Context: What role do AP departments play in managing global payments?

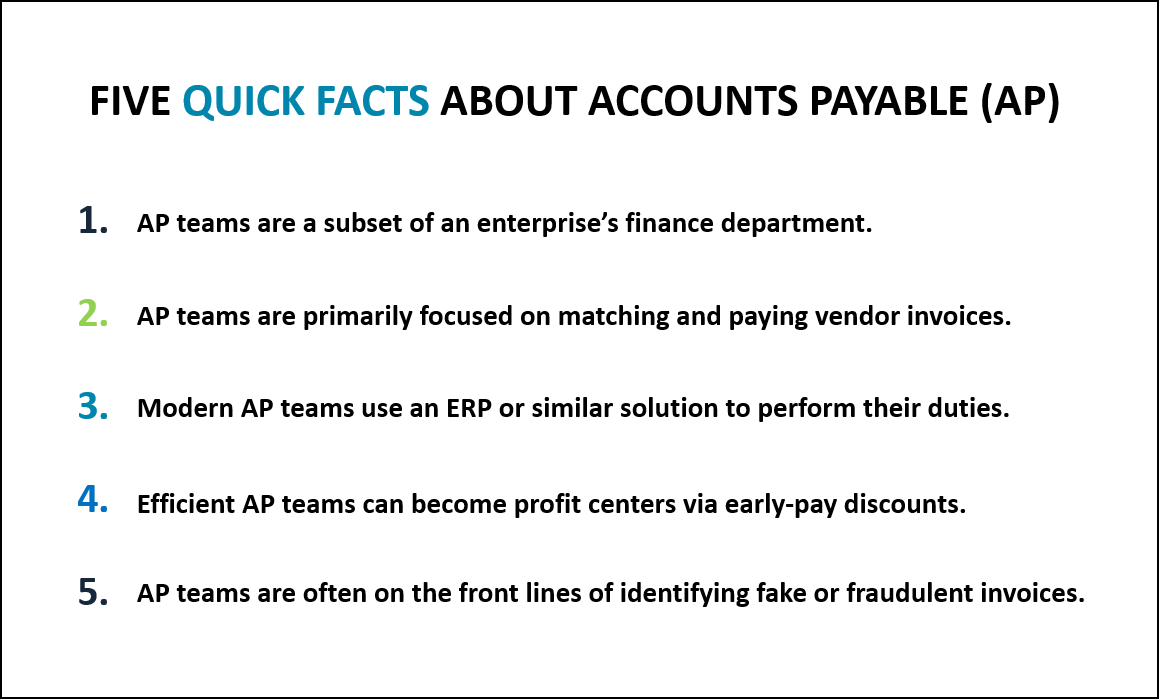

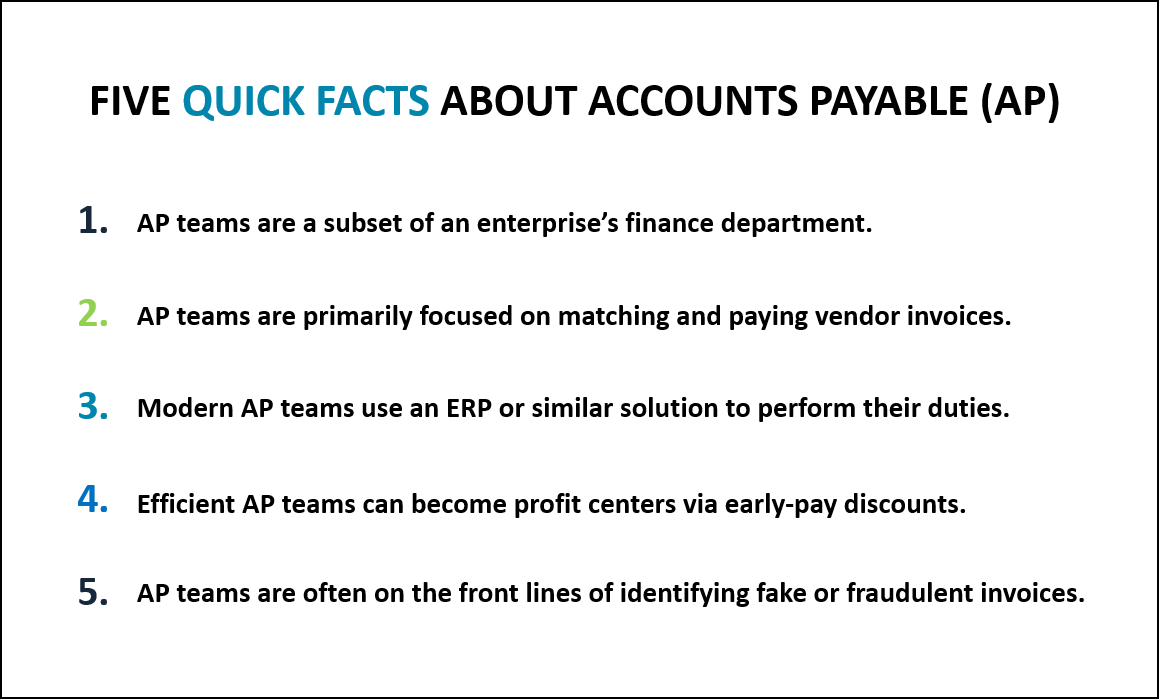

For those who may be unfamiliar or need a quick refresh, the general role of an Accounts Payable (AP) department is as follows:

When a company purchases goods and services from a supplier or vendor on credit, the accounting entry is referred to as an Account Payable (AP). On a balance sheet, it appears under current liabilities. As such, an enterprise’s AP department is responsible for ensuring these payments owed by the company arrive to suppliers and other creditors in a timely fashion.

Depending on the company’s size and scope, the AP department may consist of just one or two individuals, or up to several dozen. Most of the time, AP staff operate as a subset of the finance department and work within an ERP or similar technology solution to manage the company’s global payables (i.e. supplier or vendor invoices) and ensure that outbound payments are generated and executed according to the outstanding payments that are due to these parties.

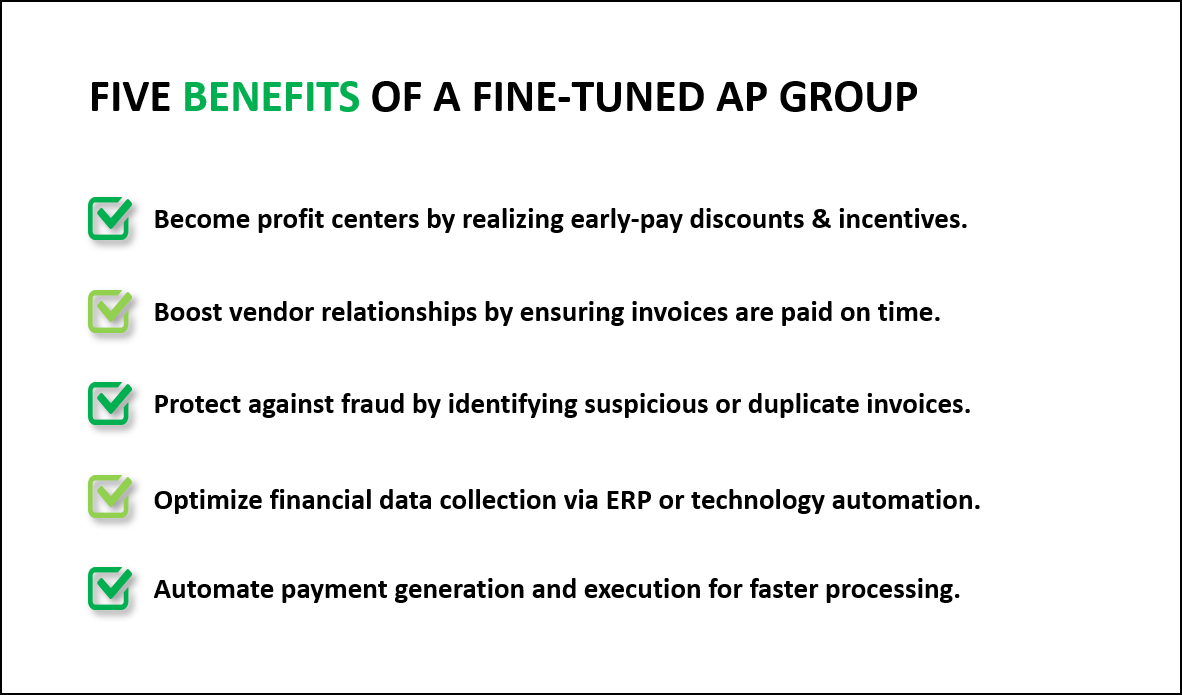

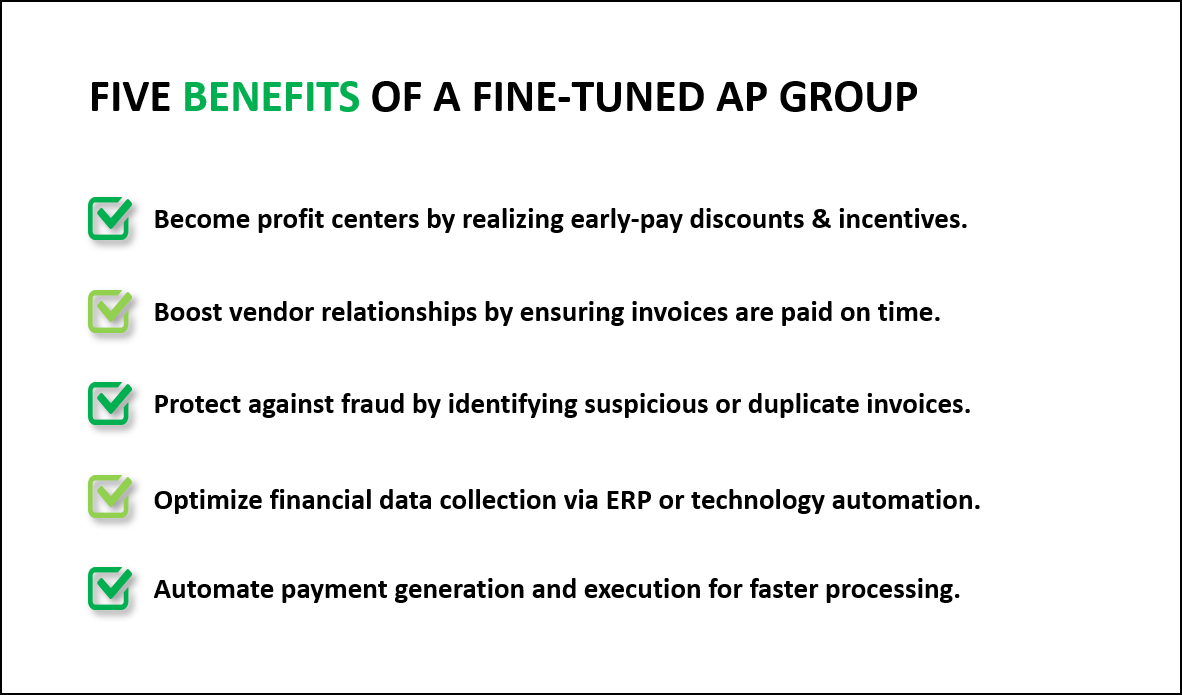

As AP groups go about managing their roles, the main benefit to their organization is that outstanding payment requests are effectively fulfilled without violating deadlines or contracts. There is often a vendor relationship aspect attached to this benefit as well, provided that invoices are paid on time. Additionally, an optimized AP group can help take advantage of early-pay discounts or other types of incentives to earn additional revenue, and can also help identify fraudulent invoice requests and other security threats. For enterprises making hundreds or thousands of payments every week, these benefits are essential.

However, despite the important role that AP groups play and the critical nature of their work, the reality is that their needs are rarely prioritized over other financial stakeholders and departments internally.

Let’s explore further.

Why don’t AP departments receive more budget & attention internally?

As an enterprise’s financial priorities and initiatives get championed by internal executives and leaders, who is most commonly advocating for AP?

In other words, which of an enterprise’s chief financial stakeholders are actively prioritizing the needs of the AP department relative to other internal departments and groups?

Although some AP managers or directors might get a say in largescale technology projects and Controllers or Treasurers may work closely with AP to ensure process cohesion, the reality for many enterprises is that AP departments rarely have a high-ranking executive or financial stakeholder that resides directly within their team.

For example, while the Treasurer often can communicate directly with the CFO and accounting groups have directors that are given a direct line for influencing important decisions, the AP group does not.

Of course, this is not to say that the AP department is always getting completely overlooked, and to be fair, other financial departments like Procurement might suffer from a similar conundrum, depending on the structure of the enterprise. However, in cases where the AP group is clearly outranked by other stakeholders, the impetus is on leaders in treasury and accounting, as well as the CFO directly, to ensure that their needs and priorities are addressed.

As noted above, the benefits of helping AP optimize its function include increased revenue and cost savings through early payment opportunities like dynamic discounting. With the right technology and workflows, AP can also play a critical role in detecting fraudulent invoices and payment requests and maintaining the organization’s good standing regarding vendor and supplier contracts and relationships.

For enterprises that are able to address AP’s needs in an effective fashion, the above benefits can be instrumental in boosting revenue, maintaining accurate financial records, and preventing fraud. However, without the proper attention, these benefits can quickly dissipate and result in a myriad of issues. This is especially the case if AP is not provided with the right technology solutions or integrations to perform their duties, as detailed further below.

Addressing the technology requirements of accounts payable

Upon examining the typical financial responsibilities that AP teams manage, the reality is that their technology needs are not that different from other financial groups, especially those of accounting.

In most cases, enterprises will have at least one (if not multiple) ERP system deployed globally. These ERPs often provide the perfect backdrop for AP to function, as global financial data can flow directly into these platforms to make for easier oversight and control. In circumstances where enterprises have strategically developed their financial technology stack to optimize the data flowing into these ERPs, the AP department can subsequently benefit from access to the same information that accounting and other departments do. And as invoices, bank statements, and payment statuses flow from various entities, vendors, and banks into the ERP(s), tasks like payment generation and invoice matching become much easier for AP to automate and control.

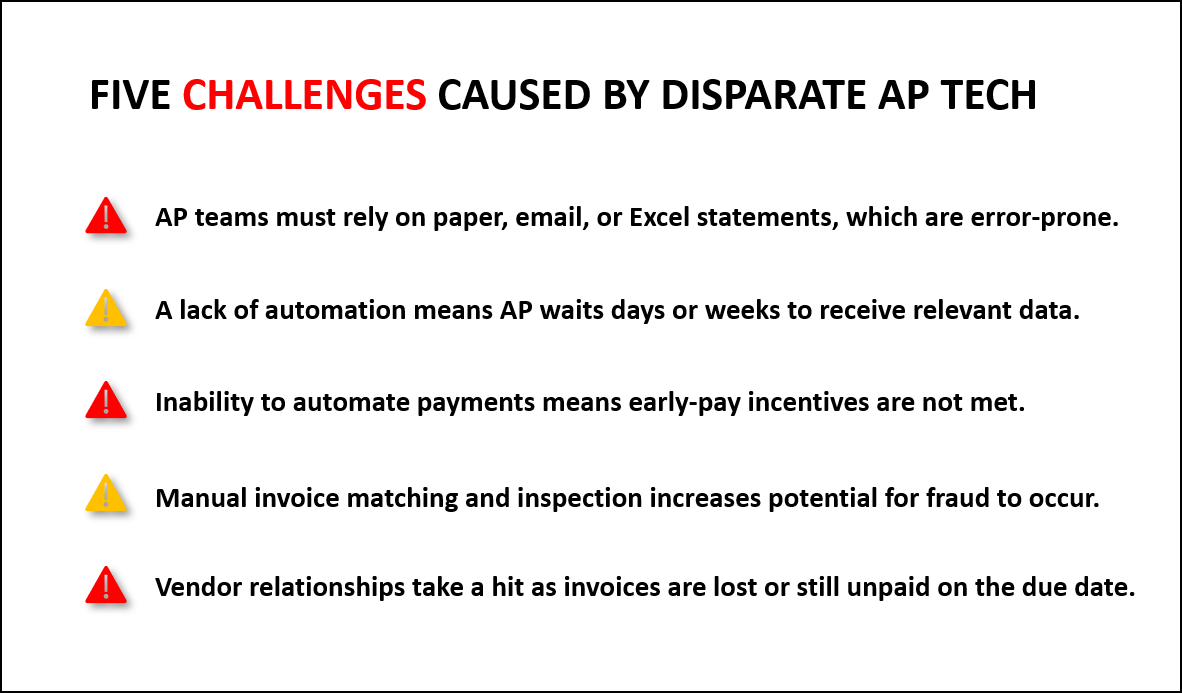

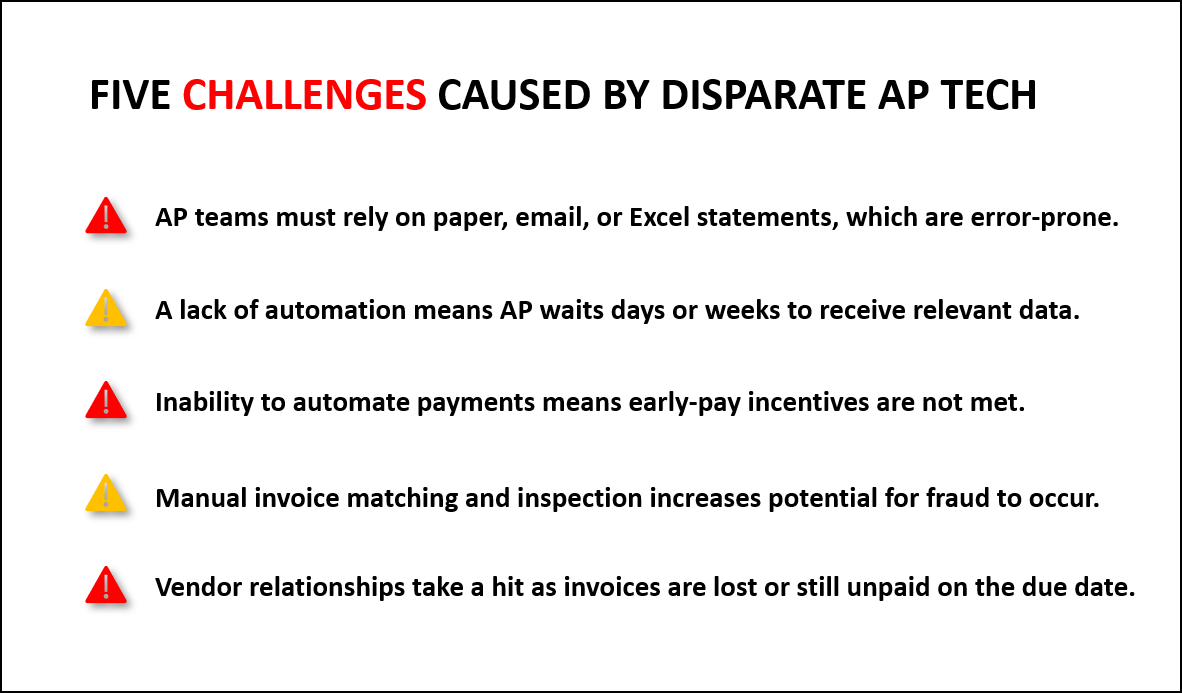

However, without the proper bank connections, system integrations, or authentication and security settings, these ERPs and disparate technology stacks can quickly become the bane of AP’s existence and lead to more headache than efficiency.

Here’s why.

For global enterprises with dozens of entities and back-office systems, as well as thousands of suppliers, vendors, and bank accounts, gathering and disseminating global financial data in a timely fashion represents a massive undertaking. For many companies, issues start to occur when their ERP is not properly integrated with all their banks, vendors, or the corresponding systems at regional entities and units. Whether due to constant M&A activity, regular implementation of new solutions, or simply a lack of IT budget and bandwidth, maintaining all the right system connections requires constant upkeep.

To make matters worse, some AP groups today are still relying on Excel, email, or paper statements, which magnifies the challenges of meeting contractual deadlines, identifying false invoices, and successfully obtaining early-pay discounts and incentives.

Ultimately, scenarios where AP must manually pull invoices and bank statements to perform their duties or where they wait days or weeks to receive data from regional offices and banks can render the benefits of their department almost entirely obsolete. And in today’s fast-paced, highly-digital environment, the simple truth is that if your enterprise is struggling to locate and aggregate financial data, then you are likely significantly behind your peers in terms of AP process efficiency.

Given what we’ve seen with many AP departments lacking the internal status to advocate for better technologies and workflows on their own, and because many enterprises might not be willing to invest in an AP-specific solutions, the best option many companies have for meeting AP’s technology needs without exasperating their budget is to invest in payments and banking technologies that can streamline the collection, aggregation, and analysis of payments and finance data for ALL internal stakeholders.

Of course, departments like AP and accounting will likely end up doing the brunt of their work in an ERP. However, by adding a global payment and bank connectivity hub to their technology stack, enterprises can ensure that all the data these groups need to do their jobs can flow into the ERP in an optimized and timely fashion.

Today, these global payments optimization capabilities are exactly what TIS offers enterprises with our Enterprise Payment Optimization (EPO) platform. The manner in which our solution optimizes the AP function while also streamlining payments, liquidity, compliance, and banking functions for Treasury, Accounting, Legal, and more is highlighted below.

How TIS gives AP & all other financial stakeholders complete control over payments

TIS’ Enterprise Payment Optimization platform is a global, multi-channel and multi-bank connectivity ecosystem that streamlines and automates the processing of a company’s payments and subsequent reporting across all their global entities, banks, and financial systems.

By sitting above an enterprise’s technology stack and connecting with all their back-office, banking, and 3rd party solutions, TIS effectively breaks down department and geographic silos to allow 360-degree payments and cash visibility and control. This includes visibility to executed vs outstanding transactions, as well as to cash positions and bank statements.

To date, the ~200 organizations that have integrated TIS with their global technology stacks have achieved near-100% real-time transparency into their payments and liquidity. This structure benefits a broad variety of internal stakeholders and also enables each group to access information through their platform of choice, since the data that passes through TIS is always delivered back to the originating systems.

This systematically controlled payments workflow is managed by TIS for both inbound balance and transaction information and outbound payment instructions. Data can be delivered from any back-office system via APIs, direct plug-ins, or agents for transmission through TIS to banks and 3rd party vendors. This means that for AP teams that use an ERP, payments and liquidity data is transmitted in near-real-time from TIS into their modules, where they can then perform automated reconciliation, payment generation, and other tasks as their role dictates.

Because of the deep connections that TIS maintains with internal systems such as ERPs or TMSs, external banks, and 3rd party vendors / service providers, the process of managing payments is simplified for every internal stakeholder. C-suite executives, treasury, accounting, AP, legal, HR, and other key personnel can access whatever financial data they need, exactly when they need it. And by automating this flow of information for both inbound and outbound payments, TIS provides the control and flexibility that enterprises need to function at their highest level.

For AP teams specifically, the extensive experience and unparalleled integration capabilities provided by TIS enable enterprises to streamline their methods for managing payments, invoicing, and reconciliation. Additional security controls, invoice inspection tools, and payment fraud alerts are implemented to ensure compliance and cohesion at every point in the process. And because the functionality provided by TIS helps all enterprise financial stakeholders, organizations that adopt TIS typically receive unanimous buy-in because each group recognizes the benefits they will obtain through TIS’ implementation.

In the digital world of enterprise payments, TIS is here to help you reimagine and simplify. For more information about how TIS can help you transform your global payments and information processes and optimize your AP function without breaking the bank, contact us to learn more.