Guide to Treasury Technlogy by ACT & AFP

| 1-5-2017| treasuryXL | ACT | AFP |

ACT and AFP have published a Guide to Treasury Technology sponsored by Bloomberg, which might be interesting for you.

and AFP have published a Guide to Treasury Technology sponsored by Bloomberg, which might be interesting for you.

Managing treasury tasks has become more complex due to globalization of markets and increasing uncertainty in business since the first AFP edition appeared in 2011. Since then treasurers faced multiple challenges to exercise control of treasury activities, especially group activities.

Managing treasury has become more complex during the years in the face of global change and increasingly uncertain markets. Treasury practitioners face magnified challenges, as they try to gain more visibility and exercise more control over group activities. Treasury technology developed quickly to help them to operate more efficiently and answer compliance requests with ever more stringent regulation. Automate processes was one of the biggest challenges. Technology can help treasury play a more strategic role, automate routines and be compliant with regulatory environment.

Joint AFP/ACT publication, sponsored by Bloomberg

This guide is the first joint AFP/ACT publication and aims to help practitioners to identify a cost-efficient solution.

The first chapter starts with a detailed introduction of the development of treasury technology, expectations towards this technology and how the evolution of the Corporate Treasurer took place. This chapter illustrates how the technology available to treasurers has developed over the last 15 years. A brief explanation of how dedicated treasury technology was first developed is followed by details of how a series of factors have moulded the treasury technology market into the one we see today. Three points are highlighted: that the treasury technology market has matured, tremendous improvements in the quality of connectivity and what the changes brought with them for Corporate Treasurers.

Why review technology?

In Chapter 2 the drivers for reviewing the technology and a case study are presented.

With the rapid changes in available technology, the increased opportunity for treasury centralization and the need for treasurers to be able to demonstrate control over activities, treasurers were reviewing how best to deploy technology in order to help them perform their various roles effectively. Given the different environments in which companies operate, the potential benefits from the deployment of a new technology solution can vary significantly. This chapter outlines some of the key drivers that are encouraging treasury practitioners to review their use of technology.

Purpose of technology

Chapter 3 deals with the purpose of technology and identifies the core roles of the treasury department. Also how treasury structure can affect the use of technology. When assessing a deployment of technology, treasurers need to determine their requirements of the technology. This chapter includes a series of questions to help treasurers clarify their existing operations and also identify how structures and processes might change with the adoption of new technology. A case study shows how a company uses a certain technology to improve process quality.

Technology solutions

Chapter 4 presents treasury technology solutions.

A wide range of technology solutions is available to support treasurers. Treasury management systems are able to support the majority of the work of most treasury departments. However, it is also possible to develop a technology solution that supports treasury departments, including those with complex operations, without adopting a treasury management system. This can be achieved by developing in-house solutions or by using tools offered by banks and other vendors. A range of potential solutions available to support treasurers is presented in this chapter.

Evaluation and building a business case

Chapter 5 is about the evaluation process and how building a business case can help to evaluate which technology fits best. How to build a business case and then how to develop a requirements definition is explained in detail. The requirements definition is a critical part of the process: it helps to set the scope for the project and is the core document in the selection process. The process of developing the requirements definition also helps to build support for, and awareness of, the project throughout the rest of the organization.

Selection, implementation and maintaining the solution

Chapter 6, 7 deal with the selection and implementation process, while chapter 9 tells you more about maintaining the solution over time.

Trends

Chapter 10, the final chapter describes some of the current trends in treasury technology and lines out how they might impact treasurers over the coming years. Some of the key areas of development in technology and also some of the market changes which might require a technological response are presented.

In the appendix of the guide you will find information on how to develop a request for proposal (RFP) , a checking list for this RFP and a very detailed country reports list.

Source: © Association for Financial Professionals, ACT (Administration) Limited and WWCP Limited (except articles by Bloomberg LP), 2016, ISBN 978 1 899518 47 0 book 978 1 899518 48 7 CD ROM, for the articles Bloomberg LP, 2016 | TMI

Our conclusion

A very detailed, valuable guide for all who want to learn more about treasury technology, want to find out more on how to select the best technology solution that meets the specific requirements of their company and what to focus on during the purchase and implementation process. You can find the guide on tmi, after registering for free.

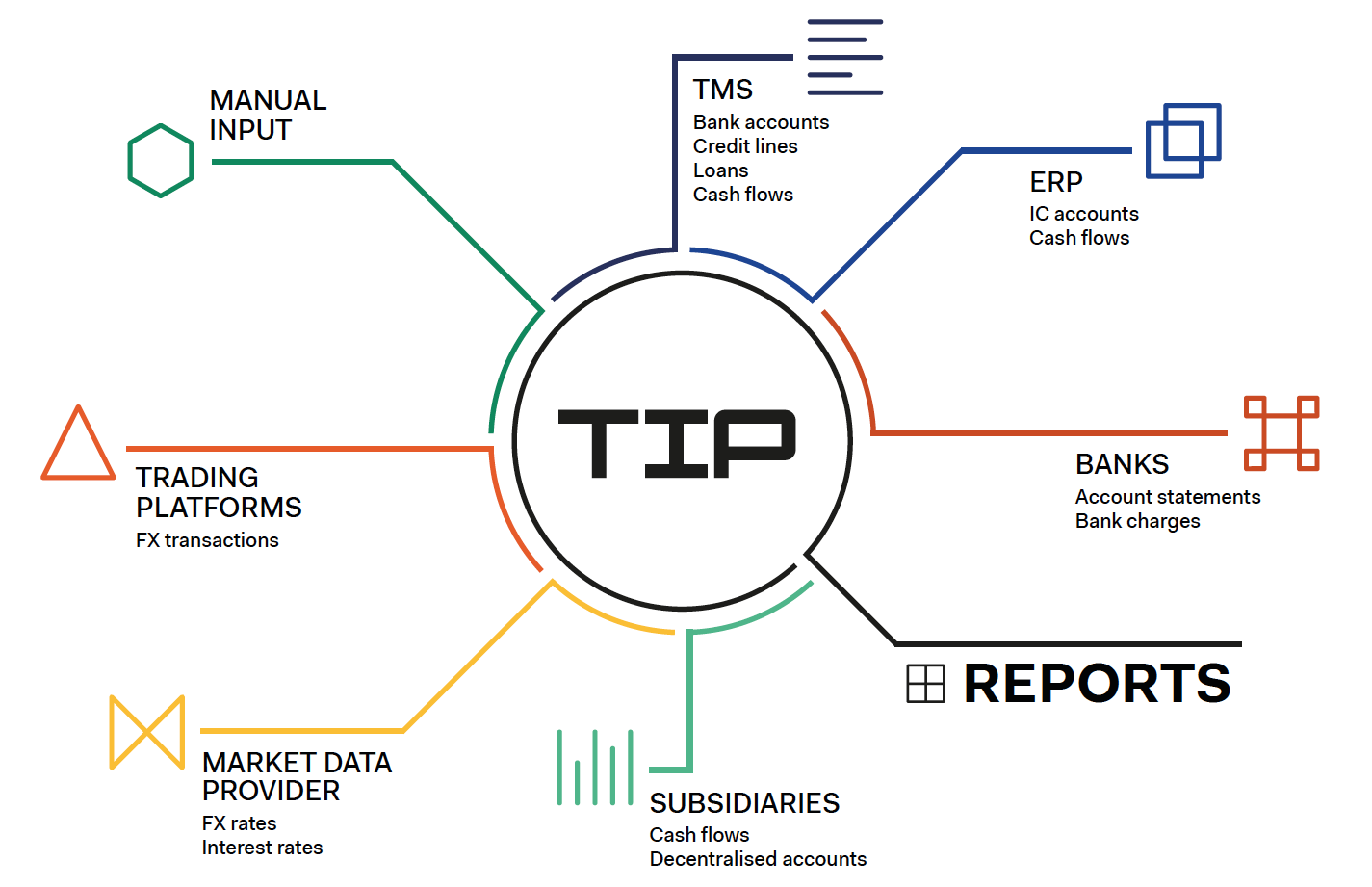

Hubert Rappold from TIPCO Treasury & Technology, puts the case for a treasury information platform (TIP), which acts as an information hub for the treasury department and reduces companies’ reliance on “Excel-based monstrosities” that are doomed to fail.

Hubert Rappold from TIPCO Treasury & Technology, puts the case for a treasury information platform (TIP), which acts as an information hub for the treasury department and reduces companies’ reliance on “Excel-based monstrosities” that are doomed to fail.

Hubert Rappold – CEO at

Hubert Rappold – CEO at

In 2014 publiceerde expert Mark van de Griendt een artikel over de voordelen (en nadelen) van SEPA en IBAN, die toen werden ingevoerd en Electronic Bank Account Management. Intussen zijn SEPA en IBAN al bekende fenomenen, maar Electronic Bank Account Management is alleen maar complexer geworden, zeker in het tijdperk van Fintech. Reden genoeg om nog een keer terug te kijken op wat Mark toen zei. Intussen zijn processen veranderd en zijn er nieuwe uitdagingen bijgekomen. Maar wij denken dat wat hij schrijft nog steeds actueel is…

In 2014 publiceerde expert Mark van de Griendt een artikel over de voordelen (en nadelen) van SEPA en IBAN, die toen werden ingevoerd en Electronic Bank Account Management. Intussen zijn SEPA en IBAN al bekende fenomenen, maar Electronic Bank Account Management is alleen maar complexer geworden, zeker in het tijdperk van Fintech. Reden genoeg om nog een keer terug te kijken op wat Mark toen zei. Intussen zijn processen veranderd en zijn er nieuwe uitdagingen bijgekomen. Maar wij denken dat wat hij schrijft nog steeds actueel is… Mark van de Griendt – Cash Management Expert at

Mark van de Griendt – Cash Management Expert at

In July 2016 our expert Pieter de Kiewit wrote an

In July 2016 our expert Pieter de Kiewit wrote an

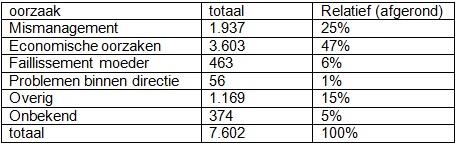

There are lots of discussions concerning risk, but let us start by trying to define what we mean by risk. In today’s article I will focus on liquidity risk. Many companies have very significant credit needs and this needs to be formally addressed with a credit analysis procedure in place. In my former articles I dealt with

There are lots of discussions concerning risk, but let us start by trying to define what we mean by risk. In today’s article I will focus on liquidity risk. Many companies have very significant credit needs and this needs to be formally addressed with a credit analysis procedure in place. In my former articles I dealt with

Theo van Houten is hoofddocent management accounting en onderzoeker bij het lectoraat Financial control aan de hogeschool van Arnhem en Nijmegen. Tevens is hij onder meer (mede-)auteur van de boeken ‘Financial control van projecten’ en ‘Bedrijfseconomie in de praktijk’.

Theo van Houten is hoofddocent management accounting en onderzoeker bij het lectoraat Financial control aan de hogeschool van Arnhem en Nijmegen. Tevens is hij onder meer (mede-)auteur van de boeken ‘Financial control van projecten’ en ‘Bedrijfseconomie in de praktijk’.