Recap conference Toekomst Betalingsverkeer

| 13-5-2019 | François de Witte | treasuryXL |

Each year in April, the Conference “Toekomst Betalingsverkeer” is organized by Euroforum in Amsterdam. This is a major event in the Payment Business, which gathers over 300 professionals. Several themes relating to Innovations on Payments came up. To start with Patrick Coppens presented an inspirational keynote speech about the Payments Innovations in China, who on this moment clearly is the trendsetter in this area.

The program consisted of several keynote speeches and round tables, where different sub-themes were discussed in small groups. I chaired two of these round table sessions on the topic of: “The View of the Treasurer on Payment Transactions”. In this article I will discuss the takeaways from the round tables I chaired and other presentations I followed at the conference.

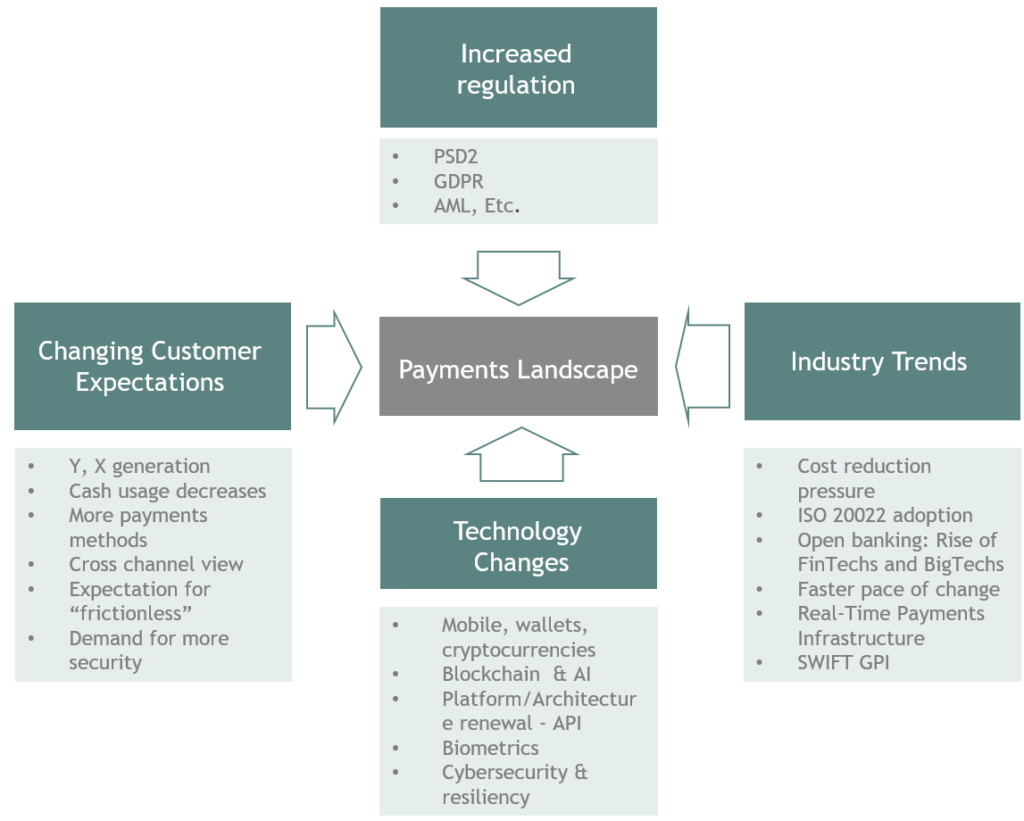

To start of my round table sessions, I showed a picture that shows my view on factors affecting the payment landscape:

We also had a lively discussion about this topic where, amongst others, the following points came up:

- If we move to a 365/7/24 payment systems, all the other components of the economy will have to follow. Real time payments will require “Real Time Treasury”: Will treasurers also have to work on a 365/7/24 basis? According to me, this will not be the case in all the industries, but in certain sectors, like Retail and e-Commerce, this might be the case, or at least treasurers will have to be “on call”.

- Large corporates will move slower to open banking then Retail and SME, but the shift towards Open Banking and Real Time Payments will also affect them.

- Beside the traditional TMS players and middleware providers, we will also see an increase in FinTech’s coming up with smart solutions for the SME and Midcaps. They will challenge the incumbent players with more flexible and lower priced solutions. The challenge for them will be to get the trust of the large corporates, which might not be willing to entrust their high volume and value payments to smaller FinTech’s.

- Currently SMEs sometimes complain about the solutions of the banks. Banks must come up with smarter solutions for the SME, because one day they might become midcaps and corporates.

- Corporates are interested in the solutions, and do not look through to the components. It is like when you go for an operation to the surgeon: you do not expect him to check the origin of the operation table. Trust will remain important.

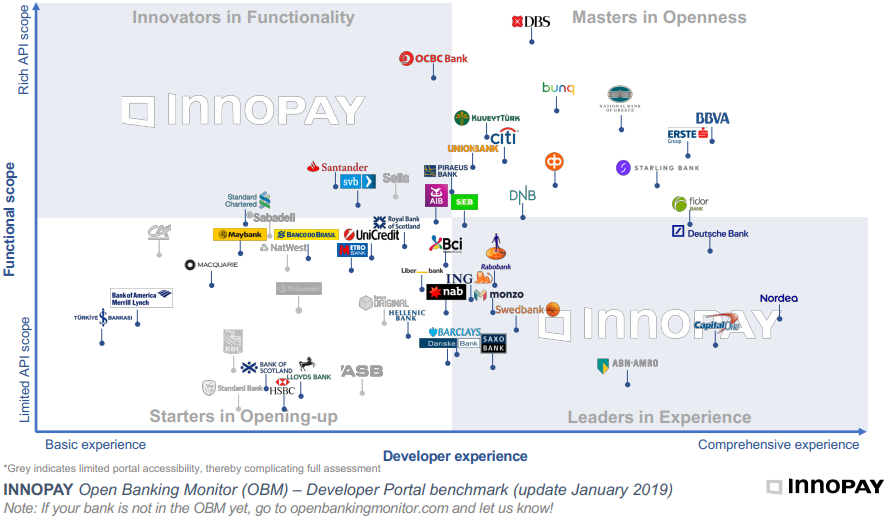

We also had an interesting presentation of Innopay, who made a mapping of the different banks in the Open Banking ecosystem. Amongst the masters in openness, we see challenger banks, Bunq, Fidor and Starling bank, the large Scandinavian banks SEB and DNB, and some global banks (Citi and BBVA). The large Dutch banks (ING, RABO, ABN AMRO) are leaders in experience but have currently still a more limited API scope.

Furthermore, there were presentations highlighting the increasing trend of “Tokenisation”. Tokenization is a process of replacing sensitive data with non-sensitive data. In the payments industry, it is used to safeguard a card’s PAN (Primary Account Number) by replacing it with a unique string of numbers. These tokens can then be passed through the internet or the various wireless networks needed to process the payment without actual bank details being exposed. These will provide some benefits such as:

- Cost savings: Tokenization takes away the burden of managing cardholder data storage in a secured way, hence reducing the costs involved with meeting and monitoring Payment Card Industry (PCI) compliance.

- Increased security: If fraudsters manage to steal tokenized data, they cannot use the stolen tokens to pay online since they are unable to link the token to payment information stored securely by the payment partner.

- Improved user-experience: Tokenization enables merchants to offer their clients the possibility to save their payment details it in a secure manner, so that the next time they make a purchase they do not need to re-enter their payment data. One-click payments significantly increase conversion at the checkout page through streamlining the payment process for shopper.

I also attended the workshop on SEPA Instant Credit Transfers (SCT Inst), where the Netherlands started in Q1 2019 a controlled roll-out. According to the EPC (European Payment Council) end-April 2019 already 50% of European PSPs (Payment Service Providers support the SCT Inst scheme. The EPC expects that a critical mass of SCT Inst scheme participants will be reached by the end of 2020, particularly in the euro area. However, currently instant payments remain mostly a local initiative, and it will take time to reach a full adoption.

These are my takeaways from the Conference “Toekomst van Betalingsverkeer”. I’’m curious to hear your thoughts about the developments in the world of payment transactions and invite you to discuss further in the comment section.

Founder & Senior Consultant at FDW Consult

Managing Director

CFO at SafeTrade Holding S.A.