|8-2-2017 | Jan Meulendijks | iTreasurer |

In October 2014 iTreasurer published an article ‘The Five Cash Management Initiatives Treasurers Should Consider‘ about how treasurers keep focus on ways to keep cash management in their organisation efficient and cost effective. As this is always an important issue and also relevant in 2017, we asked our expert Jan Meulendijks to comment on the article.

Five initiatives

iTreasurer stated in their article that treasurers should spend their time on five initiatives and that they should be part of a treasurers’ overall budget and resource planning process.

Going beyond SEPA

iTreasurer stated: ‘Initially rolled out as an approach for risk mitigation for commercial payment transactions in Euro, SEPA adopters have found that SEPA, or the Single Euro Payments Area, provides a more efficient way to transfer and collect funds across borders without managing all the different legal payment frameworks of each country. But despite the many bright spots of SEPA, “reconciliation in 2014/2015 was still a challenge,”

According to Jan Meulendijks the development of reconciliation tools has now become an issue for ERP/General ledger software developers and that the banks do not need to focus on it any more. Processing digital account information/account statements are a well established feature of financial software programs and also include the processing of open accounts receivables.

Global Account Rationalization

‘The SEPA initiative has acted as the catalyst for other global projects, with high priority placed on account rationalization. By reducing accounts across Europe, many large US multinational corporations are realizing significant savings in both hard- and soft-dollar costs. “In the SEPA environment, all corporates needed was one account for payments and one account for receivables across the SEPA landscape,’ said Mr. Brieske, Regional Head of Trade Finance and Cash Management Corporates Global Solutions Americas, Global Transaction Banking, Deutsche Bank in the article. At that time keeping every bank happy was a tough job, if not impossible. Being able to spread the wallet across fewer banks was one of the positive by-products of a bank consolidation.

‘Nowadays it is remarkable to see that “wallet sizing” has turned around completely,’ says Jan Meulendijks. ‘Today it is the companies that determine how much of their wallet will be handled by which bank and the banks no longer have influence on the amount of transactions with a company.’

In-House Bank Structures

Treasurers had continued to find ways to alleviate the growing cash balances that had become strategically more important to their organizations. Structures like in-house banks (IHBs) were becoming more commonplace as organizations took the next step to further enhance their global liquidity models. The practical considerations for the evolution of the IHB could be directly attributed to global expansion and increased revenue mix overseas in addition to complexities related to time zones, language, growth of regional shared services and decision execution.

Jan Meulendijks states that in the chart of the article the first three steps of “in-house bank progression” are no real in-house bank developments, but treasury-related measures, that now also take place in medium-sized organisations. ‘Only if companies have a real ‘payment factory’, I call it a in-house bank.’

RMB Internationalization

As a result of the ongoing RMB regulatory changes, there had been a significant improvement in the ease of making cross-border RMB payments via China. The RMB was a fairly new currency on the international scene then. The RMB internationalization project had begun to pick up steam over the second half of 2014, with many global MNCs looking to launch new cash management strategies in Asia. New structures were thought to be able to unlock China’s previously “trapped cash” challenge, and optimize their cash held in this part of the world where many opportunities lie for them.

Jan sees a tendency today that the more the deregulation of the RMB progresses the more one can treat it as any other currency. However, this is not achieved yet and Asia will continue to be an region where ‘trapped cash’ occurs on a regular basis.

Maximizing Excess Cash

According to Martin Runow, Head of Cash Management Corporates Americas, Global Transaction Banking, Deutsche Bank most MNCs then were still very risk-averse and focused on principal preservation. ‘The dilemma is corporates are looking for yield but there is little appetite to go into risky assets,’ he said in 2014. With the continuation of low yields, cash portfolio asset allocations were heavily weighted toward money market funds, US Treasuries and agency debt, corporate bonds above the single-A threshold and corporate commercial paper and certificates of deposit. Treasurers were thought to be well served to consider implementing an IHB so that their growing levels of excess cash could work harder around the globe versus sitting in a very low-yielding investment asset.

Now in 2017 Jan Meulendijks states that this is what treasury is all about: companies should not aspire the role of banker, but submit their cash into the company’s operating cycle as working capital. In fact they should fall back on effective cash management: receive in an effective way and pay with as little cost as possible.

There is a lot to win for SMEs, too.

Jan Meulendijks

Cash management, transaction banking and trade professional

Instant payment services become more popular. UniCredit is testing the EBA Clearing’s RT1 real-time platform and preparing for the roll out of this service to 30 banks in Italy and Germany. Last week Finextra published an article about this development. Our expert Jan Meulendijks gives his opinion about the EBA Clearing’s RT1 real-time platform.

Instant payment services become more popular. UniCredit is testing the EBA Clearing’s RT1 real-time platform and preparing for the roll out of this service to 30 banks in Italy and Germany. Last week Finextra published an article about this development. Our expert Jan Meulendijks gives his opinion about the EBA Clearing’s RT1 real-time platform. Jan Meulendijks – Cash management, transaction banking and trade professional

Jan Meulendijks – Cash management, transaction banking and trade professional

At its introduction time SEPA seemed to be just another (more complicated) payment method, more imposed by EU-regulations than a market requirement. For international for exporting companies however, there is a very interesting bonus in the form of SEPA’s possibilities in the field of direct debit. Foreign bank accounts can be debited (for receivables) in the same way as Dutch bank accounts.

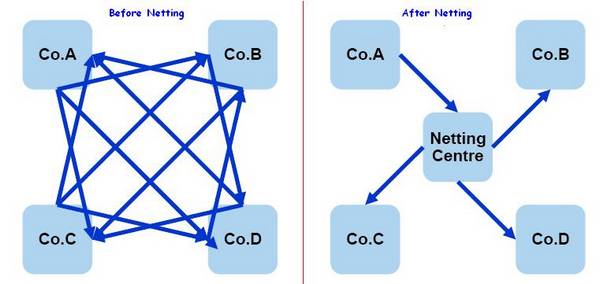

At its introduction time SEPA seemed to be just another (more complicated) payment method, more imposed by EU-regulations than a market requirement. For international for exporting companies however, there is a very interesting bonus in the form of SEPA’s possibilities in the field of direct debit. Foreign bank accounts can be debited (for receivables) in the same way as Dutch bank accounts. Netting is mainly used by global operating companies with a large number of subsidiaries; the reach of netting can however also include smaller company structures and save a lot of handling and costs.

Netting is mainly used by global operating companies with a large number of subsidiaries; the reach of netting can however also include smaller company structures and save a lot of handling and costs.

Spreadsheets, every treasurer knows how to work them. Spreadsheets are deeply embedded in treasury operations and they seem hard to eliminate. We have read multiple articles on this subject lately and we decided to ask our community: Why do treasurers still rely on spreadsheets? (source:

Spreadsheets, every treasurer knows how to work them. Spreadsheets are deeply embedded in treasury operations and they seem hard to eliminate. We have read multiple articles on this subject lately and we decided to ask our community: Why do treasurers still rely on spreadsheets? (source:  SEPA reduced the necessity to maintain foreign bank accounts in Euro-countries to a great extent, but there can still be substantial advantages to operating such accounts; an overview.

SEPA reduced the necessity to maintain foreign bank accounts in Euro-countries to a great extent, but there can still be substantial advantages to operating such accounts; an overview. Jan Meulendijks – Cash management, transaction banking and trade professional

Jan Meulendijks – Cash management, transaction banking and trade professional 26-04-2016 | by

26-04-2016 | by