What will be the Treasury Trend of 2023?

30-11-2022 | treasuryXL | LinkedIn |

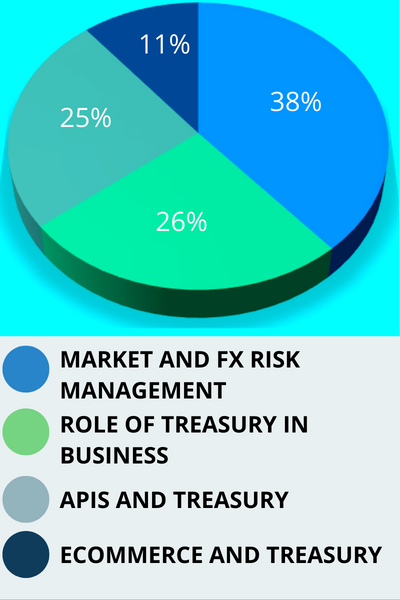

As 2023 is approaching, we explored what Treasurers are particularly looking forward to in treasury for next year. What will be the Treasury Trend of 2023? Are treasurers curious to know what is going to happen in the area of Market and FX Risk Management, or just what the developments are going to be in e-commerce related to Treasury? Or will the understanding of APIs in Treasury be the story of 2023, or the role of Treasury within companies? We sought it out!

What will be the Treasury Trend of 2023?

As 2023 is approaching, we explored what treasurers are particularly looking forward to in treasury for next year. What will become the trends in treasury management next year?Are treasurers curious to know what is going to happen in the area of Market and FX Risk Management, or just what the developments are going to be in Ecommerce related to Treasury? Or will the understanding of APIs in Treasury be the story of 2023, or the role of Treasury within companies? We sought it out! This topic was also the subject of discussion during the last webinar together with Nomentia, you can find the recording here.

Question: What are you particularly interested in that will develop in 2023 in treasury?

First observation

We see that Market and FX Risk Management stands out a little, and that there is less focus on trends in e-commerce and Treasury. What do those within treasuryXL say about this, and what are they looking forward to for next year?

View of treasuryXL experts

Huub is especially interested in the developments in APIs for Treasury for in 2023.

“My personal interest is in the focus on APIs, which is good, as APIs offer new functionalities and convenience for treasurers”

With the current political and economic turmoil, it makes sense that market risk is back on the agenda. Interest rates are rising and emerging markets are becoming riskier. My personal interest is in the focus on APIs, which is good, as APIs offer new functionalities and convenience for treasurers. However, it is a jungle because everyone promises APIs, but few deliver on them, and the few that do make them have no standards.

We also see APIs that are ‘disguised’ file connections. This makes sense, because an API means linking two applications and this can be done through authentication, security and then exchange of a file. We see this a lot with Payment Service Providers. Getting reporting files for matching purposes, for example.

The webinar the other day was interesting because Niki and I represent two different areas of treasury that are important to Patrick, a very experienced treasurer, namely market risk and technology. Together with Pieter as moderator, it was fun to hear the different perspectives and experiences!

Kim Vercoulen (Treasurer Search)

Kim is especially interested in the developments of Market and FX Risk Management for in 2023.

” Important question for the treasurer will remain what to do about this.”

I chose for Market and FX Risk Management. I think especially with inflation and higher interest rates, this is going to have an impact on the treasurer’s work within the treasury department.

This is obviously all going to play through on companies’ costs, and pressure on selling prices will also increase. Important question for the treasurer will remain what to do about this.

How this will affect the treasury market compared to the current year remains to be seen. That is what we are going to witness at Treasurer Search.