to manage this?

Foreign currency management has always been a hard part of the international business. Currency moves are unpredictable. But since Trump, one has to be aware of non-economic issues as well. Note that all the above mentioned issues can have effect on the value of the dollar. Professional guidance of your flows is becoming more and more important. Barcelona valuta experts helps you to install a decent strategy to counter unpredicted events. We guide you in protecting the cash flow.

Rob Beemster

Owner of Barcelona valuta experts BV

It is the talk of the town – US 10 year Government bond yields are rising and testing the perceived psychological level of 3 per cent. At the same time the whole yield curve is flattening – the spreads are diminishing. There are growing concerns about rising inflation, along with fears of trade wars and rising oil prices. When the threat of inflation occurs, there is a selloff in bonds and their yield goes higher. At the same time as the yield curve is flattening there is talk of the yield curve becoming inverted which, historically, is seen as the precursor to a recession. Conflicting signals – what does it all mean?

It is the talk of the town – US 10 year Government bond yields are rising and testing the perceived psychological level of 3 per cent. At the same time the whole yield curve is flattening – the spreads are diminishing. There are growing concerns about rising inflation, along with fears of trade wars and rising oil prices. When the threat of inflation occurs, there is a selloff in bonds and their yield goes higher. At the same time as the yield curve is flattening there is talk of the yield curve becoming inverted which, historically, is seen as the precursor to a recession. Conflicting signals – what does it all mean? Whenever entering into transactions with banks, both parties need to know and understand what they are trading. A relatively simple transaction like a FX spot has few terms – you buy one currency against selling another currency at an agreed rate and an agreed settlement date. The only other major factor relates to where the settlement has to take place – on what bank account are you receiving and to what bank account do you have to pay the counter currency.

Whenever entering into transactions with banks, both parties need to know and understand what they are trading. A relatively simple transaction like a FX spot has few terms – you buy one currency against selling another currency at an agreed rate and an agreed settlement date. The only other major factor relates to where the settlement has to take place – on what bank account are you receiving and to what bank account do you have to pay the counter currency.

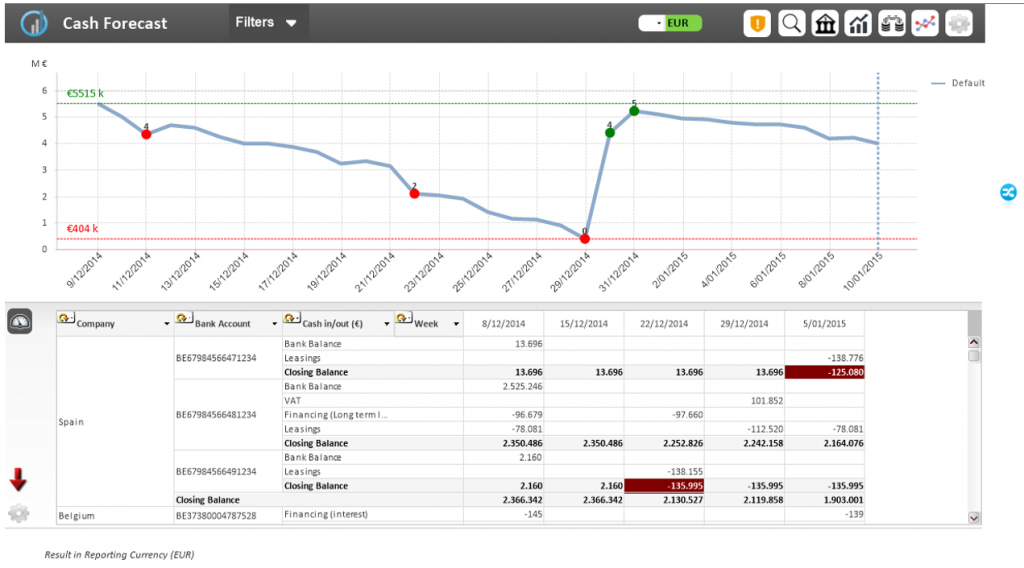

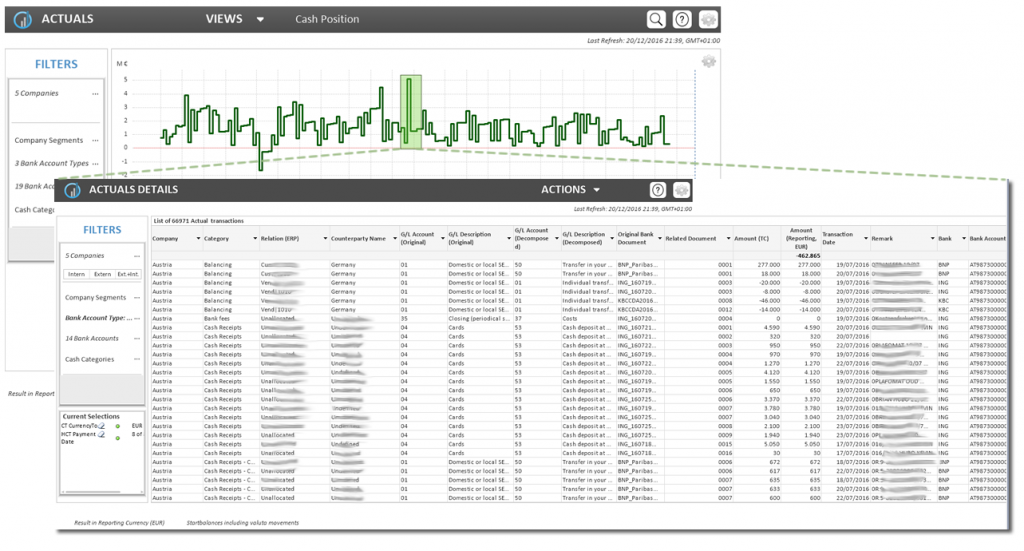

While the role of the treasurer is changing, it becomes increasingly challenging to maintain the current workflows and simultaneously take on new demanding tasks. One of these often manual and time-consuming tasks is risk management. As seen in, among others, this year’s Global Treasury Benchmark Survey of PwC, the registration and management of financial instruments stands among the top 3 challenges on the agenda of the surveyed treasurers. In this article, we take a more in-depth look at possible optimizations in some key treasury workflows.

While the role of the treasurer is changing, it becomes increasingly challenging to maintain the current workflows and simultaneously take on new demanding tasks. One of these often manual and time-consuming tasks is risk management. As seen in, among others, this year’s Global Treasury Benchmark Survey of PwC, the registration and management of financial instruments stands among the top 3 challenges on the agenda of the surveyed treasurers. In this article, we take a more in-depth look at possible optimizations in some key treasury workflows.

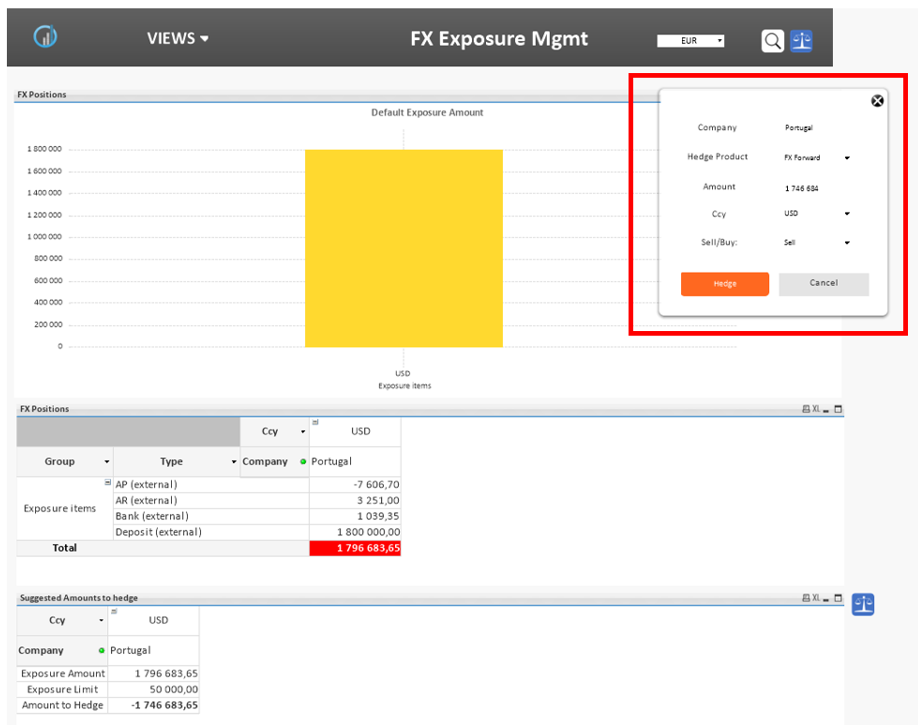

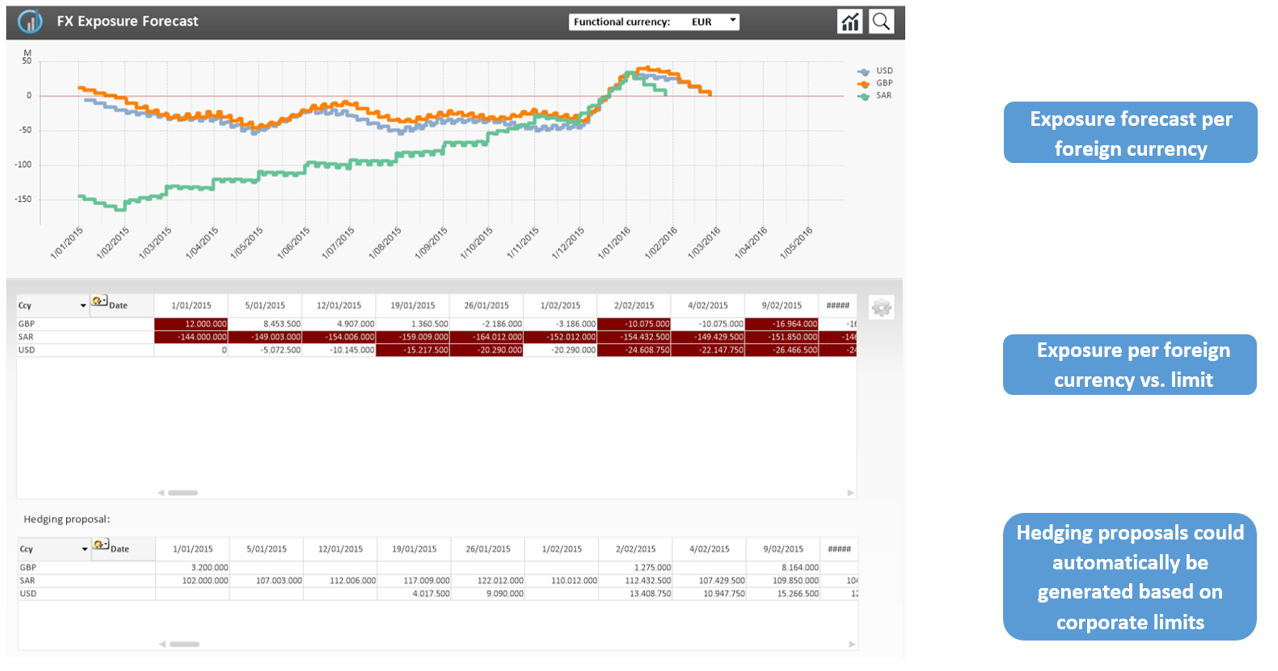

FX Exposure Management – Future positions & exposures

FX Exposure Management – Future positions & exposures