FX Swaps vs Libor and EURIBOR: Arbitrage opportunities?

| 05-07-2016 | Rob Söentken |

As we are getting closer to the end of the month, end of Q2 and end of H1 of 2016, it is interesting to see financial markets are maneuvering to get the right liquidity on board for the balance sheet. Or get rid of the unwanted liquidity. For firms with liquidity in various currencies the best means for liquidity management is FX swaps.

What is an FX swap?

In a very simple definition the FX swap is like an exchange of deposits. The big advantage is that the counterparty risk is reduced due to the exchange of notional. Operationally an FX swap is booked as two FX transactions: one to convert and another to revert. The conversion rate is against the prevailing exchange rate. The reversion rate is against the conversion rate plus or minus some ‘swap points’, which reflect the interest rate differential between the respective currencies. During the tenor the exchange rate could change, which creates counterparty risk on the mark-to-market value of the reversion. Mark-to-market risk for tenors up to 1 year is still a small when compared to full notional risk.

How would an FX swap work in theory?

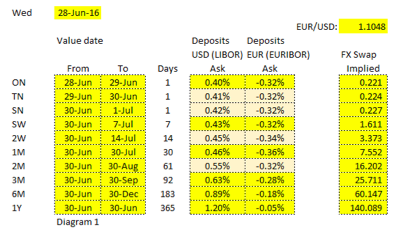

In diagram 1 the Libor and Euribor fixings for USD and EUR are listed for the respective tenors.  Now if we would consider exchanging a USD deposit versus a EUR deposit for 1 year the cash flows would be as follows:

Now if we would consider exchanging a USD deposit versus a EUR deposit for 1 year the cash flows would be as follows:

For the conversion date we take value spot (ie 2 days, in this case that is per June 30th) and we agree to exchange EUR 1 Mio vs USD 1.1048 Mio (because EUR 1 Mio at current spot of 1.1048 is USD 1.1048 Mio)

For the reversion date we take the value date for 1 year from today’s spot date. We calculate the following amounts including interest:

EUR 1 Mio x (1 + -0.05% x 365 / 360) = EUR 999,493.06

USD 1.1048 Mio x (1 + 1.20% x 365 / 360) = USD 1,118,241.73

Dividing the USD amount by the EUR amount gives the exchange rate for the reversion on the forward date, in this case that is 1.1188089. This is called the ‘forward rate’ The difference to the spot exchange rate is 0.0140089. For simplicity reasons this is multiplied by 10,000 to 140.089. This reflects the interest differential.

When executing an FX swap the EUR amounts are kept constant for both the spot and forward dates. But the USD amounts are calculated using the spot and forward exchange rates as calculated above. Therefor the interest differential is reflected in the USD amount being different between spot and forward date.

How does it work in reality?

As I mentioned at the beginning of this article, the current situation is special because we are getting close to a date special and important for balance sheet reporting. Supply and demand may push the market in a direction.

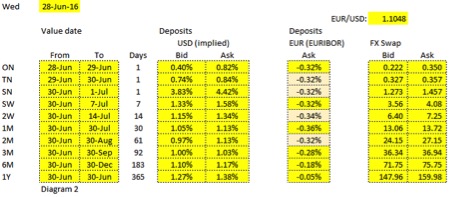

When looking at the actual FX swap rates and taking the EUR Euribor fixings as given, we can deduce the implied USD funding rates (see diagram 2). First observation is that the FX swaps appear to reflect either a substantial demand for USD from June 30th to July 1st, or a EUR supply. It is interesting to see that the 1 week fixing for EUR was not affected, while the 1 week FX swap was affected maybe 20 bppa. One reason could be the timing of the rates. Euribor is taken at one moment during the day, while FX swaps are affected by events during the day. Because w e are looking at a single day FX swap, the annualized rate could swing a lot.

e are looking at a single day FX swap, the annualized rate could swing a lot.

Another observation is that the interest rate differential between EUR and USD is actually bigger than implied by the fixings. For one month tenor the difference is 0.59% p.a.. It would seem possible that supply – demand forces can push FX swaps away from the deposit markets. Likely the counterparty limit constraints on pure deposits keep them from being arbitrages vs FX swaps, like they used to be many years ago.

How can a treasurer benefit from FX swaps?

Each individual and organization should determine for itself what he/she or it needs. And I do not want abstract from discussions around documentation requirements, collateral financing and administration, and the operational extra work. It seems obvious that there are opportunities to investigate.

One key area would be to look at the bid-offer spreads on cash liquidity in various currencies as provided by house-banks and compare those rates with and without using FX swaps. Also I could imagine non-house banks could be more competitive in providing FX swaps, while the counterparty risk is substantially smaller than when pure lending is concerned.

Ex-derivatives trader

Many CFO’s and Financial Managers would like to improve the cash awareness inside their companies. The most obvious action is to set up financial targets but how could a change of mindset be reached without new targets? One way is to see cash awareness as a product and to try to sell this product inside the company.

Many CFO’s and Financial Managers would like to improve the cash awareness inside their companies. The most obvious action is to set up financial targets but how could a change of mindset be reached without new targets? One way is to see cash awareness as a product and to try to sell this product inside the company.