26-03-2020 | treasuryXL | XE |

Emergency situations often strike with very little warning, leaving you very without much time to adapt or plan. Over this past week, people across the world have made major adjustments to their lives in order to reduce the spread of the COVID-19 coronavirus. From organizations shifting to remote work to government-mandated lockdowns, the world this week is a far cry from what many of us thought to be the norm just a month ago.

Money is one of the greatest concerns for individuals during this uncertain time (along with health). A recent poll found that in the United States alone, 18 percent of people have lost jobs or hours. As more and more governments continue to issue orders to shelter at home, lockdown, or quarantine, this figure will only rise in the coming weeks.

Today, it’s the coronavirus. In the future, there’s always the possibility of a natural disaster or other large-scale emergency forcing you to readjust your habits, spending, and way of life. But for this current situation, here’s some of our advice for budgeting and preparing.

Cash or card?

This has been a common question among people concerned about the spread of coronavirus. Some think that it’s good to have a stash of emergency cash. It prevents you from having to worry about a power outage or business shutdown affecting your bank access, and paying in cash means you won’t be handling your card after it’s been in strangers’ hands or touching the same card reader that everyone’s been touching.

On the other hand, some have raised questions about the possibility of spreading COVID-19 through the exchange of cash, particularly if they’re exchanging bills at busy establishments. However, Emily Martin, associate professor of epidemiology from the University of Michigan School of Public Health, stated to the Wall Street Journal that she “wouldn’t expect coronavirus to travel far and wide on money.”

So, what’s the answer? It doesn’t hurt to have a few days’ worth of emergency cash on your person or stashed somewhere safe. However, if going to the ATM or bank would put you or others at risk, don’t make it a priority.

Anything to avoid?

You mean, besides other people?

In times like these, the first instinct is to grab everything, just in case. But this isn’t the best approach. We recommend avoiding the following:

- Panicking. We know, it sounds ridiculous to tell you to stay calm in a pandemic. But panicking can lead to impulsive, irrational, and irresponsible financial decisions. Take a deep breath and ask yourself, “What do I need to make it through the day? The week? The month?”

- Buying more than you (and your household) need. As we’ve seen, grocery stores, pharmacies, and other essential establishments will remain open. Take what you need, take a little extra if supplies allow, but don’t hoard. Does one household really need 500 rolls of toilet paper?

- Bottled water. If (and only if) your tap water isn’t safe to drink, then you should purchase bottled water. Otherwise, you’ll be fine with the faucet.

- Frivolous purchases. Think of this as an opportunity to look at your spending and subtract from your budget. For example, many of us won’t be going to concerts, festivals, or bars anytime soon. And you probably won’t need to buy as many clothes if you’re spending all of your time at home. If you can, take this money and put it in your savings, or put it toward other, more pressing expenses.

What if I don’t have an emergency fund?

You’re not alone. Though common advice is to have 3 to 6 months’ worth of emergency money in savings, less than one-quarter of people actually have that. If you’re not happy with the state of your emergency savings, get started now. If you are still working and receiving an income, try to adjust your budget to allocate some or more to your savings each month.

Under normal circumstances, here’s what we’d recommend:

- Look at your current budget. Figure out how much you’re making, and calculate all of your normal expenses such as rent, bills, and how much you tend to spend on fun non-essentials.

- Calculate what you can save. If you have quite a bit of money left over after expenses at the end of each month, you can set your own goal for how much you’d like to shift to savings. If your budget is limited, calculate how much you could feasibly contribute to a savings account each month.

- Put your money into a separate account. If your employer pays through direct deposit, set up an automatic deposit to your emergency savings account. Otherwise, deposit it yourself, and hold yourself accountable. You can withdraw if you need to, but don’t skimp on your savings.

- Regularly assess your savings plan. Your saving plan shouldn’t stay the same forever. Every so often, take some time to review. You should reassess your budget and plans any time your financial situation changes, as well as a regular review at least once per year.

However, we recognize that now is not a normal circumstance! In our current situation, here’s what you can do to get your emergency fund started ASAP:

- See what expenses you can cut. Normally, experts recommend canceling Netflix or other streaming services, but we understand if that’s not doable right now! Instead, take a look at reducing gym memberships or shopping expenses, and take a look at your fixed costs if you need to.

- Sell a few things. If you have some nice pieces in the back of your closet that you rarely wear, or a few video games that you don’t play anymore, selling those online could help you get a little extra money.

- Can you find additional income? We understand that this is a difficult time to find employment, even more so than usual. However, if you are really hurting from a lack of income right now, look into essential businesses that need more workers or look for remote work. That said, don’t forget to keep your health and safety a priority.

Ultimately? Anything is better than nothing. Don’t think that you need to have an elaborate plan or a large nest egg for your emergency fund. Every fund starts somewhere, and the sooner you start, the sooner yours can start growing.

If you already have an emergency fund…

…and you don’t need to dip into it just yet, take advantage of this time to continue to build yours. If you’ve been able to cut your expenses during those long days at home, take what you would have spent on non-essentials and add it to your rainy day fund. This situation has offered a lot of us a very close look at what can happen to our lives and finances. If you’re managing to get by now, let’s make sure that you’ll still be fine next time.

If you do need to use your emergency fund? Don’t make yourself feel guilty. This is why you created the fund, after all. Take a deep breath, figure out what you’ll need, and let your emergency fund help you through this.

It’s a tough time right now, and many people feel like there’s no end in sight. But this current situation isn’t going to last forever. We can’t control the world’s future, but we can plan ahead for ourselves (along with a bonus backup plan) to help ourselves face future obstacles.

This is an unprecedented and uncertain time for all of us. We understand the impulse to panic, to overspend, and to worry that we may not have enough to stay safe or keep our loved ones safe. But for most of us, all we can do is prepare ourselves and (safely) support others in any way possible.

Good luck!

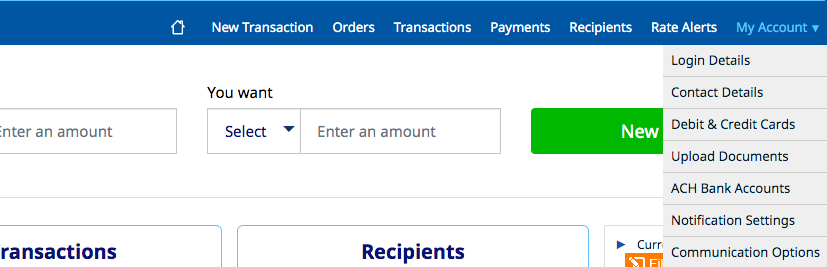

Get in touch with XE.com

About XE.com

XE can help safeguard your profit margins and improve cashflow through quantifying the FX risk you face and implementing unique strategies to mitigate it. XE Business Solutions provides a comprehensive range of currency services and products to help businesses access competitive rates with greater control.

Deciding when to make an international payment and at what rate can be critical. XE Business Solutions work with businesses to protect bottom-line from exchange rate fluctuations, while the currency experts and risk management specialists act as eyes and ears in the market to protect your profits from the world’s volatile currency markets.

Your company money is safe with XE, their NASDAQ listed parent company, Euronet Worldwide Inc., has a multibillion-dollar market capitalization, and an investment grade credit rating. With offices in the UK, Canada, Europe, APAC and North America they have a truly global coverage.

Are you curious to know more about XE?

Maurits Houthoff, senior business development manager at XE.com, is always in for a cup of coffee, mail or call to provide you detailed information.

Visit XE.com

Visit XE partner page