BNP Paribas signs an agreement for the acquisition of Kantox

17-10-2022 | treasuryXL | Kantox | LinkedIn |

treasuryXL congratulates highly valued partner Kantox with the announcement that BNP Paribas has signed an agreement to acquire the leading fintech for automation of currency risk management!

Kantox, a leading fintech for automation of currency risk management, will accelerate its growth with the support of BNP Paribas and the strengths of its integrated business model. This acquisition builds on the initial strategic partnership between BNP Paribas and Kantox initiated in September 2019.

BNP Paribas is pleased to announce the signature of an agreement for the acquisition of Kantox, a leading fintech for the automation of currency risk management. Kantox’s software solution has managed to successfully re-bundle the Corporate FX workflow, offering a one-stop-shop, API-driven, plug-and-play solution which has emerged as a unique technology within the B2B cross-border payments sector. Kantox’s technology provides an unrivalled level of automation and sophistication to Corporates in setting up hedging strategies.

By leveraging its integrated business model, BNP Paribas is well-positioned to accelerate and extend Kantox’s offering to a wide range of Corporate clients across the globe.

The acquisition of Kantox is supported by the Global Markets business of BNP Paribas’ CIB division and the business centres of the Commercial, Personal and Banking Services (CPBS) division. The two divisions aim to deploy Kantox technology to large corporates as well as SMEs and Mid-Cap clients, capitalising on market knowledge and the local presence of the group.

This acquisition illustrates BNP Paribas’ Growth Technology Sustainability 2025 plan that sets out to accelerate the development of technological innovations, enhance customer experience and provide best-in-class capabilities to its clients.

Philippe Gelis, CEO and co-founder at Kantox: “We have been serving clients together since 2019 when our technology partnership started. During those 3 years, we spent a lot of time together in the field, getting the opportunity to understand that together we were stronger and able to bring more value to clients. It is the best of both worlds, the leading software company in the currency management automation category and the leading bank in Europe.”

Olivier Osty, Head of Global Markets, BNP Paribas CIB: “We are delighted to strengthen our partnership with Kantox, which brings to our clients a unique and innovative platform to automate their currency risk management. Corporate treasurers are currently navigating turbulent markets, and advanced technology can help mitigate some of the challenges, easing the burden of manual tasks and allowing them to focus on their core business.”

Yann Gérardin, Chief Operating Officer, Head of BNP Paribas CIB: “The acquisition of Kantox presents a further illustration of our ability to establish long-term partnerships with fintechs in an ever-increasing range of areas. Supporting our clients in their international development and providing them with the most advanced technological solutions have always been our priority and are, as such key pillars of our GTS 2025 strategic plan.”

Thierry Laborde, Chief Operating Officer, Head of BNP Paribas CPBS: “This acquisition demonstrates how our distinctive model and integrated platform strategy are able to create value and develop business opportunities. Our leading positions with European companies of all sizes will enable Kantox to further accelerate its development while improving our customers’ experience.”

The acquisition is subject to regulatory approvals and is expected to complete in the coming months.

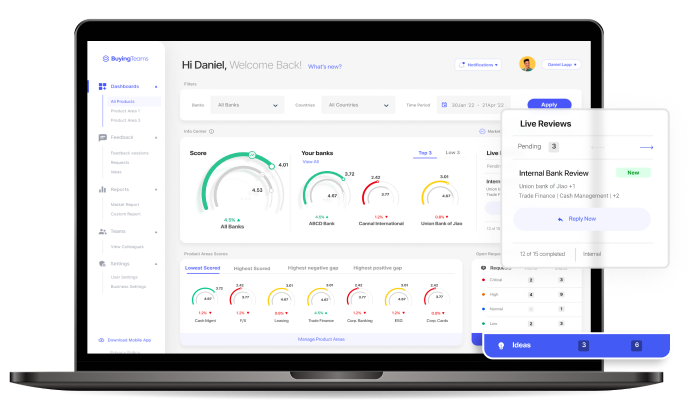

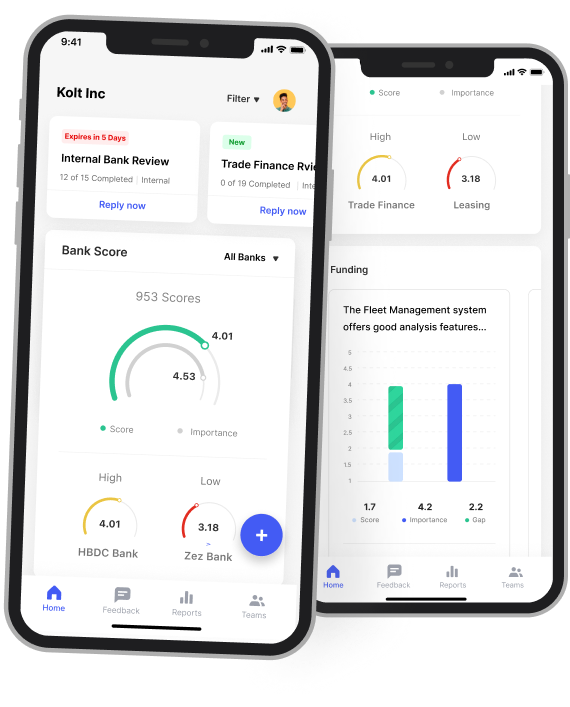

All colleagues within the company can be included and provide input, indicating which banks are performing well and in which areas of their business relationship, and indeed also where there is room (and desire from corporate side) to improve the collaboration. Input can be related to different phases; sales/advisory, delivery/implementation or indeed the daily use of the bank and will give specific and valid data that were not previously available.

All colleagues within the company can be included and provide input, indicating which banks are performing well and in which areas of their business relationship, and indeed also where there is room (and desire from corporate side) to improve the collaboration. Input can be related to different phases; sales/advisory, delivery/implementation or indeed the daily use of the bank and will give specific and valid data that were not previously available.