17-06-2022 | treasuryXL | Cashforce | TIS

Revolutionizing Global Liquidity Management for Treasury and Finance

Treasury Intelligence Solutions (TIS), a global leader in enterprise payment optimization, today announced their acquisition of Cashforce, an AI-powered provider of cash management and forecasting solutions.

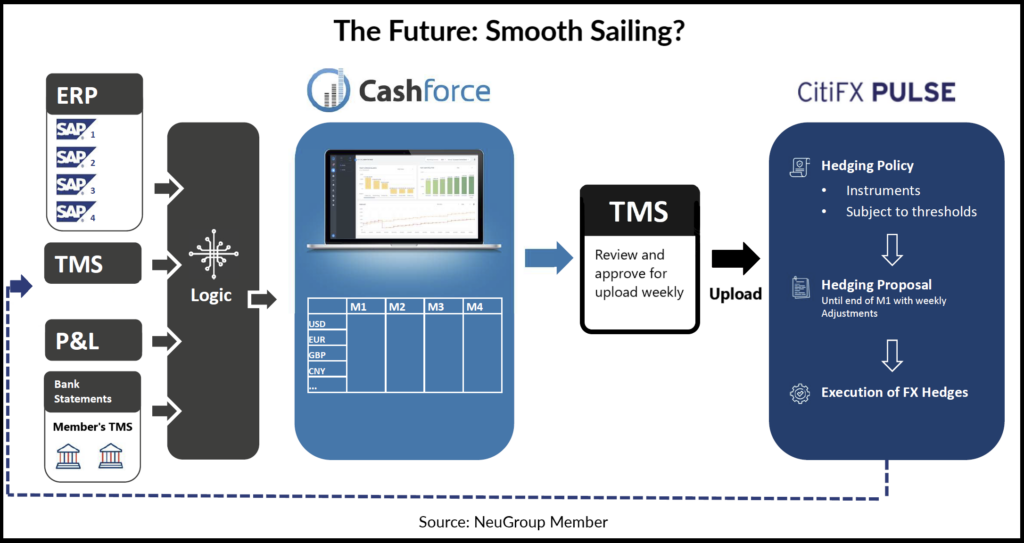

This acquisition will see Cashforce’s leading cloud solution – currently deployed at many of the largest and most sophisticated corporate treasuries in the world – become integrated with TIS’ SaaS payments platform. This unified solution will provide enterprises with an unmatched suite of capabilities for cash management, global payments, and fraud mitigation along with superior connectivity, workflows, and reporting functions.

Over the past few years, TIS and Cashforce have collaborated closely to provide a complementary offering for treasury and finance teams. These efforts were met with immediate success in the market as demand for improved cash management and forecasting tools has risen sharply. Now, TIS’ acquisition of Cashforce presents the perfect opportunity to integrate both products together as part of a more complete offering.

For the thousands of enterprise treasury and finance practitioners who currently use TIS, this acquisition provides access to faster and more accurate cash reporting, forecasting, and working capital management. To date, cash positioning and forecasting are still being performed manually by many treasury groups, which represents a major pain point for CFOs and business leaders when attempting to make strategic financial decisions. However, the robust capabilities provided by Cashforce eliminate many of these inefficiencies and ultimately enable companies to gain quick and accurate insights into their financial position based on reliable payments and liquidity data.

According to Erik Masing, Group CEO of TIS, “Cashforce has been a premier partner of TIS for several years and has contributed significantly to the cash forecasting and management capabilities we offer clients. The acquisition is a natural extension of our business and will allow TIS to further integrate Cashforce’s solution with our platform in order to offer advanced forecasting and data management capabilities to all our clients. This means enterprises can significantly reduce complexity in their global payments and cash management tech stacks by leveraging standardization and transparency afforded by a single, elegant solution.”

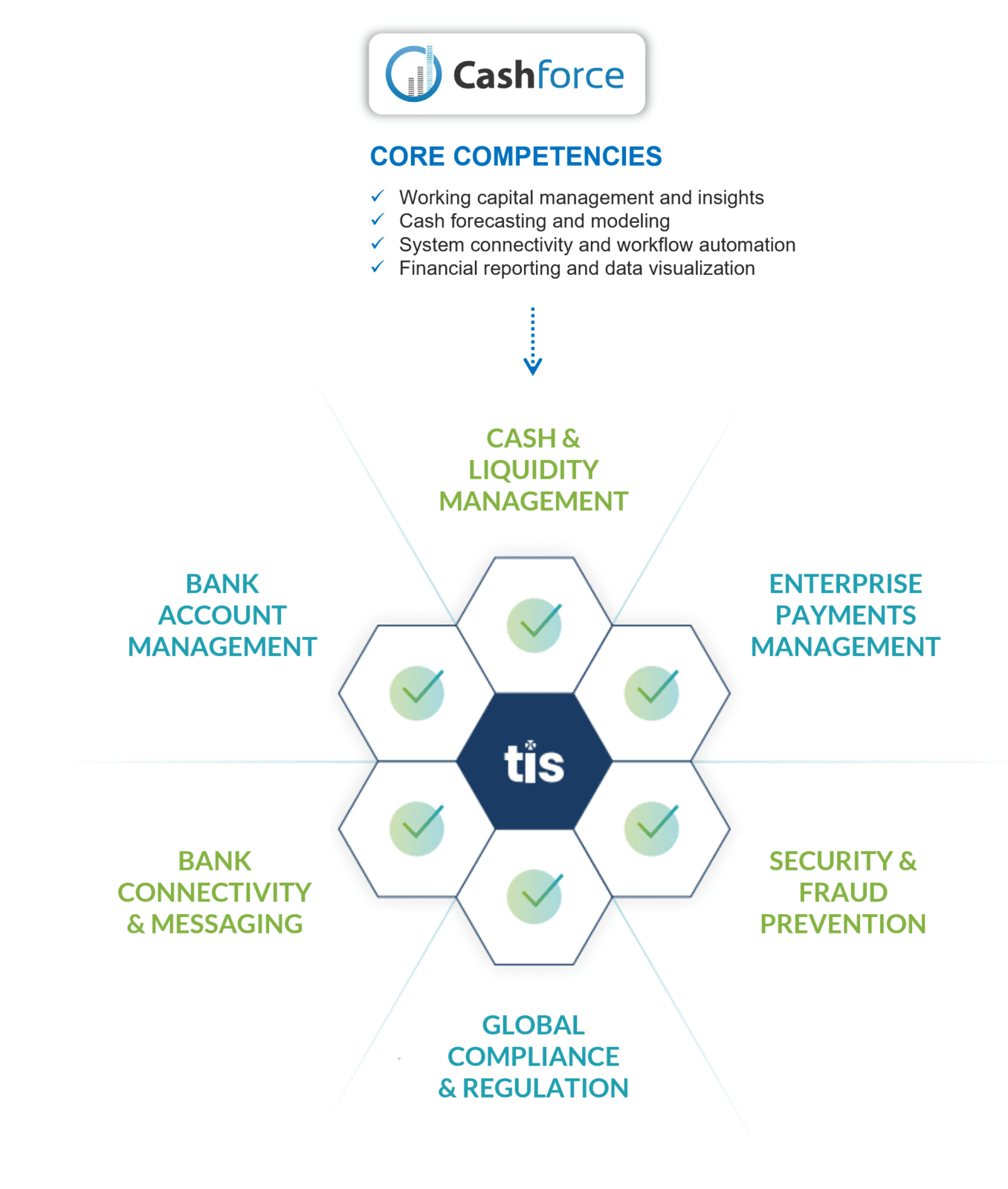

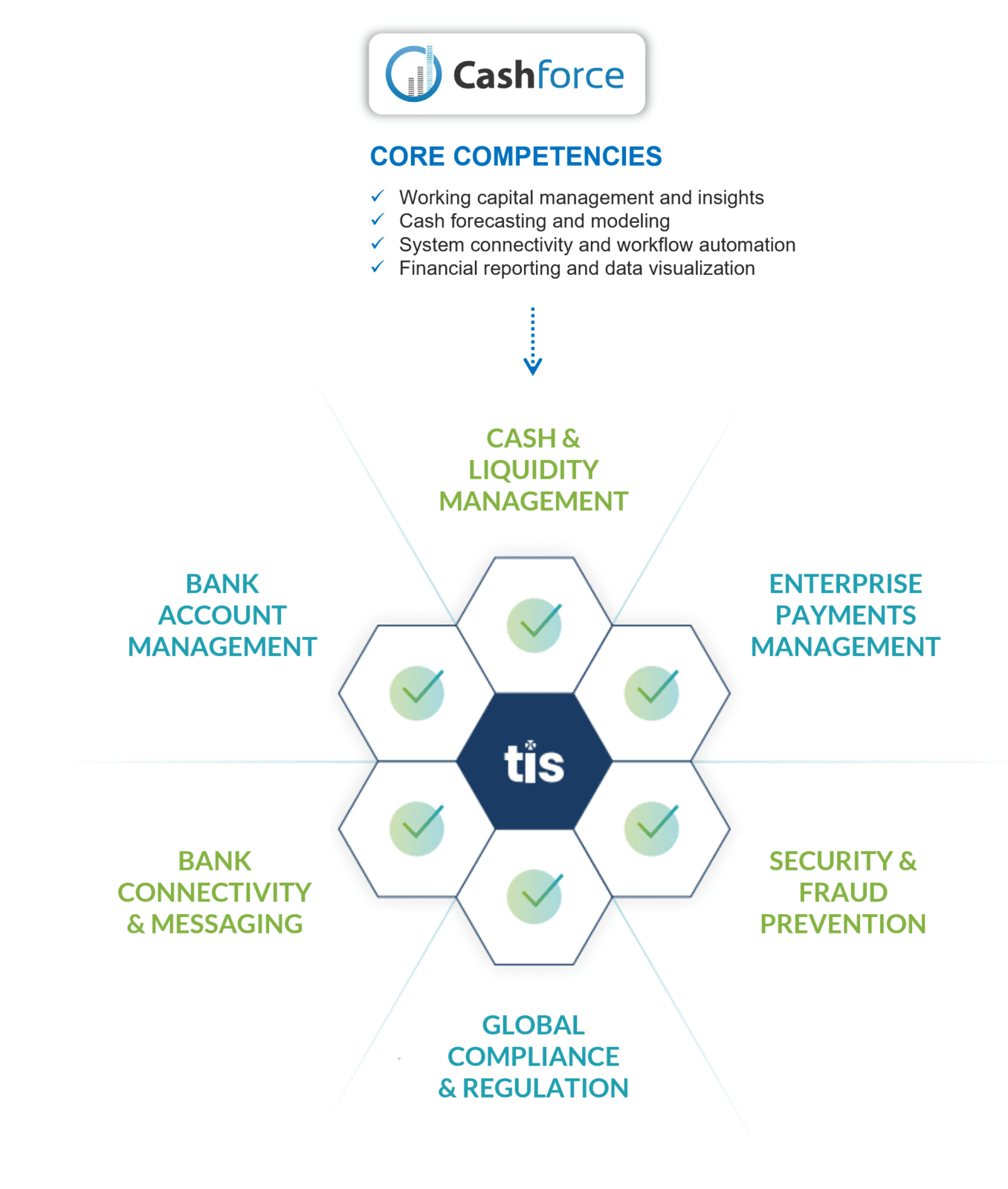

For Cashforce, the acquisition means that existing clients can now supplement their robust forecasting capabilities with TIS’ industry-leading payments and bank connectivity features. As explained by Nicolas Christiaen, Founder and CEO of Cashforce, “Giving businesses complete visibility over their cash and liquidity data has always been the core objective of Cashforce. While we have spent years perfecting our capabilities in this regard, TIS has been strengthening their suite of payments, bank connectivity, and cash management tools. When combined, these two sets of capabilities form the ideal solution for global treasury and finance teams to achieve full control and visibility over their entire payments and liquidity architecture – including all entities, back-office systems, and banks.”

With the added capabilities of Cashforce’s solution, TIS now offers a single, scalable cloud platform for clients to address needs in the following areas:

- End-to-end payment processing and bank statement management

- Global bank connectivity and financial messaging

- Real-time cash positioning and liquidity management

- Multifaceted cash forecasting, cashflow analytics, and working capital management

- Bank account management and bank documentation management

- Payment compliance and sanctions screening control

- Treasury security, regulatory compliance, and fraud mitigation tools

For more information on TIS’ acquisition of Cashforce and the advantages our combined solution will provide to enterprise treasury, finance, and executive teams, contact us at [email protected] or by using the information found on our website.

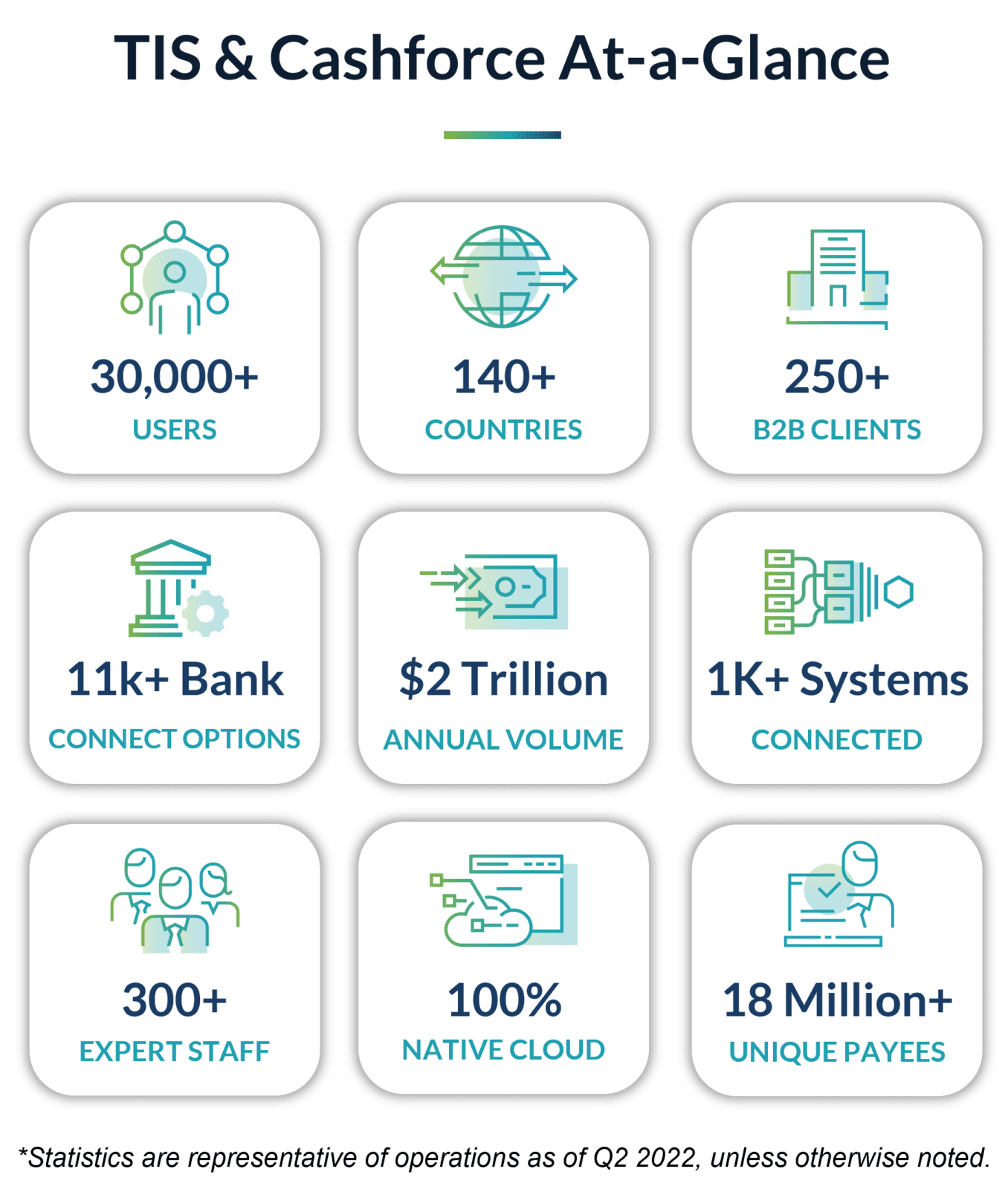

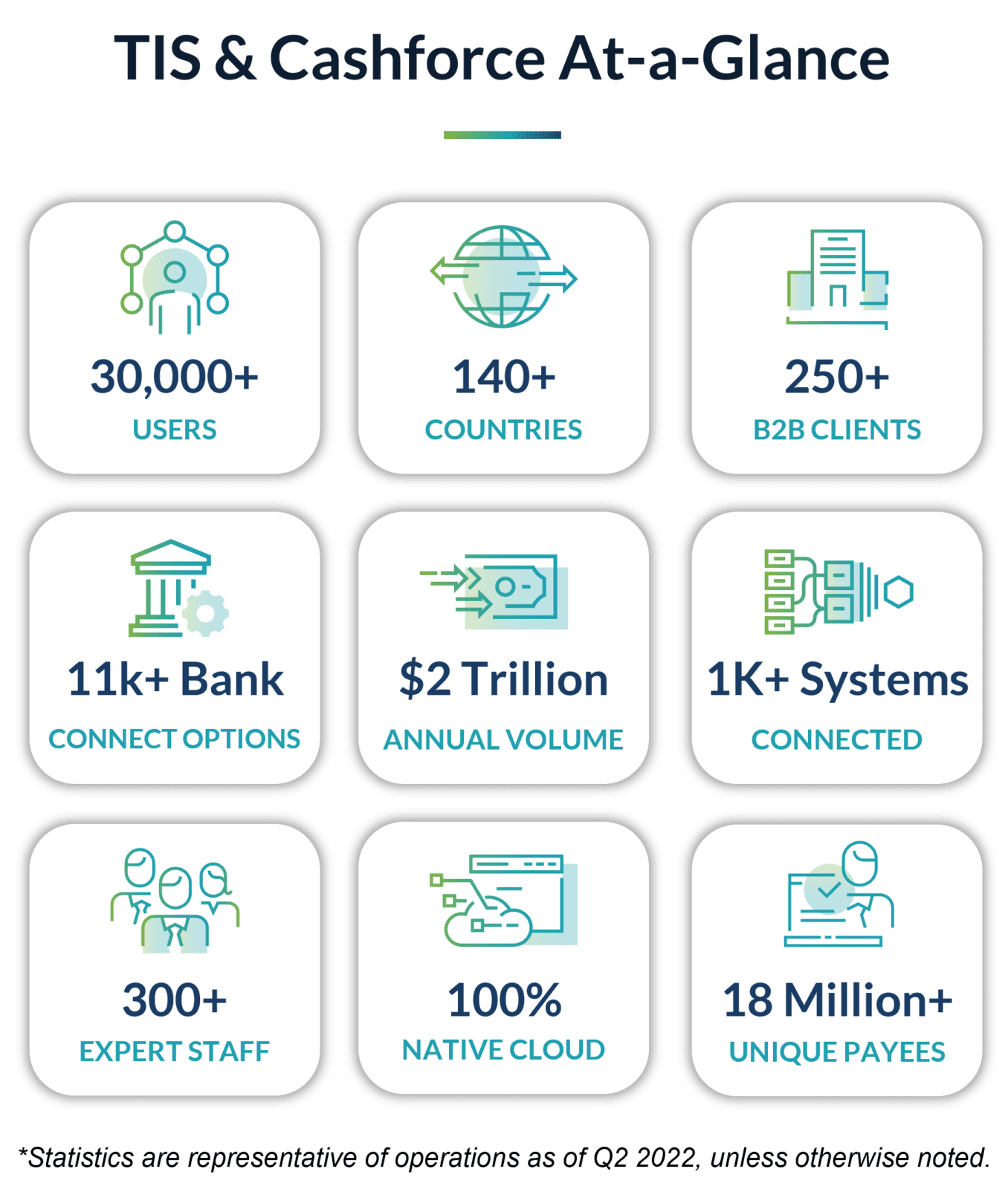

About TIS

TIS is reimagining the world of enterprise payments through a cloud-based platform uniquely designed to help global organizations optimize payments, manage cash visibility, and mitigate risk. Corporations, banks, and business vendors leverage TIS to transform how they connect global accounts, collaborate on payment processes, execute outbound payments, analyze cash flow and compliance data, and improve critical outbound payment functions. With $2 trillion in payments processed annually, the TIS corporate payments platform helps businesses improve operational efficiency, lower risk, manage liquidity, gain a strategic advantage – and ultimately achieve enterprise payment optimization.

Visit us for more information at https://www.tispayments.com.