My Currency Fundamentals for SMEs

| 24-12-2019 | by Pieter de Kiewit |

My Very Practical Currency Fundamentals for SMEs

In 2016 I informed you about my baby steps in dealing with foreign exchange exposure in a “baby steps article” on this platform. I was about to receive Euros from Switzerland and had to pay in GBP (British pounds) into the UK. Two things I learned about the fees of big banks if you transfer internationally into another currency:

- There is a transaction fee if you transfer money into another currency, in most cases a flat fee;

- The bank takes a percentage from the total amount to make GBP out of Euro.

My solution at the time was to open a GBP account to avoid both these costs. There is a monthly fee for this bank account and some simple math showed that was the way to go. Currently GBP is relatively strong and I do not expect any UK assignments shortly, so I have decided to close down the account. Time to dig in again. I have struggled with three major considerations.

Transferring GBP into Euro: struggling with the spread

If you go onto the internet to find out what the current exchange rate between two currencies is, you get a number like 1 GBP equals 1.20 Euro. So far so good. Banks and other financial services providers work with a so-called spread. They deserve a reward for their services so the price they pay for your GBP is lower than the price you pay them if you buy a pound from them. The spread is the percentage over and under the number you will find on the internet.

I am not here to endorse any businesses but I can tell you that the percentages can differ substantially. One provider asked 0.7%, the second 0.3%. The second provider does not charge a transaction fee, the first one does. If the amounts are substantial and your margins are thin, this difference can be substantially!

The hassle

When I choose for the second provider, I have to open a new account, remember new passwords, hand in documentation and think about if I can trust them. In short: a hassle.

With my first provider I have relationship of decades. I decided to ask them if there would be a chance that they would lower their prices. As I am a small business owner, I do not have a contact person anymore. I sent three emails to three different mail addresses. The first was not answered, the second was answered with “I cannot help you” and upon mail number three I received a call. The service agent mentioned she could not help me but I should call a colleague at 3:30 pm and then I would be put in the waiting line. Call me old-fashioned but that is not how I want to work. So that is what I told her. I noticed she really wanted to help but at the end of the day I got the message that my transaction was not in the millions so I would not receive an answer and there was no price-lowering. Ok.

I am not a fan of bank bashing and think they do important work. And we do not want to pick up every recruitment assignment. It is not in our interest but also not in the interest of the potential client. I would have appreciated a better line of communication.

The Market

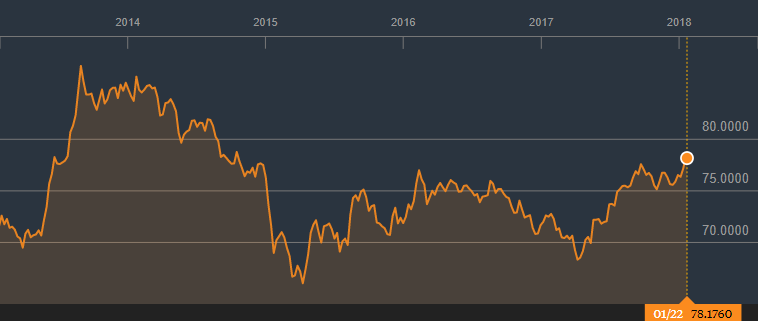

As you might have noticed, I do like my cost savings but let’s be practical. This year the conversion rate GBP – Euro has been at its’ lowest at 1.06 and at its’ highest at 1.20. So there is a difference of 0.14. The difference in the conversion rate has been 0.4%. I now chose to invest time in how to do the conversion and with which provider. Market study, good timing and luck are much better ways to optimize your returns.

Final remarks

If you, as an entrepreneur, have to deal with foreign exchange rates it is good to know how the cost structures of banks are. Also it is good to know there are alternative service providers like XE, Ebury, NBWM and Global Reach Group. If your time is limited and the number of transactions low, dig in once and decide what works for you. If you have regular and/or substantial transactions, it makes sense to keep the topic on the agenda. In that case it might be useful to gather further information and consider risk mitigating strategies and learn more about hedging, derivatives, spots, forwards, et cetera. If you want to, I can open my network for you.

Good luck and I would like to read about your experiences,

Pieter de Kiewit

Owner Treasurer Search

Christine Lagarde – the chief of the IMF – stated recently that the Eurozone countries should set up a “rainy day” fund that could be used to protect the countries in a time of economic turmoil. As the IMF is seen as the lender of last resort to the world, her words carry weight. Economies are subject to a cyclical motion – going from bad to good and then back down again. Her opinion is that closer integration is needed between the Eurozone countries to protect them from the inevitable downturn when it arrives.

Christine Lagarde – the chief of the IMF – stated recently that the Eurozone countries should set up a “rainy day” fund that could be used to protect the countries in a time of economic turmoil. As the IMF is seen as the lender of last resort to the world, her words carry weight. Economies are subject to a cyclical motion – going from bad to good and then back down again. Her opinion is that closer integration is needed between the Eurozone countries to protect them from the inevitable downturn when it arrives. There are many reasons for the creation of the Euro – mainly linked to memories of senior politicians who had experienced the Second World War, together with the fall of the Iron Curtain. Countries that trade together, share institutions, and a common currency, are less likely to declare war on each other seems to be the thinking. Furthermore, statesmen explained that economic and monetary union would lead to greater prosperity, increased employment opportunities for citizens and a higher standard of living. Cohesion, convergence, increased wealth and peace were certainly attractive points. So why, after 19 years, have the countries not achieved more convergence?

There are many reasons for the creation of the Euro – mainly linked to memories of senior politicians who had experienced the Second World War, together with the fall of the Iron Curtain. Countries that trade together, share institutions, and a common currency, are less likely to declare war on each other seems to be the thinking. Furthermore, statesmen explained that economic and monetary union would lead to greater prosperity, increased employment opportunities for citizens and a higher standard of living. Cohesion, convergence, increased wealth and peace were certainly attractive points. So why, after 19 years, have the countries not achieved more convergence? There has been a significant rise in the value of the EUR in the last year compared to the USD. From a low of USD 1.05 around the end of February 2017, the EUR has climbed up to USD 1.25 – representing an increase of around 20 per cent. Analysts are talking about the price rising above USD 1.30 later this year. All very good from the EUR side, but what is causing the EUR to appear so strong and the USD so weak?

There has been a significant rise in the value of the EUR in the last year compared to the USD. From a low of USD 1.05 around the end of February 2017, the EUR has climbed up to USD 1.25 – representing an increase of around 20 per cent. Analysts are talking about the price rising above USD 1.30 later this year. All very good from the EUR side, but what is causing the EUR to appear so strong and the USD so weak?

Despite interest rate being very low for the last few years, general consensus is that rates will eventually rise – rates will become more normal. Rates are being held down by the actions of central banks with their quantitative easing. As QE is scaled backed and stopped this should allow rates to rise from their current low levels. The big question is – how high will rates rise? The Euro is not yet 20 years old and that means that whilst there is a lot of data, it does not require looking through 50 or 60 years of data to try and find the norm.

Despite interest rate being very low for the last few years, general consensus is that rates will eventually rise – rates will become more normal. Rates are being held down by the actions of central banks with their quantitative easing. As QE is scaled backed and stopped this should allow rates to rise from their current low levels. The big question is – how high will rates rise? The Euro is not yet 20 years old and that means that whilst there is a lot of data, it does not require looking through 50 or 60 years of data to try and find the norm.

Currency volatility is a well-known uncertain component of international business. In the pre-euro era one could suffer severely by currency movements of its European neighbours. Corporations, dealing within euro countries, have diminished the currency exposure.

Currency volatility is a well-known uncertain component of international business. In the pre-euro era one could suffer severely by currency movements of its European neighbours. Corporations, dealing within euro countries, have diminished the currency exposure.

Brexit is a fact, no news here. Discussions about how this Brexit is going to look like are an ongoing topic in the newspapers. Hard Brexit or soft Brexit – what does it actually mean for the UK and the European Union? What are the consequences of a hard Brexit compared to those of a soft Brexit to all of us? It implies there are 2 paths that can be followed – actually there are 3.

Brexit is a fact, no news here. Discussions about how this Brexit is going to look like are an ongoing topic in the newspapers. Hard Brexit or soft Brexit – what does it actually mean for the UK and the European Union? What are the consequences of a hard Brexit compared to those of a soft Brexit to all of us? It implies there are 2 paths that can be followed – actually there are 3.