| 07-09-2016 | Boudewijn Schenkels |

Imagine it will be possible to transfer money within several seconds from any bank account to another bank account. 24 hours a day, 7 days a week. It will open large business opportunities enabling many innovative payments use cases.

Imagine it will be possible to transfer money within several seconds from any bank account to another bank account. 24 hours a day, 7 days a week. It will open large business opportunities enabling many innovative payments use cases.

After the introduction of SEPA the market is ready for further innovation. New payment laws (PSD2) make the payment market more competitive and new payment providing parties are anxious to participate. The continuous development of the ‘always on’ economy drives the need for faster and 24/7 payment execution.

According to the European Retail Payment Board (ERPB), an instant or immediate payment is an electronic (retail) payment solution, available 24/7/365 and resulting in immediate interbank clearing of the transaction and crediting of the payee’s account with confirmation to the payer within seconds of payment initiation, irrespective of the underlying payment instrument used and arrangements for clearing. Basically: sending and receiving payments 24/7 within seconds. National instant payment solutions have already been successfully launched in a number of European countries, such as Denmark, Poland, Sweden and the UK.

The SEPA Instant Payment, based on the SEPA Credit Transfer, can be offered in SEPA by November 2017; with the Rulebooks for this so called SCT Inst scheme becoming available in November this year. Some communities will offer Instant Payments from the start, others will follow later, but not offering Instant Payments doesn’t seem to be an option. Various other countries, including The Netherlands, Belgium, Spain and Italy, are running programmes to deliver Instant Payments to their communities in the coming years. The major Dutch banks have committed themselves to deliver Instant Payments, or what they call: “the new normal”, by May 2019.

Instant Payments in itself will offer new interesting payments use cases, but it will certainly serve as a platform to support many new innovative payments services.

Impact for Treasurers and Cash managers

For treasurers and cash managers there will be large changes as well as opportunities. For a long time banks have provided cash pooling solutions to their customers, but Instant Payments will allow to sweep accounts at any time to enable efficient cash pooling and distribution eventually throughout Europe.

Another few examples of these “future” use cases are:

- Pay upon delivery (car purchase, market place transactions) every hour of the day

- Enabling of cash transactions replacement

- Instant Pay-out of Insurance payments: in case of a calamity an immediate pay-out and availability of funds can be very beneficial for consumers;

- Instant lending: propositions where loans can be granted in near real time the pay-out can be done instantly providing the customer with access to the funds immediately

- Notary payments: immediate transfer of funds also in the weekend

- Request for Instant Payment: request a payment and get payed immediately when authorised

- Time critical or “just in time” business payments: the greater transparency in a SEPA Instant Payment (within seconds it is either successful or not) will enable businesses to pay and be paid on delivery (e.g. shipping, delivery of goods, etc.), or to settle fees such as tax, port fees etc. associated with a cargo to enable its release

- It can replace some urgent payments services

- Late cut-off times for SEPA batch payments by re-using Instant Payments: if a service is introduced that converts batch SEPA Credit Transfer payments into Instant Payments businesses can profit from the 24/7 instant character of Instant Payments without major changes to their payments environment; depending on the size of the batch and the capacity of the instant payment infrastructure batch payments can be executed in minutes or in a few hours and out of business hours; it allows business to pay later, pay on a specific day of the month and increase liquidity

- Instant Direct Debit: an Instant Direct Debit would combine the advantage for businesses of having instant clarity of the payment succeeding and receiving funds, for instance last minute lottery ticket

You will say, “too good to be true”, but they are all in scope for “the new normal”. I would like to say: be aware of all the changes and business opportunities for your organization and prepare yourself!

Boudewijn Schenkels

Senior Consultant Payments @ Payments Advisory Group

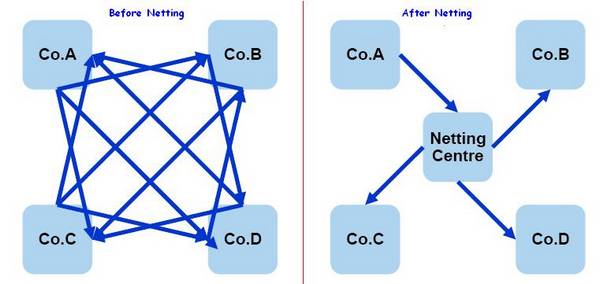

Netting is mainly used by global operating companies with a large number of subsidiaries; the reach of netting can however also include smaller company structures and save a lot of handling and costs.

Netting is mainly used by global operating companies with a large number of subsidiaries; the reach of netting can however also include smaller company structures and save a lot of handling and costs.

Jan Meulendijks – Cash management, transaction banking and trade professional

Jan Meulendijks – Cash management, transaction banking and trade professional Imagine it will be possible to transfer money within several seconds from any bank account to another bank account. 24 hours a day, 7 days a week. It will open large business opportunities enabling many innovative payments use cases.

Imagine it will be possible to transfer money within several seconds from any bank account to another bank account. 24 hours a day, 7 days a week. It will open large business opportunities enabling many innovative payments use cases.