Options are for wimps

26-04-2016 | by Rob Soentken |

Does it make sense to use options for hedging? The following little story is about a senior person who I respect a lot, and who didn’t like using options.

Does it make sense to use options for hedging? The following little story is about a senior person who I respect a lot, and who didn’t like using options.

One day he asked me to execute some call options for his investment book. He never used options, so I asked him if he had changed his mind about the product. He just laughed and said he hadn’t.

“Why would I buy an option if I know the prices are going up? Any option premium I pay is lost money.”

Somehow I’m convinced he held the same opinion about selling options.

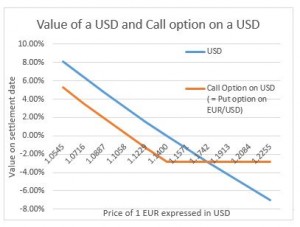

Value of a USD and Call option on a USD

Diagram 1 explains his feelings. I assume he was considering only the left half of the payoff diagram. After an appreciation of the USD, a USD is always worth more than a call option on a USD, the difference being the option premium.

Diagram 1 explains his feelings. I assume he was considering only the left half of the payoff diagram. After an appreciation of the USD, a USD is always worth more than a call option on a USD, the difference being the option premium.

There is no downside if you ‘know’ where the market is going, if there is no uncertainty. Using options implies you are not sure about the direction. In a way he was saying ‘options are for wimps’.

The future of the USD is leading

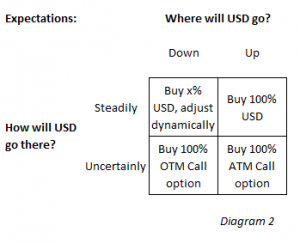

For a company importing goods from outside the EUR zone the choice could be very similar: to buy the foreign currency outright or buy a call option on that currency. Possible actions are driven by the views on 2 dimensions of the USD future:

- Where will USD go? Down or Up?

- How will USD go there? Steadily or Uncertainly?

These 2 dimensions lead to 4 possible actions for hedging currency risk, as depicted in Diagram 2.

If the view on USD is Up, in a Steadily way the choice to ‘buy USD or buy an option’ is straightforward: Buy 100% of the required USD, because any option premium would be wasted money.

If the view on USD is Up but in an Uncertain manner, it could be recommendable to buy 100% At-The-Money options. Obviously the premium is an expense, but considering the expected Uncertain price action the price of USD could also be going down, meaning the USD can be purchased against cheaper than expected prices. This would represent a gain possibly offsetting and exceeding the loss of the premium.

If the view on USD is Down and in an Uncertain manner, it could be recommendable to buy 100% Out-Of-The-Money options. Like my manager in the beginning of this article, this call would be a back-stop against unexpected outcomes. Obviously the premium is an expense, but considering the strike being Out-Of-The-Money, it’s a relatively small one.

Finally, if the view on the USD is Down, and in a Steadily way it could be an interesting approach to hedge a certain percentage and to add to that position in a dynamic way, until the full 100% of the required USD amount has been purchased. In a way this position is a replication of buying a Call option, without incurring the expense of the premium. Obviously there could and would be cost involved if additional USD purchases would be above the initial purchase. But if the Down view materialises, there would be gains in the form of cheaper USD purchases.

Above article reflects the personal views of the writer. It should not be used as a guidance to the use of derivatives in the context of investments or risk management. Any investor or risk manager should develop and determine their own independent views and actions.

Ex-derivatives trader