Blockchain : What to expect for 2017?

| 23-08-2016 | Carlo de Meijer |

We are now 8 months further on in 2016. Blockchain seems to be not a hype anymore but increasingly becoming a reality. What can we learn from what happened in the area of blockchain up till now. Is it possible to make predictions for 2017 and further? Let’s give a try!

We are now 8 months further on in 2016. Blockchain seems to be not a hype anymore but increasingly becoming a reality. What can we learn from what happened in the area of blockchain up till now. Is it possible to make predictions for 2017 and further? Let’s give a try!

What happened this year?

On the basis of the various activities and developments during this year a number of trends can be recognised. These could give enough ammunition for a number of predictions on blockchain for 2017.

Increased knowledge sharing

First of all the growing interest and therefor the growing need for knowledge about blockchain. We have seen an explosion of articles, reports, conferences, workshops, seminars, roundtables etc. on blockchain. Many people were educated what blockchain is, its possible applications etc.

Growing investments in blockchain start-ups

We also have seen a boom in the number of start-ups that is developing applications of blockchain technology. They have become very popular among investors. The industry has invested larger sums in these corporates.

Ongoing innovations

These growing investments in start-ups have allowed for ongoing innovations in private blockchain technology, with an increasing number of second and third generation applications popping up.

Consortiums and partnerships coming up

With the believe amongst financial institutions that a go-alone approach is not the right way, we have seen the coming up of a number of collaborative initiatives including R3CEV, Hyperledger project, China Ledger and of various strategic alliances between fintechs, blockchain platforms and financial institutions.

Experimentation and testing stage

Though this year was one of experimentation and testing, with many trials, proof of concepts etc., also first real-world blockchain applications have been launched for small groups but not yet for massive use.

Regulators enter the blockchain scene

What we also have seen is the growing interest and involvement of regulators. Blockchain technology is getting growing attention from various regulatory bodies amid concerns over governance and cybercrime. They try to figure out what is really new about blockchain in case it really takes off.

What can we expect in 2017?

Starting from these developments in the blockchain area, what can we expect for 2017 and beyond?

We are beyond the hype

First of all, looking at 2016, we may say that the blockchain hype is over to a large extent and that 2017 will be a year of practicality. Long-time seen as a hype, just like Pokemon Go, there is growing believe that blockchain is here to stay. Not only financial institutions, but also central banks and governments are nowadays interested in blockchain technology and its potential. This may further broaden the audience of Blockchain believers in a rapid way.

Focus on blockchain integration

Financial institutions will increasingly look for integration of blockchain technology with other areas of the fintech eco system. Existing systems within financial institutions need to adopt to the blockchain element. It must fit in with other banking systems (such as KYC, AML, customer record and other record systems, data warehouses etc).

Integration will not be limited to just installing blockchain technology within their own organisation. It will mean getting many other organisations to adopt and integrate their existing systems with the technology (including businesses proicess and organisational changes). This process may take several years.

Private blockchain networks

While new blockchain consortiums and strategic partnerships will arrive, we will also see an accelerated deployment of private blockchain networks. Multiple networks of trusted platforms each connecting a subset of industry players. This however will ask for an overall distributed ledger, that will be open source with common standards and protocols, enabling interoperability via APIs.

Use cases will be further broadened to non-financial applications

While the focus long time has largely been on applications in the financial world, we will increasingly see blockchain applications in other areas. These may range from decentralised and cloud services including patient records and healthcare support; electronic voting andvoters authentication to cloud based learning and student authentication, digital identity management to land titling and many more. This may allow – just like The Internet – a growing number of people to get in touch with blockchain technology and may open the door to many more.

Blockchain technology will become more mature enabling better and more secure applications ….

Blockchain technology will become more mature, gradually solving issues such as scalability and system integration. We will see more tools and interfaces available. Microsoft Azure for example has started to provide Baas (blockchain -as-a-service) which will enable developers to build more tools. It will allow financial institutions to create all types of tailor made environments using industry level frameworks.

… and also directly-chained solutions

It however will not be limited to blockchain solutions. The technology may also enable directly-chained (instead of block-chained) transactions. In these schemes consensus will be simplified by requiring confirmation just from a limited subset of trusted participants. In these private blockchain schemes that should lead to much faster confirmation times.

In 2017 we will see real-world applications

While 2016 was the year of hit and trial, with many experiments, the banking industry’s proof-of-concept phase will continue according to the Morgan Stanley Report. But 2017 will also see a number of real world applications using blockchain technology.

While the focus long time has been on payments and the securities industry, early real-world blockchain applications will still be limited to use cases such as trade finance, syndicated loans or reference data management, so activities that are not dependent on a critical mass of assets already being on blockchain. Real-world use cases for payments and clearing & settlement purposes however will take several years.

A growing number of market entrants will come with new and more sophisticated innovative offerings for financial institutions. It is thereby expected that they will continue to develop new functionalities for existing blockchain systems to their users, while other applications will emerge.

The year of smart contracts

It is expected that smart contracts will grow in popularity. These contracts that will be stored in the distributed ledger, are getting more accurate and more feasible for real world applications. They are expected to become an integral part of many blockchain solutions. To settle transactions these smart contracts need to be connected to the real world banking system. For banks it is thus important that blockchain will be integrated with their banking systems as well as with their API (Application Program Interface).

Some expect that there will be “a single dominant leading, open source, scalable, enterprise ready, distributed ledger optimised for private blockchain with full support for these smart contracts”. There are a number of organisations working on this.

Growing competition for blockchain platforms

We will see many more platforms to be released. But also increased competition between the various blockchain offerings like Ethereum, Hyperledger, and many more. It is expected that an interface for external users will be developed including APIs, giving others access to the tools will begin to be leveraged.

Increased discussion about standards

The discussion about the need for common industry standards and protocols will continue. There is agreement that common standards and protocols are a must. But not yet next year. There will be multiple networks of trusted platforms all with their own standards and protocols. This however will increase the need for interoperability.

Security gets highest priority

A growing number of institutions are looking at how to use blockchain in their activities. As the blockchain systems may handle more and more assets, contracts and other valuable information, the security part op blockchain applications will get prior attention, to guarantee privacy and integrity of information stored in the ledger.

Regulators enter the scene

Growing focus on security and other risk issues will bring regulators to the forefront. It is expected that regulators will increasingly discuss and operate in collaboration with the industry, to reach the best regulatory solutions for all parties involved. This will help them to develop their policy position towards blockchain technology, assess challenges and benefits of the technology from a regulatory perspective and assess whether new rules are needed.

Economist and researcher

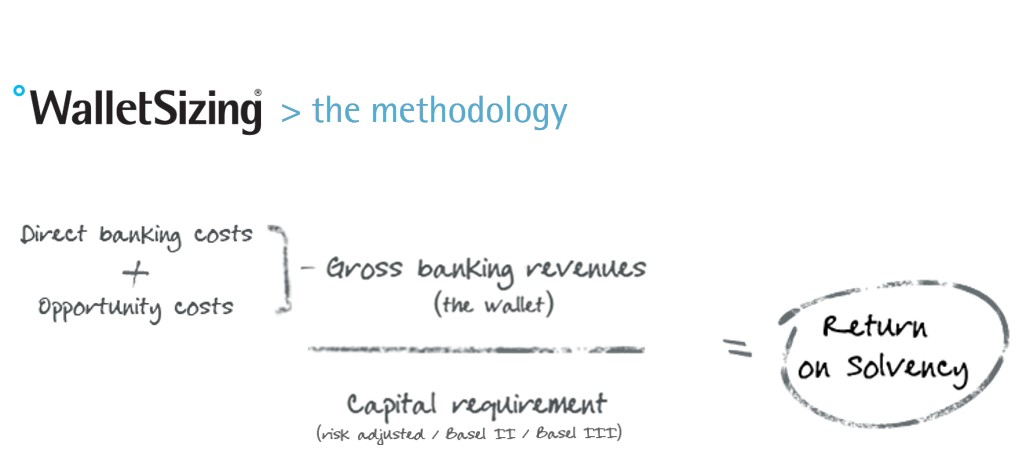

On april 13th of this year the Fintech innovation awards took place. Vallstein won the innovation award in treasury management with their Walletsizing® system. We asked Huub Wevers from Vallstein to give us an update on this new system. What’s new about it and who will benefit from using Walletsizing®?

On april 13th of this year the Fintech innovation awards took place. Vallstein won the innovation award in treasury management with their Walletsizing® system. We asked Huub Wevers from Vallstein to give us an update on this new system. What’s new about it and who will benefit from using Walletsizing®?

Huub Wevers is responsible for Corporate Solutions at Vallstein, the leading Bank Relationship Management specialist. Before joining Vallstein he has had eighteen years of experience in Banking at ABN AMRO and RBS, notably Transaction Banking. His responsibilities included Product Management, Account Management, Implementation and Operations, whereby his last role was the leadership of all Service & Operations in EMEA for RBS. At Vallstein Huub is responsible for building out the software solutions that Vallstein offers for corporates. Solutions that automate bank relationship management in order to assess the profitability that a corporate has for their banks, using all banking products and Basel III.

Huub Wevers is responsible for Corporate Solutions at Vallstein, the leading Bank Relationship Management specialist. Before joining Vallstein he has had eighteen years of experience in Banking at ABN AMRO and RBS, notably Transaction Banking. His responsibilities included Product Management, Account Management, Implementation and Operations, whereby his last role was the leadership of all Service & Operations in EMEA for RBS. At Vallstein Huub is responsible for building out the software solutions that Vallstein offers for corporates. Solutions that automate bank relationship management in order to assess the profitability that a corporate has for their banks, using all banking products and Basel III.