Corporates: Caveat IBOR!

03-11-2020 | treasuryXL | Enigma Consulting |

Many of the world’s leading benchmark base rates are about to change; this could impact your business in unexpected ways.

Since Roman times, the phrase ‘caveat emptor’ – let the buyer beware – has been used in agreements as a warning that a lack of due diligence could come back to bite you. For today’s corporate treasurer it might instead be more relevant to use (with apologies to the linguists out there) ‘caveat IBOR’.

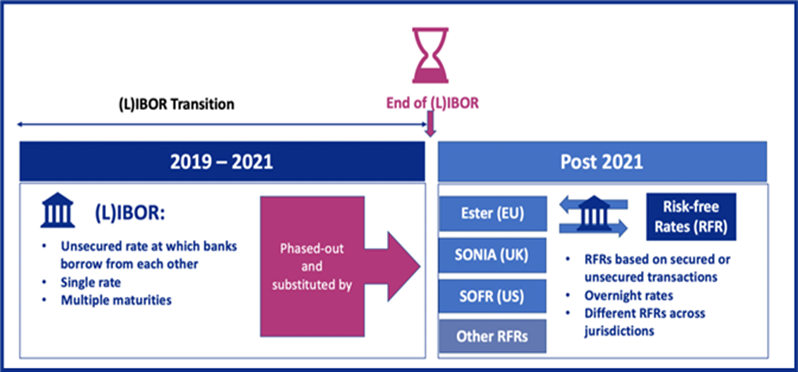

For the past 40 years, IBOR has been the benchmark used to determine the interest rates applied to a myriad of financial products. All this is about to change: starting on 31st December 2021 many of these rates will cease to exist and be replaced by ‘Risk-Free-Rates’ (RFRs).

The potential impact of these changes is often seriously underestimated. Corporate companies need to prepare today to be ready for banks wanting to discuss changes to existing contracts in the coming months.

The 4 to 6 months ahead of us are arguably the most critical period in the transition away from LIBOR. The time to act is now.

– FCA July 2020

Why should I care about the IBOR transition?

It is highly likely that your organisation will be affected by the IBOR transition. Most corporate organisations underestimate the impact, thinking that the ‘only’ thing that will change is a base rate and its calculation method. Before you join their ranks, take some time to reflect on the following:

- The IBOR will cease to exist, starting on the 31st December 2021 and be replaced by Risk-Free-Rates (RFRs) with a different basis for calculation

- These changes will impact financial (e.g. bond, (intercompany) loan, (multi-currency) credit facility) contracts as well as commercial contracts with an IBOR related ‘late payment clause’

- This in turn will impact processes in the Treasury functions, with knock-on effects to supporting departments, Legal, IT systems, accounting, and tax reporting to name just a few

- IBOR transition is progressing at a different pace across jurisdictions and financial products (e.g. loans, bonds, and derivatives), adding to the complexity of managing the transition

In the coming months you are going to be approached by your bank(s) to discuss changes to contracts maturing after 2021. To be prepared for these discussions, it is essential that you have a solid idea of what the repercussions of these changes will be on your organisation.

From IBOR to RFRs: a brief history

For the past 4 decades, IBOR (interbank offered rates, including LIBOR and EURIBOR) have been the benchmark for lending, hedge contracts, current accounts, valuation models etc. The (L)IBOR is calculated by processing hypothetical borrowing transactions that are submitted by a few ‘panel’ banks.

In 2012, the LIBOR scandal came to light: it was discovered that since 2008, panel banks had been colluding to illegally manipulate the rates. This set in motion that regulators, central banks, and market participants started a search for a safer alternative to the LIBOR. In 2017, the Financial Conduct Authority (FCA) announced that it would not compel or persuade panel banks to make LIBOR submissions after December 31st, 2021.

As a direct result, LIBOR term rates (1m, 3m, 6m, 12m) for USD, GBP, CHF, JPY, EUR will cease to be published as per December 31st, 2021. Other benchmarks such as EONIA and EURIBOR are similarly subject to an interest rate benchmark reform and it was decided to also discontinue the submission of EONIA after December 31st, 2021. Additionally, other benchmarks, such as JIBAR (ZAR), SIBOR (SGD), SOR (SGD) and Euroyen TIBOR (JPY) are undergoing comparable reforms[1]. See the sidebar (at the bottom of this article) for additional IBOR related details.

To minimise the possibility of fraud in future, global working groups have defined a new reference rate and calculation system. As a result, IBOR will be replaced by secured or unsecured transaction-based alternative Risk-Free Rates (RFRs) by the end of 2021. These new interest rate benchmarks are determined on the basis of transactions[2] and are therefore significantly more robust and resistant to manipulation.

Covid-19 will not buy you any time

After the worldwide outbreak of the Covid-19 virus, the world has changed rapidly. Uncertain times have arrived with a looming global economic recession. While many expected the pandemic to postpone the deadline, this does not to appear to be borne out by reality.

UK regulators have indeed postponed the deadline for the cessation of new issuances of GBP LIBOR-referencing loan products maturing after 2021 to the end of Q1 2021, instead of Q3 2020[3]. However, it is widely expected that the deadline for migrating existing LIBOR related contracts to alternative risk-free benchmarks will remain unchanged. Indeed, the FCA even emphasised in July 2020 that the LIBOR deadline is not going to change and that “The time to act is now.”

ISDA agreements and IBOR transition

On October 23, 2020 ISDA (International Swaps and Derivatives Association) finalised the protocols and other documentation by which outstanding derivatives contracts which reference LIBOR can be transformed in order to work with the new RFRs[4]. The FCA has repeatedly urged market participants from all sectors – sell side, buy side, non-financial, to ensure they are ready for the end of LIBOR by adhering to the protocol that ISDA is producing[5].

How will the IBOR transition impact you?

At a basic level, your corporate organisation’s existing IBOR-based interest rates will be replaced by new RFR-based rates. As these depend on a different underlying valuation methodology, any place in the organisation that currently relies on or makes use of an IBOR-based rate could potentially be impacted:

- Corporates have a variety of products with financial contracts that refer to an IBOR related benchmark. These can be bond agreements, loan agreements, cash pooling agreements, (multi-currency) credit facility agreements, derivatives, intercompany loan agreements and many other instruments. In particular, larger organisations active across multiple regions in the world with more complex non-Euro instruments will be impacted

- Commercial contracts with e.g. ‘late payment clauses’ with charges involving an IBOR related benchmark will also be impacted

- Processes and other aspects related to these agreements and contracts across the Treasury functions (such as Corporate Finance, Risk Management and Cash Management & Working Capital) will need to be reviewed, and changed if impacted: Legal, IT systems and interfaces, reporting, accounting (e.g. hedge-accounting), Tax, policies, procedures, valuation models will all require attention

- Interim milestones intended to smoothen the IBOR transition will lead to a cessation of the issuance of new LIBOR referenced products maturing after 2021. (For example, this will be the case for GBP LIBOR referenced bonds, loans, and derivatives; from Q2 2021, new GBP denominated issuances for these products will already refer to the alternative RFR.)

- An additional complication is that the IBOR transition is progressing in different stages across different jurisdictions and different financial products

- And, quite simply, there are many aspects that are as yet unknown, amongst which:

- what the impact of applying hedge accounting to IBOR referenced instruments will be

- whether and when alternative reference rate term structures will be available and for which products

- how compounding daily rates over time will be handled in the absence of a term structure for cash management purposes

- whether fallback language will be available

- how liquid the market for (L)IBOR rates will be towards the end date of 31st December 2021

- whether and when EURIBOR and other IBOR critical benchmarks will be discontinued

The magnitude of change is well-recognised by banks and financial institutions, and they are demonstrating an increasing sense of urgency to address contracts maturing after 2021. Be prepared for a call from your bank in the coming months!

What should you do to prepare?

As the deadline approaches, you will need to know your level of exposure and impact in order to prevent surprises. What will the impact of the IBOR transition be on your TMS and ERP systems, your credit facilities, bank loans, cash pooling, bonds, ISDA agreements and intercompany agreements? What impacts will these have on your processes and supporting systems? Which complexities will need to be managed?

Having this information at hand will enable you to be a proper sparring partner for your banks when they renegotiate contract terms.

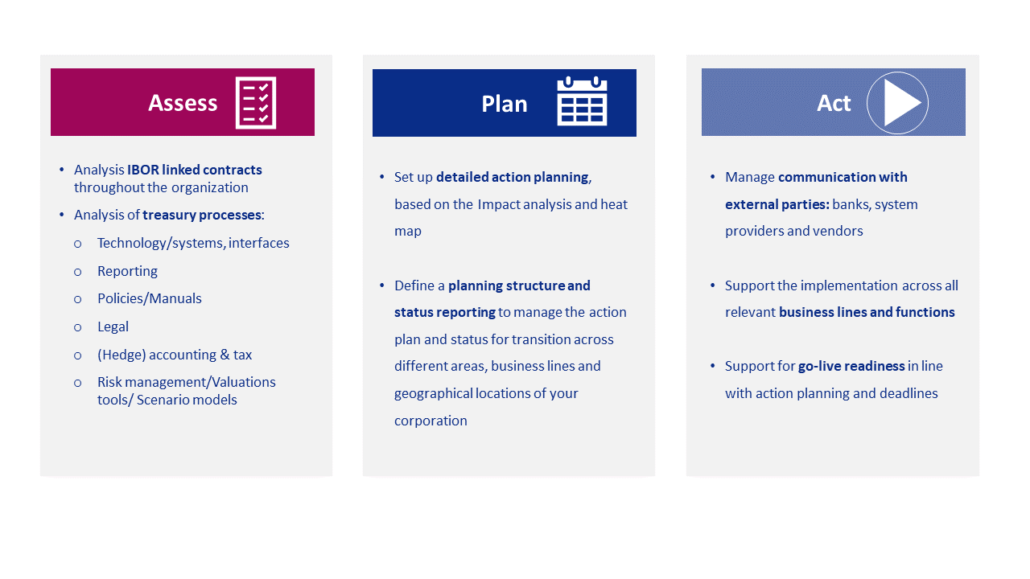

Depending on the complexity of your contracts, the IBOR phase out could substantially affect your corporate organisation. Prevent unnecessary loss by preparing yourself, following this three-step approach:

1. Assess impact

The first step you should take is to analyse the IBOR related contracts in use throughout your organisation. Determine which contracts have an IBOR related component and the size of the exposure. Once you have assessed the complexity of your IBOR related contracts, analyse the impact on related areas (ranging from Tax and Legal to IT systems, and procedures, reporting, accounting (e.g. hedge-accounting), and the like).

2. Plan actions

On completing your impact assessment, create a detailed action plan. Define a project team governance to manage this action plan and the status of the transition across different areas, business lines, and geographical locations. In particular, take care to ensure external resource availability regarding e.g. Legal counselling and system provider experts, as demand for these specialists will rapidly increase as the IBOR transition deadline approaches.

3. Act and implement

Step three is the implementation of your action plan throughout the affected areas of your organisation. In this ‘Act’ phase it is important to maintain the conversation with external parties, such as banks and system providers. It is also of vital importance to support the implementation across all relevant business lines and functions, maintaining support for go-live readiness in line with the defined action plan and deadlines.

A golden opportunity

The good news is that there is still time to assess the impact of the pending IBOR changes on your organisation and to act upon it if needs be. The sooner you have an idea of the potential consequences for your organisation, the sooner you will be able to mitigate these. This understanding will also give you more leverage in the coming discussions with your bank(s).

Moreover, the IBOR phase out may bring a golden opportunity for corporates to re-evaluate the current contract agreements and look for better deals. Consider this: during the IBOR migration contracts are in fact ‘renegotiated’ and banks will need to come up with a new offer. Will you take that offer as a corporate client? That all depends on your level of understanding and preparation.

IBOR may well be a golden opportunity, but it is up to you as a corporate treasurer to seize it by acting rather sooner than later! Corporates: Caveat IBOR!

If you are interested in how we can help you to assess your IBOR related contract complexity or if you want to understand how we can support your corporate organisation in the IBOR phase out transition, you can contact us on:

If you are interested in how we can help you to assess your IBOR related contract complexity or if you want to understand how we can support your corporate organisation in the IBOR phase out transition, you can contact us on:

[email protected] or look at www.enigmaconsulting.nl

[1] A more extensive overview of IBOR benchmarks and related alternative risk free rates can be found on the website of The Investment Association (in cooperation with Linklaters): Table Interbank Offered Rates (IBORs) and Alternative Reference Rates (ARRs), version September 24, 2020

[2] Source: Interest rate benchmark reform – overnight risk-free rates and term rates, Financial Standards Board, July 12 2018

[3] Source: Further statement from the RFRWG on the impact of Coronavirus on the timeline for firms’ LIBOR transition plans, Bank of England, March 25 2020

[4] Source: ISDA launches IBOR fallbacks supplement and protocol October 23, 2020

[5] Source: LIBOR transition – the critical tasks ahead of us in the second half of 2020, Financial Conduct Authority, July 14 2020

SIDEBAR

Selected Highlights of IBOR Phase Out Related Facts[1]

General

- LIBOR term rates (1m, 3m, 6m, 12m) for USD, GBP, CHF, JPY, EUR will cease to be published per December 31st, 2021

- Overnight, transaction based “alternatives” for these currencies are already live: ESTER (EUR); SONIA (GBP); TONAR (JPY); SARON (CHF) and SOFR (USD)[2]

- EONIA is based on Ester + 8.5 basis points (since October 2nd, 2019). EONIA will cease to be published per December 31st, 2021

- As of October 2019, EURIBOR is published as a hybrid rate (mix of actual transactions + panel consultation) and will continue to be published. EURIBOR is expected to be continued into the foreseeable future, however discontinuation is still a possibility. At the time of writing, it is uncertain if and when this will happen

- Various consultation groups are assessing reform proposals and alternatives, such as:

- Working Group on Sterling Risk Free Rates regarding GBP LIBOR

- Alternative Reference Rates Committee (ARRC) regarding USD LIBOR

- Working Group on Euro Risk Free Rates regarding EONIA and EURIBOR

- Financial institutions have performed a global impact assessment on their financial contracts and have created IBOR migration teams

- Across different jurisdictions and different financial products, the IBOR transition is progressing in different stages

- Calculation methodologies across different alternative RFRs could differ and a term structure is still missing for most of the alternative benchmarks

ISDA (International Swaps and Derivatives Association)

- On May 14, 2020 a summary of the response to the “ISDA 2020 Consultation on How to Implement Pre-Cessation Fallbacks on Derivatives” was published. The majority of market participants support a combination of pre-cessation and permanent cessation fallbacks without optionality or flexibility in the IBOR Fallbacks Supplement and IBOR Fallbacks Protocol[3]

- On July 21, 2020 Bloomberg and ISDA announced that Bloomberg Index Services Limited (BISL) had begun calculating and publishing fallbacks that ISDA intends to implement for certain key interbank offered rates (IBORs)[4]

- ISDA launched the IBOR Fallbacks Protocol and the IBOR Fallbacks Supplement to implement the new fallbacks for legacy and new derivative contracts on October 23, 2020. From effective date January 25, 2021, all new cleared and non-cleared interest rate derivatives that reference the definitions will include the fallbacks[5]

SIDEBAR

Central Counterparty Clearing houses

- On July 27, 2020 LCH, Eurex Clearing and CME Group implemented a discounting switch from EONIA to Ester for cleared OTC EUR denominated derivatives related to Price Alignment Interest (PAI[6]) and Price Alignment Amount (PAA) regarding Settle-to-Market collateral[7]

- On October 19, 2020 LCH, Eurex Clearing and CME Group implemented a discounting switch from EFFR to SOFR for cleared OTC USD denominated derivatives related to Price Alignment Interest (PAI) and Price Alignment Amount (PAA) regarding Settle-to-Market collateral

USD LIBOR transition and Alternative Reference Rates Committee (ARRC)

- The ARRC issued a deadline on September 30, 2020, in order to establish RFP processes to facilitate the eventual publication of (a) forward-looking term SOFR rates and (b) the ARRC’s recommended spread adjustment for transition of legacy contracts[8]

- From September 30, 2020 onwards, new syndicated business loans must include ARRC hardwired fallback language

- From October 31, 2020 onwards, new bilateral business loans must include ARRC hardwired fallback language

- From December 31, 2020 onwards, no new Floating Rate Notes referring to USD LIBOR and maturing after 2021 should be issued

GBP LIBOR transition and Working Group on Sterling Risk Free Rates

- New bonds issuances maturing after 2021 and referring to GBP LIBOR should be ceased after Q1 2021[9]

- New loans issuances maturing after 2021 and referring to GBP LIBOR should be ceased after Q1 2021

- Initiation of new linear derivatives linked to GBP LIBOR that expire after 2021 should cease after Q1 2021

[1] The list of highlights does not have the intention to give a complete overview of all events and only reflects recent developments

[2] A more extensive overview of IBOR benchmarks and related alternative risk free rates can be found on the website of The Investment Association (in cooperation with Linklaters): Table Interbank Offered Rates (IBORs) and Alternative Reference Rates (ARRs), version September 24, 2020

[3] Source: Summary of Responses to the ISDA 2020 Consultation on How to Implement Pre-Cessation Fallbacks in Derivatives. A pre-cessation announcement would be an announcement that the IBOR benchmark is no longer representative of the interbank lending rate. A cessation announcement would be a public announcement that the administrators of different IBOR benchmarks have or will cease to provide IBOR benchmarks

[4] Calculations published by BISL include the adjusted RFR (compounded in arrears), the spread adjustment and the ‘all in’ IBOR fallback rates for the following IBORs across various tenors: the Australian Dollar Bank Bill Swap Rate (BBSW), the Canadian Dollar Offered Rate (CDOR), Swiss franc LIBOR, EURIBOR, Euro LIBOR, Sterling LIBOR, HIBOR, Euroyen TIBOR, Yen LIBOR, TIBOR and US Dollar LIBOR (see https://www.isda.org/2020/07/21/bloomberg-begins-publishing-calculations-related-to-ibor-fallbacks/ )

[5] Source: ISDA launches IBOR fallbacks supplement and protocol October 23, 2020

[6] PAI is the overnight cost of funding collateral. It is debited from the receiver and transferred to the payer to cover the loss of interest on posted collateral. Imagine an Interest Rate Swap, cleared through a CCP such as LCH, Eurex Clearing or CME Group. At the beginning of the life of the swap the PV is close to zero, so worth little to either party. Over the life of the trade the value of the floating leg will vary leading to an NPV to one of the parties. The change in this NPV from day to day is what Variation Margin is, calculated and moved by a CCP on a daily basis.

[7] LCH Discounting Switch Ester and SOFR

CME Discounting Switch Ester and SOFR

Eurex Clearing Discounting Switch Ester and SOFR

[8] ARRC USD LIBOR Transition Timelines, New York Fed, version September 9 2020

[9] UK RFR Roadmap | 2020-21 intermediate update, Bank of England, September 2020